Are you prepared for an additional unbelievable buying and selling information?

Effectively, lined up for you right now…

…I’m broadcasting the last word showdown…

Fib Extension vs Retracement!

Though these instruments may look advanced on the floor, that’s solely as a result of most merchants overcomplicate them…

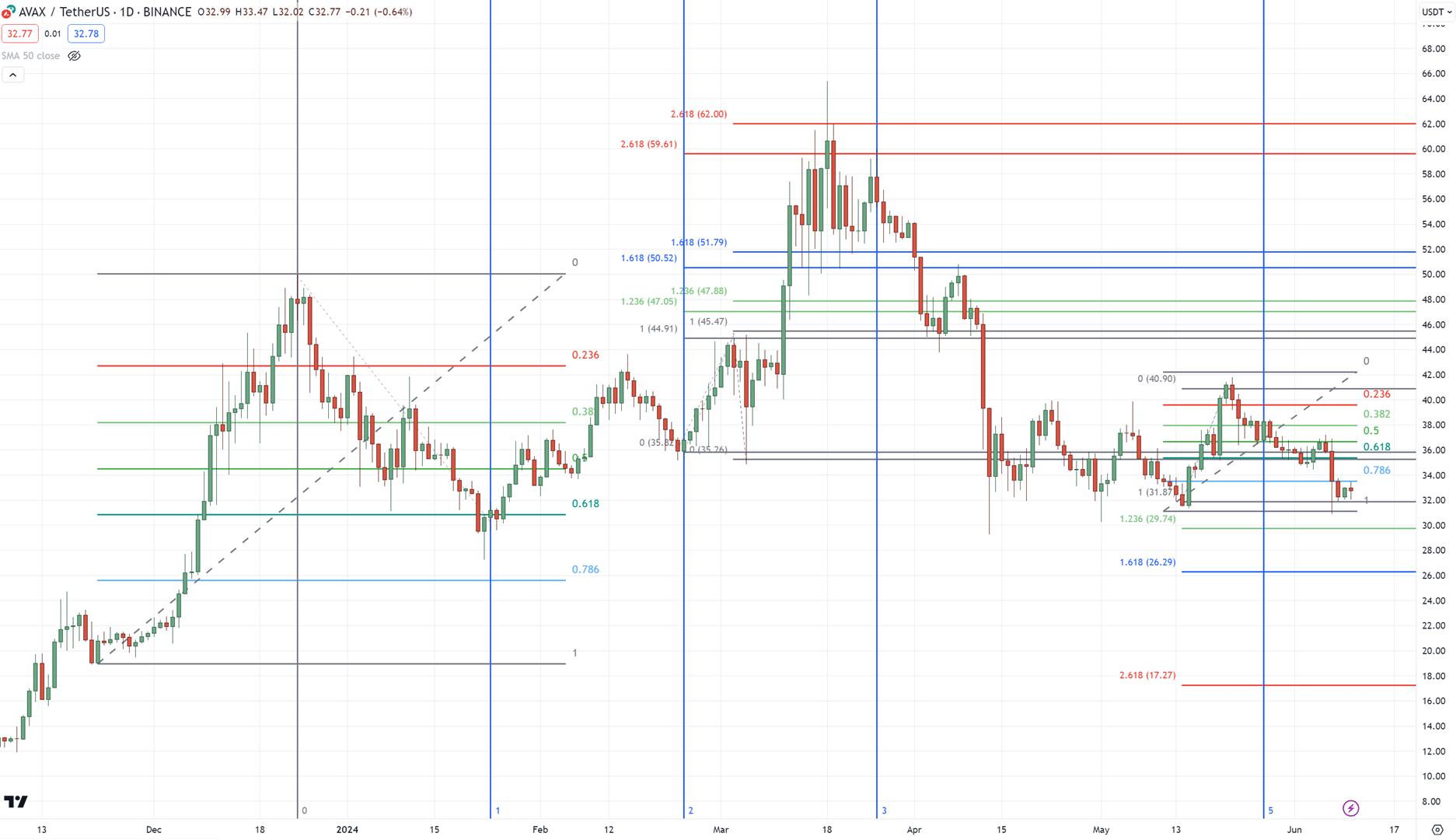

Not solely that, however there are a tonne of Fibonacci instruments on the market to get misplaced in!…

Seems fairly complicated, proper?

That’s why this information filters out the noise, serving to you get per two superior Fibonacci instruments on the identical time!

You’ll cowl:

- What these two Fibonacci instruments are and the way they’re meant for use out there

- The key to utilizing each the Fibonacci extension and retracement like a professional

- A whole technique and framework to revenue from each

- Frequent errors on utilizing the Fib extension vs retracement (and what you need to do as a substitute)

By the top of this information…

You’ll grasp utilizing and buying and selling with these superior Fibonacci wonders!

Are you prepared?

Then let’s get began!

Fib Extension vs Retracement: What Are They and How Do They Work?

This text focuses on these two Fibonacci instruments right now…

That’s proper, I gained’t be discussing each single type of Fibonacci device on the market.

Why?

As a result of the primary objective of this information is easy:

That will help you seize and revenue from developments straightforwardly and persistently!

Sounds good, proper?

So, let’s begin with Fib retracement…

Fibonacci Retracement

Principally, consider it like this.

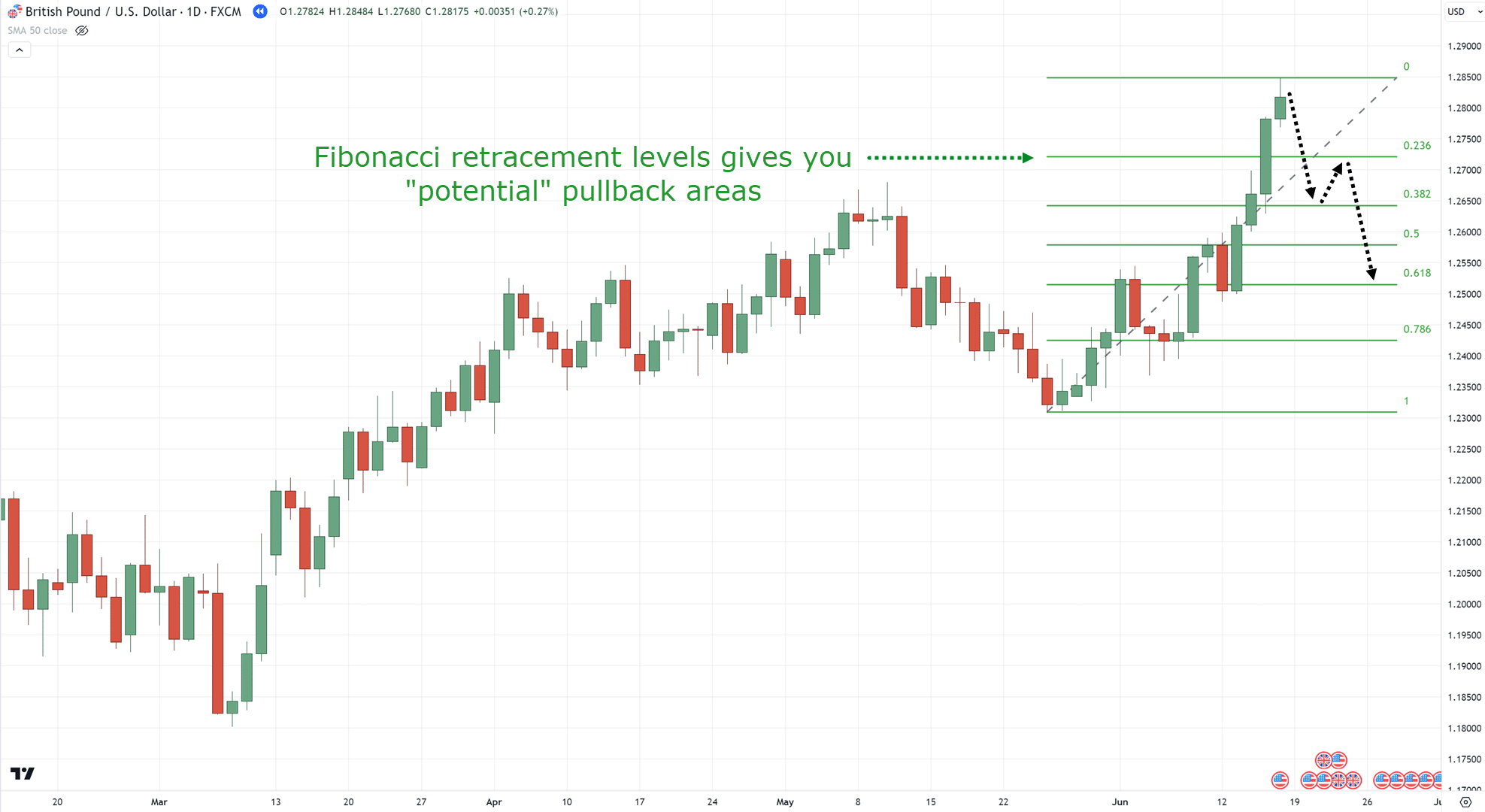

You’ve had an excellent run-up in value, and also you’re making an attempt to determine how deep the pullback will go when it occurs…

Actually, the Fib retracement is a superb device to make use of on this scenario.

Why?

Effectively, by plotting a Fib retracement from the underside to the highest of the present leg…

…you’ll be capable to anticipate how deep the pullback will go!…

Nice, huh?

However – take observe!

This device doesn’t “predict” how deep pullbacks will get.

It does, nonetheless, provide you with a number of ranges to commerce when the market reverses from them (which I’ll let you know extra about within the later part).

On the opposite facet of the coin…

There may be the Fib extension, the explorer charting uncharted territories…

Fibonacci Extension

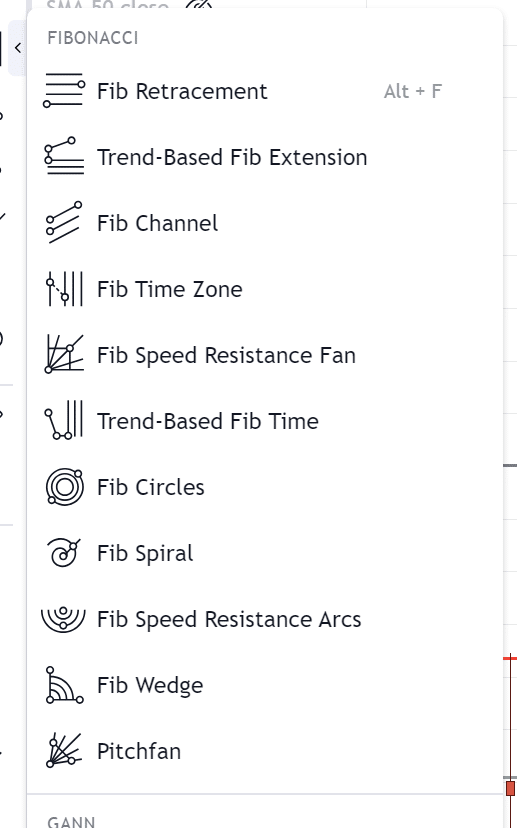

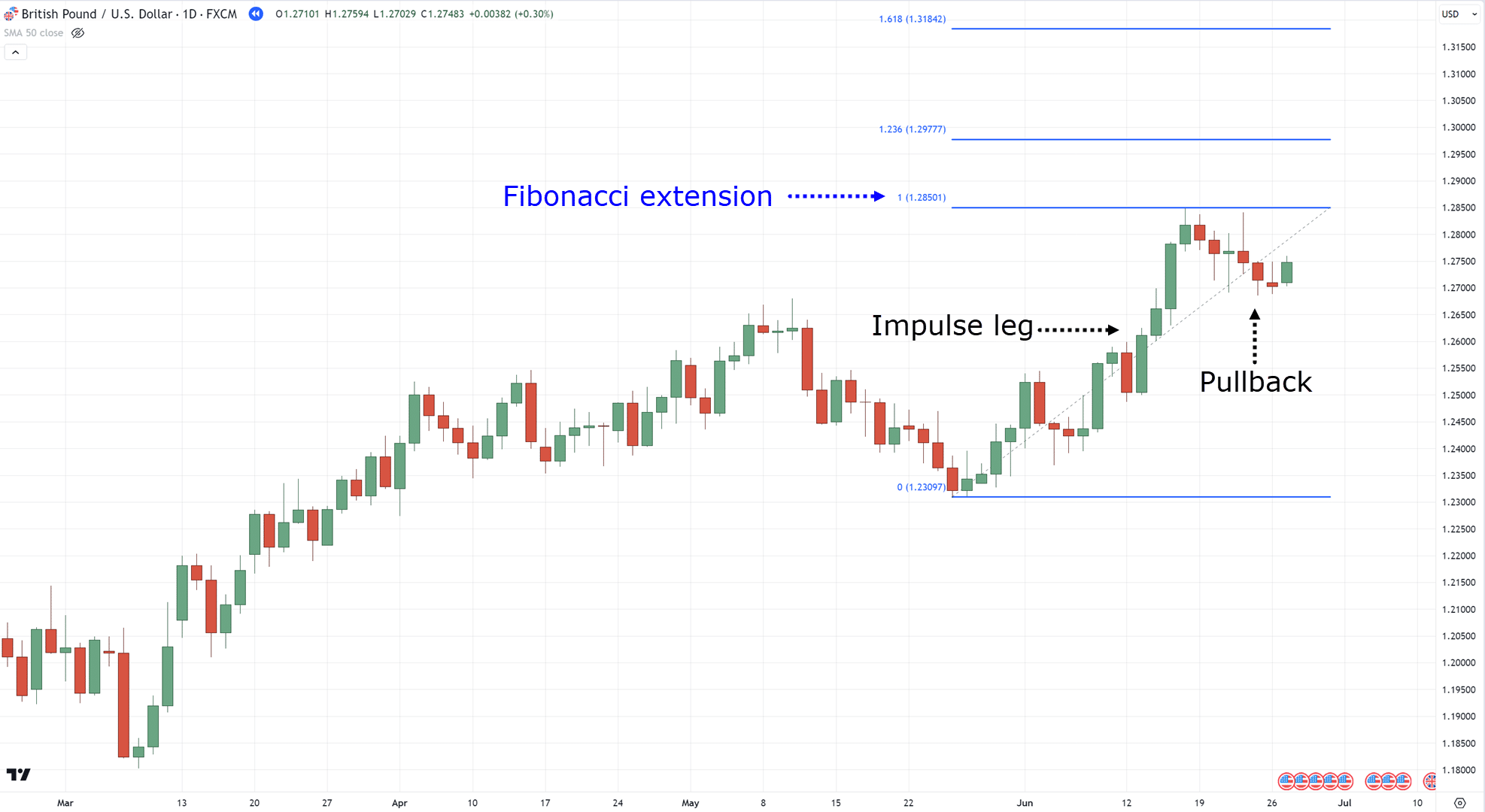

Much like the Fibonacci retracement, plot this on an present value leg…

However as a substitute of on the lookout for a pullback…

…it’s projecting the place the value may head subsequent throughout a breakout!

Principally, the Fibonacci retracement device is the important thing to coming into pullbacks…

…whereas the Fibonacci extension helps you outline your take-profit ranges…

Whereas each instruments are a part of the Fibonacci household, they clearly serve very totally different roles in your buying and selling technique.

So, with that mentioned…

How precisely do you utilize these instruments successfully?

You possibly can analyze markets with all of them day, however what are the essential steps wanted to start buying and selling?

Learn on to seek out out within the subsequent part!

Fib Extension vs Retracement: Learn how to Use Each Instruments Like a Professional

First issues first…

You’ll want to get proficient in plotting these Fibonacci instruments.

If it’s one thing you’re battling for the time being, don’t panic, as there’s a unbelievable information for you right here.

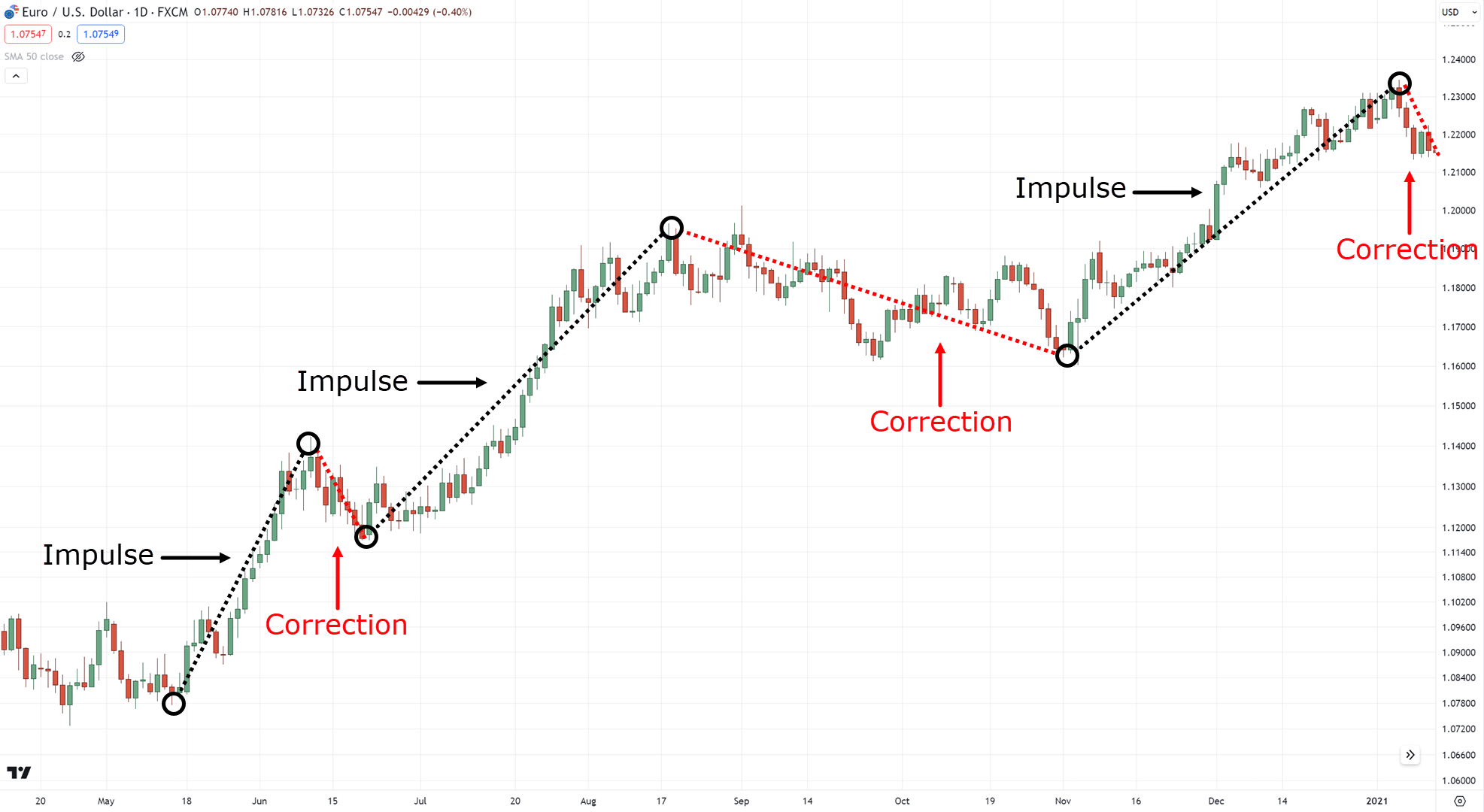

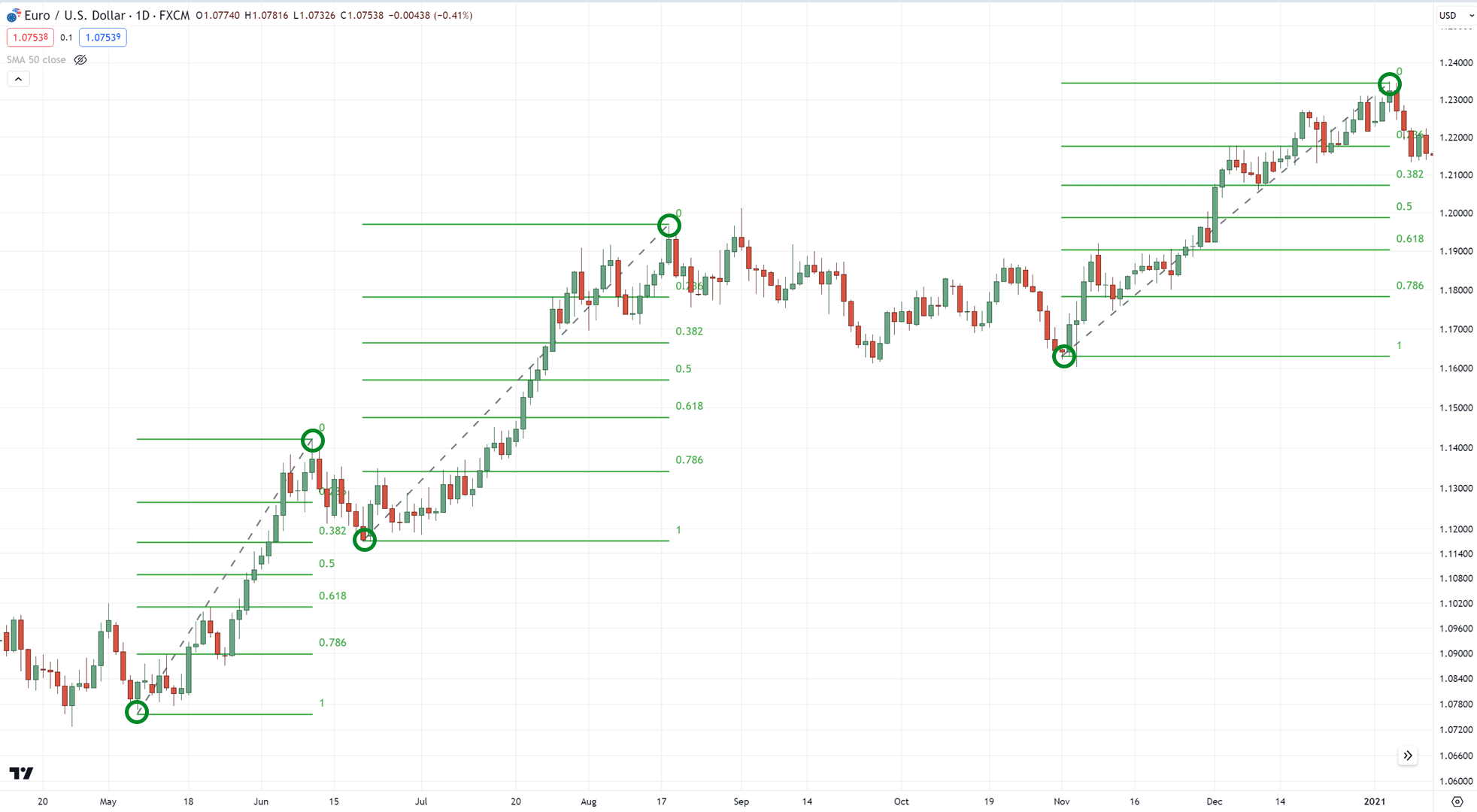

However to place issues merely, you have to discover ways to acknowledge “impulse strikes” within the markets reminiscent of these…

…as a result of their tops and bottoms are your references when plotting your Fib extension vs retracement instruments…

Are you able to see how they’re drawn?

So, with that out of the best way…

Listed here are the stuff you want to remember when utilizing each the Fib extension vs retracement.

First up…

Outline your pattern first

This might be a recurring theme within the article.

In any case, understanding the context of the markets is king!

When the market is in an uptrend, place your Fibonacci from backside to prime…

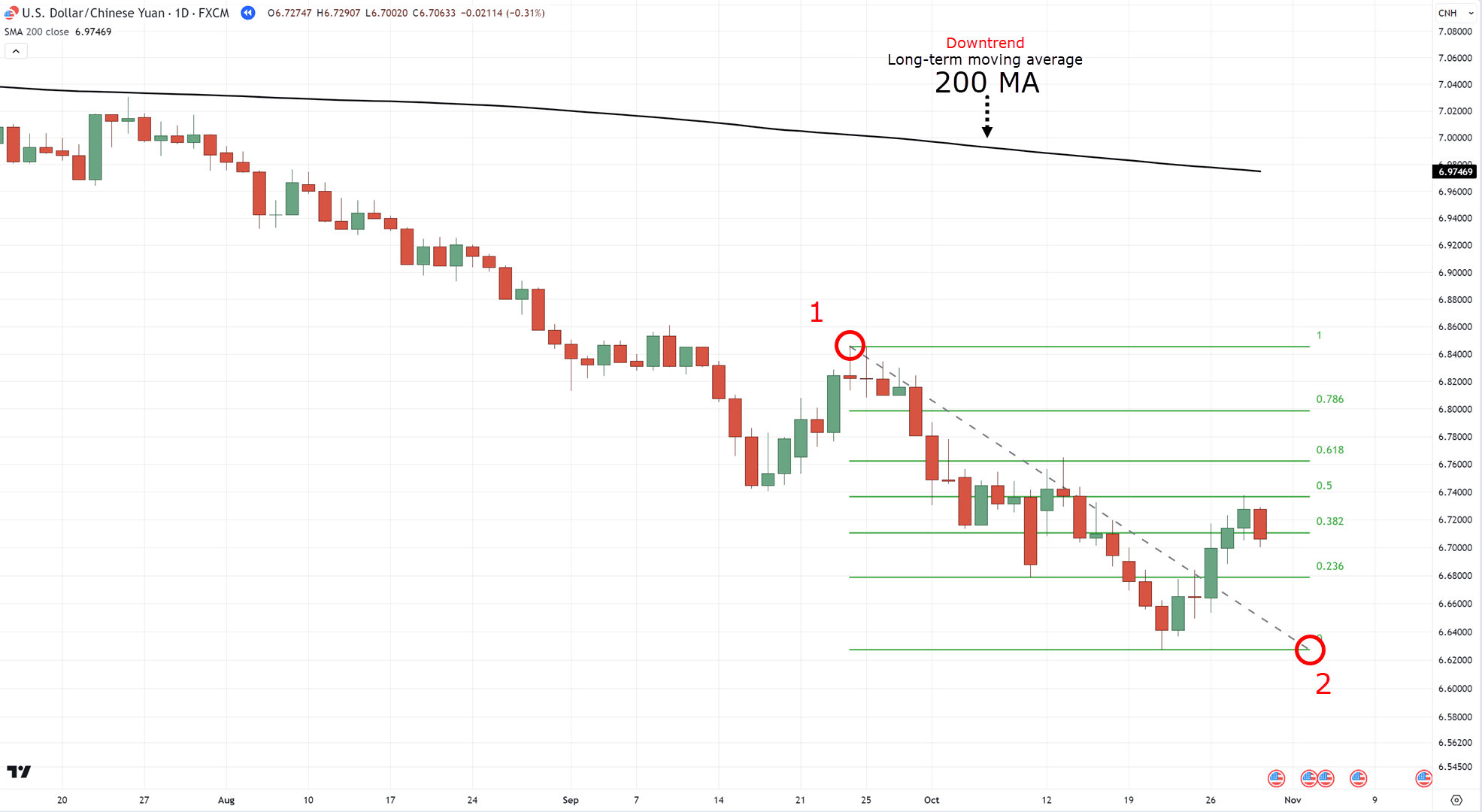

…if the market is in a downtrend, then plot your Fibonacci from prime to backside as a substitute…

Straightforward, proper?

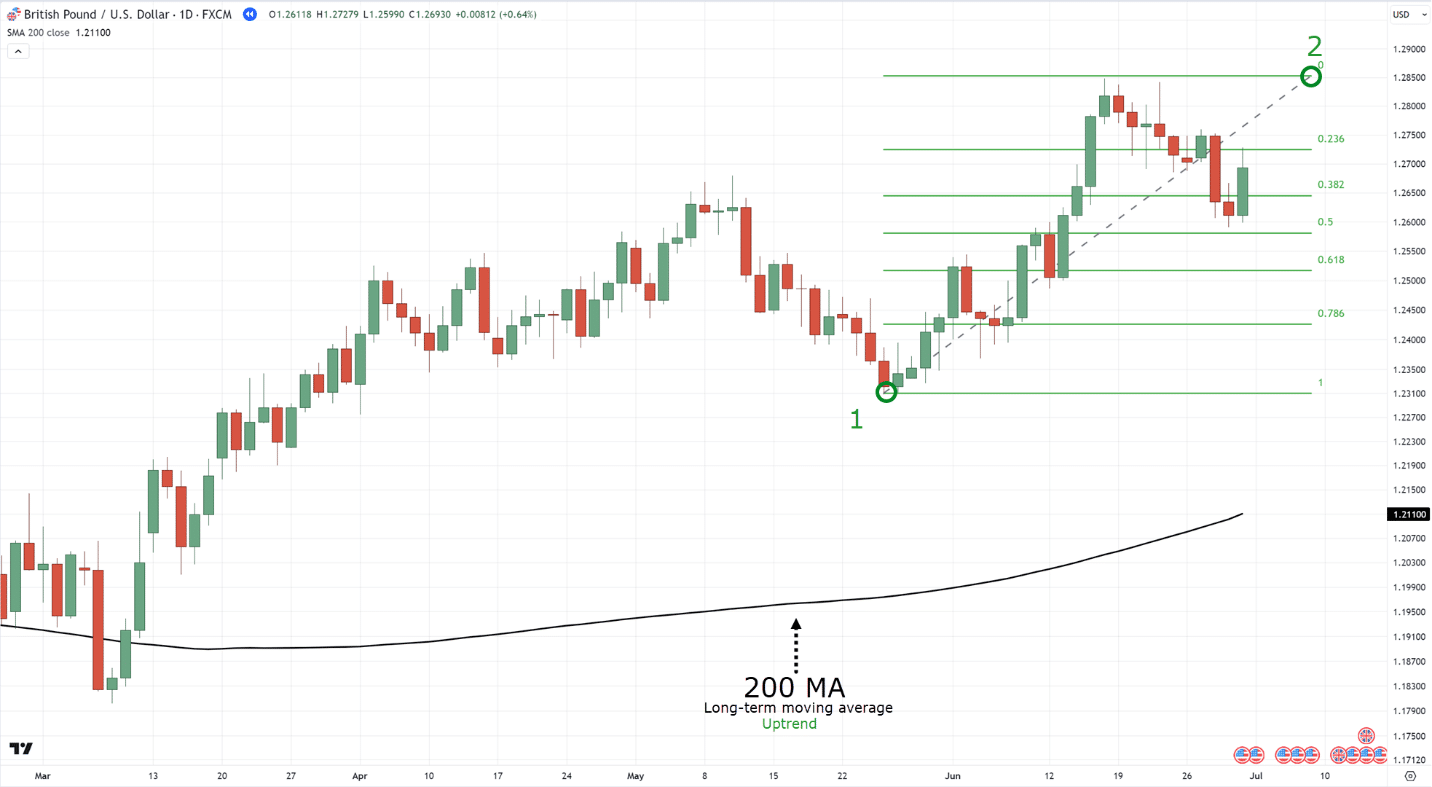

If it’s worthwhile to brush up on the 200-period shifting common, you possibly can at all times take a look at this nice writeup right here, too: The 200 Day Shifting Common Technique Information

Alright, when you’ve outlined your pattern, the subsequent factor you have to give attention to is…

Outline your setups

Right here’s a cheat code for you:

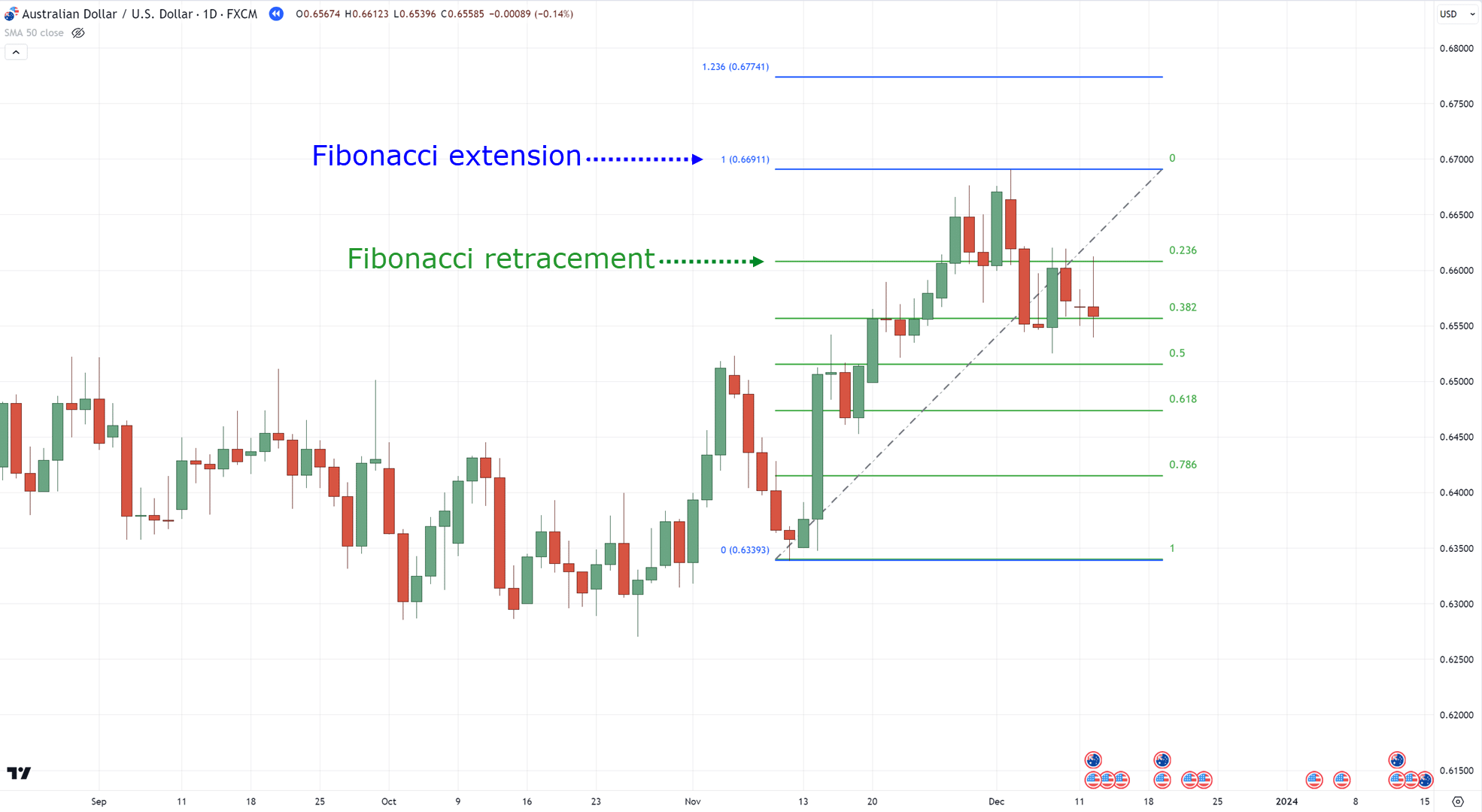

Pullback setups?

Fibonacci retracement.

Breakout setups?

Fibonacci extension.

That’s proper, if you happen to’re trying to find these candy pullback trades, whip out your Fibonacci retracement device!

It’s excellent for pinpointing these ranges the place the market may catch its breath earlier than persevering with…

Pullback setup utilizing the Fibonacci retracement:

And as at all times, we’re timing these setups together with the general pattern.

Based mostly on the instance, the market is in a downtrend, so we’ll be timing for shorts.

Following to date?

As a result of on the flip facet…

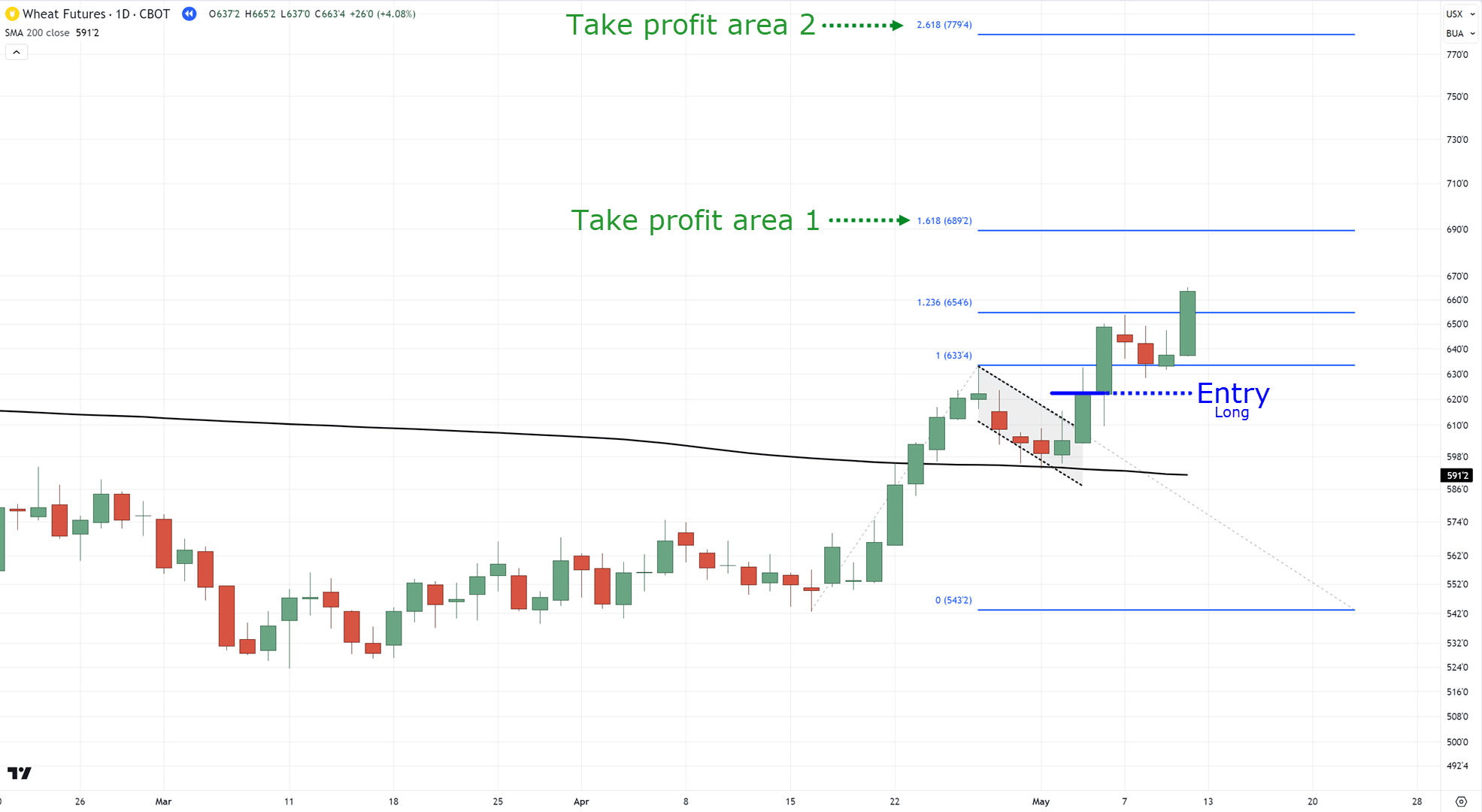

In case you’re desperate to catch breakout trades, the Fibonacci extension is your finest buddy!

This device will show you how to challenge the place the value may head as soon as it breaks free from its present vary…

Breakout buying and selling setup utilizing the Fibonacci extension:

Look good?

At this level, I can hear your questions…

“So… how do I precisely enter trades?”

“When do I press the purchase button?”

“Can I exploit each the Fib extension vs retracement?”

(Spoiler alert: Completely!)

Relaxation assured, my buddy, within the subsequent part, I’ll share a secret method on tips on how to mix each instruments for max buying and selling awesomeness…

…and reply the remainder of your wonderful questions!

Fib Extension vs Retracement: A Full Combo Technique

Able to stage up your buying and selling sport?

The key ingredient to combining each instruments is named the TAEE framework.

This framework is the core basis of all buying and selling ideas we normally train right here.

Particularly when mastering each Fib extension vs retracement.

So what does this framework stand for?

TAEE stands for figuring out the Pattern (T), Space of Worth (A), Entries (E), and Exits (E).

Right here’s tips on how to use it to mix Fib extension and retracement like a professional!

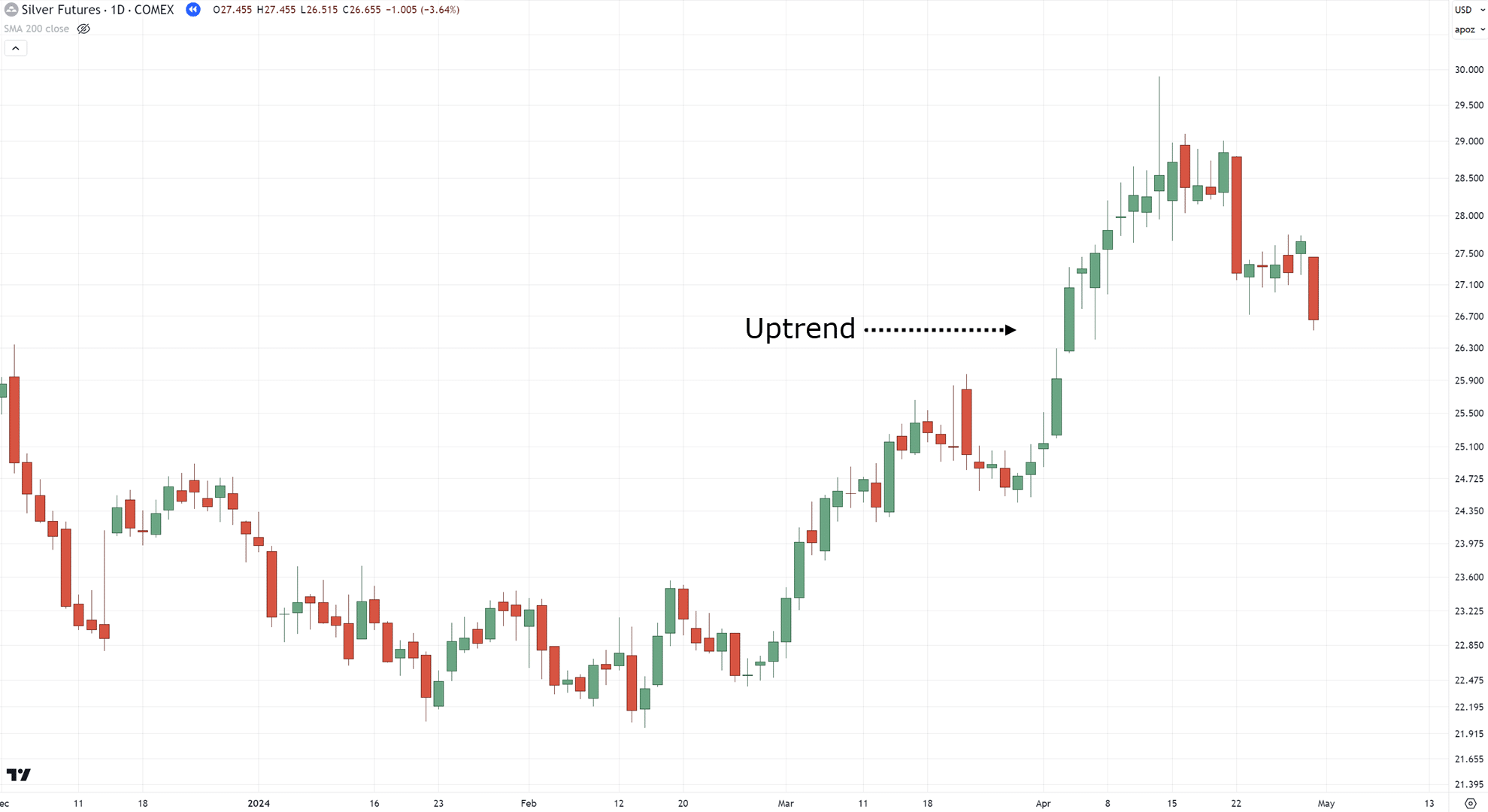

Step 1: Determine the Pattern

You’ve seen this earlier than, so let’s soar straight in.

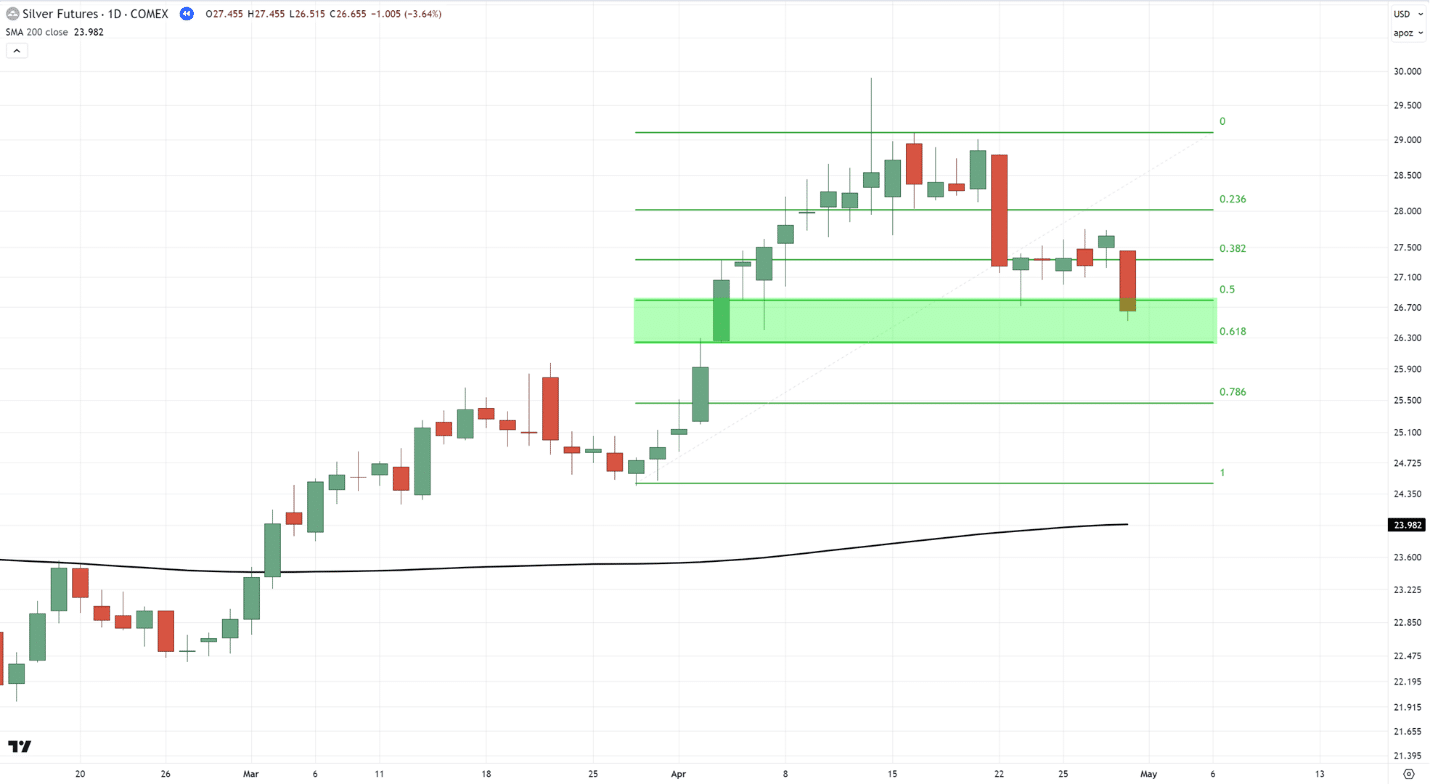

On this instance, we’ll use an uptrend…

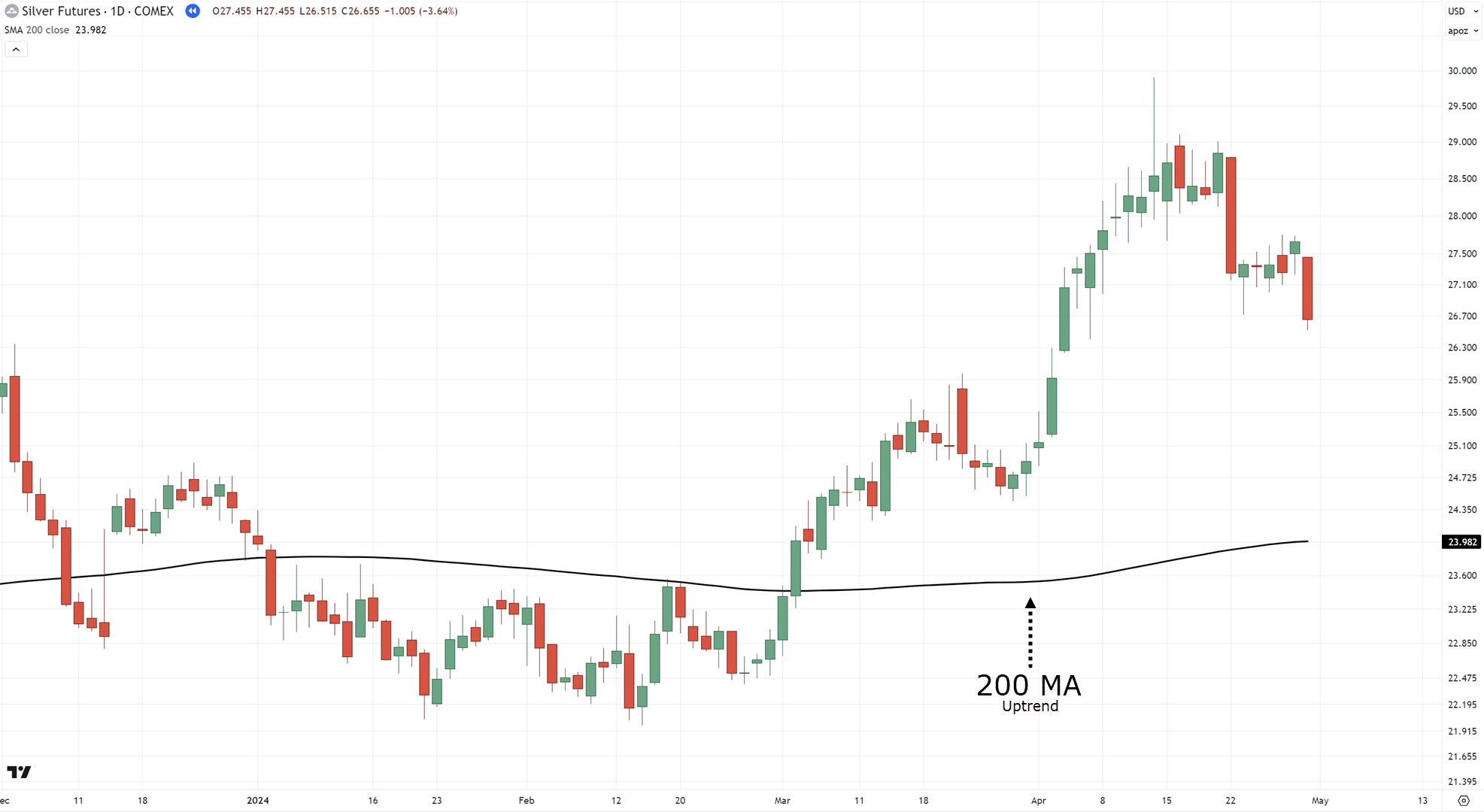

There may be a whole lot of methods to outline your developments, however on this case, I’ll use a long-term shifting common interval such because the 200-period shifting common.

If the value is above the 200 MA?

Uptrend.

If the value is under it?

Downtrend.

And on this instance?…

That’s proper… it’s in an uptrend!

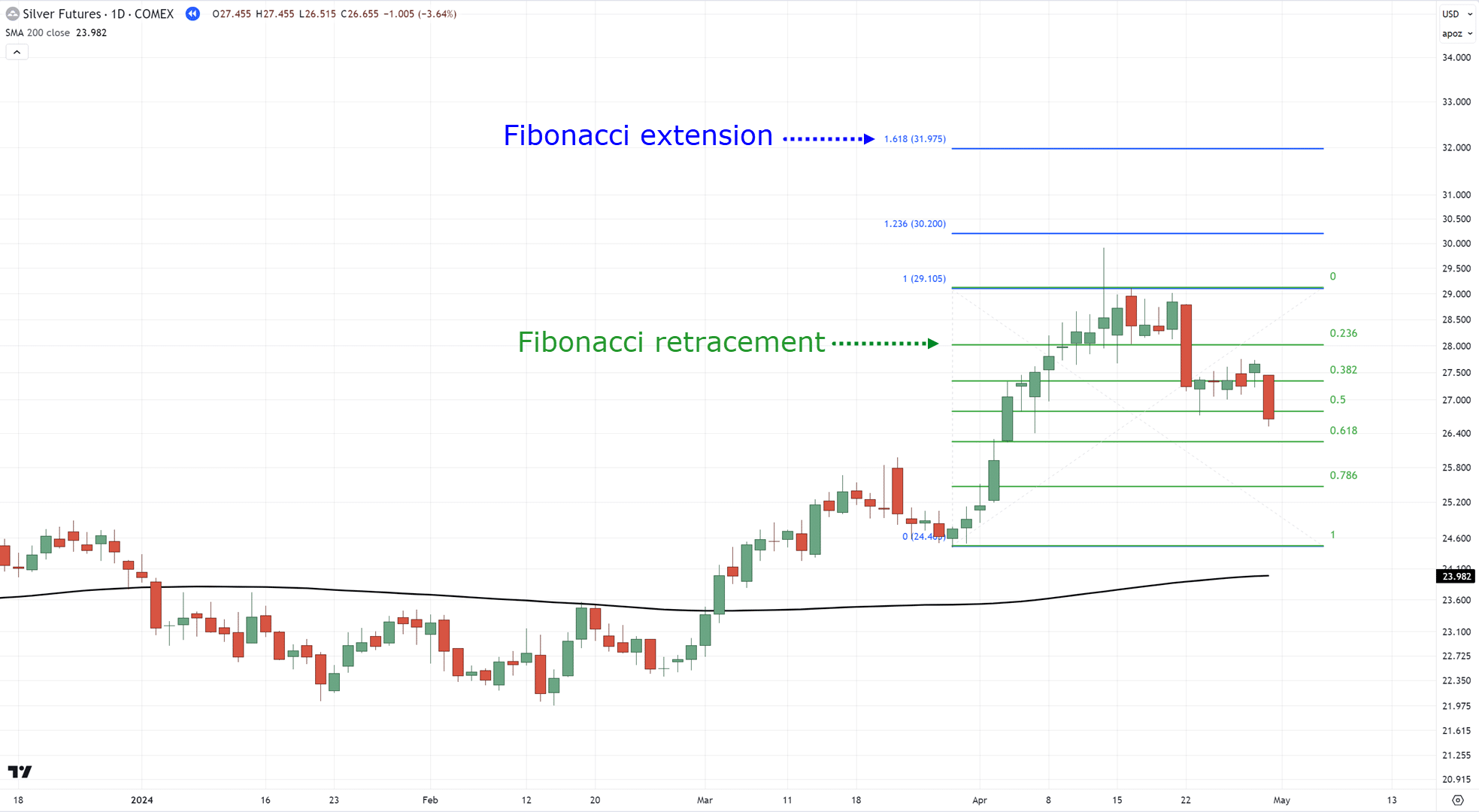

Step 2: Determine the Space of Values

That is the place the magic begins.

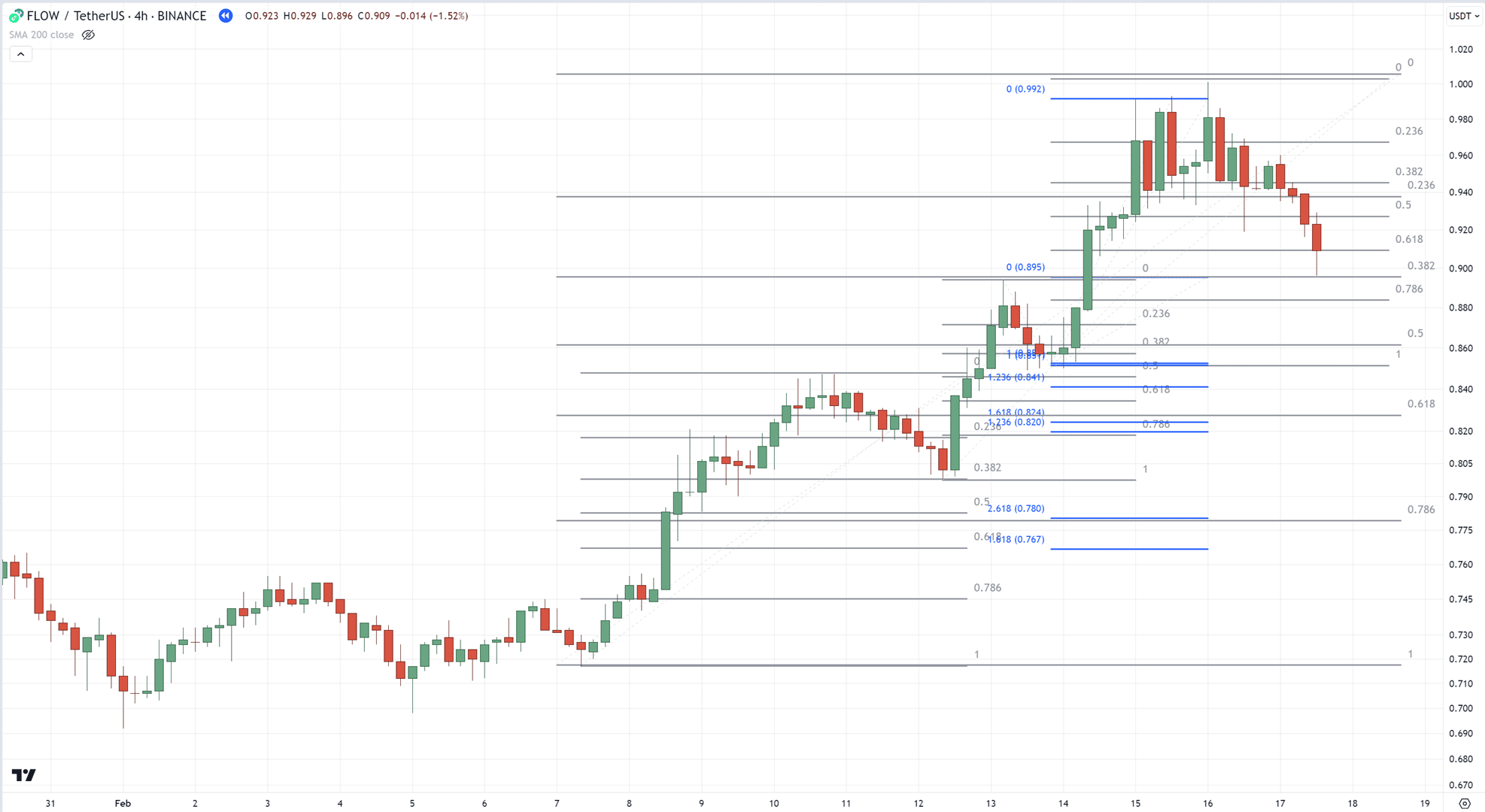

Begin by plotting each your Fib extension vs retracement on the present leg of the transfer…

You heard me – on each of them!

And bear in mind, you need to plot them from backside to prime because it’s in an uptrend:

Obtained it?

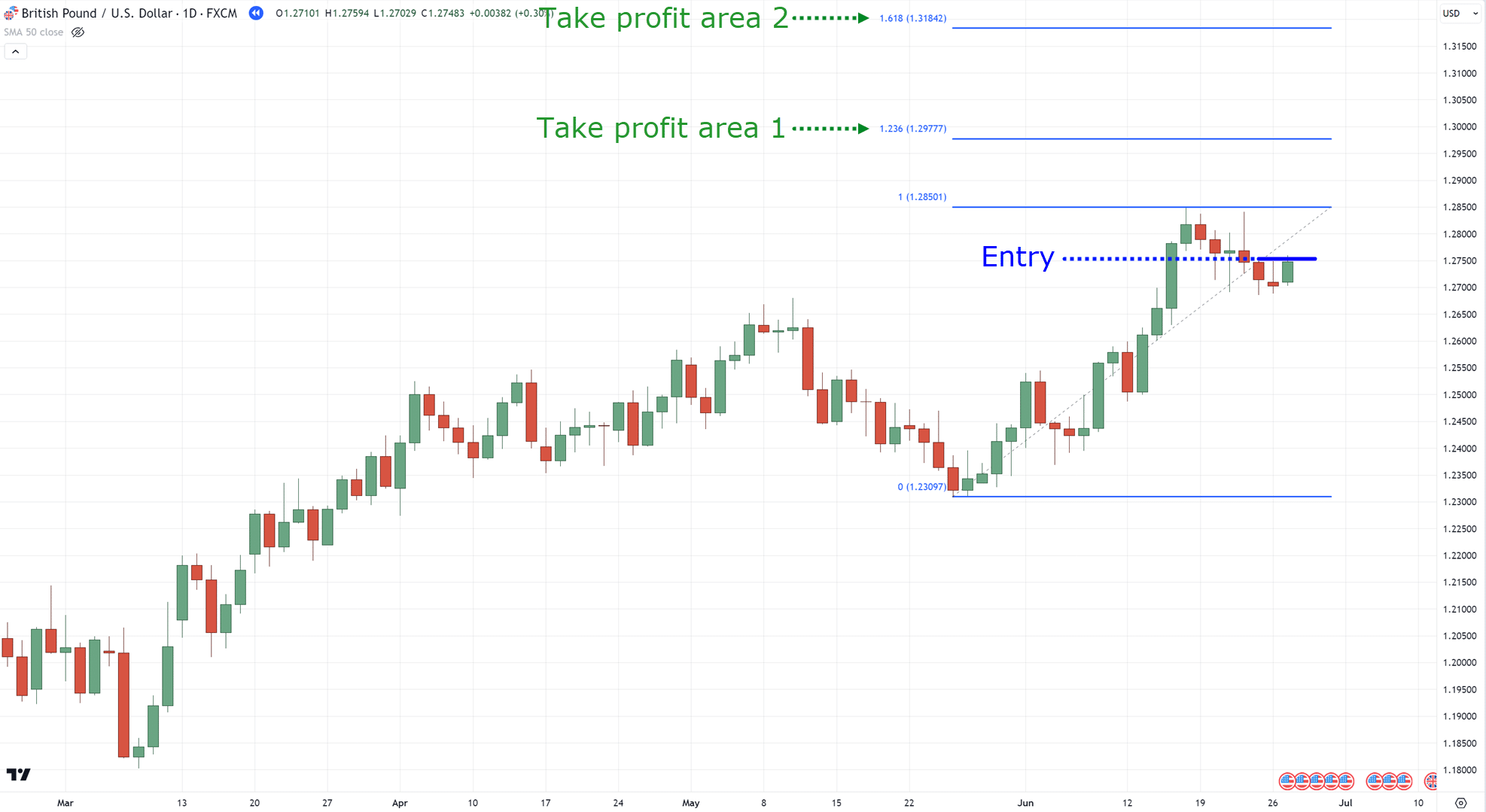

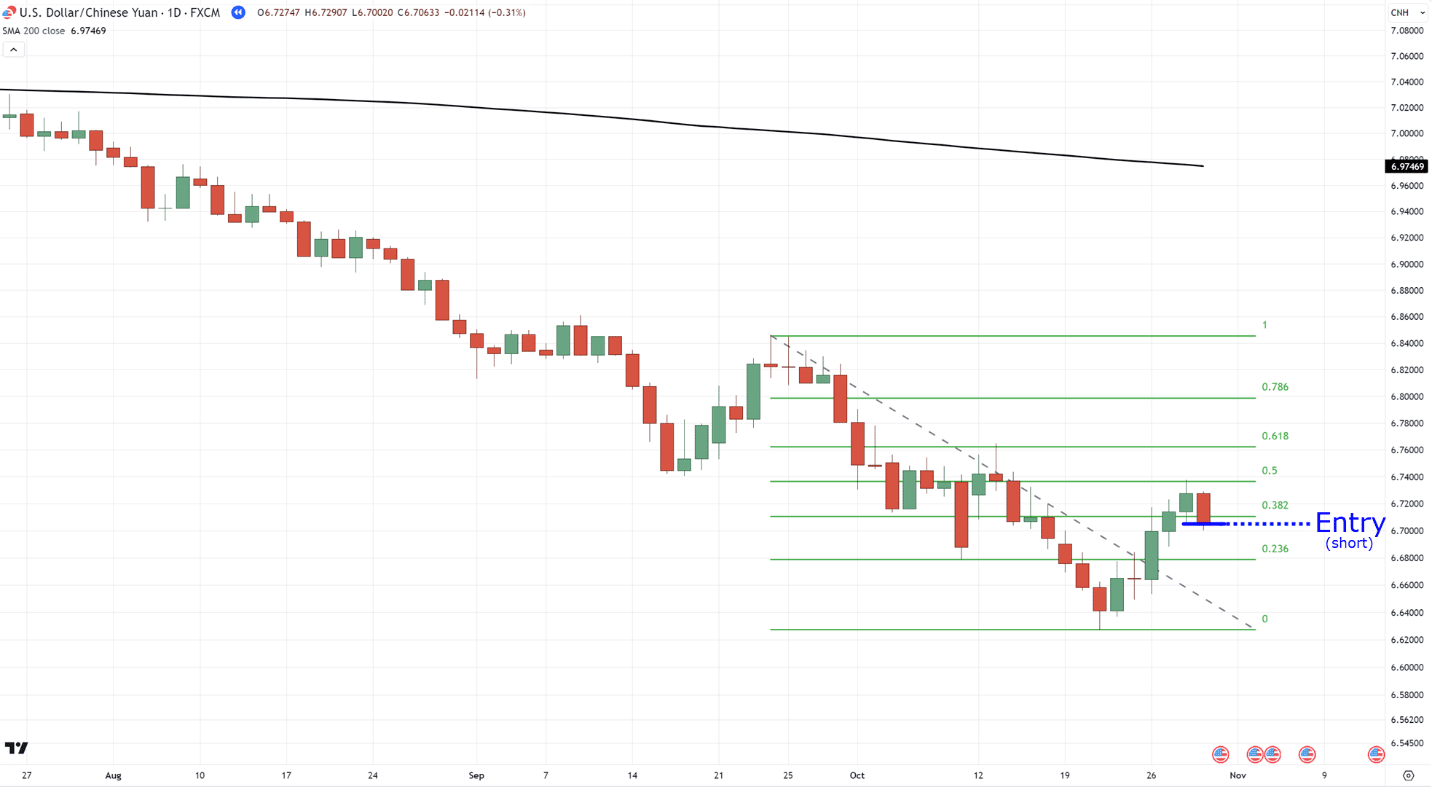

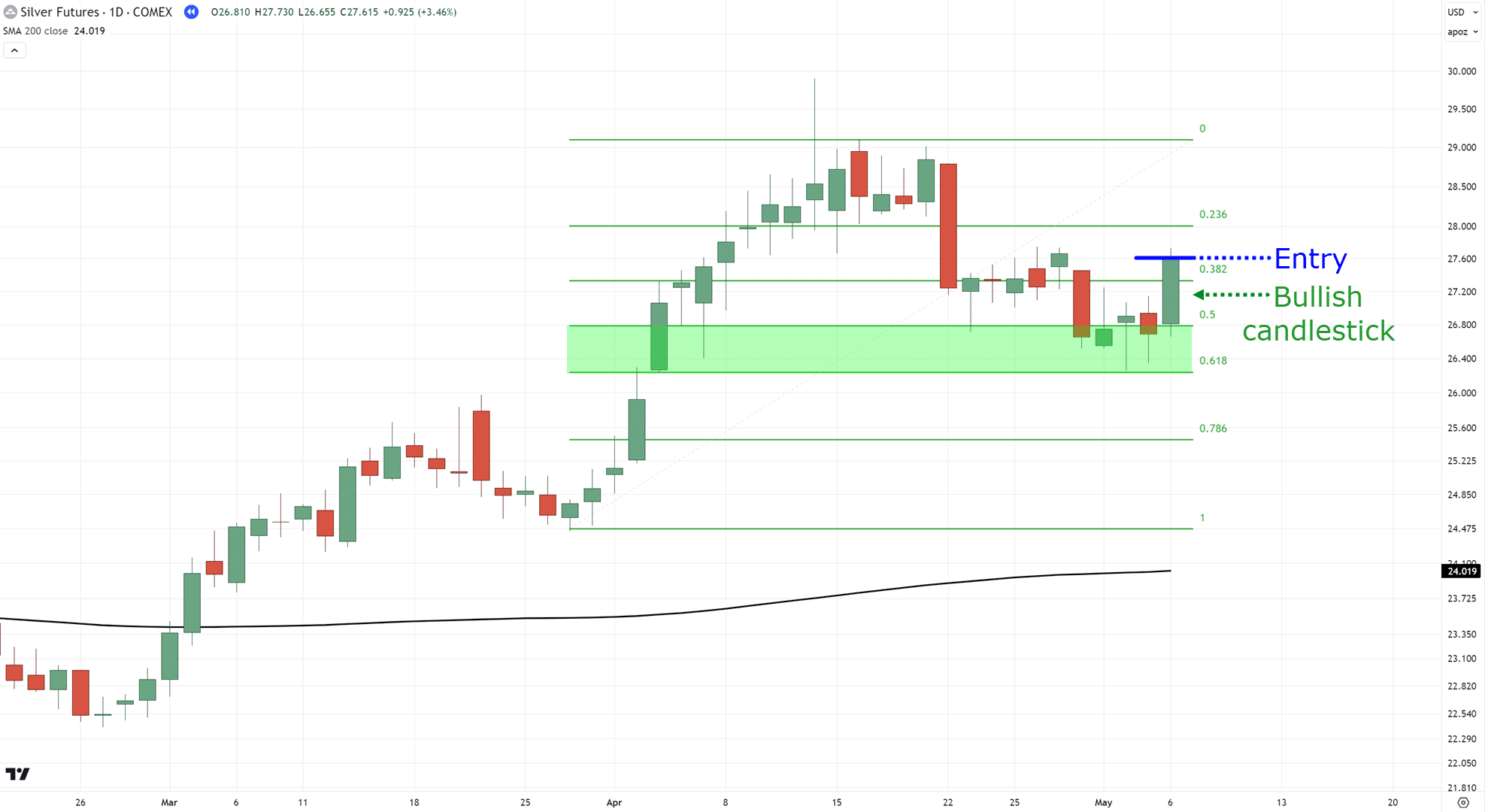

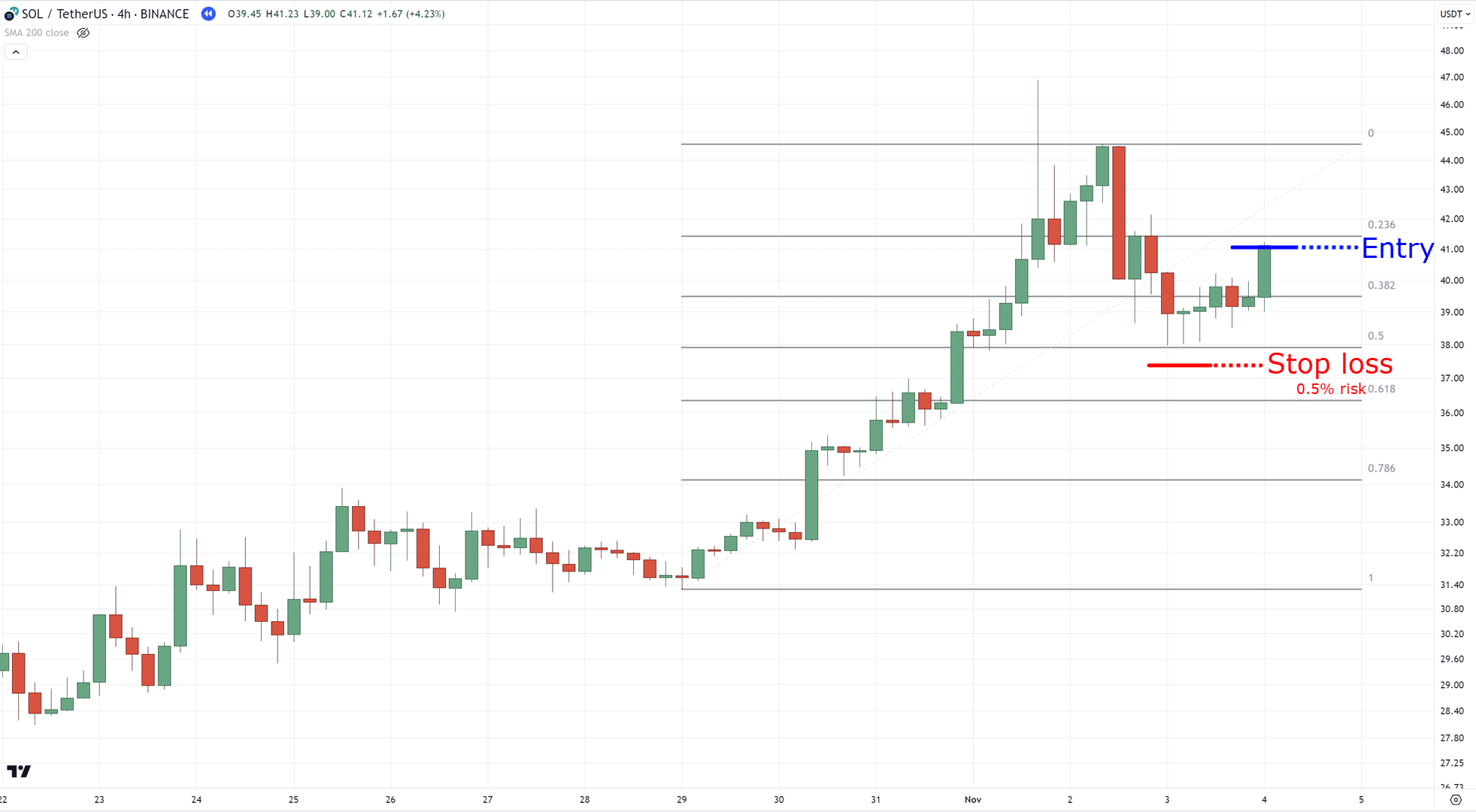

Step 3: Determine your Entries

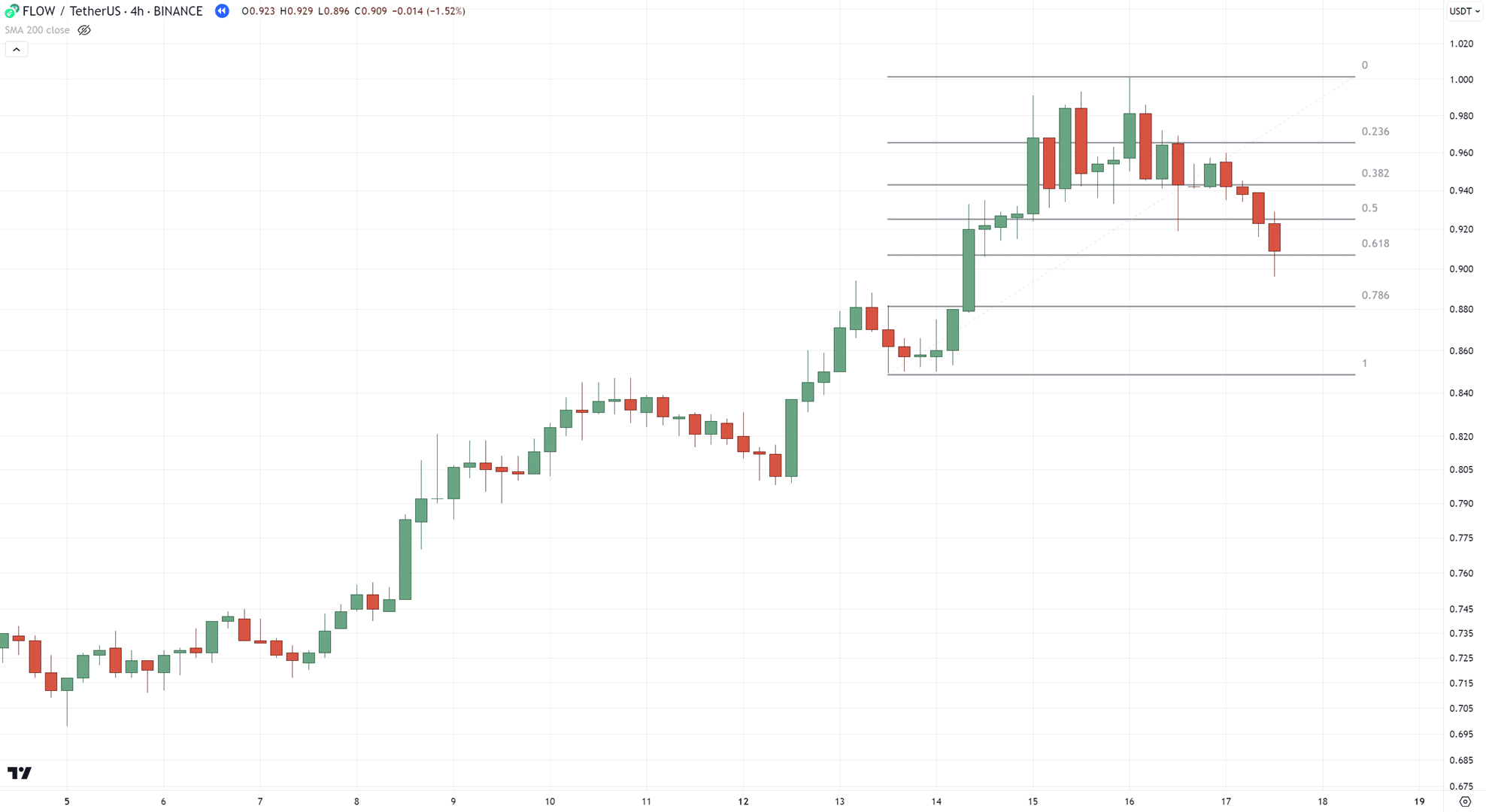

Now, you need to regulate the Fibonacci retracement first.

That is the place you will see your entries!

You’ll need to look ahead to the value to shut under a serious stage between 50.0% and 61.8% stage…

The trick is…

…ready for the value to shut again above the main ranges – with a powerful bullish candlestick!…

When you see that, enter on the subsequent candle open…

…and that’s it!

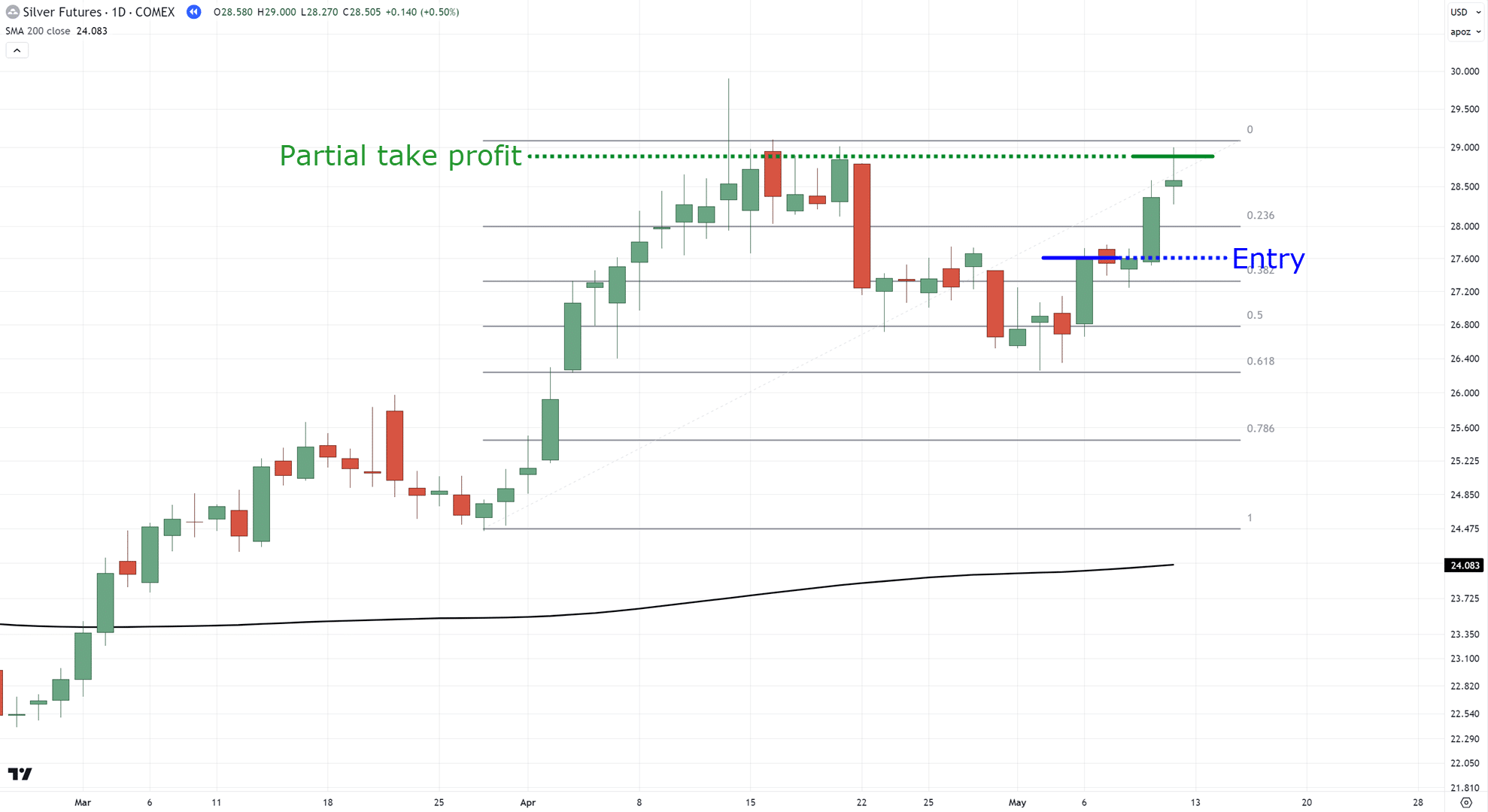

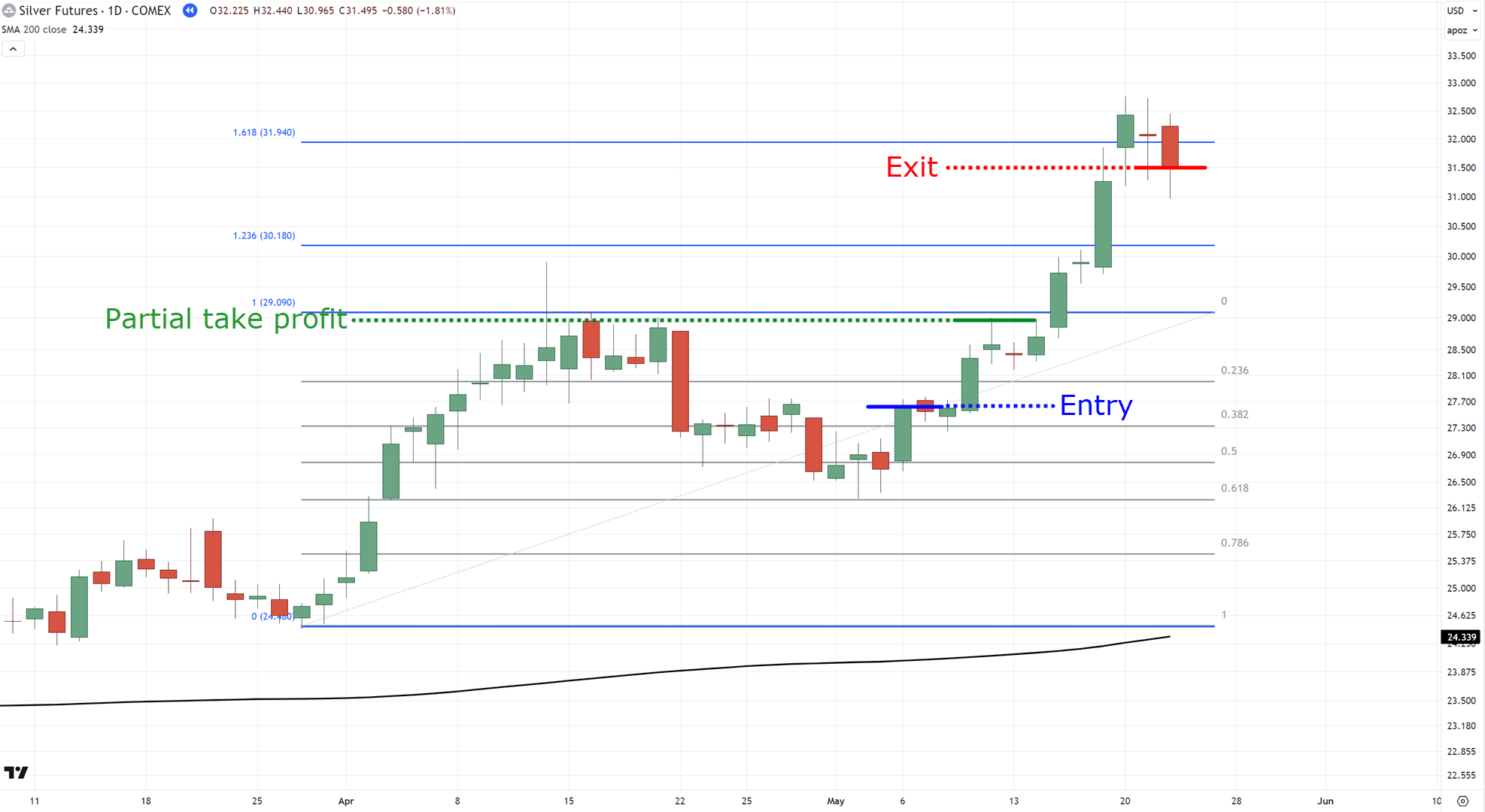

Step 4: Determine your Exits

That is the place the Fibonacci extension actually shines.

As soon as the value reaches the closest excessive, you possibly can take partial income…

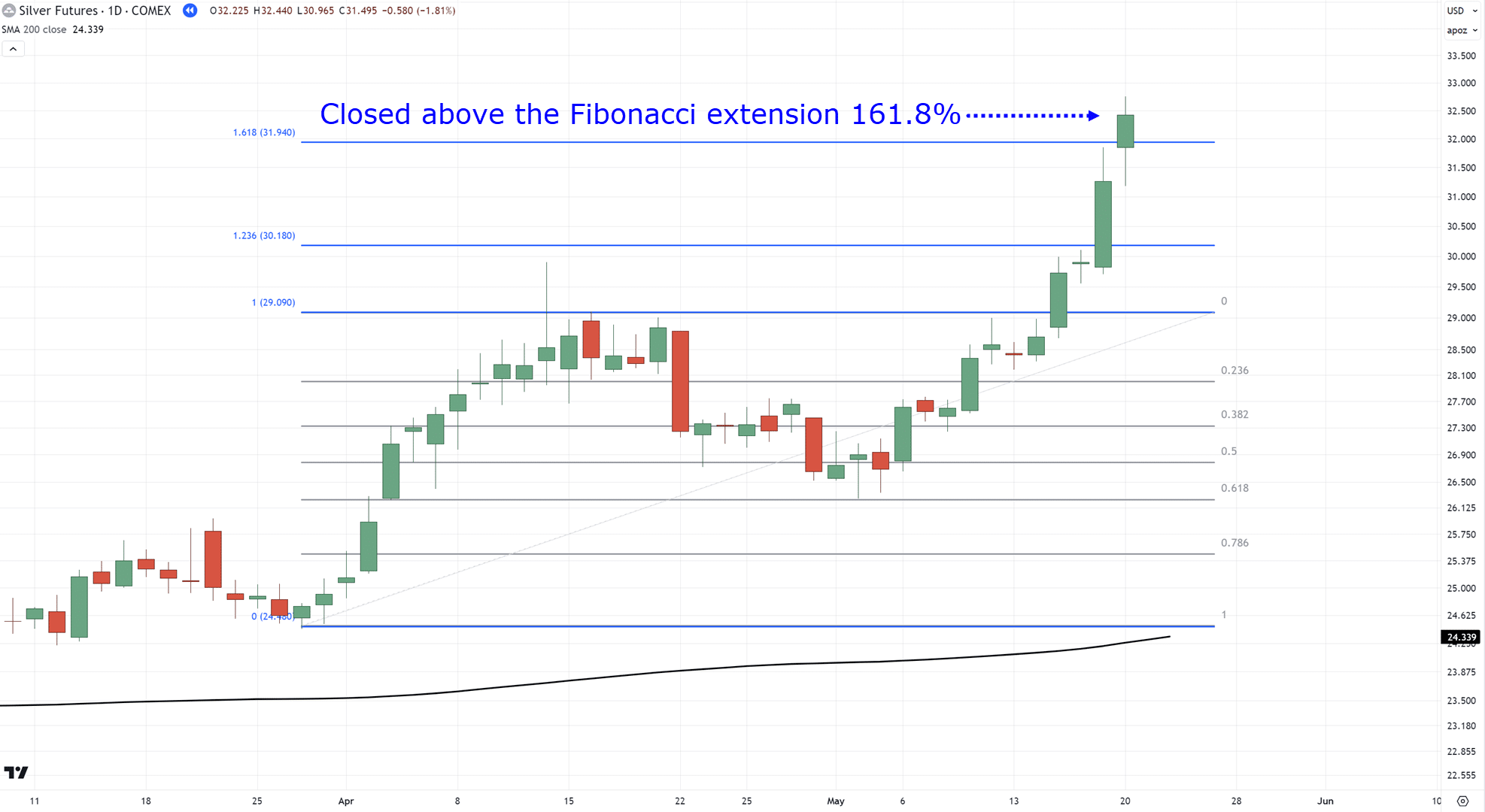

Then, for the remaining place, look ahead to the value to shut above a Fibonacci extension stage….

If it closes again under it, exit the commerce…

Principally, this acts like a trailing cease loss, catching the breakout momentum.

At all times bear in mind – you’re on the lookout for robust breakouts right here!

Actually, that is much like the way you entered the commerce:

Wait to shut past a sure Fibonacci stage…

…then enter when it closes again!

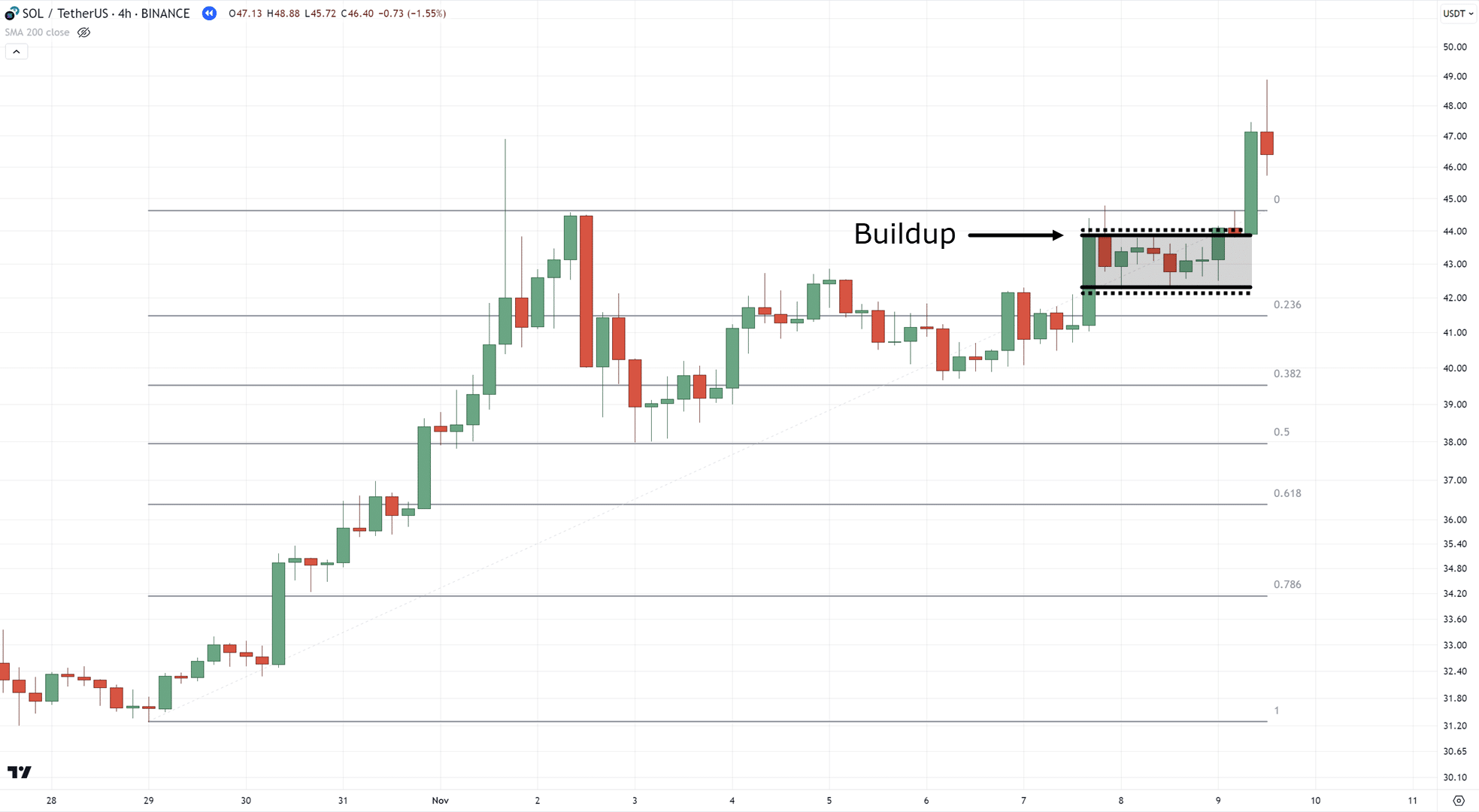

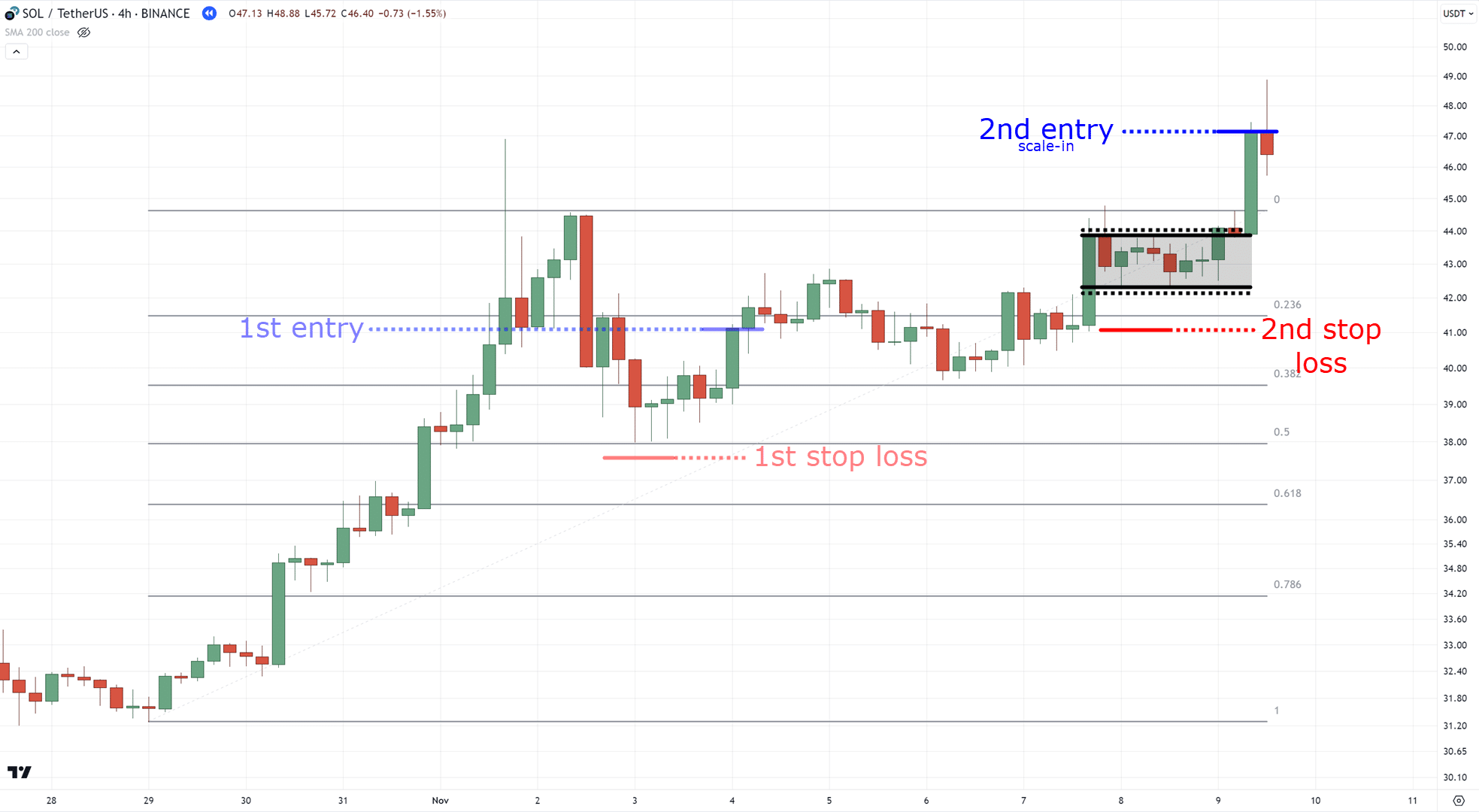

BONUS: Versatile commerce administration

Right here’s an additional trick which may show helpful.

In your first entry, danger 0.5% in your entries with Fibonacci retracement…

Following this, if the value makes a build-up at resistance after which breaks out…

…scale in your trades utilizing the Fibonacci extension to path your cease loss!…

…you possibly can see there’s some actual flexibility within the system!

You possibly can both danger small then scale in…

…or take partial income and path the remaining half…

…or just have mounted take revenue on the nearest resistance!

Fairly cool, proper?

Now, within the subsequent and remaining part…

I’ll share essential DOs and DON’Ts with regards to Fib Extension vs Retracement.

And sure, you’ll need to know tips on how to use it in addition to how to not use it!

Fib Extension vs Retracement: Issues to keep away from

I do know I shared with you some spicy methods on tips on how to use each instruments.

Nonetheless, one factor to at all times pay attention to is to…

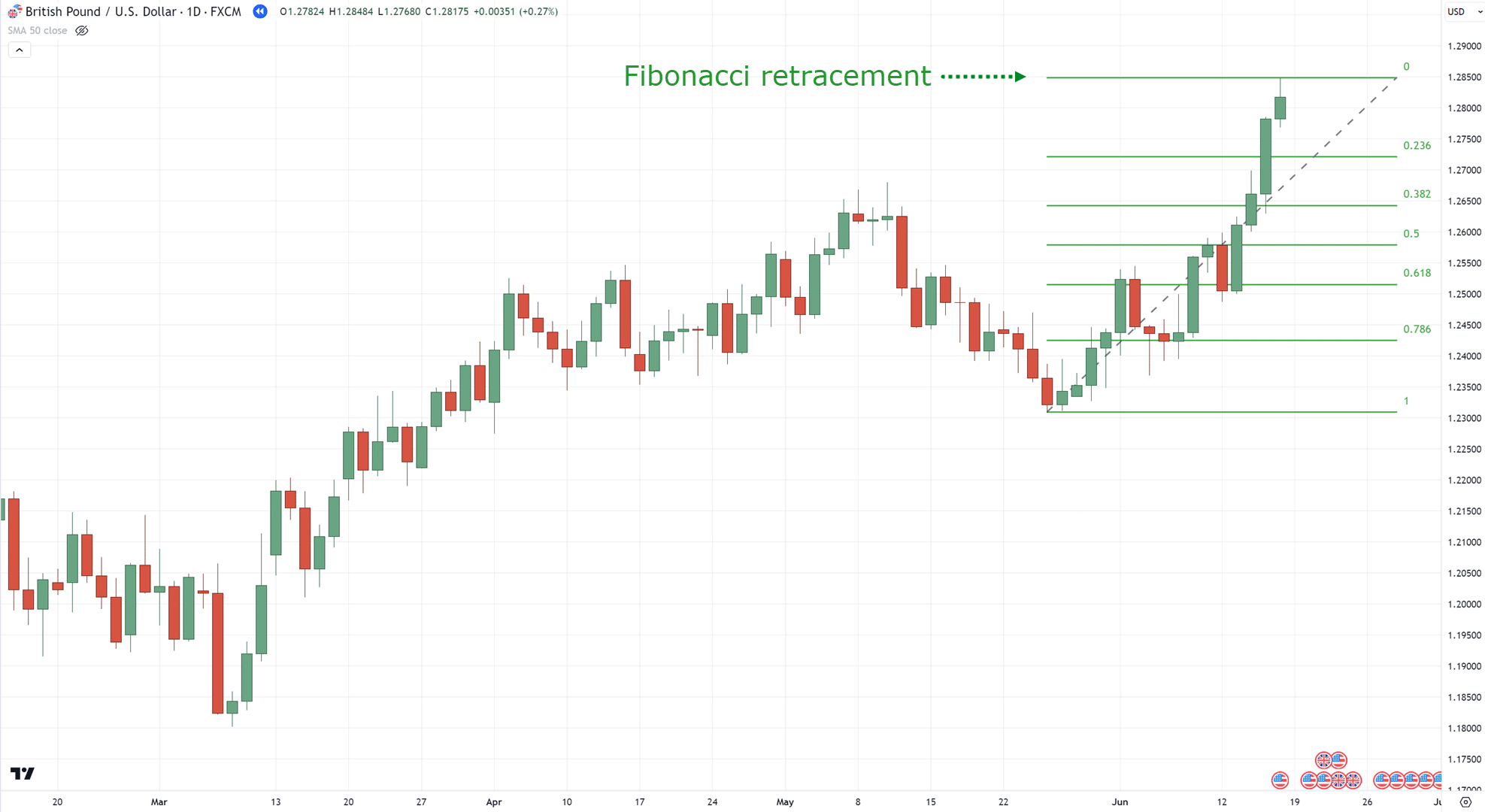

Keep away from plotting too many Fibonacci in your chart

Keep in mind…

You’re utilizing these Fibonacci instruments that can assist you commerce the markets.

Which means that you need to keep away from plotting them like this…

(are you able to even see the numbers?)

And attempt to plot them extra like this…

And always remember, it’s worthwhile to give attention to the present value!

It is best to at all times be plotting Fibonacci ranges which can be related.

It’s a completely essential level.

Now, I do know you could be pondering…

“However I’ve seen merchants plot a ton of Fibonacci retracements and extensions to revenue from the markets!”

Positive, if you happen to plan to make use of the Fibonacci instruments to investigate the market, then sure!

However if you wish to use it to commerce the markets, then comply with the golden rule:

Hold it easy!

As a result of simplicity brings about consistency, which results in way more dependable outcomes.

Now…

Whereas you should utilize each the extension and retracement collectively…

Keep in mind that all the things is determined by the context.

Don’t use the Fibonacci instruments out of context

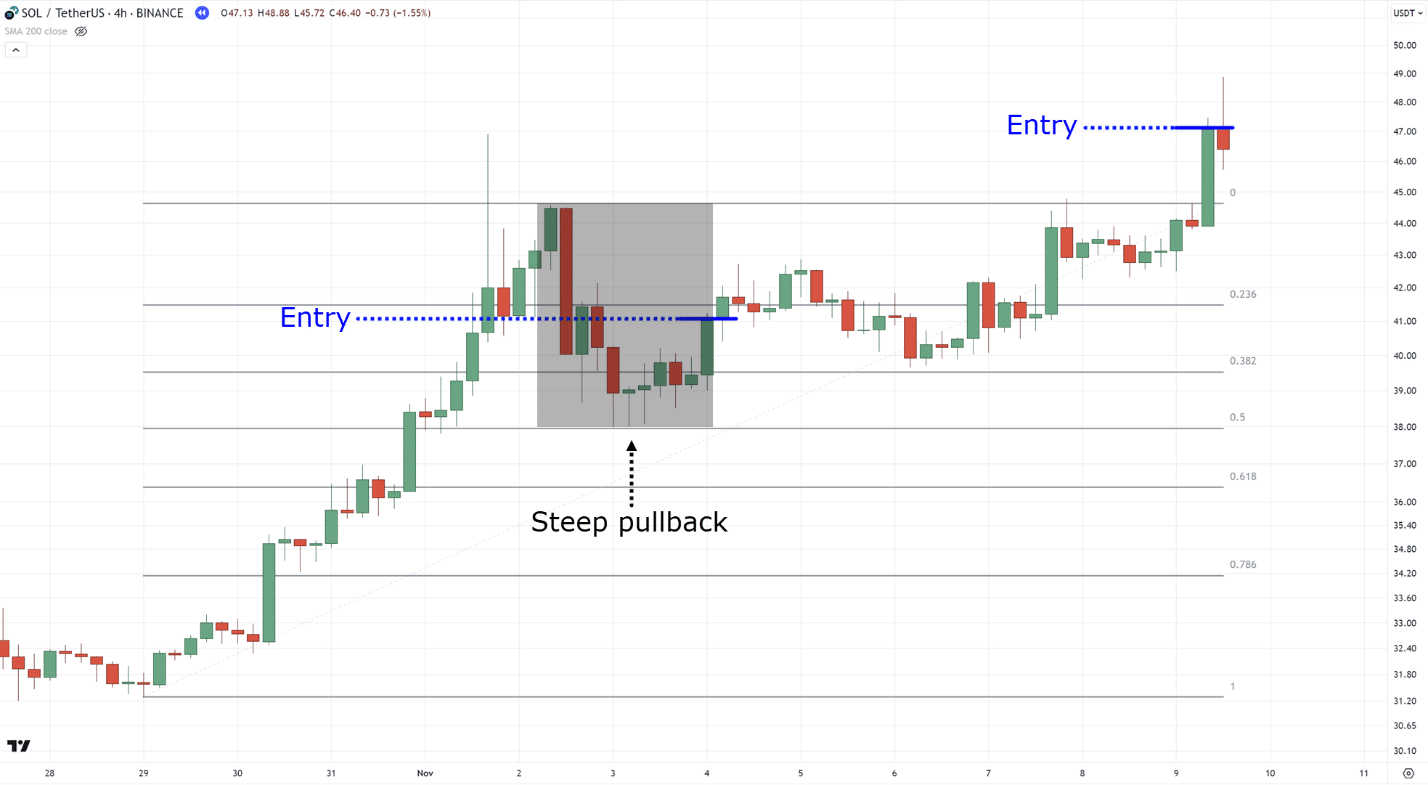

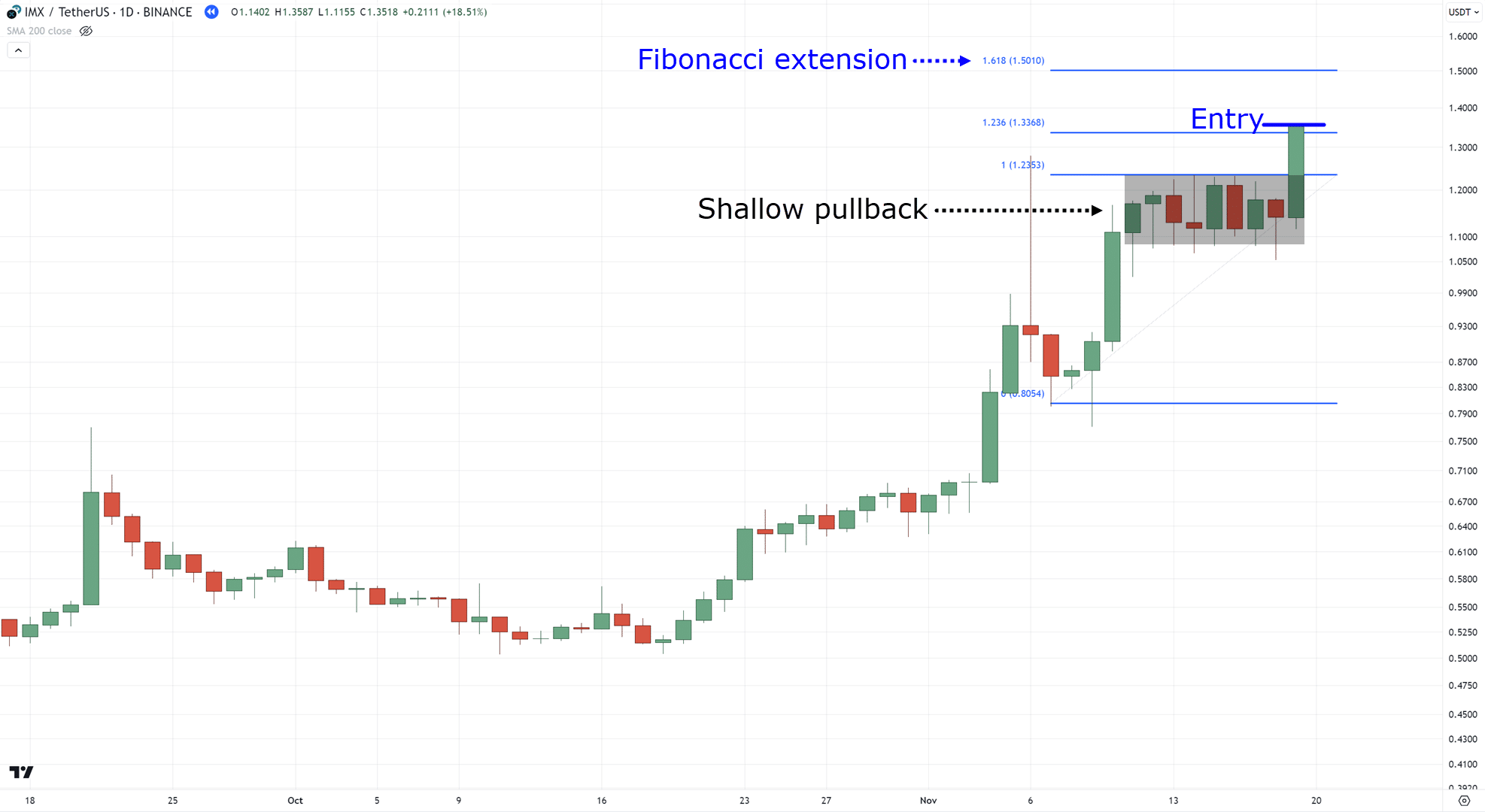

If the pullback is steep, use the Fibonacci retracement + extension combo…

But when the pullback is shallow, give attention to timing the breakout and solely use the Fibonacci extension to know the place to take your income…

Which means that not solely do it’s worthwhile to know HOW to plot them…

…but in addition WHEN to plot them!

Loads to consider, proper?

So let’s break it down one final time!

Conclusion

Initially, the Fib extension vs retracement device appears like a tough buying and selling idea you’ve at all times wished to grasp however by no means tried.

However as you’ve discovered on this information…

Utilizing these instruments doesn’t should be so sophisticated!

With a little bit of follow, you should utilize them to assist pull constant income from the markets.

To sum up, right here’s what you’ve discovered right now:

- Fib retracement captures pullbacks, whereas Fib extension initiatives breakout targets, with each serving distinctive roles in your buying and selling

- At all times begin with figuring out the pattern and the setups you are attempting to seize, then use which Fibonacci device is related to your setup

- Utilizing the TAEE framework is an easy and repeatable step-by-step course of so that you can execute in your charts

- The Fib extension vs retracement additionally permits you to be versatile in your danger administration by scaling in or scaling out of your trades

- Keep away from overcomplicated strategies – hold your plots easy with the aim of buying and selling, and don’t make a full market evaluation report

- Whereas each the Fib extension and retracement can be utilized on the identical time, solely use them relying on the context of the market

So, that’s just about it!

Now, over to you…

What’s your expertise utilizing these Fibonacci instruments?

Are there ideas right here you don’t agree on?

Or, if you happen to’ve been utilizing these instruments for some time already, have you ever discovered something new alongside the best way?

Bounce in and talk about it within the feedback under!