Jerome Powell faces a difficult process this week of each assuring traders the financial system stays on stable footing whereas additionally conveying policymakers stand able to step in if obligatory.

Article content material

(Bloomberg) — Jerome Powell faces a difficult process this week of each assuring traders the financial system stays on stable footing whereas additionally conveying policymakers stand able to step in if obligatory.

Article content material

Article content material

Even because the Federal Reserve chair has touted US resilience, uneasiness sparked by President Donald Trump’s quickly escalating commerce struggle has despatched shares tumbling over the previous month. Bond yields are down, too, as is shopper sentiment as worries concerning the financial outlook mount.

Commercial 2

Article content material

“Powell wants to present some form of a sign that they’re watching it,” mentioned Dominic Konstam, head of macro technique at Mizuho Securities USA. Whereas the Fed chief will seemingly make it clear that officers don’t goal the inventory market, they’ll’t ignore the latest slide, he warned.

The Fed is broadly anticipated to go away rates of interest regular once they meet March 18-19, however merchants now see excessive odds of three fee cuts this 12 months, most definitely starting in June. Economists typically count on two reductions, just like what forecasters foresee policymakers’ up to date projections to point out Wednesday.

Some traders warning that if officers proceed to sign solely two reductions in 2025, it turns into all of the extra necessary for the Fed chief to emphasise the central financial institution’s willingness to regulate borrowing prices if the labor market stumbles.

“On the margin, the Fed may make it barely higher or barely worse,” mentioned James Athey, a portfolio supervisor at Marlborough Funding Administration. “However clearly they’ll’t utterly calm markets as a result of the hit to sentiment has come largely from the White Home.”

Article content material

Commercial 3

Article content material

On prime of the escalating and ever-changing tariff threats towards America’s largest buying and selling companions, the Trump administration hasn’t carried out a lot to downplay recession dangers. The president mentioned March 9 that the US financial system faces a “interval of transition,” and his Treasury Secretary Scott Bessent famous the US and markets are in want of a “detox.”

Market Response

The 2-year yield, most delicate to the Fed’s financial coverage, has declined nearly 60 foundation factors from a mid-January peak to a trough this month of three.83%, the bottom stage in over 5 months. And whereas shares superior on Friday, the transfer got here after a selloff that culminated in a ten% plunge of the S&P 500 from its peak. Wall Avenue’s so-called concern gauge — the VIX — at one level final week climbed to the best ranges since August.

These market jitters have ramped up the stakes as officers launch contemporary financial projections that stand to supply perception into how a lot officers anticipate Trump’s insurance policies will have an effect on the financial system. Policymakers are anticipated to barely downgrade their forecasts for progress this 12 months and bump up their outlook for so-called core inflation, which excludes meals and power.

Commercial 4

Article content material

However Powell will seemingly be reticent to ensure traders the Fed will spring into motion on the first indicators of a faltering financial system and not using a key caveat: Officers have to see proof inflation is sustainably transferring towards their 2% aim and that expectations for future value progress stay secure.

“We’ll hear the message that issues are nonetheless holding up, and that coverage is in a very good place the place the Fed can react in both course — whether or not that’s stubbornly excessive inflation or a extra marked slowdown within the financial system,” mentioned Sarah Home, a senior economist at Wells Fargo & Co. “Now what I wish to hear extra is simply getting extra readability on how they’re weighing the 2 sides of their mandate.”

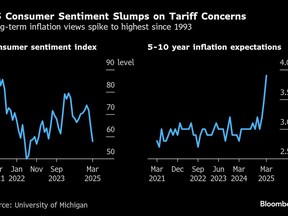

Whereas shopper costs rose at a slower tempo in February and the producer value index was unchanged from a month earlier, the elements that feed into the Fed’s most popular inflation measure — the non-public consumption expenditures value index — had been largely firmer. A intently watched measure of long-term inflation expectations climbed for a 3rd month to a greater than three-decade excessive.

Commercial 5

Article content material

Such information limits the Fed’s capability to behave and bolster the financial system till the weak spot begins to look extra straight within the labor market, mentioned Matthew Luzzetti, chief US economist for Deutsche Financial institution AG. That would present up within the type of weaker payroll positive aspects, an increase within the unemployment fee or a spike in layoffs, he mentioned.

“There’s plenty of uncertainty that’s on the market, and it’s potential that that filters into the onerous information, however they will be in sort of a wait-and-see mode to see whether or not or not that occurs,” mentioned Luzzetti, who doesn’t count on the Fed to decrease charges this 12 months. “On the identical time, I believe they’re seeing higher proof that their job on inflation is just not carried out.”

If the Fed had been to confront a weakening financial system amid still-elevated inflation, about two-thirds of economists in a Bloomberg survey mentioned they might count on officers to carry borrowing prices regular.

Complicating the outlook is the chance that different insurance policies proposed by the Trump administration, akin to tax cuts and deregulation, may increase the financial system and inflation within the months forward. Powell and his colleagues have emphasised they’re watching to see what the “internet results” of Trump’s insurance policies might be on the financial system and need extra readability on the general influence earlier than adjusting coverage.

Commercial 6

Article content material

“Regardless of elevated ranges of uncertainty, the US financial system continues to be in a very good place,” Powell mentioned earlier this month at an occasion in New York, his final public remarks earlier than officers collect this week. “We don’t have to be in a rush, and are nicely positioned to attend for higher readability.”

Stability Sheet

Wall Avenue strategists can even be eager for any hints on the Fed’s plans to pause or additional sluggish the velocity at which the central financial institution is decreasing its stability sheet — a course of often known as quantitative tightening or QT. Minutes of the January gathering revealed policymakers had mentioned the potential have to pause or sluggish the method till lawmakers can strike a deal over the federal government’s debt ceiling.

“The argument for March is that the Fed has already talked about it,” mentioned Blake Gwinn, head of US charges technique at RBC Capital Markets. “So why not simply do it — as they’ll pause QT after which simply restart it later.”

What to Watch

- Financial information:

- March 17: Empire manufacturing; retail gross sales; enterprise inventories; NAHB housing market index

- March 18: Housing begins; constructing permits; import and export costs; New York Fed companies enterprise exercise; industrial manufacturing; capability utilization; manufacturing manufacturing

- March 19: MBA mortgage functions; internet long-term and whole TIC flows

- March 20: Present account; preliminary jobless claims; Philadelphia Fed enterprise outlook; main index; present dwelling gross sales

- Fed calendar:

- March 21: New York Fed President John Williams

- Public sale calendar:

- March 17; 13-, 26-week payments

- March 18: 52-week payments; 6-week payments; 20-year bond reopening

- March 19: 17-week payments

- March 20: 4-, 8-week payments; 10-year TIPS reopening

—With help from Kristine Aquino, Nazmul Ahasan, Ye Xie and Maria Eloisa Capurro.

Article content material