- XLM’s unbelievable rally indicated intense shopping for stress regardless of the altcoin season not absolutely kicking in.

- A brief-term pullback from the overbought ranges can’t be dominated out, given the overbought ranges.

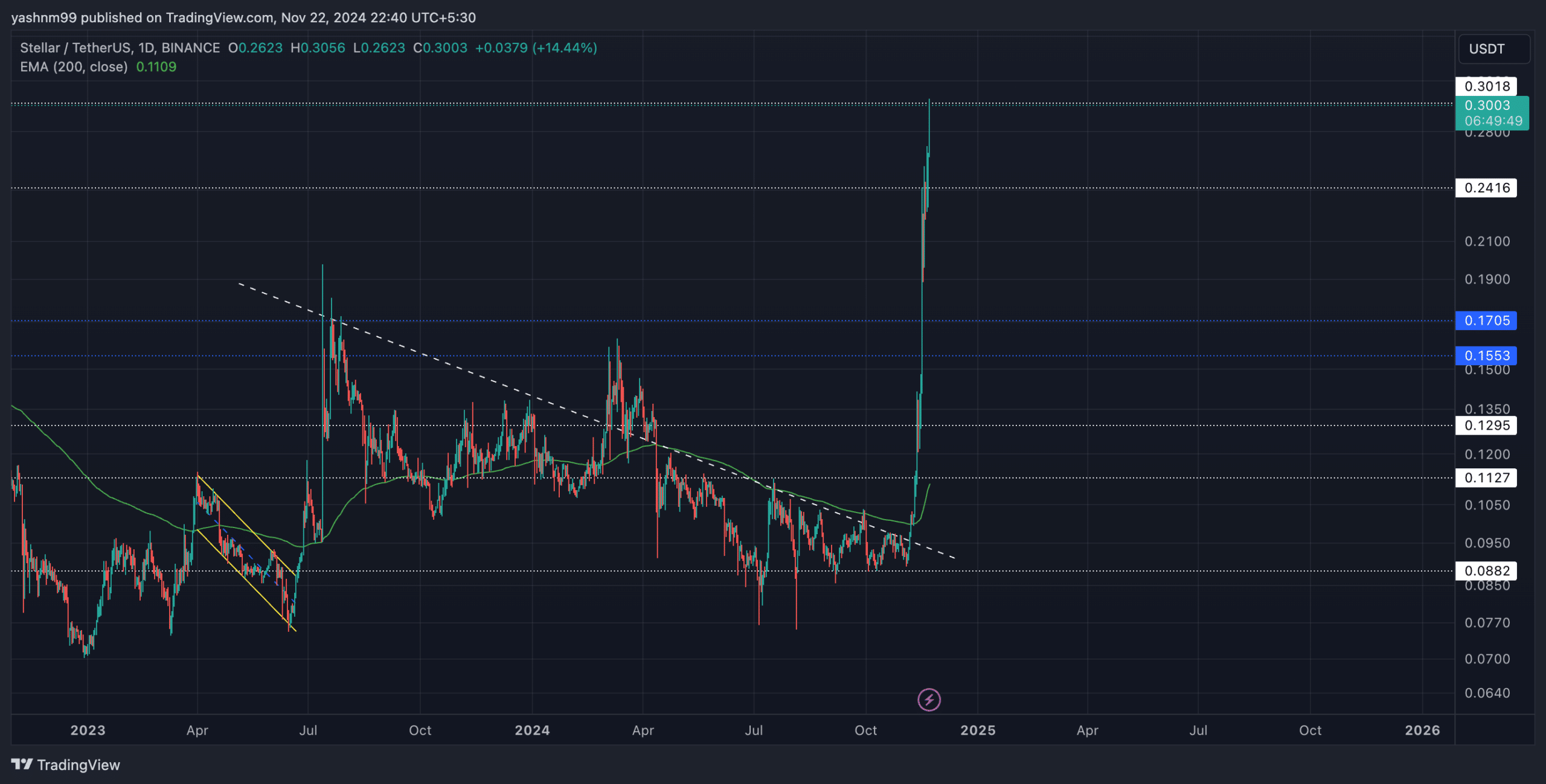

Stellar [XLM] has been on a parabolic rise as bullish sentiment round Bitcoin [BTC] fueled a rally, pushing Stellar to the touch its multi-yearly highs.

On the time of writing, XLM traded at $0.3027 after witnessing a 26% improve within the final 24 hours. With the RSI resting above 86 and the market being closely overbought, a possible pullback may very well be on the horizon.

Nevertheless, the market stays in a bullish part, so any change in broader market sentiment may considerably impression XLM’s path.

Can XLM bulls maintain on after 220% surge?

Whereas the altcoin season was but to reach (given Ethereum’s [ETH] weak efficiency), XLM stood out amongst most altcoins after witnessing an over 220% bounce prior to now 17 days.

This surge got here after discovering assist on the $0.08 stage, main the bulls to push above the vital 200-day EMA (at $0.1109 at press time).

In consequence, XLM touched its 35-month excessive on the twenty second of November to check resistance on the $0.3 mark. The present worth motion has set XLM close to this resistance zone.

Any shut above this stage can set the stage for bulls to march towards the $0.4 resistance within the coming weeks.

A near-term failure to breach this stage may result in a retracement towards the $0.24 assist, which aligns with the beforehand breached trendline resistance.

The continuing rally, backed by Bitcoin’s historic climb to new all-time highs, offers hope for continued upward momentum. Nevertheless, the overbought RSI may set off a doable consolidation or retracement quickly.

Key ranges to look at

Resistance: The $0.3 stage is a serious resistance stage for bulls. A profitable break above this may take XLM to the subsequent resistance stage, $0.4.

Help: On the draw back, quick assist is positioned round $0.24. An unlikely fall under this might lead XLM to revisit the $0.17 area.

XLM derivatives knowledge evaluation

Buying and selling quantity has surged by 92.97% to succeed in $2.32 billion—a big uptick implying robust curiosity within the ongoing rally.

Open Curiosity rose by 56.83% to $174.74 million, suggesting merchants are more and more putting positions and probably anticipating main strikes.

The 24-hour lengthy/brief ratio for XLM stood at 0.9743, indicating a fairly balanced sentiment.

Learn Stellar’s [XLM] Worth Prediction 2024–2025

Nevertheless, the Lengthy/Brief Ratio for accounts and prime merchants on Binance was extra optimistic at 1.0186 and 1.0346, indicating a slight edge for bulls.

Consumers ought to nonetheless monitor Bitcoin’s motion and assess the general market sentiment earlier than opening an extended or brief place.

Disclaimer: The knowledge offered doesn’t represent monetary, funding, buying and selling, or different kinds of recommendation and is solely the author’s opinion