uschools

That is an replace of my macroeconomic evaluation on the rates of interest and a doable recession forward. Most analysts agree that US GDP development is slowing down. The labor market just isn’t as sturdy because it was once, the inflation knowledge should not as worrying as they as soon as had been, whereas the Fed is now extra dovish. As Nobel winner Joseph Stiglitz says, the Fed raised charges ‘too far, too quick‘—and now wants to chop large. In different phrases, so as to allow the tender touchdown, the Fed has to chop the rates of interest very quick. In any other case, it may be too late to stop the approaching recession. On this article, I’ll cowl the current macroeconomic statistics, current the totally different eventualities underneath the present financial situations, and likewise present a couple of ideas for traders on the most effective plan of action.

My earlier article about US rates of interest

Once I wrote my earlier evaluation concerning the Fed’s cuts, the Fed was anticipated to chop rates of interest solely as soon as within the fourth quarter of 2024. Now, the Fed is predicted to chop the charges on Wednesday this week. Wednesday will nonetheless be September and solely the third quarter of 2024. Furthermore, extra price cuts will possible comply with as a result of proper now, the charges are at their multi-year highs and everyone seems to be anxious concerning the coming recession. Like a few months in the past, when my earlier article was revealed, US macroeconomic statistics present lowering inflation. Like earlier than, the unemployment price is fairly low however step by step growing. I might personally suggest traders develop extra cautious and conservative, whereas staying away from overvalued firms. However let me clarify this later on this article.

US macroeconomic statistics

Let me focus on the precise macroeconomic statistics.

First, I want to discuss inflation numbers, probably the most intently watched for knowledge.

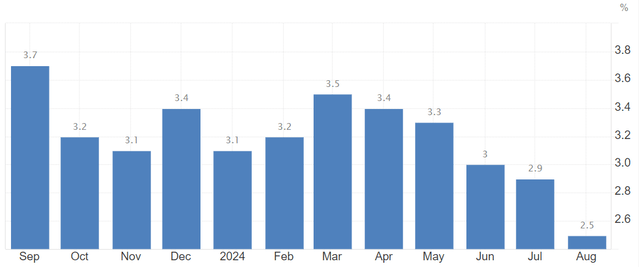

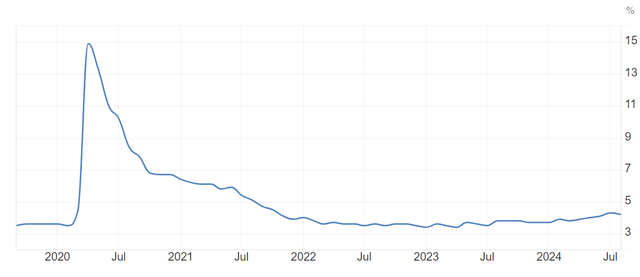

Common US inflation price—annual inflation price

The overall inflation price is close to this yr’s lows. The Fed’s inflation goal is 2%. The variety of 2.5% may be very near this supreme quantity.

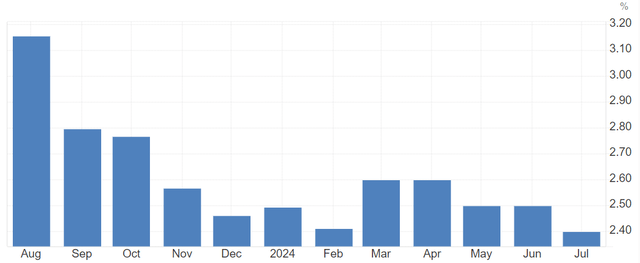

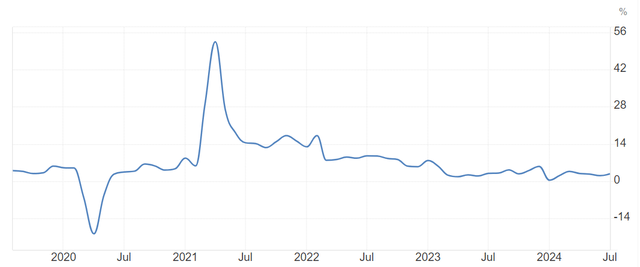

As considerations the patron value index year-on-year modifications (CPI inflation, in different phrases, considered one of traders’ most intently watched macroeconomic indicators), its development has clearly slowed down.

CPI Core (YoY)

Additionally, the core PCE index is the Fed’s favourite inflation measure. It excludes the 2 most unstable indicators, specifically meals and vitality and permits seeing the overall inflation pattern.

Core PCE Index

We will clearly see that the index is hardly rising, which means that PCE inflation has additionally decreased.

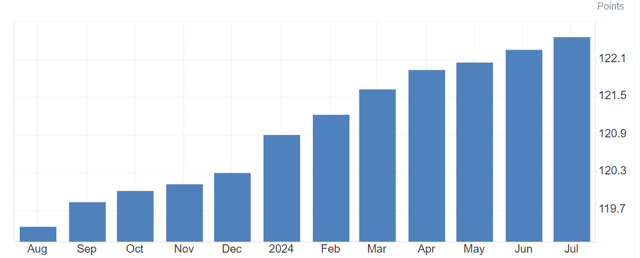

US unemployment price

The US unemployment price remains to be fairly low, albeit not as little as it was once in November or December final yr. On the 5-year graph, we are able to see that the unemployment price is simply barely rising.

US unemployment price

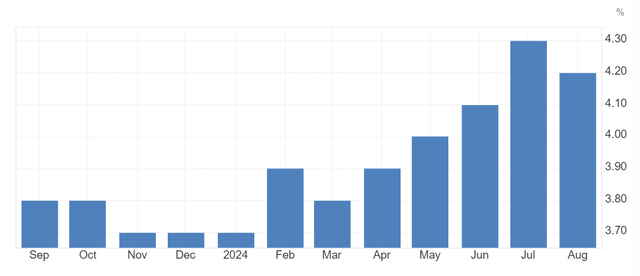

The retail gross sales, nonetheless, current probably the most worrying image. These are actually low in comparison with those recorded within the years 2021 and 2022.

US retail gross sales YoY

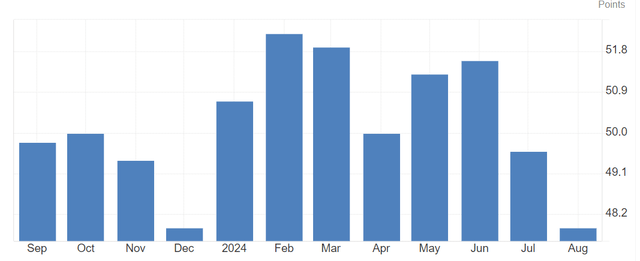

The US manufacturing PMI index displaying manufacturing actions is pointing in direction of contraction, at present standing at about 48.

US Manufacturing PMI

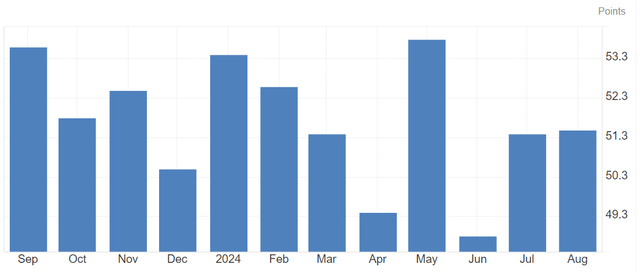

The US Non-Manufacturing PMI displaying providers actions is at present standing at 51.3. Though it’s increasing, it’s doing so at a really gradual tempo.

US Non-Manufacturing PMI

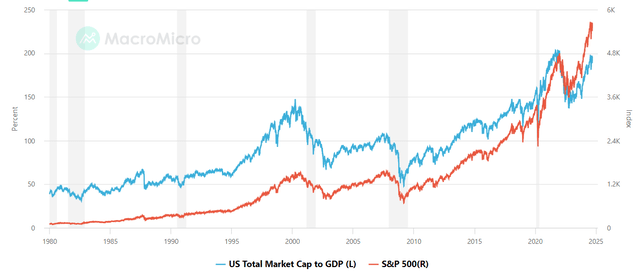

It is usually vital to evaluate how overheated the US inventory market is. Usually, if there are asset bubbles, it’s a signal of an financial increase, the stage of the financial cycle simply previous a recession. One of many methods to evaluate if the inventory market is overvalued is by utilizing the so-called Buffett indicator, which compares the overall market capitalization of all US shares with the quarterly output of the US financial system. The inventory market is pretty valued if the overall worth of the Wilshire 5000 index (which measures the overall market) is about on par with the newest quarterly GDP estimate. If shares commerce at about 70% of GDP, they’re thought of to be undervalued. If the market cap is at about twice the dimensions of the financial system, that is thought of a significant menace.

Proper now, the indicator is close to all-time highs. Solely in 2021 was the Buffett indicator larger.

Mushy touchdown

Mushy touchdown remains to be within the playing cards, in fact. That is effectively doable if the Fed eases very quick. In spite of everything, financial cycles are inclined to last more than 4 years. The final recession we had was in 2020 throughout the Covid-19 pandemic.

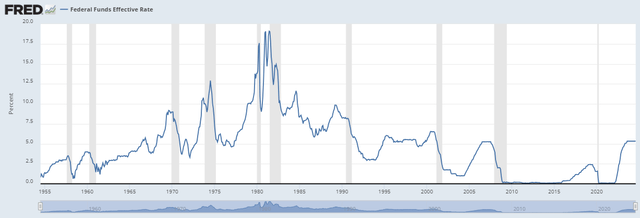

As will be seen from the graph beneath (recessions are shaded areas on the diagram), in many of the cases, financial cycles—durations between recessions—are inclined to final about ten years. Prior to now, nonetheless, financial cycles had been considerably shorter. However then, after the Nineteen Eighties, the cycles received longer, which means we’ve been having fun with longer durations of stability for some time. Allow us to hope that one thing comparable may really occur now.

As will be additionally seen from this graph above, recessions largely occur when the rates of interest are close to file highs. If the Fed eases in a well timed method, no recession will occur, it appears.

After the financial situations get tighter, they quickly ease, one thing which is about to occur proper now.

For the primary time, the Fed can reduce the rates of interest by 0.50%, one thing that JPMorgan Chase (JPM) and Joseph Stiglitz recommend is cheap. Slightly, slowing job development and affordable inflation numbers demand a price reduce, it appears. Nonetheless, easing too quick can dramatically elevate the cash mass within the US financial system, thus making inflation numbers improve dramatically. That is one other excessive that must be averted.

Exhausting touchdown

“Exhausting touchdown,” also called an financial disaster, is one other doable situation. This may occur if the Fed doesn’t ease quick sufficient, in my view. Aside from sure macroeconomic elements, tight financial situations can be an indication {that a} recession is close to. However there is also exterior, surprising “black swan” occasions, together with a doable inflation surge (just like the Seventies oil value surge), market volatility resulting from elections, wars and any extra political tensions, such because the worsening of a commerce struggle between the US and China or the US and Russia. Add to that the truth that there are asset bubbles. In different phrases, the inventory market is very overvalued regardless of the worsening macroeconomic situations. Overheated asset markets and tight financial situations often result in recessions. In some circumstances, there might be a mixture of things. For instance, the US financial system can decelerate resulting from geopolitical tensions, however the Fed may reduce the rates of interest too slowly, thus making the inventory market panic, which may hurt most traders’ portfolios.

The place to take a position now?

The important thing query here’s what to do about that. Selecting the place to take a position is dependent upon how conservative you might be. Most traders count on decrease rates of interest forward, and a few predict a recession is close to. On this case, it’s worthwhile to contemplate shopping for treasured metals. These are already appreciated, particularly gold, however they’ve a lot additional room to run. I wrote many instances in my earlier articles that gold was low cost relative to the liquidity that was accessible in the marketplace. Silver is now less expensive than gold. However for these traders unwilling to purchase treasured metals however wishing to keep away from portfolio losses, it’s a excellent concept to chop stakes in overvalued firms and financial institution shares. Overvalued development stars are inclined to plunge in worth when the financial system is slowing down, however probably the most vital inventory market crash occurs when there may be an financial disaster.

Conclusion

In conclusion, I might say {that a} tender touchdown of the US financial system is a probable situation. However on this case, the rates of interest must be lowering at fairly a quick tempo. If there isn’t a tender touchdown of the financial system, which means a probable recession forward, then the Fed would in all probability need to lower the charges dramatically the best way it did throughout the 2020 disaster. In both case, traders ought to brace for decrease rates of interest forward. Nonetheless, I might not personally make investments an excessive amount of cash in development shares as a result of these don’t do effectively throughout crises. However I might as an alternative choose to purchase treasured metals, though these have already appreciated considerably. But, these nonetheless have substantial development potential.