- SAND’s bullish pennant breakout targets $1, supported by robust worth motion above $0.62.

- Lowered trade reserves and bullish on-chain metrics strengthened the case for upward worth momentum.

The Sandbox [SAND] has sparked optimism amongst merchants because it broke above a crucial resistance at $0.62, forming a bullish pennant on the each day chart.

This breakout recommended a possible rally to the $1 mark, pushed by rising market momentum and enhancing on-chain exercise.

At press time, SAND was buying and selling at $0.6308, reflecting an 8.60% acquire within the final 24 hours. Nonetheless, the value faces upcoming resistance ranges that might problem its capacity to maintain this upward transfer.

SAND worth motion evaluation

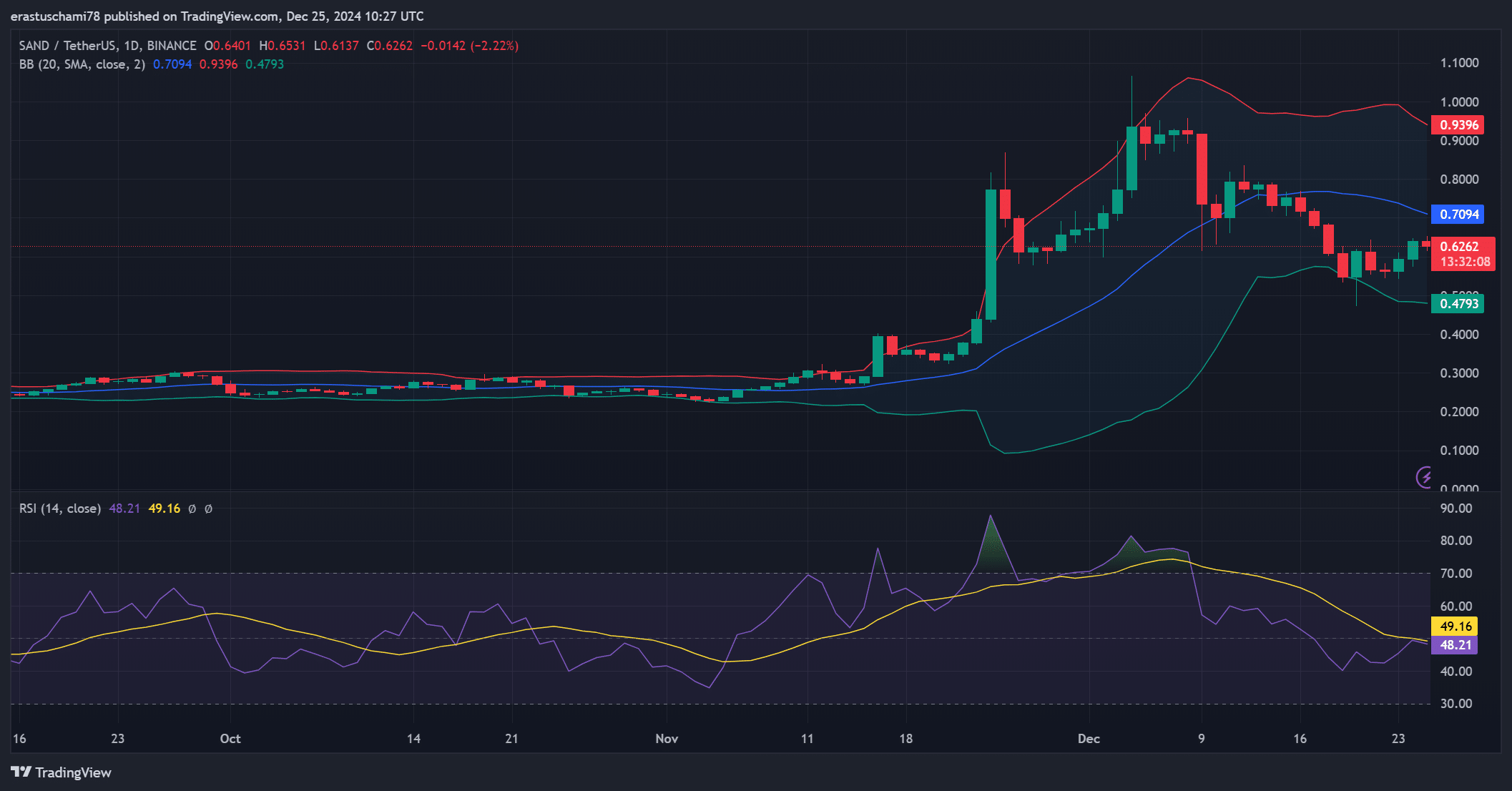

SAND’s current worth motion has demonstrated constant respect for the bullish pennant sample, confirming $0.62 as a pivotal stage.

The breakout above this resistance has triggered shopping for curiosity, indicating potential for upward continuation.

Due to this fact, the following key goal for SAND lies at $0.75, with $1.00 being the psychological stage to observe.

On the draw back, a correction might see help at $0.43 being examined, significantly if bullish momentum falters. Moreover, merchants ought to monitor for consolidation, which can precede one other breakout.

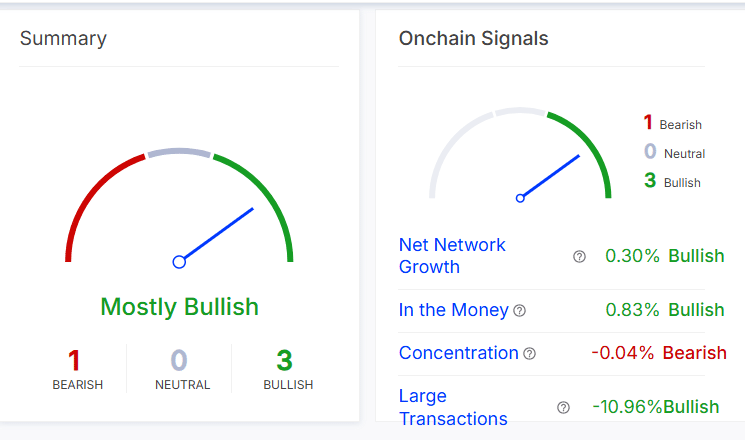

On-chain indicators spotlight rising curiosity

On-chain metrics additional bolster SAND’s bullish outlook. Internet community progress has risen by 0.30%, signaling regular consumer adoption, whereas 0.83% of holders are actually “within the cash,” reflecting worthwhile positions.

Nonetheless, focus of enormous holders has barely declined by 0.04%, indicating minor profit-taking exercise.

Moreover, giant transactions have surged by 10.96%, showcasing heightened exercise amongst institutional merchants.

These metrics recommend rising curiosity, however the slight dip in focus highlights the significance of monitoring distribution tendencies carefully.

Technical indicators align with bullish outlook

Technical indicators supplied extra affirmation of SAND’s upward potential. The RSI was 49 at press time, indicating impartial momentum with a bullish tilt.

Moreover, Bollinger Bands are narrowing, signaling a possible breakout as worth volatility compresses.

If SAND sustains this momentum, an explosive transfer upward might observe. Nonetheless, failure to take care of help above $0.62 could result in a brief retracement earlier than one other try at resistance ranges.

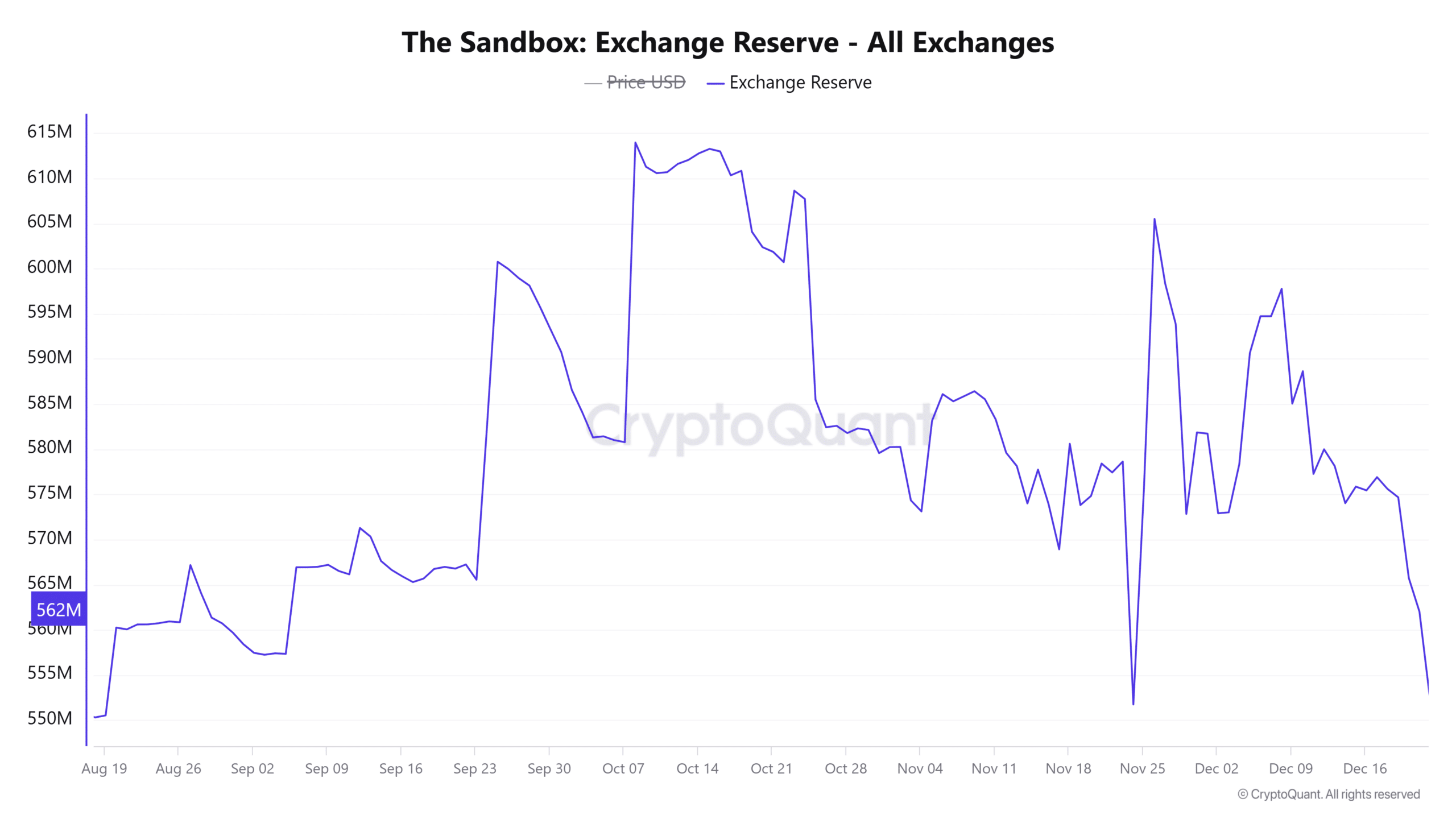

Change reserve evaluation indicators lowered promoting stress

Change reserve knowledge painted a bullish image, with a 1.51% drop in SAND’s reserves during the last 24 hours. This decline signifies that fewer tokens can be found for buying and selling, as holders transfer cash off exchanges.

Moreover, lowered provide on exchanges usually diminishes promoting stress, offering a positive setting for worth will increase.

Due to this fact, continued decreases in reserves might additional help the continuing rally.

Is your portfolio inexperienced? Try the SAND Revenue Calculator

Can SAND attain $1?

SAND has robust potential to succeed in $1.00, supported by its bullish pennant breakout, enhancing on-chain metrics, and lowered promoting stress.

Nonetheless, sustaining this momentum would require overcoming key resistance ranges and sustaining broader market optimism. The subsequent few days will probably be crucial in figuring out SAND’s trajectory.