TABLE OF CONTENTS

- Navigating the Wash Sale Rule

- The Betterment Answer

- TLH+ Mannequin Calibration

- Greatest Practices for TLH+

- How we calculate the worth of TLH+

- Conclusion

There are lots of methods to get your investments to work tougher for you— diversification, draw back threat administration, and an applicable mixture of asset courses tailor-made to your really useful allocation. Betterment does this robotically through its ETF portfolios.

However there’s one other means that will help you get extra out of your portfolio—utilizing funding losses to enhance your after-tax returns with a way referred to as tax loss harvesting. On this article, we introduce Betterment’s Tax Loss Harvesting+™ (TLH+™): a classy, absolutely automated instrument that Betterment prospects can select to allow.

Betterment’s TLH+ service scans portfolios recurrently for alternatives (short-term dips that consequence from market volatility) for alternatives to understand losses which might be helpful come tax time. Whereas the idea of tax loss harvesting isn’t new for rich buyers, TLH+ makes use of various improvements that typical implementations might lack. It takes a holistic strategy to tax-efficiency, looking for to optimize user-initiated transactions along with including worth via automated exercise, reminiscent of rebalances.

What’s tax loss harvesting?

Capital losses can decrease your tax invoice by offsetting features, however the one solution to notice a loss is to promote the depreciated asset. Nonetheless, in a well-allocated portfolio, every asset performs a necessary function in offering a bit of whole market publicity. For that motive, an investor shouldn’t wish to surrender potential anticipated returns related to every asset simply to understand a loss.

At its most elementary degree, tax loss harvesting is promoting a safety that has skilled a loss—after which shopping for a correlated asset (i.e. one that gives comparable publicity) to switch it. The technique has two advantages: it permits the investor to “harvest” a helpful loss, and it retains the portfolio balanced on the desired allocation.

How can it decrease your tax invoice?

Capital losses can be utilized to offset capital features you’ve realized in different transactions over the course of a yr—features on which you’d in any other case owe tax. Then, if there are losses left over (or if there have been no features to offset), you’ll be able to offset as much as $3,000 of odd earnings for the yr. If any losses nonetheless stay, they are often carried ahead indefinitely.

Tax loss harvesting is primarily a tax deferral technique, and its profit relies upon totally on particular person circumstances. Over the long term, it may add worth via some mixture of those distinct advantages that it seeks to offer:

- Tax deferral: Losses harvested can be utilized to offset unavoidable features within the portfolio, or capital features elsewhere (e.g., from promoting actual property), deferring the tax owed. Financial savings which can be invested might develop, assuming a conservative progress price of 5% over a 10-year interval, a greenback of tax deferred can be value $1.63. Even after belatedly parting with the greenback, and paying tax on the $0.63 of progress, you’re forward.

- Pushing capital features right into a decrease tax price: If you happen to’ve realized short-term capital features (STCG) this yr, they’ll usually be taxed at your highest price. Nonetheless, in the event you’ve harvested losses to offset them, the corresponding acquire you owe sooner or later might be long-term capital acquire (LTCG). You’ve successfully turned a acquire that might have been taxed as much as 50% at the moment right into a acquire that shall be taxed extra flippantly sooner or later (as much as 30%).

- Changing odd earnings into long-term capital features: A variation on the above: offsetting as much as $3,000 out of your odd earnings shields that quantity out of your prime marginal price, however the offsetting future acquire will probably be taxed on the LTCG price.

- Everlasting tax avoidance in sure circumstances: Tax loss harvesting gives advantages now in trade for growing built-in features, topic to tax later. Nonetheless, beneath sure circumstances (charitable donation, bequest to heirs), these features might keep away from taxation totally.

Navigating the Wash Sale Rule

Abstract: Wash sale rule administration is on the core of any tax loss harvesting technique. Unsophisticated approaches can detract from the worth of the harvest or place constraints on buyer money flows as a way to perform.

At a excessive degree, the so-called “wash sale rule” disallows a loss from promoting a safety if a “considerably equivalent” safety is bought 30 days after or earlier than the sale. The rationale is {that a} taxpayer shouldn’t get pleasure from the advantage of deducting a loss if they didn’t actually eliminate the safety.

The wash sale rule applies not simply to conditions when a “considerably equivalent” buy is made in the identical account, but in addition when the acquisition is made within the particular person’s IRA/401(ok) account, and even in a partner’s account. This broad software of the wash sale rule seeks to make sure that buyers can’t make the most of nominally totally different accounts to take care of their possession, and nonetheless profit from the loss.

A wash sale involving an IRA/401(ok) account is especially unfavorable. Typically, a “washed” loss is postponed till the alternative is offered, but when the alternative is bought in an IRA/401(ok) account, the loss is completely disallowed.

If not managed appropriately, wash gross sales can undermine tax loss harvesting. Dealing with proceeds from the harvest isn’t the only real concern—any deposits made within the following 30 days (whether or not into the identical account, or into the person’s IRA/401(ok)) additionally must be allotted with care.

Avoiding the wash

The only solution to keep away from triggering a wash sale is to keep away from buying any safety in any respect for the 30 days following the harvest, protecting the proceeds (and any inflows throughout that interval) in money. This strategy, nevertheless, would systematically preserve a portion of the portfolio out of the market. Over the long run, this “money drag” may damage the portfolio’s efficiency.

Extra superior methods repurchase an asset with comparable publicity to the harvested safety that isn’t “considerably equivalent” for functions of the wash sale rule. Within the case of a person inventory, it’s clear that repurchasing inventory of that very same firm would violate the rule. Much less clear is the therapy of two index funds from totally different issuers (e.g., Vanguard and Schwab) that observe the identical index. Whereas the IRS has not issued any steerage to recommend that such two funds are “considerably equivalent,” a extra conservative strategy when coping with an index fund portfolio can be to repurchase a fund whose efficiency correlates carefully with that of the harvested fund, however tracks a unique index.

TLH+ is mostly designed round this index-based logic, though it can’t keep away from potential wash gross sales arising from transactions in tickers that observe the identical index the place one of many tickers isn’t at present a main, secondary, or tertiary ticker (as these phrases are outlined on this white paper). This example may come up, for instance, when different tickers are transferred to Betterment or the place they had been beforehand a main, secondary, or tertiary ticker. Moreover, for some portfolios constructed by third events (e.g., Vanguard, Blackrock, or Goldman Sachs), sure secondary and tertiary tickers observe the identical index. Sure asset courses in portfolios constructed by third events (e.g., Vanguard, Blackrock, or Goldman Sachs) should not have tertiary tickers, such that completely disallowed losses may happen if there have been overlapping holdings in taxable and tax-advantaged accounts.

Choosing a viable alternative safety is only one piece of the accounting and optimization puzzle. Manually implementing a tax loss harvesting technique is possible with a handful of securities, little to no money flows, and rare harvests. Belongings might nevertheless dip in worth however doubtlessly recuperate by the top of the yr, subsequently annual methods or rare harvests might go away many losses on the desk. The wash sale administration and tax lot accounting essential to help extra frequent harvesting shortly turns into overwhelming in a multi-asset portfolio—particularly with common deposits, dividends, and rebalancing.

An efficient loss harvesting algorithm ought to be capable of maximize harvesting alternatives throughout a full vary of volatility eventualities, with out sacrificing the investor’s international asset allocation. It ought to reinvest harvest proceeds into correlated alternate property, all whereas dealing with unexpected money inflows from the investor with out ever resorting to money positions. It must also be capable of monitor every tax lot individually, harvesting particular person tons at an opportune time, which can rely on the volatility of the asset. TLH+ was created as a result of no accessible implementations appeared to unravel all of those issues.

Present methods and their limitations

Each tax loss harvesting technique shares the identical primary objective: to maximise a portfolio’s after-tax returns by realizing built-in losses whereas minimizing the unfavourable influence of wash gross sales.

Approaches to tax loss harvesting differ primarily in how they deal with the proceeds of the harvest to keep away from a wash sale. Under are the three methods generally employed by guide and algorithmic implementations.

After promoting a safety that has skilled a loss, current methods would probably have you ever …

|

Present technique |

Drawback |

|

Delay reinvesting the proceeds of a harvest for 30 days, thereby guaranteeing that the repurchase won’t set off a wash sale. |

Whereas it’s the simplest technique to implement, it has a significant disadvantage: no market publicity—additionally referred to as money drag. Money drag hurts portfolio returns over the long run, and will offset any potential profit from tax loss harvesting. |

|

Reallocate the money into a number of totally totally different asset courses within the portfolio. |

This technique throws off an investor’s desired asset allocation. Moreover, such purchases might block different harvests over the subsequent 30 days by organising potential wash gross sales in these different asset courses. |

|

Change again to authentic safety after 30 days from the alternative safety. Widespread guide strategy, additionally utilized by some automated investing providers. |

A switchback can set off short-term capital features when promoting the alternative safety, lowering the tax advantage of the harvest. Even worse, this technique can go away an investor owing extra tax than if it did nothing. |

The hazards of switchbacks

Within the 30 days main as much as the switchback, two issues can occur: the alternative safety can drop additional, or go up. If it goes down, the switchback will notice a further loss. Nonetheless, if it goes up, which is what any asset with a constructive anticipated return is predicted to do over any given interval, the switchback will notice short-term capital features (STCG)—kryptonite to a tax-efficient portfolio administration technique.

An try to mitigate this threat might be setting a better threshold based mostly on volatility of the asset class—solely harvesting when the loss is so deep that the asset is unlikely to thoroughly recuperate in 30 days. In fact, there’s nonetheless no assure that it’s going to not, and the value paid for this buffer is that your lower-yielding harvests may also be much less frequent than they might be with a extra subtle technique.

Examples of unfavourable tax arbitrage

Detrimental tax arbitrage with automated 30-day switchback

An automated 30-day switchback can destroy the worth of the harvested loss, and even improve tax owed, quite than cut back it. A considerable dip presents a superb alternative to promote a complete place and harvest a long-term loss. Proceeds will then be re-invested in a extremely correlated alternative (monitoring a unique index). 30 days after the sale, the dip proved short-term and the asset class greater than recovered. The switchback sale ends in STCG in extra of the loss that was harvested, and truly leaves the investor owing tax, whereas with out the harvest, they might have owed nothing.

As a consequence of a technical nuance in the way in which features and losses are netted, the 30- day switchback may end up in unfavourable tax arbitrage, by successfully pushing current features into a better tax price.

When including up features and losses for the yr, the principles require netting of like in opposition to like first. If any long-term capital acquire (LTCG) is current for the yr, it’s essential to web a long-term capital loss (LTCL) in opposition to that first, and solely then in opposition to any STCG.

Detrimental tax arbitrage when unrelated long-term features are current

Now let’s assume the taxpayer realized a LTCG. If no harvest takes place, the investor will owe tax on the acquire on the decrease LTCG price. Nonetheless, in the event you add the LTCL harvest and STCG switchback trades, the principles now require that the harvested LTCL is utilized first in opposition to the unrelated LTCG. The harvested LTCL will get used up totally, exposing your complete STCG from the switchback as taxable. As a substitute of sheltering the extremely taxed acquire on the switchback, the harvested loss acquired used up sheltering a lower-taxed acquire, creating far higher tax legal responsibility than if no harvest had taken place.

Within the presence of unrelated transactions, unsophisticated harvesting can successfully convert current LTCG into STCG. Some buyers recurrently generate important LTCG (as an illustration, by regularly diversifying out of a extremely appreciated place in a single inventory). It’s these buyers, actually, who would profit probably the most from efficient tax loss harvesting.

Detrimental tax arbitrage with dividends

Detrimental tax arbitrage may end up in reference to dividend funds. If sure situations are met, some ETF distributions are handled as “certified dividends”, taxed at decrease charges. One situation is holding the safety for greater than 60 days. If the dividend is paid whereas the place is within the alternative safety, it won’t get this favorable therapy: beneath a inflexible 30-day switchback, the situation can by no means be met. Because of this, as much as 20% of the dividend is misplaced to tax (the distinction between the upper and decrease price).

The Betterment Answer

Abstract: Betterment’s TLH+ approaches tax-efficiency holistically, looking for to optimize transactions, together with buyer exercise.

The advantages TLH+ seeks to ship, embrace:

- No publicity to short-term capital features in an try to reap losses. By our proprietary Parallel Place Administration (PPM) system, a dual-security asset class strategy enforces desire for one safety with out needlessly triggering capital features in an try to reap losses, all with out placing constraints on buyer money flows.

- No unfavourable tax arbitrage traps related to much less subtle harvesting methods (e.g., 30-day switchback), making TLH+ particularly fitted to these producing giant long-term capital features on an ongoing foundation.

- Zero money drag. With fractional shares and seamless dealing with of all inflows throughout wash sale home windows, each greenback of your ETF portfolio is invested..

- Tax loss preservation logic prolonged to user-realized losses, not simply harvested losses, robotically defending each from the wash sale rule. Briefly, consumer withdrawals all the time promote any losses first.

- No disallowed losses via overlap with a Betterment IRA/401(ok). We use a tertiary ticker system to eradicate the opportunity of completely disallowed losses triggered by subsequent IRA/401(ok) exercise.² This makes TLH+ ultimate for individuals who put money into each taxable and tax-advantaged accounts.

- Harvests additionally take the chance to rebalance throughout all asset courses, quite than re-invest solely inside the similar asset class. This additional reduces the necessity to rebalance throughout unstable stretches, which implies fewer realized features, and better tax alpha.

By these improvements, TLH+ creates important worth over manually-serviced or much less subtle algorithmic implementations. TLH+ is accessible to buyers —absolutely automated, efficient, and at no further value.

Parallel securities

To make sure that every asset class is supported by optimum securities in each main and alternate (secondary) positions, we screened by expense ratio, liquidity (bid-ask unfold), monitoring error vs. benchmark, and most significantly, covariance of the alternate with the first.1

Whereas there are small value variations between the first and alternate securities, the price of unfavourable tax arbitrage from tax-agnostic switching vastly outweighs the price of sustaining a twin place inside an asset class.

TLH+ incorporates a particular mechanism for coordination with IRAs/401(ok)s that requires us to choose a 3rd (tertiary) safety in every harvestable asset class (besides in municipal bonds, which aren’t within the IRA/401(ok) portfolio). Whereas these have a better value than the first and alternate, they don’t seem to be anticipated to be utilized typically, and even then, for brief durations (extra under in IRA/401(ok) safety).

Parallel Place Administration

As demonstrated, the unconditional 30-day switchback to the first safety is problematic for various causes. To repair these issues, we engineered a platform to help TLH+, which seeks to tax-optimize consumer and system-initiated transactions: the Parallel Place Administration (PPM) system.

PPM permits every asset class to comprise a main safety to characterize the specified publicity whereas sustaining alternate and tertiary securities which can be carefully correlated securities, ought to that end in a greater after-tax end result.

PPM gives a number of enhancements over the switchback technique. First, pointless features are minimized if not completely averted. Second, the parallel safety (might be main or alternate) serves as a protected harbor to attenuate wash gross sales—not simply from harvest proceeds, however any money inflows. Third, the mechanism seeks to guard not simply harvested losses, however losses realized by the client as nicely.

PPM not solely facilitates efficient alternatives for tax loss harvesting, but in addition extends most tax-efficiency to customer-initiated transactions. Each buyer withdrawal is a possible harvest (losses are offered first). And each buyer deposit and dividend is routed to the parallel place that might reduce wash gross sales, whereas shoring up the goal allocation.

PPM has a desire for the first safety when rebalancing and for all money move occasions—however all the time topic to tax issues. That is how PPM behaves beneath varied situations:

|

Transaction |

PPM habits |

|

Withdrawals and gross sales from rebalancing |

Gross sales default out of the alternate place (if such a place exists), however not on the expense of triggering STCG—in that case, PPM will promote a lot of the first safety first. Rebalancing will try to cease wanting realizing STCG. Taxable features are minimized at each choice level—STCG tax tons are the final to be offered on a consumer withdrawal. |

|

Deposits, buys from rebalancing, and dividend reinvestments |

PPM directs inflows to underweight asset courses, and inside every asset class, into the first, except doing so incurs higher wash sale prices than shopping for the alternate. |

|

Harvest occasions |

TLH+ harvests can come out of the first into the alternate, or vice versa, relying on which harvest has a higher anticipated worth. After an preliminary harvest, it may make sense sooner or later to reap again into the first, to reap extra of the remaining main into the alternate, or to do nothing. Harvests that might trigger extra washed losses than realized losses are minimized if not completely averted. |

Wash sale administration

Managing money flows throughout each taxable and IRA/401(ok) accounts with out needlessly washing realized losses is a posh drawback.

TLH+ operates with out constraining the way in which that prospects favor contributing to their portfolios, and with out resorting to money positions. With the advantage of parallel positions, it weighs wash sale implications of each deposit and withdrawal and dividend reinvestment, and seeks to systematically select the optimum funding technique. This technique protects not simply harvested losses, but in addition losses realized via withdrawals.

Avoiding wash sale via tertiary tickers in IRA/401(ok)

As a result of IRA/401(ok) wash gross sales are significantly unfavorable—the loss is disallowed completely—TLH+ ensures that no loss realized within the taxable account is washed by a subsequent deposit right into a Betterment IRA/401(ok) with a tertiary ticker system in IRA/401(Ok) and no harvesting is completed in IRA/401(ok).

Let’s have a look at an instance of how TLH+ handles a doubtlessly disruptive IRA influx with a tertiary ticker when there are realized losses to guard, utilizing actual market knowledge for a Developed Markets asset class.

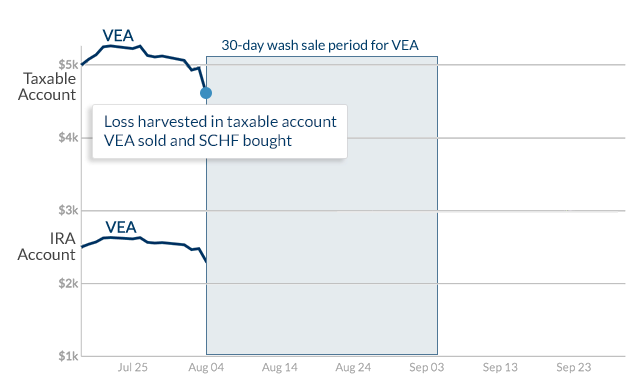

The client begins with a place in VEA, the first safety, in each the taxable and IRA accounts. We harvest a loss by promoting your complete taxable place, after which repurchasing the alternate safety, SCHF.

Loss Harvested in VEA

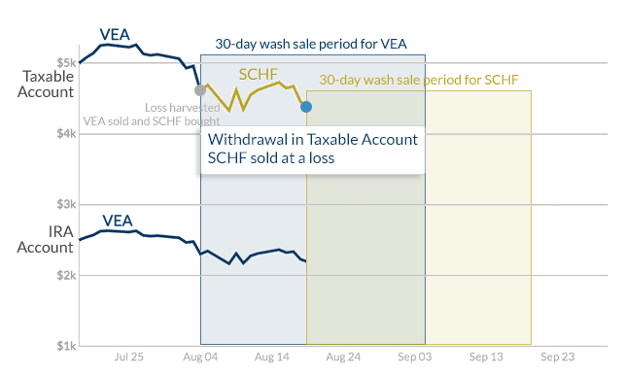

Two weeks move, and the client makes a withdrawal from the taxable account (your complete SCHF place, for simplicity), desiring to fund the IRA. In these two weeks, the asset class dropped extra, so the sale of SCHF additionally realized a loss. The VEA place within the IRA stays unchanged.

Buyer Withdrawal Sells SCHF at a Loss

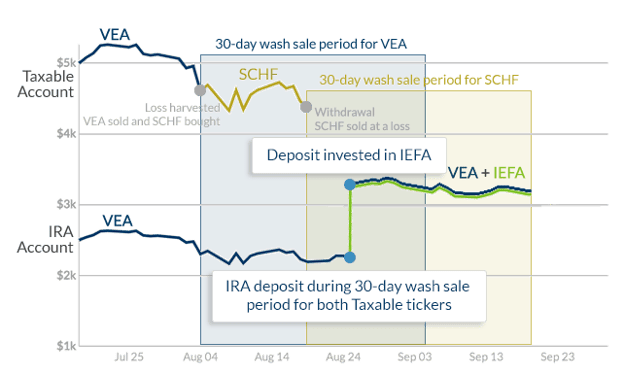

A couple of days later, the client contributes to his IRA, and $1,000 is allotted to the Developed Markets asset class, which already incorporates some VEA. Although the client now not holds any VEA or SCHF in his taxable account, shopping for both one within the IRA would completely wash a helpful realized loss. The Tertiary Ticker System robotically allocates the influx into the third choice for developed markets, IEFA.

IRA Deposit into Tertiary Ticker

Each losses have been preserved, and the client now holds VEA and IEFA in his IRA, sustaining desired allocation always. As a result of no capital features are realized in an IRA/401(ok), there isn’t any hurt in switching out of the IEFA place and consolidating your complete asset class in VEA when there isn’t any hazard of a wash sale.

The consequence: Prospects utilizing TLH+ who even have their IRA/401(ok) property with Betterment can know that Betterment will search to guard helpful realized losses each time they deposit into their IRA/401(ok), whether or not it’s lump rollover, auto-deposits and even dividend reinvestments.

Sensible rebalancing

Lastly, TLH+ directs the proceeds of each harvest to rebalance your complete portfolio, the identical means {that a} Betterment account handles any incoming money move (deposit, dividend). A lot of the money is predicted to remain in that asset class and be reinvested into the parallel asset, however a few of it might not. Recognizing each harvest as a rebalancing alternative additional reduces the necessity for extra promoting in occasions of volatility, additional lowering tax legal responsibility. As all the time, fractional shares permit the inflows to be allotted with precision.

TLH+ Mannequin Calibration

Abstract: To make harvesting choices, TLH+ optimizes round a number of inputs, derived from rigorous Monte Carlo simulations.

The choice to reap is made when the profit, web of value, exceeds a sure threshold. The potential advantage of a harvest is mentioned intimately under (“Outcomes”). Not like a 30-day switchback technique, TLH+ doesn’t incur the anticipated STCG value of the switchback commerce. Due to this fact, “value” consists of three parts: buying and selling expense, execution expense, and elevated value of possession for the alternative asset (if any).

Buying and selling prices are included within the wrap price paid by Betterment prospects. TLH+ is engineered to issue within the different two parts, configurable on the asset degree, and the ensuing value approaches negligible. Bid-ask spreads for the majority of harvestable property are slender. We search funds with expense ratios for the foremost main/alternate ETF pairs which can be shut, and within the case the place a harvest again to the first ticker is being evaluated, that distinction is definitely a profit, not a price.

There are two basic approaches to testing a mannequin’s efficiency: historic backtesting and forward-looking simulation. Optimizing a system to ship the most effective outcomes for under previous historic durations is comparatively trivial, however doing so can be a traditional occasion of knowledge snooping bias. Relying solely on a historic backtest of a portfolio composed of ETFs that permit for 10 to twenty years of dependable knowledge when designing a system meant to offer 40 to 50 years of profit would imply making various indefensible assumptions about basic market habits.

The superset of choice variables driving TLH+ is past the scope of this paper—optimizing round these variables required exhaustive evaluation. TLH+ was calibrated through Betterment’s rigorous Monte Carlo simulation framework, spinning up 1000’s of server situations within the cloud to run via tens of 1000’s of forward-looking eventualities testing mannequin efficiency. We have now calibrated TLH+ in a means that we imagine optimizes its effectiveness given anticipated future returns and volatility, however different optimizations may end in extra frequent harvests or higher outcomes relying on precise market situations.

Greatest Practices for TLH+

Abstract: Tax loss harvesting can add some worth for many buyers, however excessive earners with a mix of very long time horizons, ongoing realized features, and plans for some charitable disposition will reap the most important advantages.

It is a good level to reiterate that tax loss harvesting delivers worth primarily resulting from tax deferral, not tax avoidance. A harvested loss might be helpful within the present tax yr to various levels, however harvesting that loss usually means creating an offsetting acquire sooner or later sooner or later. If and when the portfolio is liquidated, the acquire realized shall be increased than if the harvest by no means befell.

Let’s have a look at an instance:

Yr 1: Purchase asset A for $100.

Yr 2: Asset A drops to $90. Harvest $10 loss, repurchase comparable Asset B for $90.

Yr 20: Asset B is value $500 and is liquidated. Positive factors of $410 realized (sale worth minus value foundation of $90)

Had the harvest by no means occurred, we’d be promoting A with a foundation of $100, and features realized would solely be $400 (assuming comparable efficiency from the 2 correlated property.) Harvesting the $10 loss permits us to offset some unrelated $10 acquire at the moment, however at a worth of an offsetting $10 acquire sooner or later sooner or later.

The worth of a harvest largely will depend on two issues. First, what earnings, if any, is accessible for offset? Second, how a lot time will elapse earlier than the portfolio is liquidated? Because the deferral interval grows, so does the profit—the reinvested financial savings from the tax deferral have extra time to develop.

Whereas nothing herein needs to be interpreted as tax recommendation, analyzing some pattern investor profiles is an efficient solution to respect the character of the advantage of TLH+.

Who advantages most?

The Bottomless Positive factors Investor: A capital loss is barely as helpful because the tax saved on the acquire it offsets. Some buyers might incur substantial capital features yearly from promoting extremely appreciated property—different securities, or maybe actual property. These buyers can instantly use all of the harvested losses, offsetting features and producing substantial tax financial savings.

The Excessive Revenue Earner: Harvesting can have actual profit even within the absence of features. Every year, as much as $3,000 of capital losses might be deducted from odd earnings. Earners in excessive earnings tax states (reminiscent of New York or California) might be topic to a mixed marginal tax bracket of as much as 50%. Taking the total deduction, these buyers may save $1,500 on their tax invoice that yr.

What’s extra, this deduction may gain advantage from constructive price arbitrage. The offsetting acquire is prone to be LTCG, taxed at round 30% for the excessive earner—lower than $1,000—an actual tax financial savings of over $500, on prime of any deferral worth.

The Regular Saver: An preliminary funding might current some harvesting alternatives within the first few years, however over the long run, it’s more and more unlikely that the worth of an asset drops under the preliminary buy worth, even in down years. Common deposits create a number of worth factors, which can create extra harvesting alternatives over time. (This isn’t a rationale for protecting cash out of the market and dripping it in over time—tax loss harvesting is an optimization round returns, not an alternative to market publicity.)

The Philanthropist: In every state of affairs above, any profit is amplified by the size of the deferral interval earlier than the offsetting features are ultimately realized. Nonetheless, if the appreciated securities are donated to charity or handed right down to heirs, the tax might be averted totally. When coupled with this end result, the eventualities above ship the utmost advantage of TLH+. Rich buyers have lengthy used the twin technique of loss harvesting and charitable giving.

Even when an investor expects to principally liquidate, any gifting will unlock a few of this profit. Utilizing losses at the moment, in trade for built-in features, affords the partial philanthropist various tax-efficient choices later in life.

Who advantages least?

The Aspiring Tax Bracket Climber: Tax deferral is undesirable in case your future tax bracket shall be increased than your present. If you happen to count on to realize (or return to) considerably increased earnings sooner or later, tax loss harvesting could also be precisely the incorrect technique—it might, actually, make sense to reap features, not losses.

Particularly, we don’t advise you to make use of TLH+ in the event you can at present notice capital features at a 0% tax price. Beneath 2023 tax brackets, this can be the case in case your taxable earnings is under $11,625 as a single filer or $89,250 in case you are married submitting collectively. See the IRS web site for extra particulars.

Graduate college students, these taking parental go away, or simply beginning out of their careers ought to ask “What tax price am I offsetting at the moment” versus “What price can I fairly count on to pay sooner or later?”

The Scattered Portfolio: TLH+ is rigorously calibrated to handle wash gross sales throughout all property managed by Betterment, together with IRA property. Nonetheless, the algorithms can’t keep in mind info that isn’t accessible. To the extent {that a} Betterment buyer’s holdings (or a partner’s holdings) in one other account overlap with the Betterment portfolio, there might be no assure that TLH+ exercise won’t battle with gross sales and purchases in these different accounts (together with dividend reinvestments), and end in unexpected wash gross sales that reverse some or all the advantages of TLH+. We don’t advocate TLH+ to a buyer who holds (or whose partner holds) any of the ETFs within the Betterment portfolio in non-Betterment accounts. You possibly can ask Betterment to coordinate TLH+ along with your partner’s account at Betterment. You’ll be requested on your partner’s account info after you allow TLH+ in order that we will help optimize your investments throughout your accounts.

The Portfolio Technique Collector: Electing totally different portfolio methods for a number of Betterment objectives might trigger TLH+ to establish fewer alternatives to reap losses than it would in the event you elect the identical portfolio technique for your entire Betterment objectives.

The Speedy Liquidator: What occurs if all the further features resulting from harvesting are realized over the course of a single yr? In a full liquidation of a long-standing portfolio, the extra features resulting from harvesting may push the taxpayer into a better LTCG bracket, doubtlessly reversing the advantage of TLH+. For individuals who count on to attract down with extra flexibility, good automation shall be there to assist optimize the tax penalties.

The Imminent Withdrawal: The harvesting of tax losses resets the one-year holding interval that’s used to differentiate between LTCG and STCG. For many buyers, this isn’t a difficulty: by the point that they promote the impacted investments, the one-year holding interval has elapsed they usually pay taxes on the decrease LTCG price. That is significantly true for Betterment prospects as a result of our TaxMin characteristic robotically realizes LTCG forward of STCG in response to a withdrawal request. Nonetheless, in case you are planning to withdraw a big portion of your taxable property within the subsequent 12 months, you must wait to activate TLH+ till after the withdrawal is full to scale back the opportunity of realizing STCG.

Different Impacts to Think about

Traders with property held in several portfolio methods ought to perceive the way it impacts the operation of TLH+. To be taught extra, please see Betterment’s SRI disclosures, Versatile portfolio disclosures, the Goldman Sachs good beta disclosures, and the BlackRock goal earnings portfolio disclosures for additional element. Purchasers in Advisor-designed customized portfolios via Betterment for Advisors ought to seek the advice of their Advisors to grasp the restrictions of TLH+ with respect to any customized portfolio. Moreover, as described above, electing one portfolio technique for a number of objectives in your account whereas concurrently electing a unique portfolio for different objectives in your account might cut back alternatives for TLH+ to reap losses resulting from wash sale avoidance.

As a consequence of Betterment’s month-to-month cadence for billing charges for advisory providers, via the liquidation of securities, tax loss harvesting alternatives could also be adversely affected for purchasers with significantly excessive inventory allocations, third get together portfolios, or versatile portfolios. Because of assessing charges on a month-to-month cadence for a buyer with solely fairness safety publicity, which tends to be extra opportunistic for tax loss harvesting, sure securities could also be offered that would have been used to tax loss harvest at a later date, thereby delaying the harvesting alternative into the longer term. This delay can be resulting from avoidance of triggering the wash sale rule, which forbids a safety from being offered solely to get replaced with a “considerably comparable” safety inside a 30-day interval.

Elements which is able to decide the precise advantage of TLH+ embrace, however are usually not restricted to, market efficiency, the dimensions of the portfolio, the inventory publicity of the portfolio, the frequency and measurement of deposits into the portfolio, the supply of capital features and earnings which might be offset by losses harvested, the tax charges relevant to the investor in a given tax yr and in future years, the extent to which related property within the portfolio are donated to charity or bequeathed to heirs, and the time elapsed earlier than liquidation of any property that aren’t disposed of on this method.

All of Betterment’s buying and selling choices are discretionary and Betterment might resolve to restrict or postpone TLH+ buying and selling on any given day or on consecutive days, both with respect to a single account or throughout a number of accounts.

Tax loss harvesting isn’t appropriate for all buyers. Nothing herein needs to be interpreted as tax recommendation, and Betterment doesn’t characterize in any method that the tax penalties described herein shall be obtained, or that any Betterment product will end in any specific tax consequence. Please seek the advice of your private tax advisor as as to if TLH+ is an appropriate technique for you, given your specific circumstances. The tax penalties of tax loss harvesting are advanced and unsure and could also be challenged by the IRS. You and your tax advisor are liable for how transactions carried out in your account are reported to the IRS in your private tax return. Betterment assumes no accountability for the tax penalties to any consumer of any transaction.

See Betterment’s TLH+ disclosures for additional element.

How we calculate the worth of TLH+

Over 2022 and 2023, we calculated that 69% of Betterment prospects who employed the technique noticed potential financial savings in extra of the Betterment charges charged on their taxable accounts for the yr.

To achieve this conclusion, we first recognized the accounts to think about, outlined as taxable investing accounts that had a constructive steadiness and TLH+ turned on all through 2022 and 2023. We excluded belief accounts as a result of their tax remedies might be highly-specific they usually made up lower than 1% of the info.

For every account’s taxpayer, we pulled the brief and long run capital acquire/loss within the related accounts realized in 2022 and 2023 utilizing our buying and selling and tax information. We then divided the acquire/loss into these attributable to a TLH transaction and people not attributable to a TLH transaction.

Then, for every tax yr, we calculated the short-term features offset by taking the higher of the short-term loss realized by TLH+ and the short-term acquire attributable to different transactions. We did the identical for long-term acquire/loss. If there have been any losses leftover, we calculated the quantity of odd earnings that might be offset by taking the higher of the client’s reported earnings and $3,000 ($1,500 if the client is married submitting individually) after which taking the higher of that quantity and the sum of the remaining long-term and short-term losses (after first subtracting any non-TLH+ losses from odd earnings). If there have been any losses leftover in 2022 in spite of everything that, we carried these losses ahead to 2023.

At this level, we had for every buyer the quantity of short-term features, long-term features and odd earnings offset by TLH for every tax yr. We then calculated the short-term and long-term capital features charges utilizing the federal tax brackets for 2022 and 2023 and the reported earnings of the taxpayer, their reported tax submitting standing, and their reported variety of dependents. We assumed the usual deduction and conservatively didn’t embrace state capital features taxes as a result of some states should not have capital features tax. We calculated the odd earnings price together with federal taxes, state taxes, and Medicare and Social Safety taxes utilizing the consumer’s reported earnings, submitting standing, variety of dependents, assumed normal deduction, and age (assuming Medicare and Social Safety taxes stop on the retirement age of 67). We then utilized these tax charges respectively to the offsets to get the tax invoice discount from every kind of offset and summed them as much as get the full tax discount.

Then, we pulled the full charges charged to the customers on the account in query that had been accrued in 2022 and 2023 from our price accrual information and in contrast that to the tax invoice discount. If the tax invoice discount was higher than the charges, we thought-about TLH+ to have not directly paid for the charges within the account in query for the taxpayer in query. This was the case for 69% of consumers.2

Conclusion

Abstract: Tax loss harvesting might be an efficient means to enhance your investor returns with out taking further draw back threat.