- The accumulationdistribution indicator was comparatively flat, exhibiting restricted shopping for curiosity.

- Uniswap confronted a possible assist breakdown, focusing on $4.68.

Uniswap [UNI] confronted vital promoting strain over the previous week, with AMBCrypto noting a possible 30% worth decline.

Regardless of this, buying and selling volumes on Uniswap’s Celo deployment have elevated, highlighting a distinction between market sentiment and adoption tendencies.

Uniswap’s worth has been constantly falling, reaching $6.6 on the 4th of November, its lowest stage since October. This marked a 60% drop from its yearly peak.

The upcoming U.S. elections have added to the volatility, with merchants now in search of decrease assist ranges for stability.

Uniswap breaks bearish pennant

The technical evaluation pointed to additional draw back for Uniswap, because it has damaged beneath a bearish pennant formation on the every day chart.

Key assist at $4.68 aligned with the projected worth goal from the pennant sample, marking a flooring for this sell-off.

With the Stochastic RSI within the oversold territory beneath 20, bearish momentum seems entrenched, indicating that downward strain might proceed earlier than a potential reversal.

The token’s motion beneath the 200-day and 50-day Exponential Shifting Averages (EMA) introduces the probability of a loss of life cross sample.

This sample, a sign of prolonged bearish tendencies, final appeared on the twenty fifth of July, resulting in a subsequent 40% drop.

The current break beneath important shifting averages reaffirms the bearish outlook.

Regardless of the value decline, deployment on Uniswap’s Celo has seen substantial progress, with buying and selling volumes rising roughly 20-fold since January 2024.

Weekly buying and selling on Celo grew from $10 million to just about $350 million, underscoring Uniswap’s traction within the decentralized finance (DeFi) house.

On-chain metrics present regular progress

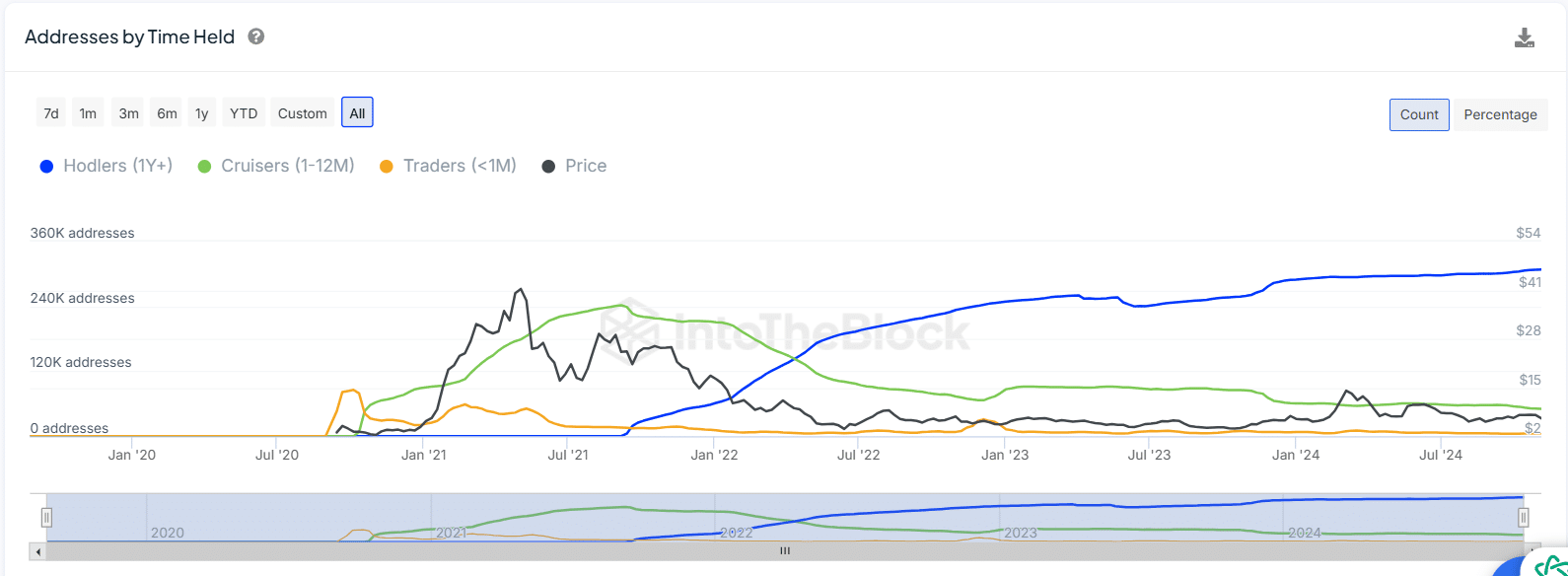

Deal with evaluation revealed a gentle improve in long-term holders, with over 360,000 addresses holding Uniswap for greater than a yr.

This rise in holders recommended a core base of long-term traders, offering a level of stability regardless of the present sell-off strain.

In the meantime, cruisers, or these holding between one and twelve months, have stabilized round 120,000 addresses after peaking in early 2021.

Quick-term merchants, who usually maintain for lower than a month, stay a minor group, indicating that speculative curiosity has diminished because the market matures.

Divergence in UNI funding charges indicators…

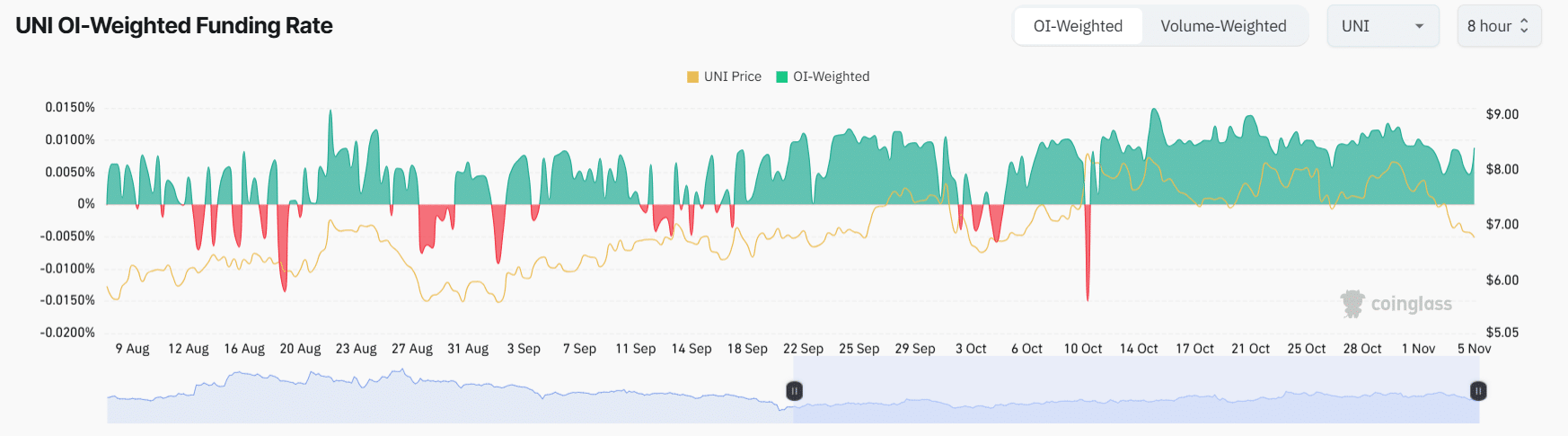

Optimistic funding charges, proven in inexperienced, point out occasions when lengthy positions have been dominant, highlighting bullish sentiment.

Nevertheless, intermittent purple dips beneath the impartial line reveal intervals of unfavorable funding, highlighting bearish strain. Since late October, the funding fee has been predominantly optimistic, however the UNI worth development exhibits a constant decline.

Is your portfolio inexperienced? Take a look at the UNI Revenue Calculator

This signaled that regardless of the willingness of merchants to go lengthy, the underlying market sentiment remained weak.

Such a divergence between funding charges and worth suggests warning amongst traders as the value continues its downtrend, with lengthy positions probably dealing with mounting strain because the market corrects.