- XRP’s NVT ratio has surged to new highs, suggesting a rising hole between its market cap and precise community exercise

- Excessive NVT ratios have traditionally led to corrections, making XRP’s present rally seem speculative.

XRP’s current value surge has captured the eye of each merchants and long-term traders. A pointy spike within the NVT ratio, amongst different on-chain indicators, raises questions in regards to the sustainability of this rally.

Whereas value momentum is robust, the surge in NVT steered a rising disconnect between market worth and community exercise.

This evaluation will study whether or not this indicators a possibility or a warning for the longer term path of XRP.

XRP NVT ratio surges

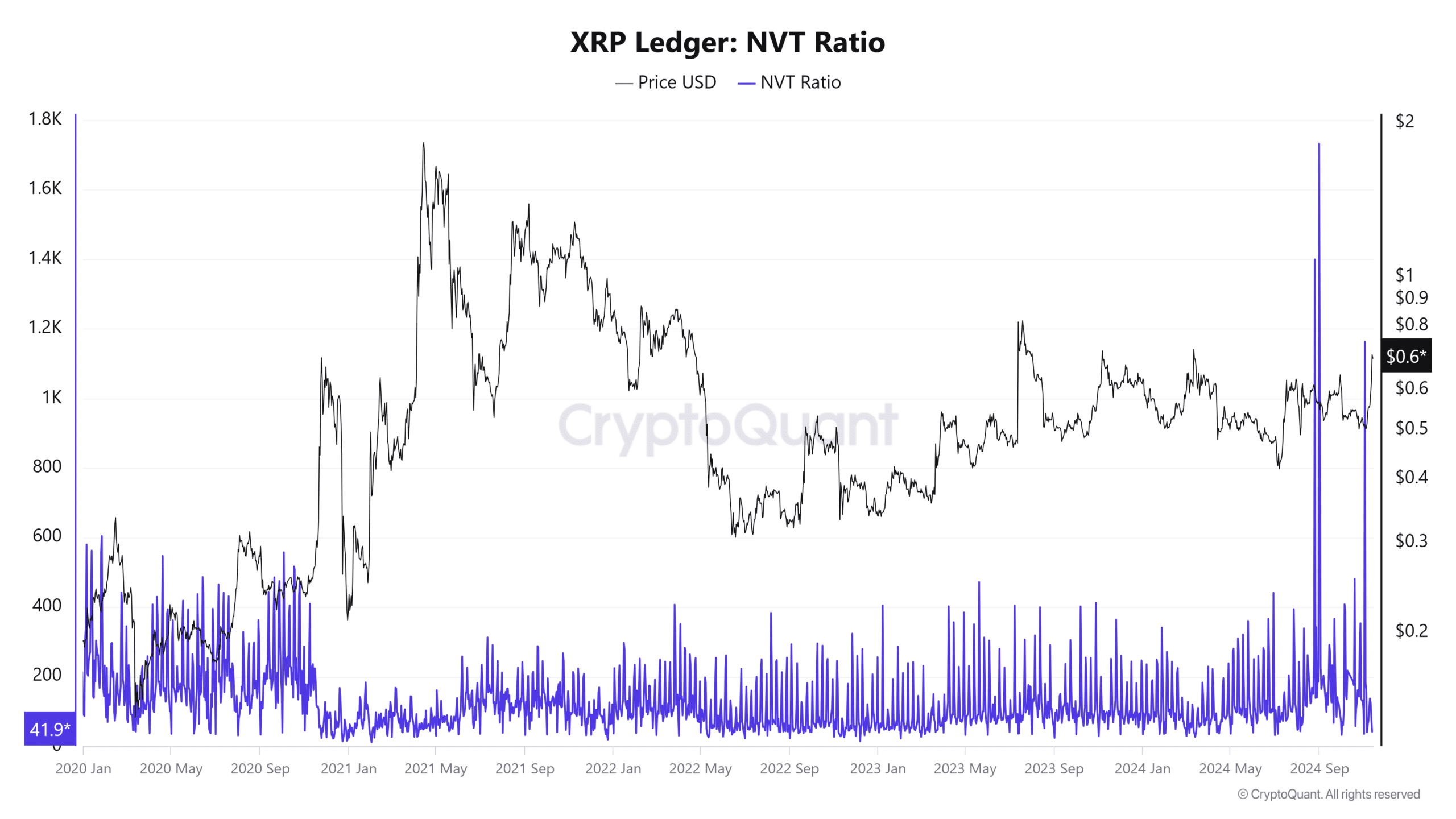

XRP’s NVT ratio has seen important fluctuations lately. Between 2020 and early 2021, it ranged from 200 to 600, reflecting a balanced market.

Nonetheless, from mid-2021 to early 2022, it spiked above 1,000, indicating intervals of overvaluation pushed by hypothesis.

Lately, the NVT ratio surged to round 1,800, one in all its highest ranges, suggesting a disconnect between XRP’s market cap and on-chain transaction quantity.

Traditionally, such spikes have preceded value corrections. To maintain present value ranges, XRP wants a pointy rise in on-chain exercise.

Traders ought to monitor transaction volumes intently, as a failure to extend may sign a possible value pullback.

Hypothesis or continued momentum?

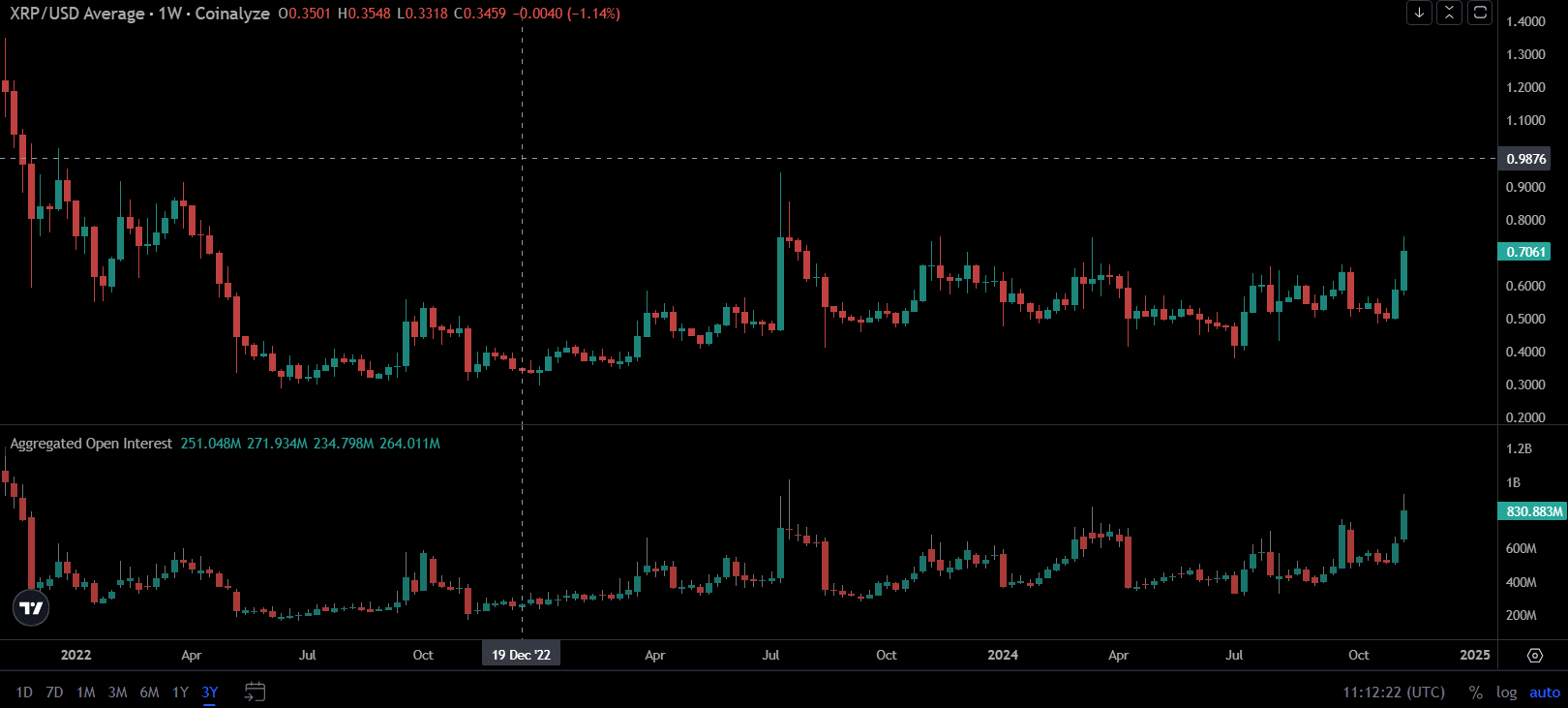

XRP’s current value rise has been accompanied by a pointy enhance in Open Curiosity, reaching round $830M, signaling rising market hypothesis and leverage.

Traditionally, spikes in Open Curiosity coincide with important value strikes, however in addition they increase considerations about over-leverage, which may result in volatility or corrections.

Constructive Funding Charges point out a powerful bullish bias, fueling upward momentum, but in addition growing the danger of a reversal if momentum slows.

Mixed with the excessive NVT ratio, this means speculative curiosity could also be outpacing on-chain exercise, elevating questions in regards to the sustainability of the rally.

Community well being

XRP’s 24-hour buying and selling quantity stood at $6.81 billion at press time, in response to CoinGecko.

Whereas this excessive determine demonstrated important market exercise, it additionally warrants additional evaluation within the context of XRP’s total community well being.

Elevated buying and selling quantity generally is a signal of rising market curiosity and liquidity, doubtlessly supporting XRP’s value rise.

Nonetheless, when coupled with the excessive NVT ratio and growing Open Curiosity, this determine may additionally level to heightened hypothesis somewhat than natural development pushed by community utility.

Learn Ripple’s [XRP] Worth Prediction 2024-25

A excessive buying and selling quantity alongside speculative habits usually indicators short-term value actions somewhat than long-term worth appreciation.

For XRP’s value surge to be sustainable, a extra balanced relationship between buying and selling quantity and on-chain exercise is required.