Wait, what? One other candlestick article?!

However after all!

Though they don’t have all of the solutions on a regular basis, candlesticks are a vital supply of data when coping with markets.

Fact be advised, it’s not apparent at first look what they’re making an attempt to say, proper?

Effectively, it’s time to dig down into the small print and actually get into what’s happening…

That’s why I’ve written this text on understanding Candlesticks in Technical Evaluation!

On this article, you’ll cowl:

- What precisely a candlestick is

- Why candlesticks are vital

- How momentum and indecision are mirrored in candlesticks

- The significance of utilizing candlesticks within the right context

- Suggestions and tips for profitable candlestick utilization

- Widespread errors and limitations to be careful for

Are you prepared?

Then let’s go!

What’s a Candlestick?

At its core, a candlestick is a kind of worth chart utilized in technical evaluation that shows the excessive, low, open, and shut costs of an asset for a selected interval.

Let’s check out a Candlestick and analyse it…

Anatomy of Candlestick:

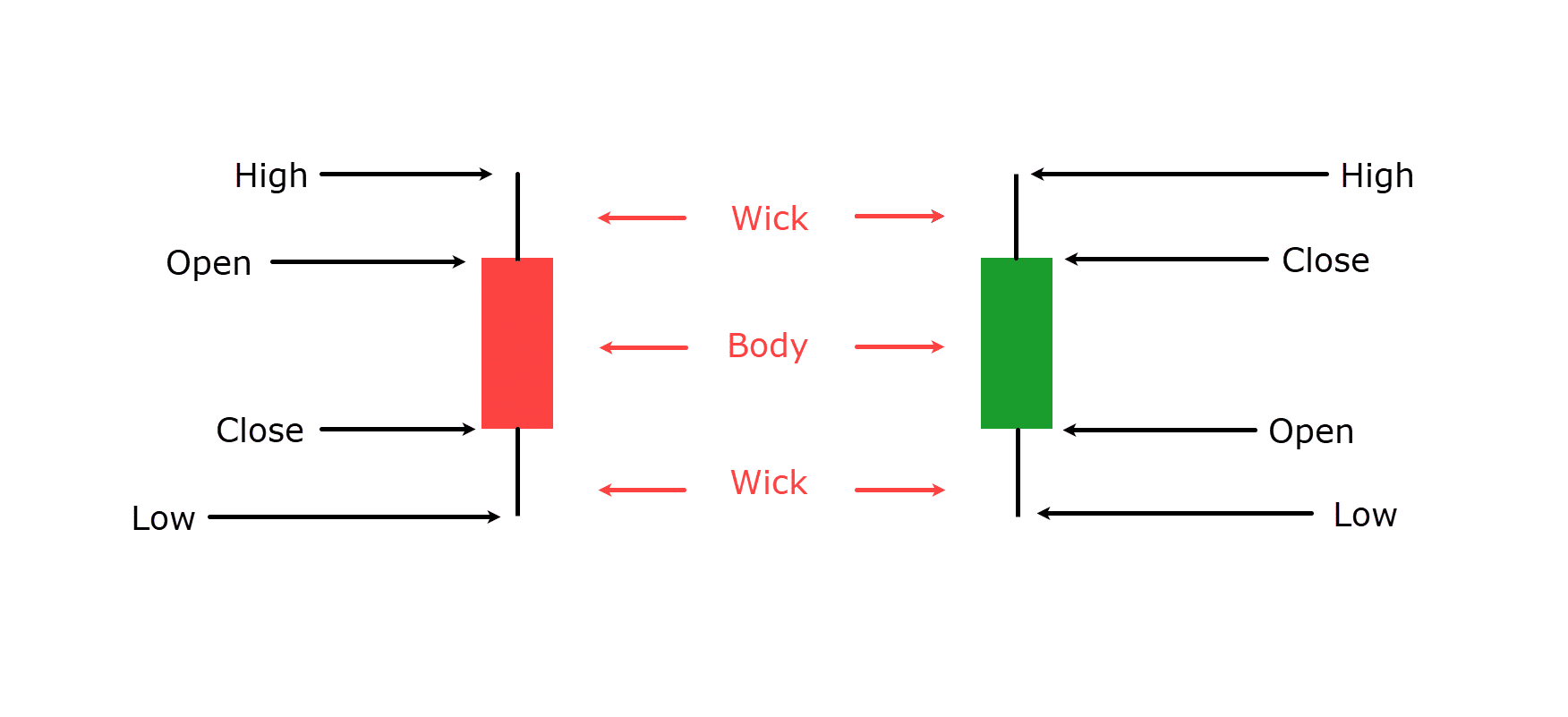

Candlesticks are created with a physique and wicks (or shadows).

The physique represents the vary between the open and shut costs…

The wicks present the best and lowest costs reached throughout the buying and selling session…

By analyzing the form and coloration of the candlestick, merchants can gauge market sentiment and potential future actions.

Physique: Open and Closes

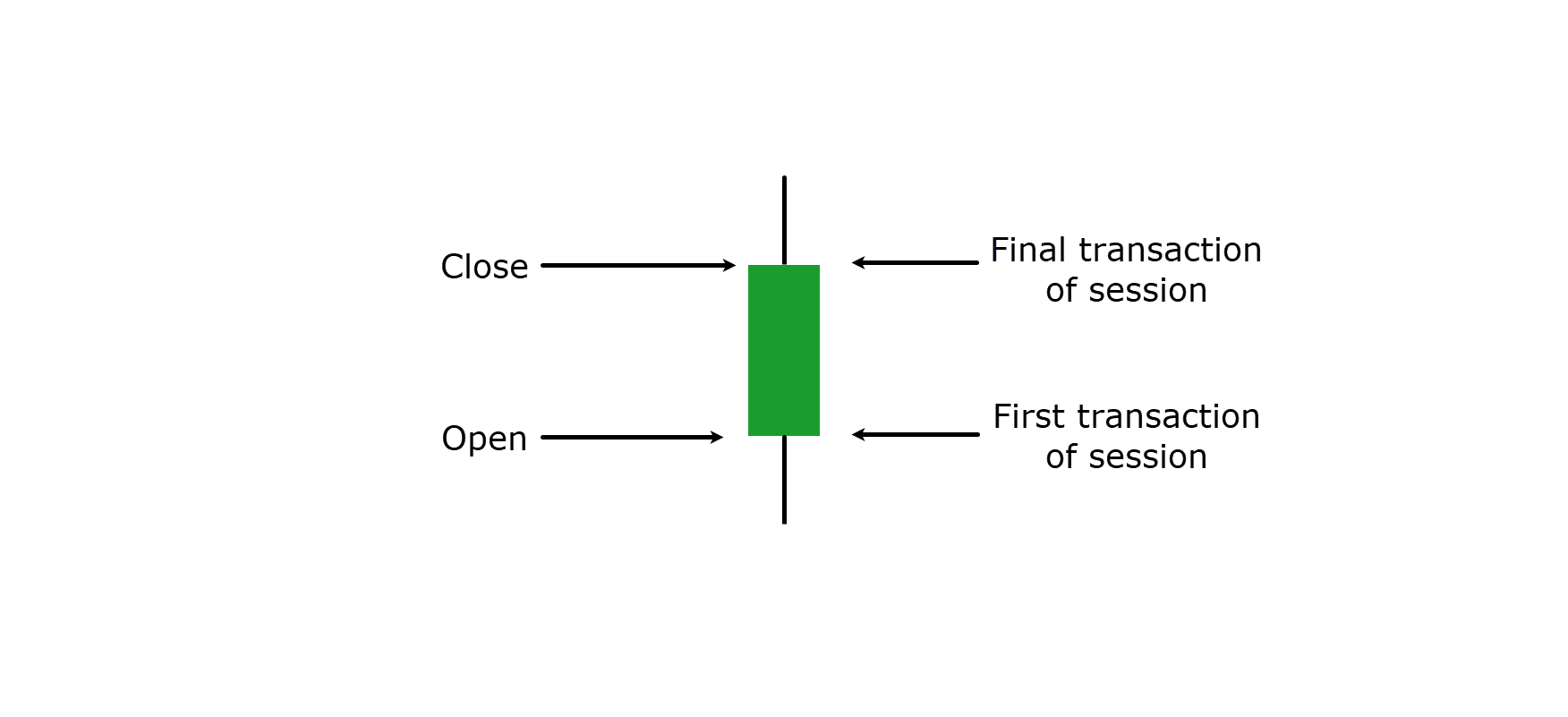

As touched on above, every candlestick has a physique, shaped by the open and shut costs of the buying and selling session.

The size and place of the physique throughout the candlestick present essential details about market momentum and investor sentiment…

Candlestick Physique:

As you’ll be able to see, the open worth marks the primary transaction worth in the beginning of the buying and selling session, whereas the shut worth is the ultimate transaction worth on the finish of the session.

Relying on the chosen timeframe—be it 4 hours, 1 day, or 1 hour—every candlestick represents the value motion inside that particular interval.

The colour of the physique additionally performs a big position.

If that exact instance was a every day candlestick, it might imply the value closed greater than it opened over that complete day.

It is because a inexperienced (or white) candlestick indicators bullish sentiment and suggests consumers held management throughout the session.

Conversely, a crimson (or black) candlestick reveals that the shut worth is decrease than the open worth, signaling a bearish sentiment and suggesting that sellers dominated the session.

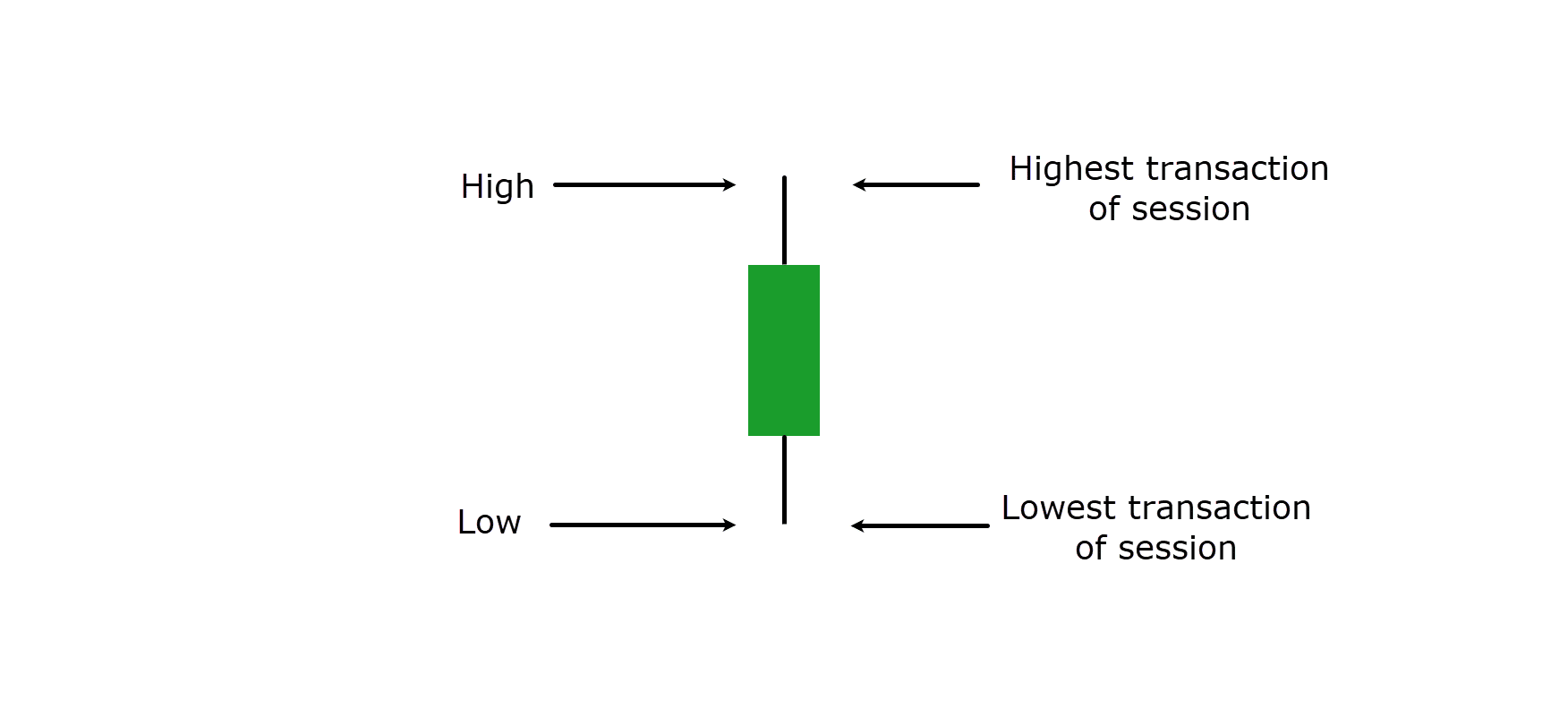

Wicks: Excessive and Low

Along with the physique, candlesticks characteristic wicks, which prolong above and under the physique…

Candlestick Wicks:

The higher wick reveals the best worth reached throughout the session, whereas the decrease wick reveals the bottom worth.

It’s the wick that may present worthwhile perception into the value extremes and volatility throughout the session.

For now, perceive that lengthy wicks can recommend sturdy resistance or assist ranges, in addition to potential reversals, whereas quick wicks point out comparatively steady buying and selling throughout the session’s open and shut vary.

Let’s have a look at how these our bodies and wicks can mix…

Momentum Candlesticks

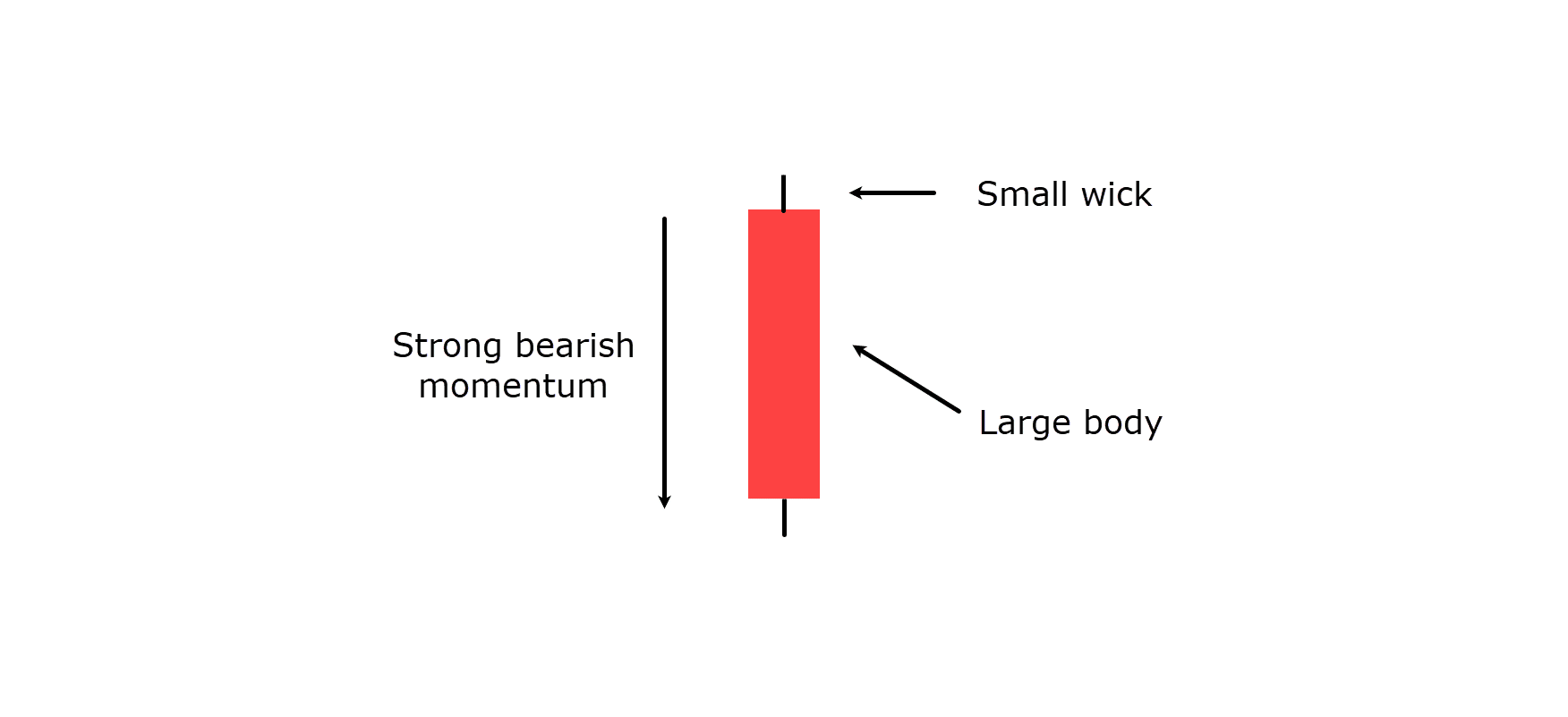

Momentum candlesticks are characterised by their lengthy our bodies and minimal wicks, indicating sturdy shopping for or promoting stress all through the session…

Bearish Momentum Candle Instance:

As proven within the diagram above, an extended crimson candlestick suggests sturdy bearish momentum, with sellers pushing costs decrease whereas dealing with little opposition.

Conversely, an extended inexperienced candlestick would point out sturdy bullish momentum, with consumers driving costs up decisively.

Recognizing these momentum candlesticks will help you determine and journey market traits, so look out for them!

Indecision Candlesticks

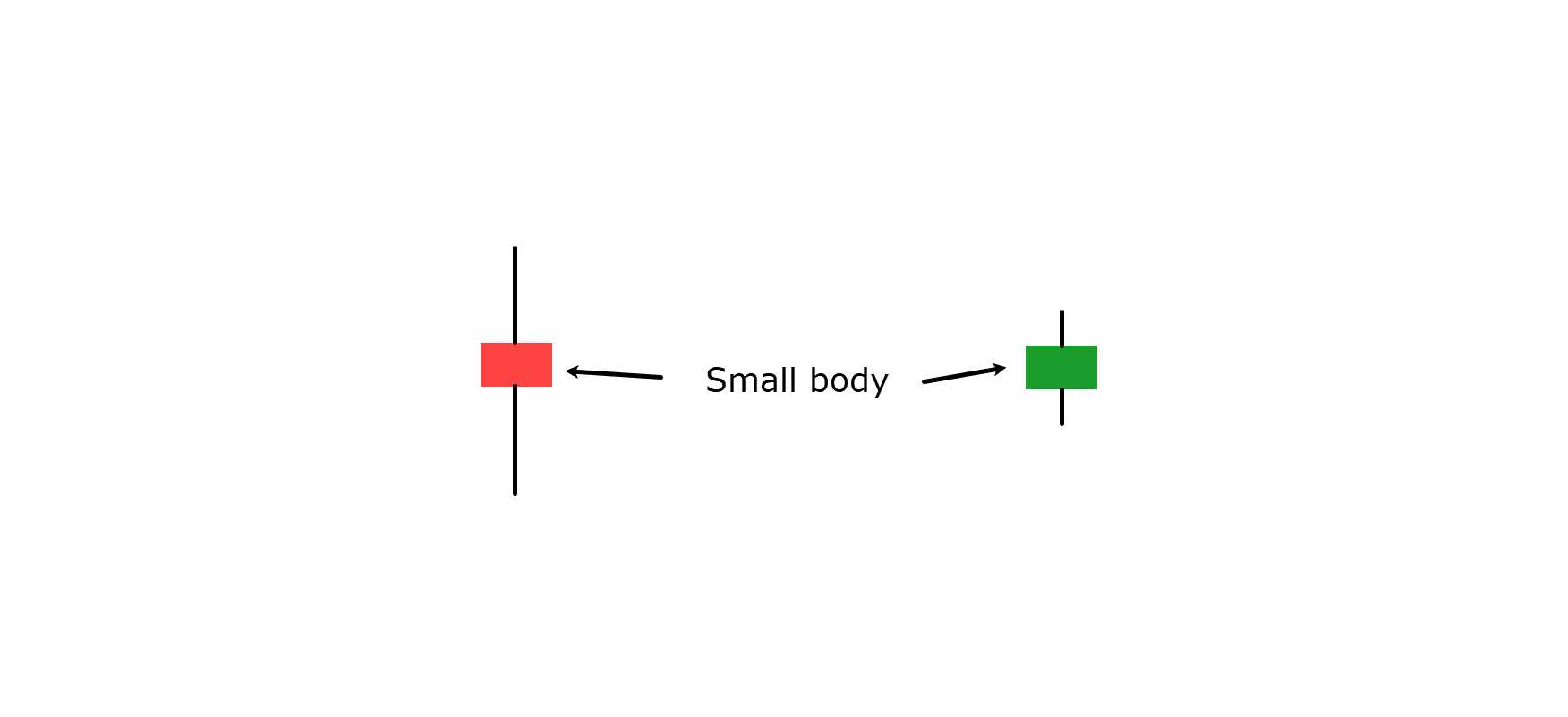

Indecision candlesticks, resembling doji or spinning tops, are shaped when the open and shut costs are very shut or equal, leading to a small physique and lengthy wicks…

Indecision Candles:

These candlesticks signify a stalemate between consumers and sellers, with neither facet in a position to achieve a definitive benefit.

The looks of indecision candlesticks typically precedes market reversals or durations of consolidation, signaling merchants to train warning and anticipate clearer indicators earlier than making selections…

Why They Are Vital

Candlesticks supply a common view of market dynamics that different charting strategies can’t match.

A key significance lies in providing a fast evaluation of market knowledge throughout buying and selling periods.

A Holistic Approach of Viewing the Market

As every candlestick shows the open, excessive, low, and shut costs, they allow you to view the complete vary of market exercise throughout the specified timeframe.

These particulars permit you to shortly assess market sentiment, determine traits, and make extra knowledgeable buying and selling selections with a easy look on the chart.

The Motive Candlesticks Exist

Candlesticks exist as a result of they break down complicated knowledge into one thing a lot simpler to know.

In contrast to line charts, which solely present closing costs over time, candlesticks reveal how consumers and sellers labored towards one another.

This interplay is essential for understanding market psychology and predicting future actions!

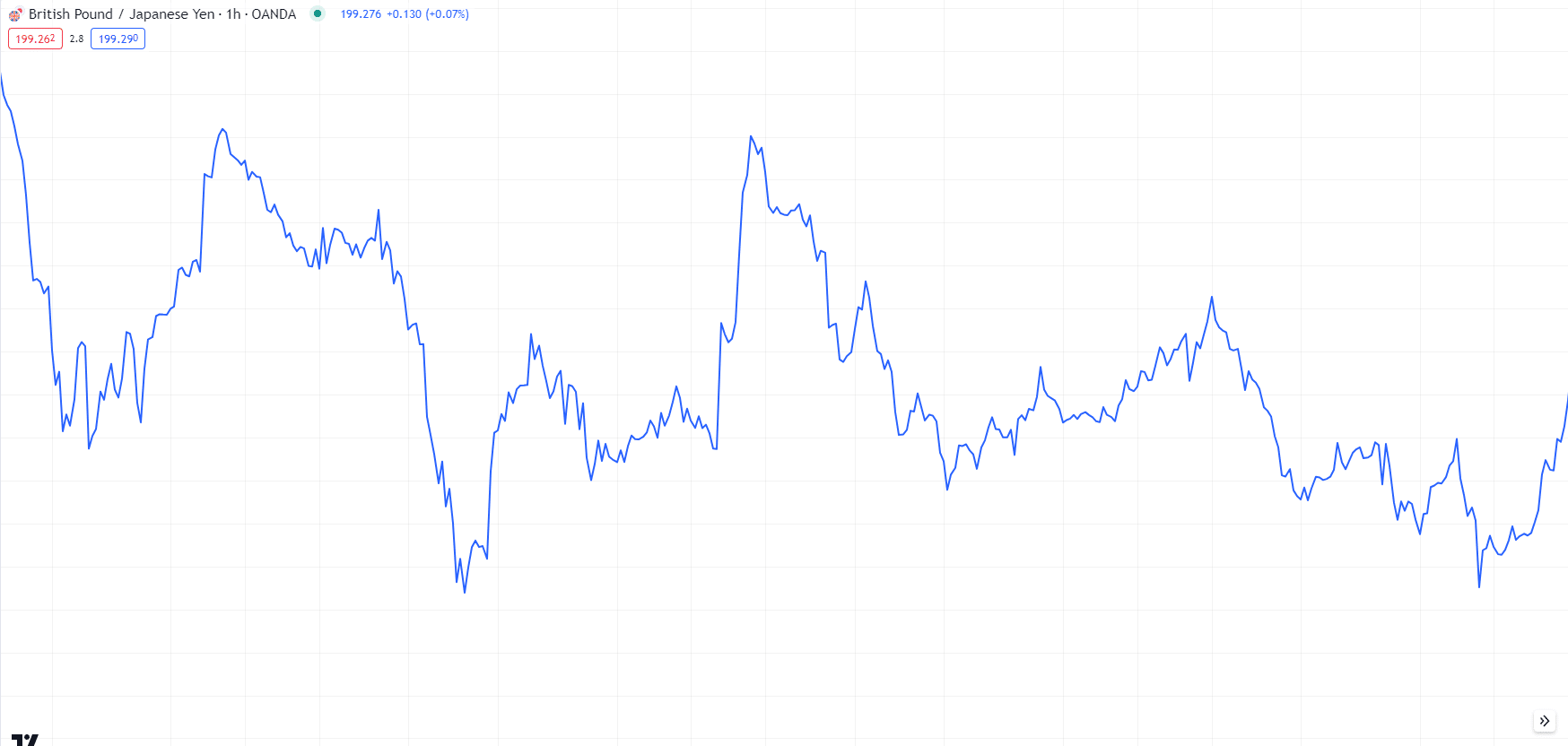

Let’s check out two an identical charts, one candlestick, and the opposite line…

GBPJPY 1-Hour Timeframe Line Chart:

See how this line chart does give us a basic concept of the place the value has been and the place it may very well be going?

Nonetheless, you may battle to see how these worth swings occurred or why…

That’s as a result of line charts can’t show data resembling worth rejection; the place costs check sure ranges however fail to carry them.

Let’s have a look at the identical chart however with candlesticks…

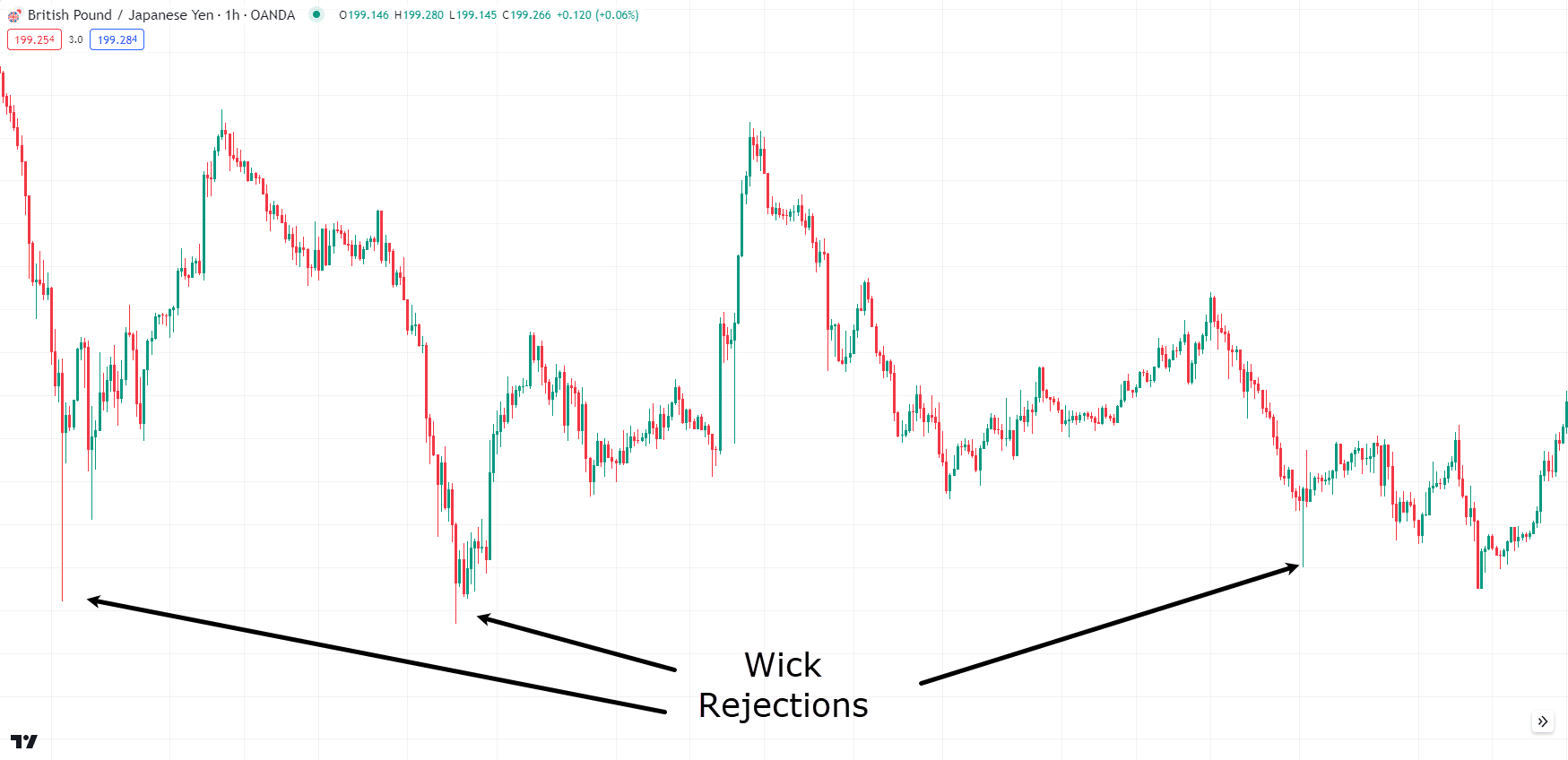

GBPJPY 1-Hour Timeframe Candlestick Chart:

See how the value initially depraved decrease than what the road chart represented?

That is essential data that was unavailable within the line chart, because of the closing worth being a lot greater.

It’s an important instance of promoting stress being met with stronger shopping for stress, and, because of your candlestick chart, you’ll be able to see there’s a sturdy probability of worth bouncing once more as assist on this space sooner or later!

This type of detailed data is crucial for figuring out potential reversal factors and understanding market sentiment.

Limitations of Different Charting Methods

Different charting strategies, resembling bar charts or point-and-figure charts, even have limitations in the best way they current knowledge.

Whereas bar charts do present open, excessive, low, and shut costs, they don’t supply the identical degree of readability and intuitive insights supplied by candlesticks.

Level-and-figure charts can give attention to worth actions and ignore time, however neglect issues such because the pace and period of worth modifications.

Candlesticks present the very best of all worlds in a simple illustration.

Piecing Collectively the Market Story

OK, I do know I typically discuss in regards to the story of the market!

Chances are you’ll ask, “What story? It’s merely some candles at sure costs on a chart, isn’t it?”

The rationale I get excited is as a result of once you spend loads of time watching charts, you start to begin piecing collectively every chart’s personal little story…

…all via piecing collectively a number of candlesticks.

When the candlesticks begin to act the identical means, it reveals you a small indication of what’s occurring out there…

…similar to it’s speaking to you!

Candlesticks present each how the session is progressing, in addition to the continuity and movement of market traits over time.

This makes it simpler to identify patterns, resembling bullish or bearish engulfing patterns, doji formations, and morning or night stars, that are important for predicting future market instructions.

Through the use of candlesticks, you’ll be able to join the dots between periods, gaining a clearer understanding of total market habits – and the story that the market is telling you!

How Are Candlesticks Used?

I touched on why candlesticks are used however let’s delve deeper into how one can learn the candlesticks’ story to provide you a bonus out there.

Rejection: Bulls or Bears Successful

One key facet of candlestick evaluation is knowing rejection, which happens when the value exams a sure degree however fails to maintain it.

That is typically seen via the candlestick wicks.

As an illustration, an extended higher wick signifies that consumers pushed the value up throughout the session, however sellers finally overpowered them, driving the value again down earlier than the shut…

Promoting Stress Diagram:

It suggests potential bearish sentiment or resistance at greater ranges.

This works the identical at a assist degree the place an extended decrease wick suggests sellers drove the value down, however consumers regained management, pushing the value again up.

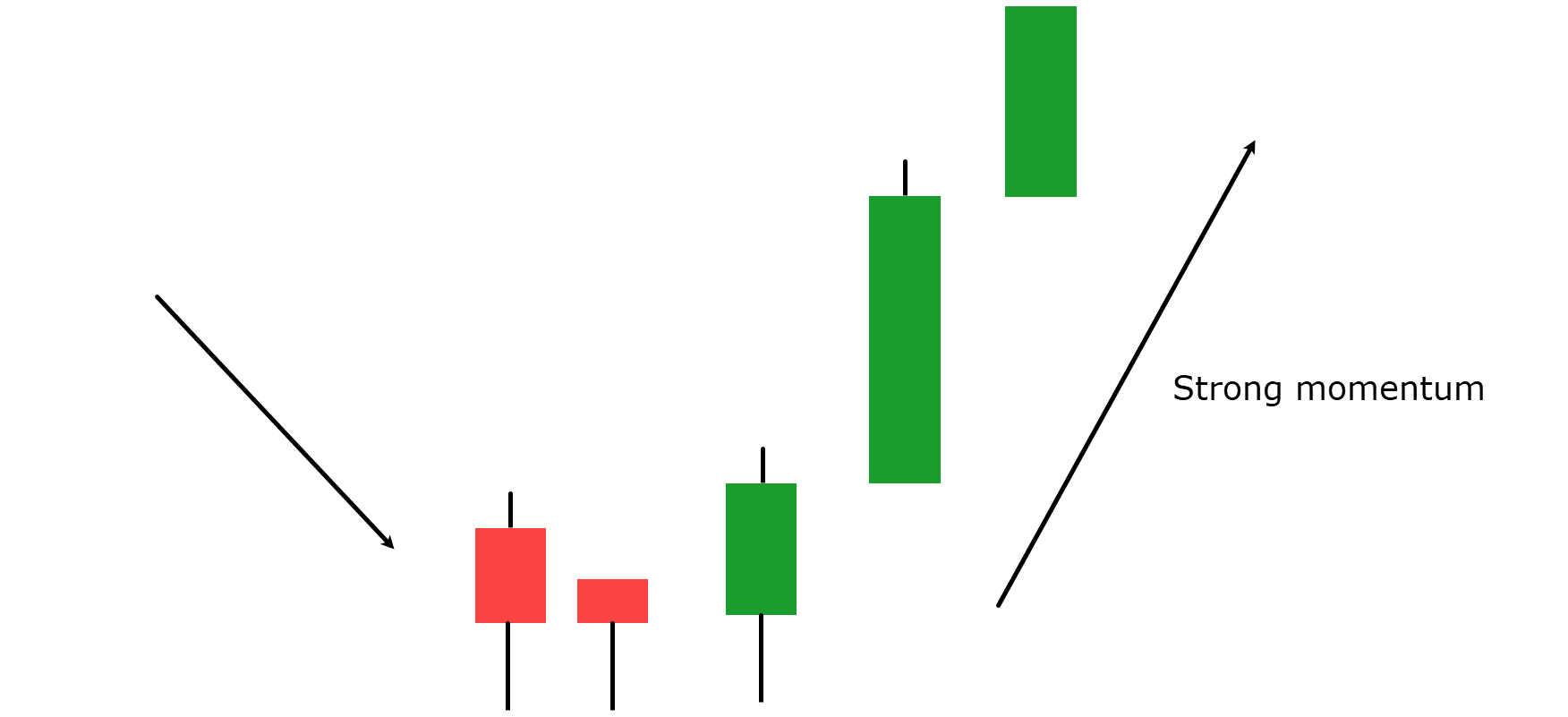

Momentum: Clear Visibility in Candles

Candlesticks additionally make it simple to see momentum throughout the market.

A sequence of lengthy inexperienced (bullish) candles with minimal wicks means sturdy upward momentum, suggesting consumers are in management…

Bullish Momentum Candles:

See how the inexperienced candles utterly outweighed the crimson candles on the backside of the development?

This visible illustration of momentum helps merchants determine and observe prevailing traits and predict market movement.

Patterns: Names and Meanings

Over time, merchants have recognized particular candlestick patterns that present insights into potential future market actions.

They’re typically a mixture of the above rejection candles and momentum candles, and when used with different market analyses, they will turn into a robust device.

The sample names typically mirror what the candles appear like, providing a fast and straightforward strategy to visualise and perceive what the candlesticks try to signify.

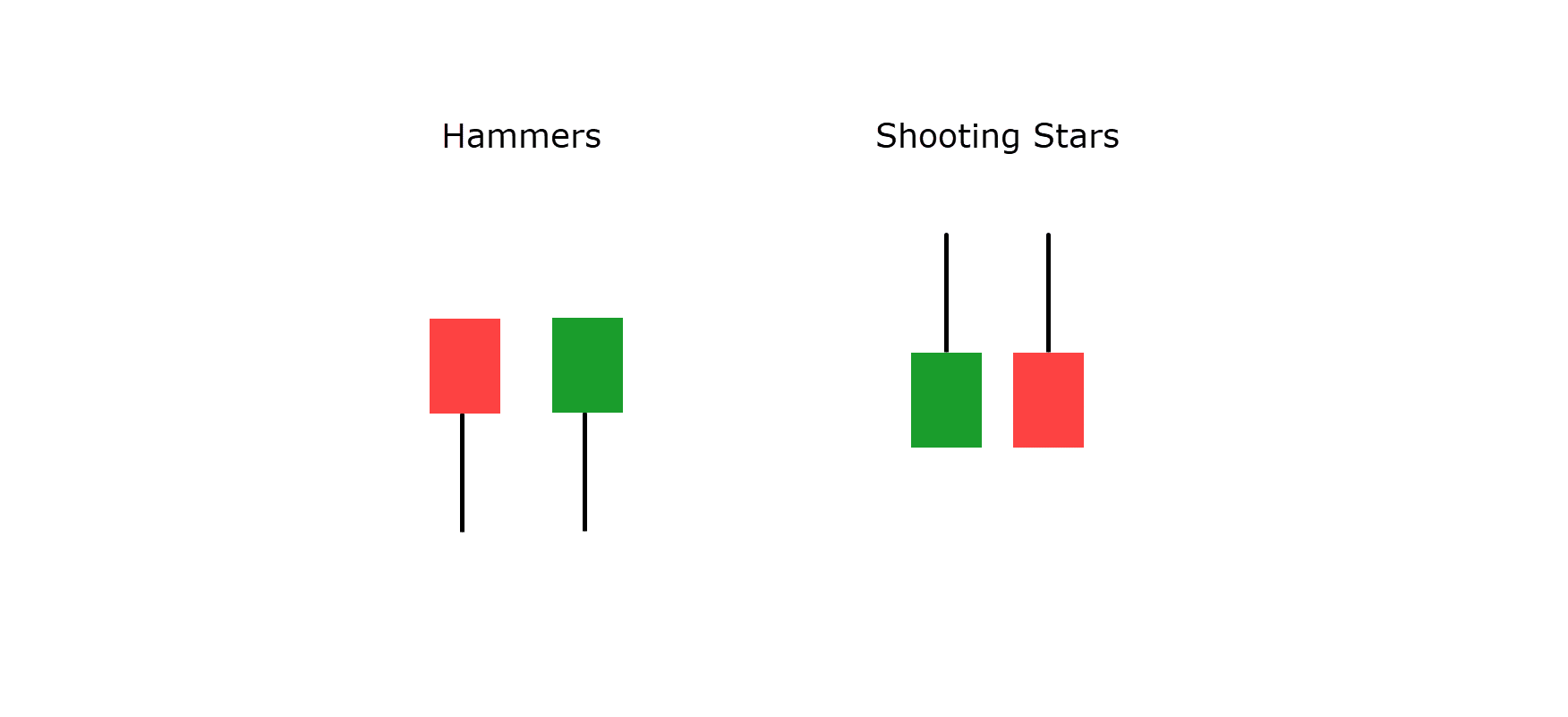

Some patterns you might have heard of are Hammers and Taking pictures Stars – typically used for detecting rejection out there at assist and resistances…

Hammer and Taking pictures Star Examples:

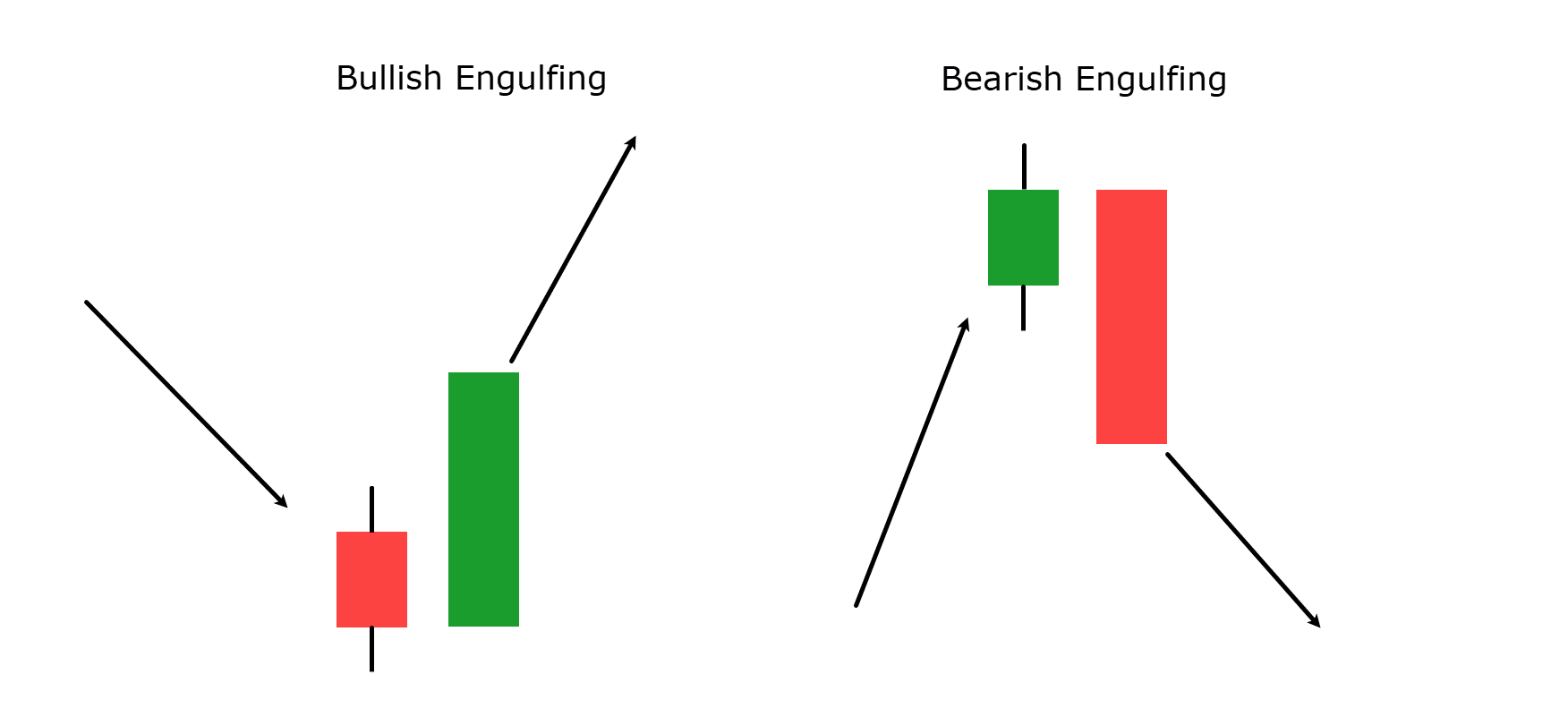

There are additionally bearish and bullish engulfing patterns.

These typically spotlight the momentum in a sure route that utterly engulfs a number of of the earlier candles, exhibiting that momentum has drastically shifted…

Bullish and Bearish Engulfing Patterns:

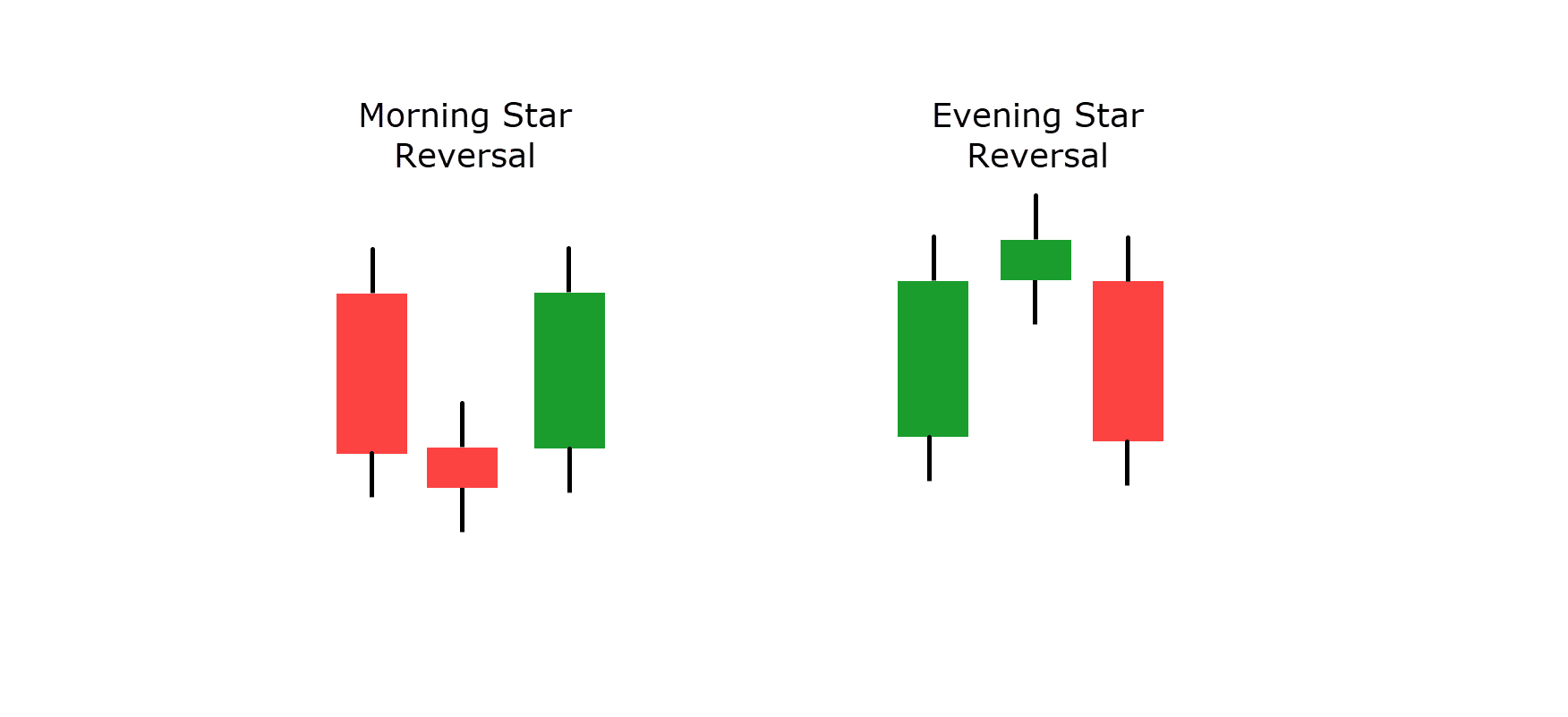

Morning and Night star reversal patterns are sometimes discovered at key turning factors out there.

They’re a mixture of rejection or indecision candles and infrequently adopted by engulfing like candles that sign sturdy momentum within the new route…

Morning and Night Star Reversal Patterns:

Many different combos of candlesticks make up worthwhile patterns, and I encourage searching for them out in your charts to assist perceive the tales they’re telling you!

What Are Some Suggestions and Tips to Efficiently Use Candlesticks?

Candlesticks are a robust device in technical evaluation, however their effectiveness is vastly enhanced when used with sure methods and greatest practices.

Listed below are some ideas and tips to maximise the worth of candlesticks in your buying and selling:

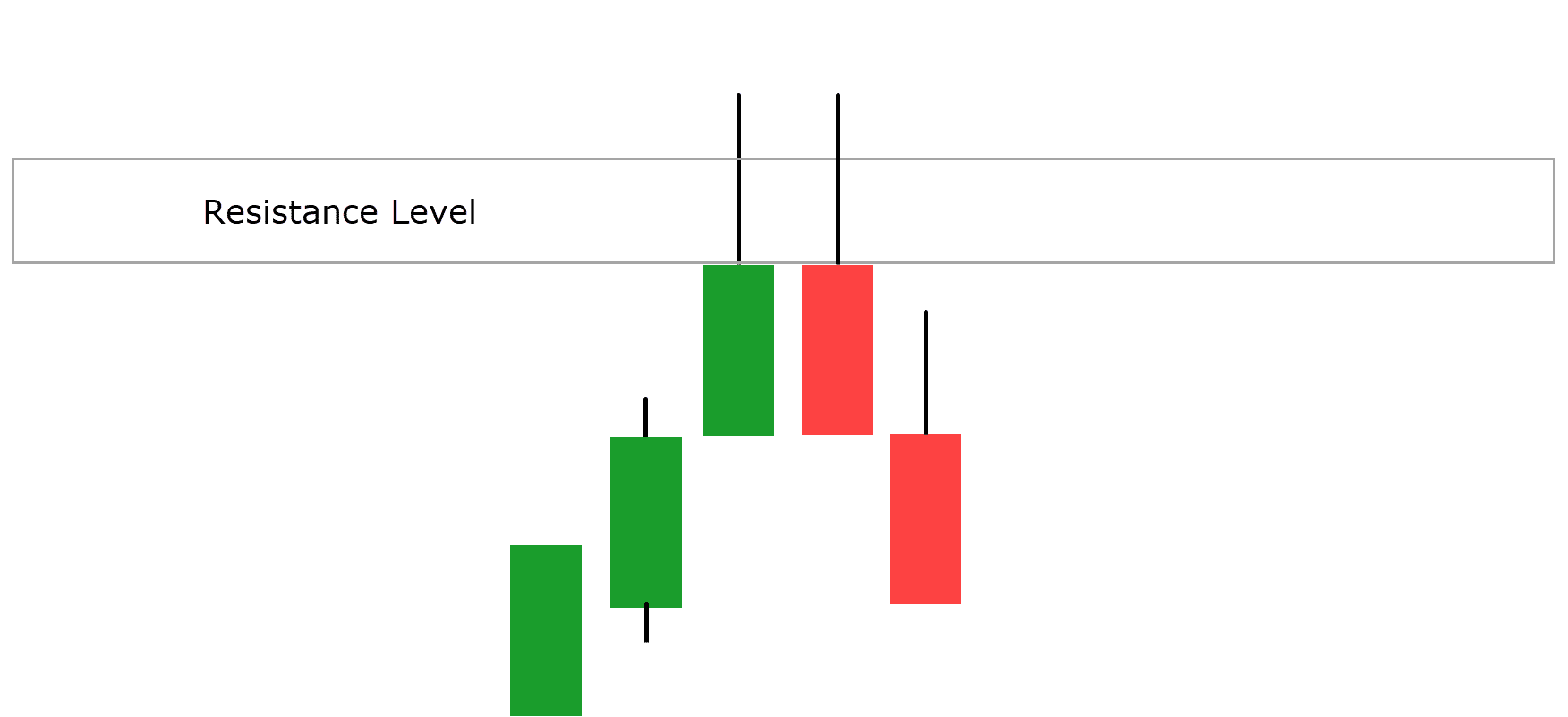

Key Areas of Worth

Utilizing candlestick patterns with key areas of worth—resembling assist and resistance ranges, trendlines, and transferring averages—is significant to success.

Key areas of worth are important worth ranges the place the market has traditionally proven sturdy reactions, both reversing route or accelerating momentum…

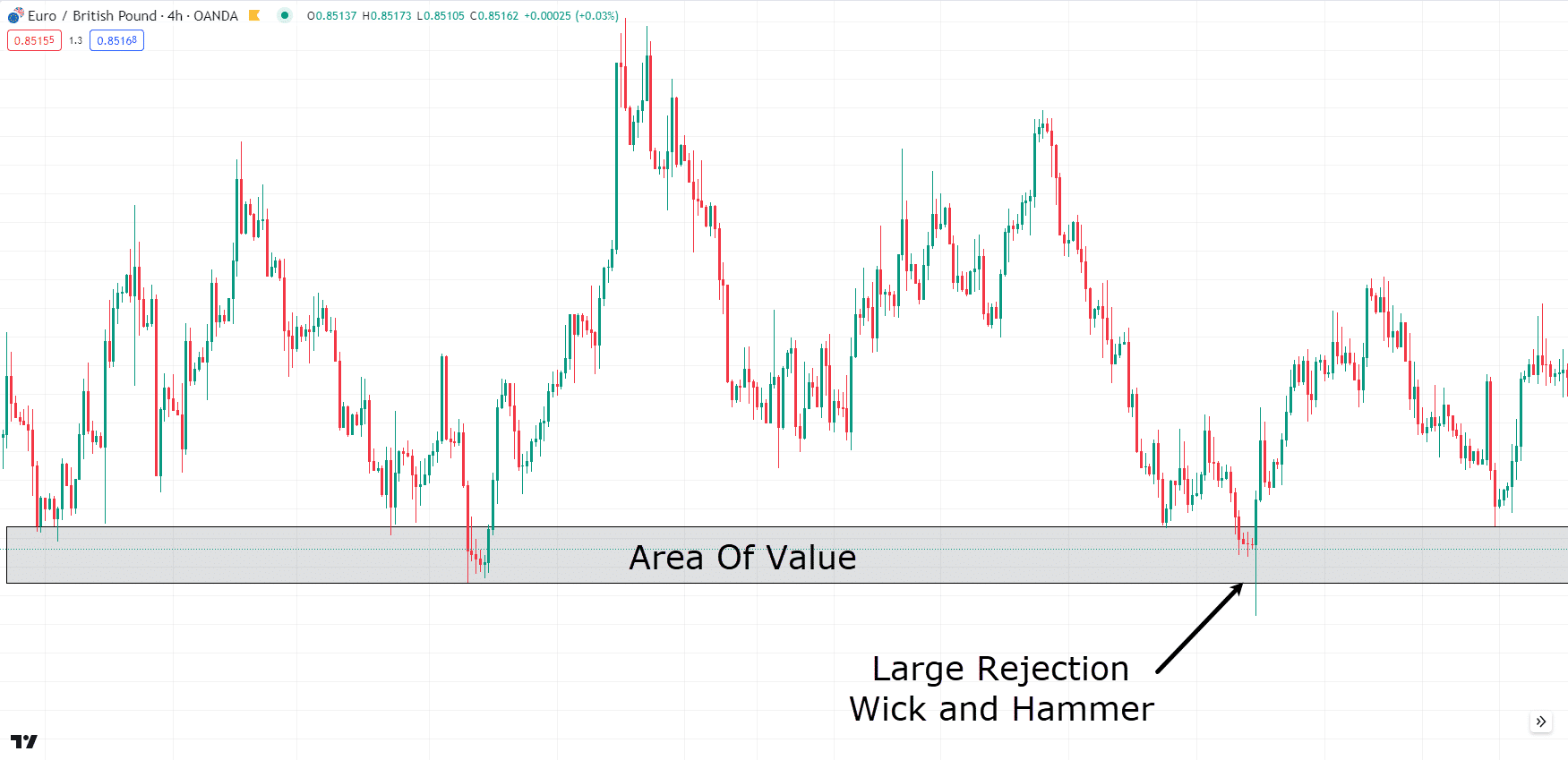

EUR/GBP Hammer Candlestick At Space Of Worth:

For instance, figuring out a bullish candlestick sample like a hammer at a serious assist degree can present a stronger sign for a possible reversal.

Equally, recognizing a bearish engulfing sample at a resistance degree may point out an upcoming downward transfer.

By specializing in these areas, you’ll be able to enhance the accuracy and reliability of your candlestick evaluation.

Group of Candlesticks Collectively

Analyzing a bunch of candlesticks collectively, relatively than in isolation, can present a deeper perception into market sentiment and strengthen your technical evaluation.

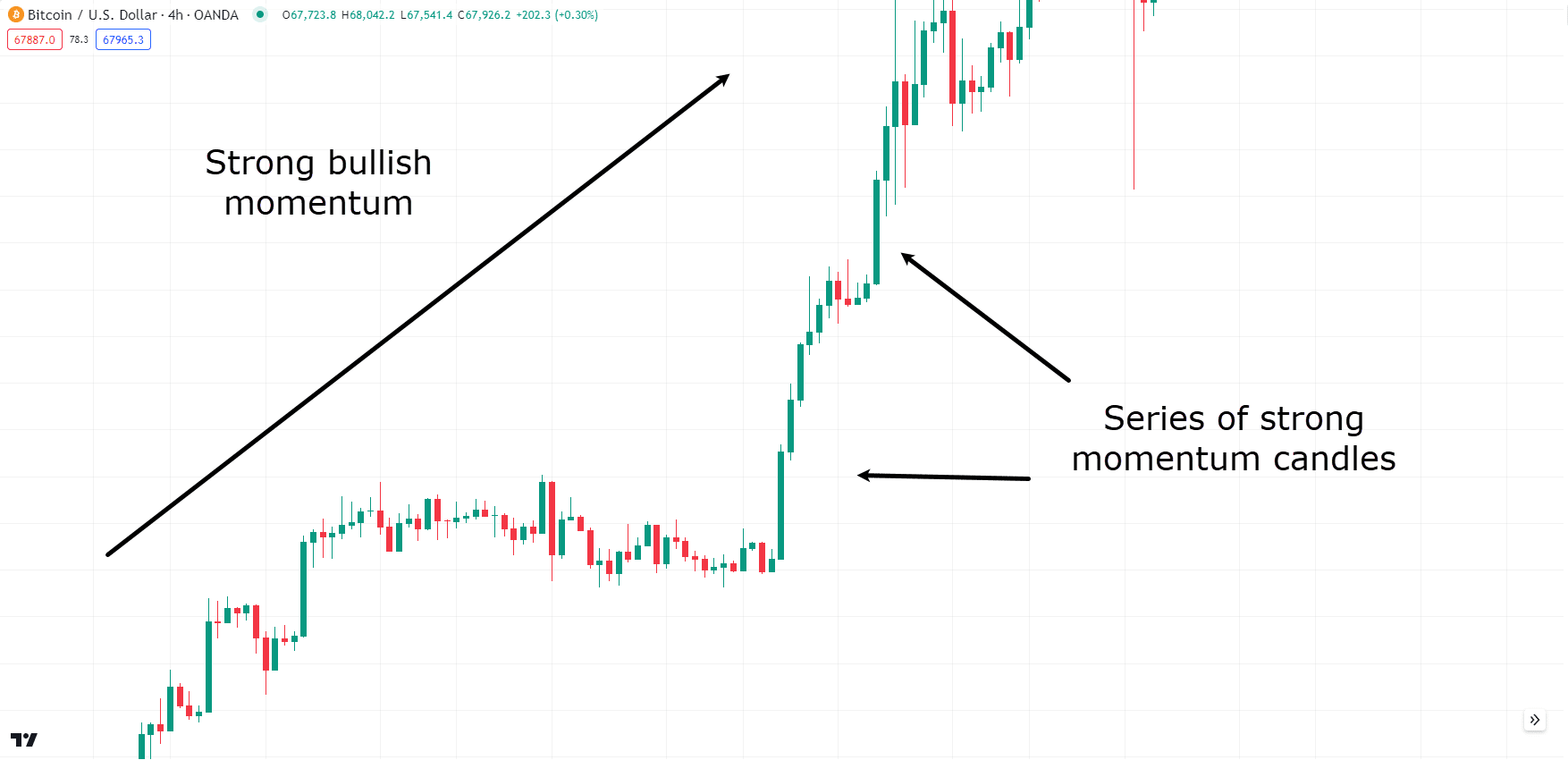

As an illustration, a sequence of bullish candlesticks forming greater highs and better lows inside an uptrend can affirm ongoing bullish momentum…

BTC/USD Sturdy Bullish Momentum:

When candlesticks act in a really related means, or there are a sequence of candlesticks all exhibiting the identical type of rejection or momentum, it may be an important early indicator that worth may both react to a degree or proceed with its sturdy momentum.

Wick Rejection

Wick rejection is a typical however important phenomenon, particularly in key areas of worth.

Wick rejection happens when the value strikes to a sure degree however then retreats, leaving an extended wick and a shorter physique on the candlestick.

It signifies that purchasing or promoting stress has are available in at that degree, inflicting a reversal.

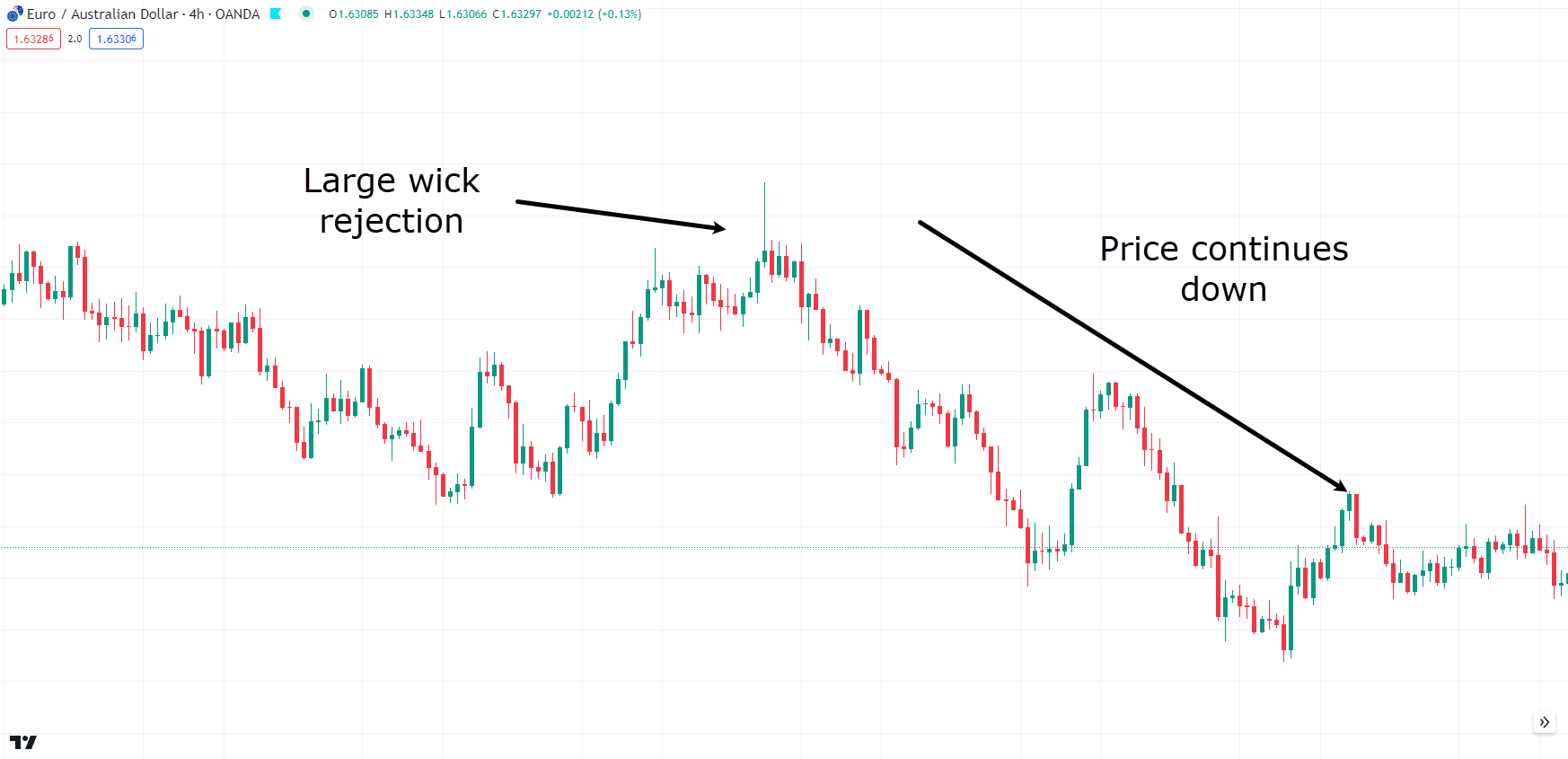

For instance, an extended higher wick on a candlestick that kinds at a resistance degree means that regardless of an try by consumers to push the value greater, sellers have taken management, driving the value again down…

EUR/AUD Wick Rejection:

This is usually a sign to promote or keep away from shopping for.

By paying shut consideration to wick rejections, particularly along with different technical indicators and key areas of worth, you’ll be able to achieve insights into potential reversals and continuations out there.

Bear in mind, the longer the wick, the larger the rejection!

Integrating Candlestick Evaluation with General Technique

This implies not relying solely on candlestick patterns however utilizing them as one piece of the puzzle in your buying and selling technique.

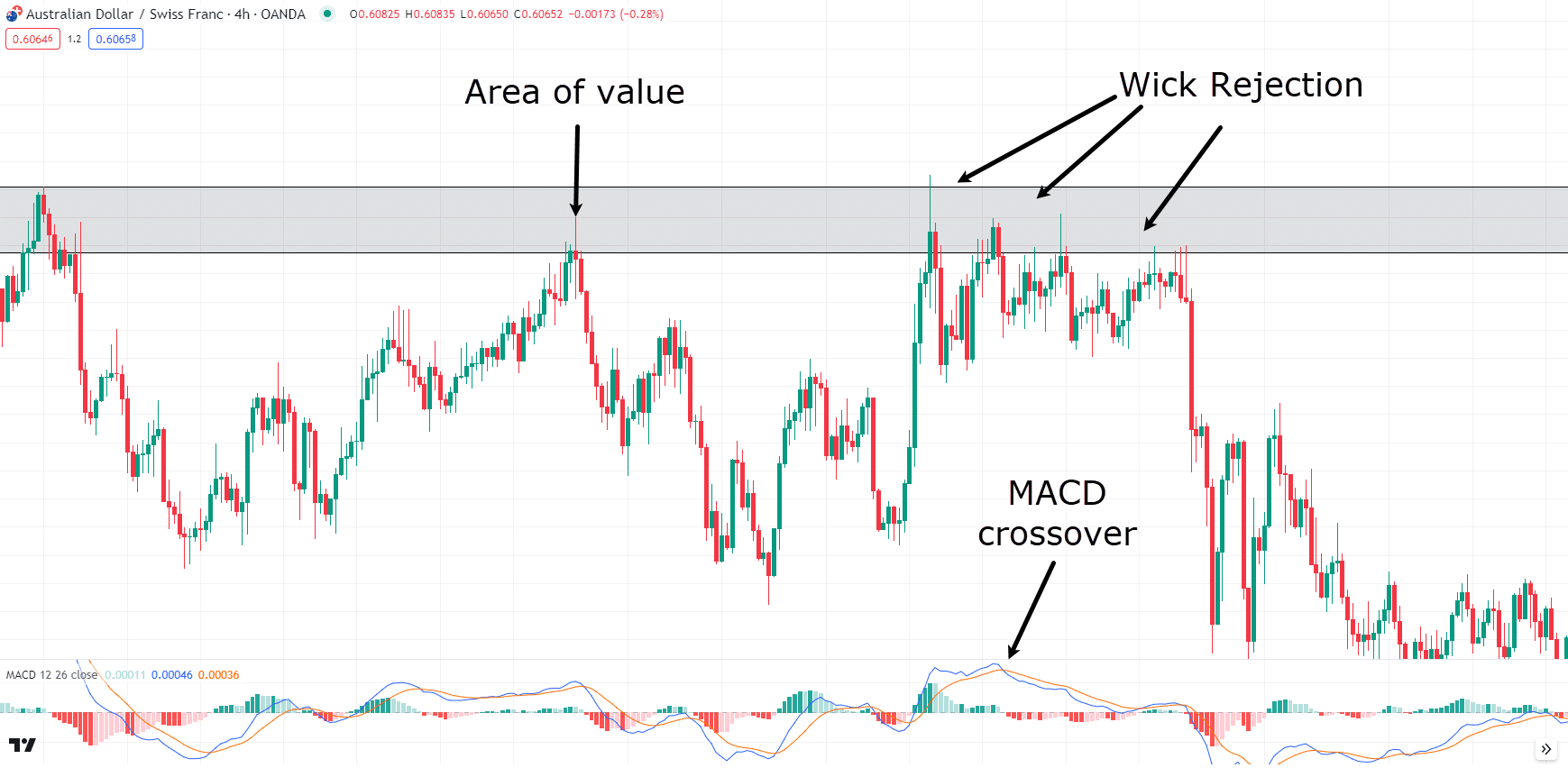

Combining candlestick insights with development evaluation, quantity knowledge, and different technical indicators kinds a well-rounded view of market circumstances.

Issues like utilizing candlestick evaluation with different technical indicators resembling RSI (Relative Power Index), MACD (Shifting Common Convergence Divergence), or Bollinger Bands can supply further affirmation and scale back the chance of false indicators…

AUD/CHF Instance A number of Technical Indicators:

This common method will help you make extra knowledgeable buying and selling selections.

Importantly, you must also observe endurance and self-discipline.

Look forward to clear candlestick patterns to type at key areas of worth, and use them together with different indicators to substantiate your evaluation.

Keep away from making hasty selections primarily based on single candlesticks or ambiguous patterns, as these can typically result in false indicators.

What Are Some Widespread Errors and Limitations of Candlesticks?

Whereas candlesticks are a worthwhile device in technical evaluation, they don’t seem to be with out their limitations.

Utilizing Them within the Improper Areas of the Chart

Probably the most widespread errors I see is utilizing candlestick patterns within the improper areas of the chart.

Candlestick patterns are only once they seem at key areas of worth, resembling assist and resistance ranges, trendlines, or important transferring averages.

For instance, there’s no level in making an attempt to make sense of a hammer in the midst of a spread and taking motion primarily based on it.

Value is commonly drawn to key areas of worth, and though a candle is likely to be bullish or bearish for that session, it doesn’t all the time imply there can be follow-through!

Not Taking within the General Context of the Market

One other mistake is failing to think about the general context of the market.

Candlesticks present worthwhile details about worth motion inside a selected timeframe, however they by no means supply an entire image simply on their very own.

Ignoring the bigger market context, such because the prevailing development, market sentiment, and basic components, can result in misguided selections.

It’s vital to think about the upper timeframes when analyzing candlesticks and ask your self whether or not this sample on the decrease timeframe actually has a lot weight – all whereas contemplating the a lot bigger context of the market!

(candlesticks on greater timeframes have way more weight and which means than these on a decrease timeframe.)

Bear in mind to think about any information occasions occurring and use that to raised perceive why sure candlesticks might have extra quantity or momentum earlier than contemplating whether or not or not it’s a worthwhile entry set off!

Subjectivity

Deciphering candlestick patterns could be fairly subjective.

Totally different merchants may even see completely different patterns and even interpret the identical sample in their very own methods, resulting in inconsistency in evaluation and decision-making.

It’s vital to analyse the property you commerce and begin to provide you with your individual which means and understanding of the number of candlestick patterns.

Ask your self what rejection seems like, or how huge an engulfing sample must be so that you can take into account it a worthwhile sample.

It’s typically a person conclusion with no proper or improper reply.

Conclusion

In conclusion, candlesticks are a worthwhile device for predicting market actions and may function an important indicator for trades.

When used within the right context of the market and with different technical evaluation instruments, candlesticks can offer you an edge in anticipating market outcomes.

To summarize, on this article, you’ve:

- Realized what a candlestick is

- Mentioned the significance of candlesticks in technical evaluation

- Explored methods to analyze candlesticks and the tales they inform

- Reviewed widespread candlestick patterns and their meanings

- Recognized ideas and tips for profitable candlestick utilization

- Highlighted widespread errors and limitations of utilizing candlesticks

Congratulations on uncovering one other important device for profitable buying and selling!

Through the use of candlesticks to enhance your different technical evaluation, you’re nicely in your strategy to changing into a extra knowledgeable and efficient dealer.

Now – I’m keen to listen to your ideas on candlestick evaluation…

Do you at present use candlestick patterns in your buying and selling?

Are you able to see why they’re a essential part of technical evaluation?

How a lot success have you ever had with them?

Share your ideas and experiences within the feedback under!