- A latest spike in large-volume transactions coincided with TON’s worth drop, signaling potential near-term weak point

- Nevertheless, a attainable rally could possibly be forming as chart patterns recommended an upward shift could comply with

Over the previous month, Toncoin [TON] has misplaced 10.12% of its worth – An indication of latest bearish momentum. And nonetheless, the rise in massive transaction volumes, mixed with rising technical indicators, recommended that this dip could also be short-term, with a rebound doubtless within the close to future.

Giant sell-off pushes TON into short-term decline

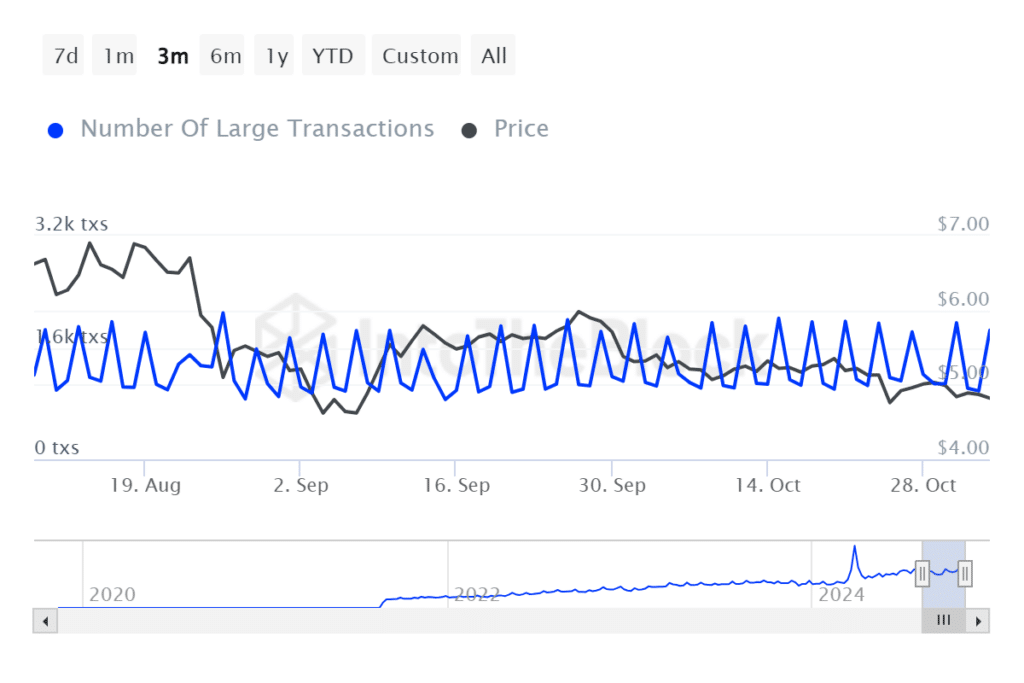

TON has recorded a surge in massive transactions over the past 24 hours. In response to information from IntoTheBlock, these transactions have risen to 1,850.

A spike in massive transaction counts, coupled with a worth dip and a 27% hike in quantity to 195.15 million, collectively, had been an indication of bearish momentum. In addition they hinted at an additional decline as whales have been promoting.

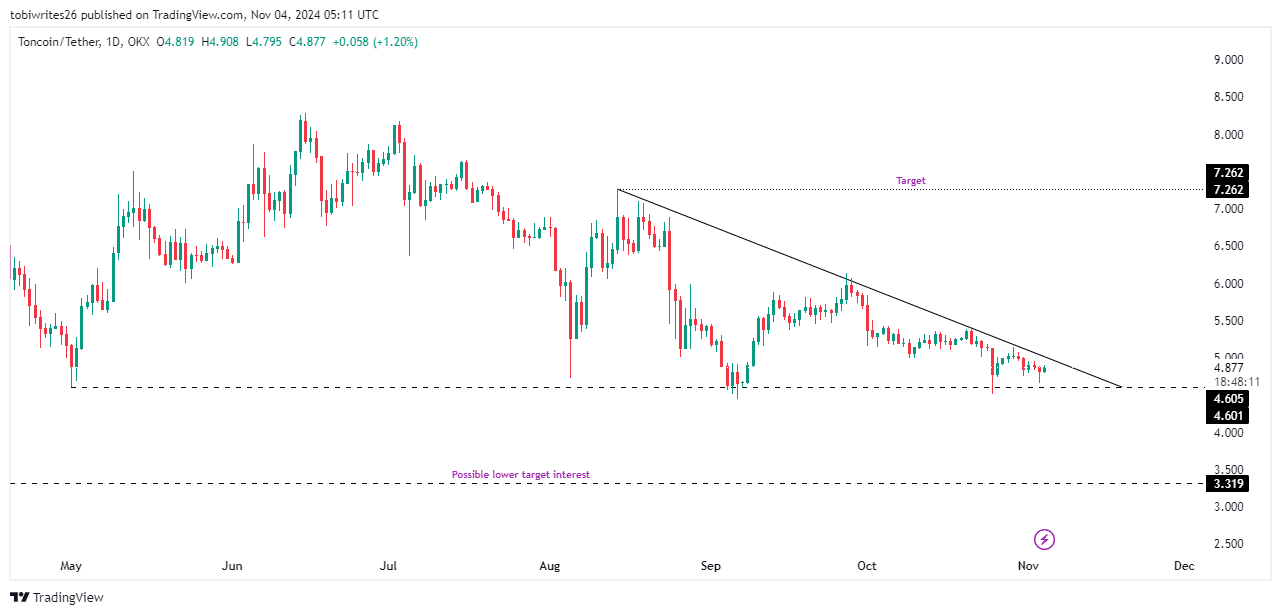

Technically, this downturn is predicted to be short-lived, with TON prone to hit a help stage round $4.601. That is the place a robust shopping for cluster may drive a worth rebound, which wasn’t removed from its press time worth of $4.873.

This help appeared to align with a descending line sample, which can act as a bullish catalyst if TON breaks above the road with a confirmed shut. Such a breakout may push the value as much as a goal of $7.262.

Nevertheless, if promoting stress intensifies, TON could as a substitute drop to a decrease help stage close to $3.319.

Sentiment aligns with TON’s bullish outlook

The prevailing narrative for TON recommended {that a} short-term decline could precede a rebound that would drive the asset in the direction of a long-term goal.

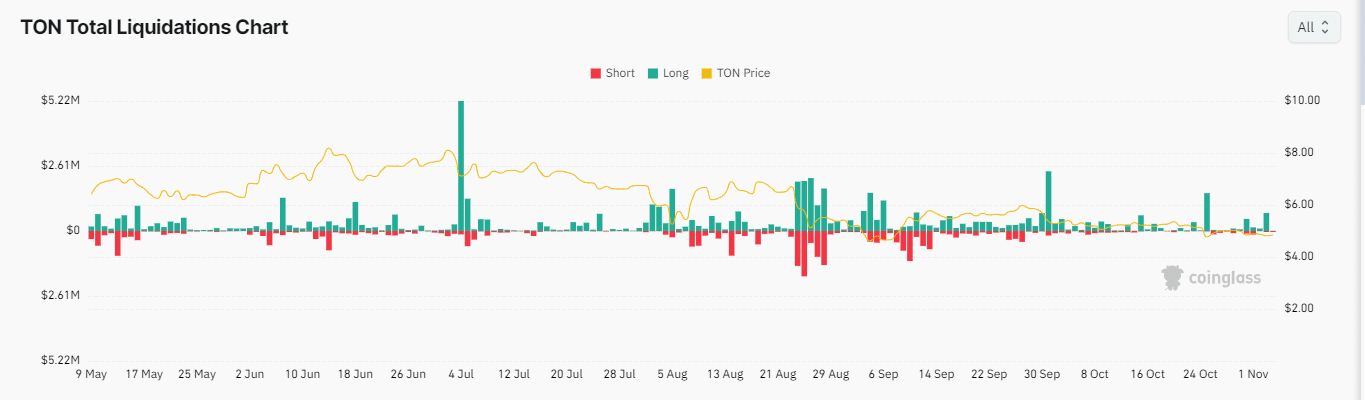

Market sentiment, on the time of writing, pointed to a attainable short-term decline. Particularly as liquidation information from the previous 24 hours revealed that lengthy merchants have taken important losses – An indication of potential downward stress.

Particularly, lengthy merchants have misplaced $340.9k, a notable distinction to the $76.76k misplaced by quick merchants. This disparity is an indication that the market has been transferring counter to the aspect with bigger losses—An indication of additional draw back for TON.

Nevertheless, with quick liquidations at a comparatively shut stage to lengthy liquidations, the promoting stress remained average. What this implies is that any drop could also be restricted and will set the stage for a fast rebound.

Additional supporting this potential reversal was the Weighted Funding Price—A charge exchanged between merchants in perpetual Futures markets based mostly on lengthy and quick positioning. At press time, it had turned optimistic.

A optimistic funding price means lengthy positions are paying quick positions – An indication of accelerating bullish sentiment. This shift recommended that regardless of a attainable transient decline, TON’s worth could quickly discover help and switch north.

In abstract, whereas TON could file a short-term pullback, rising bullish sentiment and average promoting stress recommended that any decline could possibly be short-lived. This could probably propel the asset in the direction of an accelerated restoration.

- A latest spike in large-volume transactions coincided with TON’s worth drop, signaling potential near-term weak point

- Nevertheless, a attainable rally could possibly be forming as chart patterns recommended an upward shift could comply with

Over the previous month, Toncoin [TON] has misplaced 10.12% of its worth – An indication of latest bearish momentum. And nonetheless, the rise in massive transaction volumes, mixed with rising technical indicators, recommended that this dip could also be short-term, with a rebound doubtless within the close to future.

Giant sell-off pushes TON into short-term decline

TON has recorded a surge in massive transactions over the past 24 hours. In response to information from IntoTheBlock, these transactions have risen to 1,850.

A spike in massive transaction counts, coupled with a worth dip and a 27% hike in quantity to 195.15 million, collectively, had been an indication of bearish momentum. In addition they hinted at an additional decline as whales have been promoting.

Technically, this downturn is predicted to be short-lived, with TON prone to hit a help stage round $4.601. That is the place a robust shopping for cluster may drive a worth rebound, which wasn’t removed from its press time worth of $4.873.

This help appeared to align with a descending line sample, which can act as a bullish catalyst if TON breaks above the road with a confirmed shut. Such a breakout may push the value as much as a goal of $7.262.

Nevertheless, if promoting stress intensifies, TON could as a substitute drop to a decrease help stage close to $3.319.

Sentiment aligns with TON’s bullish outlook

The prevailing narrative for TON recommended {that a} short-term decline could precede a rebound that would drive the asset in the direction of a long-term goal.

Market sentiment, on the time of writing, pointed to a attainable short-term decline. Particularly as liquidation information from the previous 24 hours revealed that lengthy merchants have taken important losses – An indication of potential downward stress.

Particularly, lengthy merchants have misplaced $340.9k, a notable distinction to the $76.76k misplaced by quick merchants. This disparity is an indication that the market has been transferring counter to the aspect with bigger losses—An indication of additional draw back for TON.

Nevertheless, with quick liquidations at a comparatively shut stage to lengthy liquidations, the promoting stress remained average. What this implies is that any drop could also be restricted and will set the stage for a fast rebound.

Additional supporting this potential reversal was the Weighted Funding Price—A charge exchanged between merchants in perpetual Futures markets based mostly on lengthy and quick positioning. At press time, it had turned optimistic.

A optimistic funding price means lengthy positions are paying quick positions – An indication of accelerating bullish sentiment. This shift recommended that regardless of a attainable transient decline, TON’s worth could quickly discover help and switch north.

In abstract, whereas TON could file a short-term pullback, rising bullish sentiment and average promoting stress recommended that any decline could possibly be short-lived. This could probably propel the asset in the direction of an accelerated restoration.