- Crypto’s weak market sentiment has prolonged into the brand new week.

- BTC might quickly enter the following leg of the bull run, per Bernstein analysts.

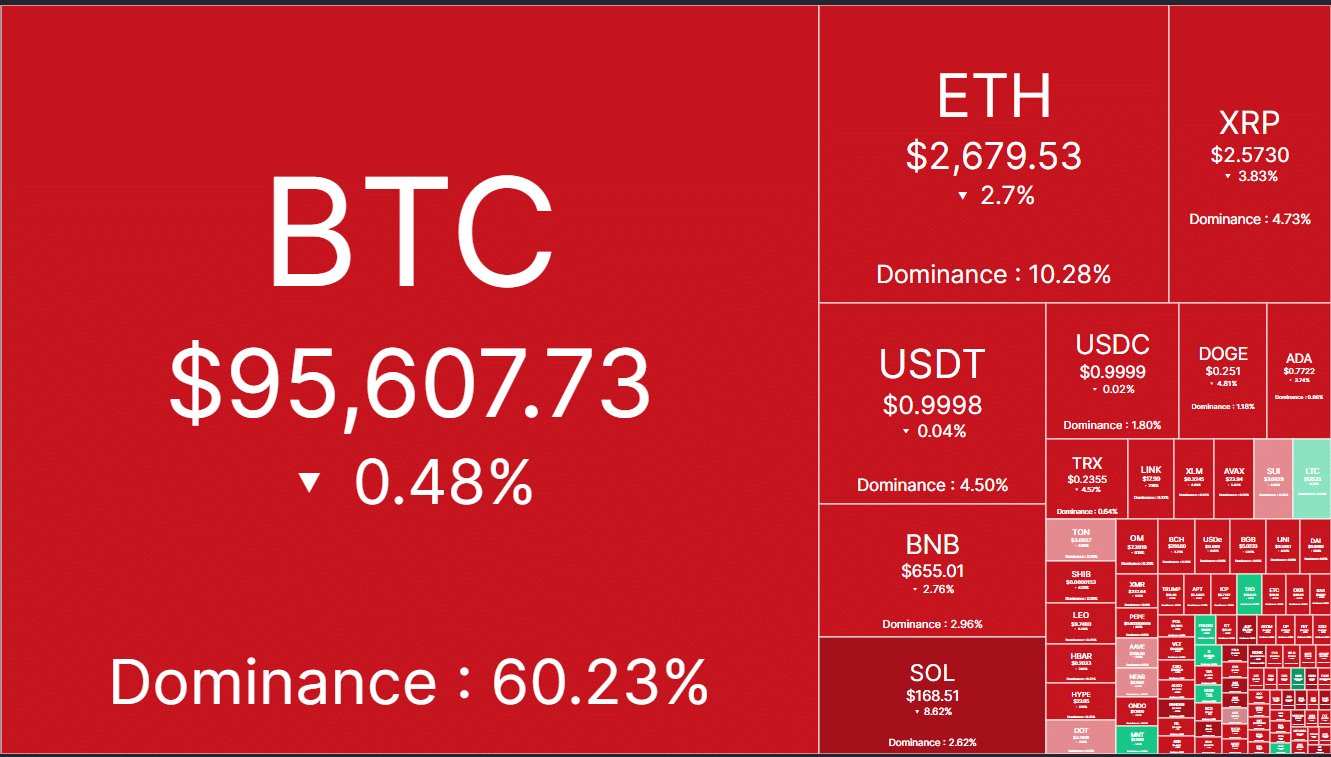

Crypto prolonged its weekend losses into the brand new week as market cap dropped from $3.3T to $3.15T. That’s a $150B worn out from the market in three days.

Over the identical interval, Solana[SOL] dumped the toughest. It shed 15% and slipped under $170 at press time. XRP adopted with an 8% decline however was nonetheless above $2.5.

Nevertheless, Bitcoin [BTC] decreased by lower than 3% whereas Ethereum [ETH] retracted solely 2%, signaling sturdy efficiency throughout prolonged weak point.

LIBRA worsens market sentiment

The crypto market has been muted below macro uncertainty however worsened by the LIBRA meme-coin ‘rip-off’.

Commenting on the day by day market efficiency, crypto choices buying and selling desk, QCP Capital famous,

“BTC dominance has risen to ~60%, reaching four-year highs as #ETH and different altcoins proceed to underperform. The current $LIBRA “rug pull” scandal involving Argentinian President Javier Milei has additional dampened sentiment round altcoins and memecoins.”

In addition to, BTC’s upside has been capped for the reason that January hawkish Fed rate of interest pause.

In actual fact, Fed governor, Patrick Harker not too long ago maintained the hawkish stance. Harker known as for maintaining rates of interest regular till inflation moderates.

The bearish stress has stored the king coin under $100K for almost two weeks, however BTC Dominance (BTC.D) has shot above 60%, additional blocking the rebound of altcoins.

Curiously, analysts like Realvision’s Jamie Coutts projected one other flush might be doubtless earlier than BTC bounces.

“Now some stable protocols are down 50-80%. Two weeks in the past we had an honest flush and excessive liquidation day. Sentiment is horrible. In all probability going to see yet one more first rate flush.”

Regardless of the boring markets, Bernstein analysts, led by Gautam Chhugani, made a bullish name for BTC within the medium time period. The analysts mentioned,

“The following leg of the Bitcoin bull market is loading up with a confluence of a number of constructive catalysts…We imagine the Crypto Process Pressure (led by David Sacks) is concentrated on delivering the Nationwide Bitcoin reserve, upon the course of the President.”

They projected that the US Sovereign Wealth Fund (SWF) might embrace BTC and different crypto as reserve belongings.

- Crypto’s weak market sentiment has prolonged into the brand new week.

- BTC might quickly enter the following leg of the bull run, per Bernstein analysts.

Crypto prolonged its weekend losses into the brand new week as market cap dropped from $3.3T to $3.15T. That’s a $150B worn out from the market in three days.

Over the identical interval, Solana[SOL] dumped the toughest. It shed 15% and slipped under $170 at press time. XRP adopted with an 8% decline however was nonetheless above $2.5.

Nevertheless, Bitcoin [BTC] decreased by lower than 3% whereas Ethereum [ETH] retracted solely 2%, signaling sturdy efficiency throughout prolonged weak point.

LIBRA worsens market sentiment

The crypto market has been muted below macro uncertainty however worsened by the LIBRA meme-coin ‘rip-off’.

Commenting on the day by day market efficiency, crypto choices buying and selling desk, QCP Capital famous,

“BTC dominance has risen to ~60%, reaching four-year highs as #ETH and different altcoins proceed to underperform. The current $LIBRA “rug pull” scandal involving Argentinian President Javier Milei has additional dampened sentiment round altcoins and memecoins.”

In addition to, BTC’s upside has been capped for the reason that January hawkish Fed rate of interest pause.

In actual fact, Fed governor, Patrick Harker not too long ago maintained the hawkish stance. Harker known as for maintaining rates of interest regular till inflation moderates.

The bearish stress has stored the king coin under $100K for almost two weeks, however BTC Dominance (BTC.D) has shot above 60%, additional blocking the rebound of altcoins.

Curiously, analysts like Realvision’s Jamie Coutts projected one other flush might be doubtless earlier than BTC bounces.

“Now some stable protocols are down 50-80%. Two weeks in the past we had an honest flush and excessive liquidation day. Sentiment is horrible. In all probability going to see yet one more first rate flush.”

Regardless of the boring markets, Bernstein analysts, led by Gautam Chhugani, made a bullish name for BTC within the medium time period. The analysts mentioned,

“The following leg of the Bitcoin bull market is loading up with a confluence of a number of constructive catalysts…We imagine the Crypto Process Pressure (led by David Sacks) is concentrated on delivering the Nationwide Bitcoin reserve, upon the course of the President.”

They projected that the US Sovereign Wealth Fund (SWF) might embrace BTC and different crypto as reserve belongings.