- Stellar Lumens’ pullback was headed to key help ranges at $0.3 and $0.36

- An upside liquidity sweep might affect a probable value rebound towards $0.50.

Stellar Lumens [XLM] pumped 45% in early January however erased some positive factors. The current market sell-off might provide swing merchants and buyers one other shopping for alternative.

After hovering from $0.30 to just about 50 cents, XLM’s ongoing pullback was headed towards key ranges that might curiosity bulls once more.

Stellar Lumens value prediction

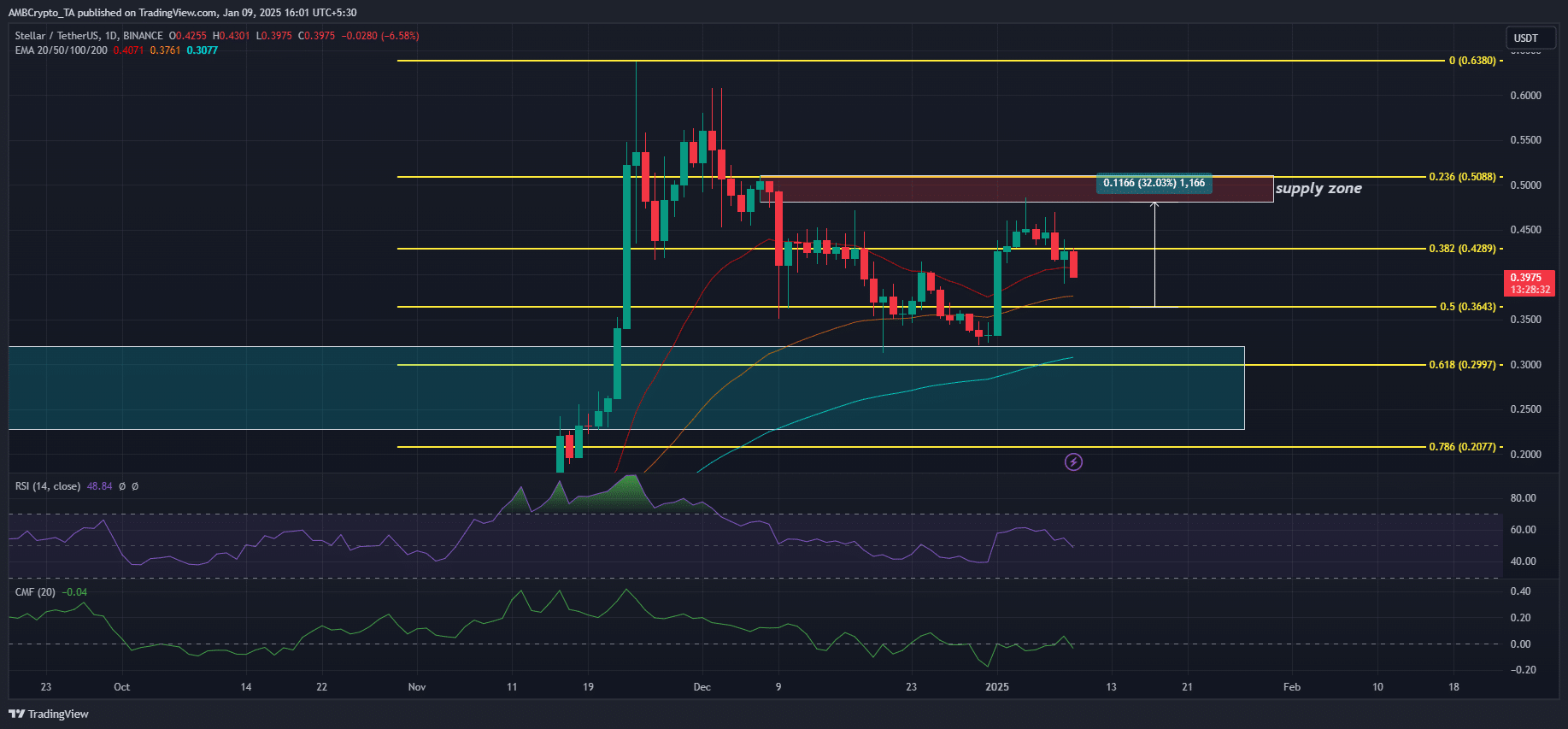

First, the New Yr’s upswing flipped the each day chart market construction bullish. This might be shifted if the retracement prolonged beneath the current low at $0.32.

Till that bearish market construction shift occurs, the present outlook was primed for bulls.

The current pullback was about 18% and closed in on key ranges of $0.36, and the December help stopped the vacation sell-off at $0.30.

The 2 ranges might be market re-entry for bulls focusing on overhead provide beneath $0.50 (purple zone). A bullish concept could be invalidated if XLM prolonged its decline to beneath $0.30.

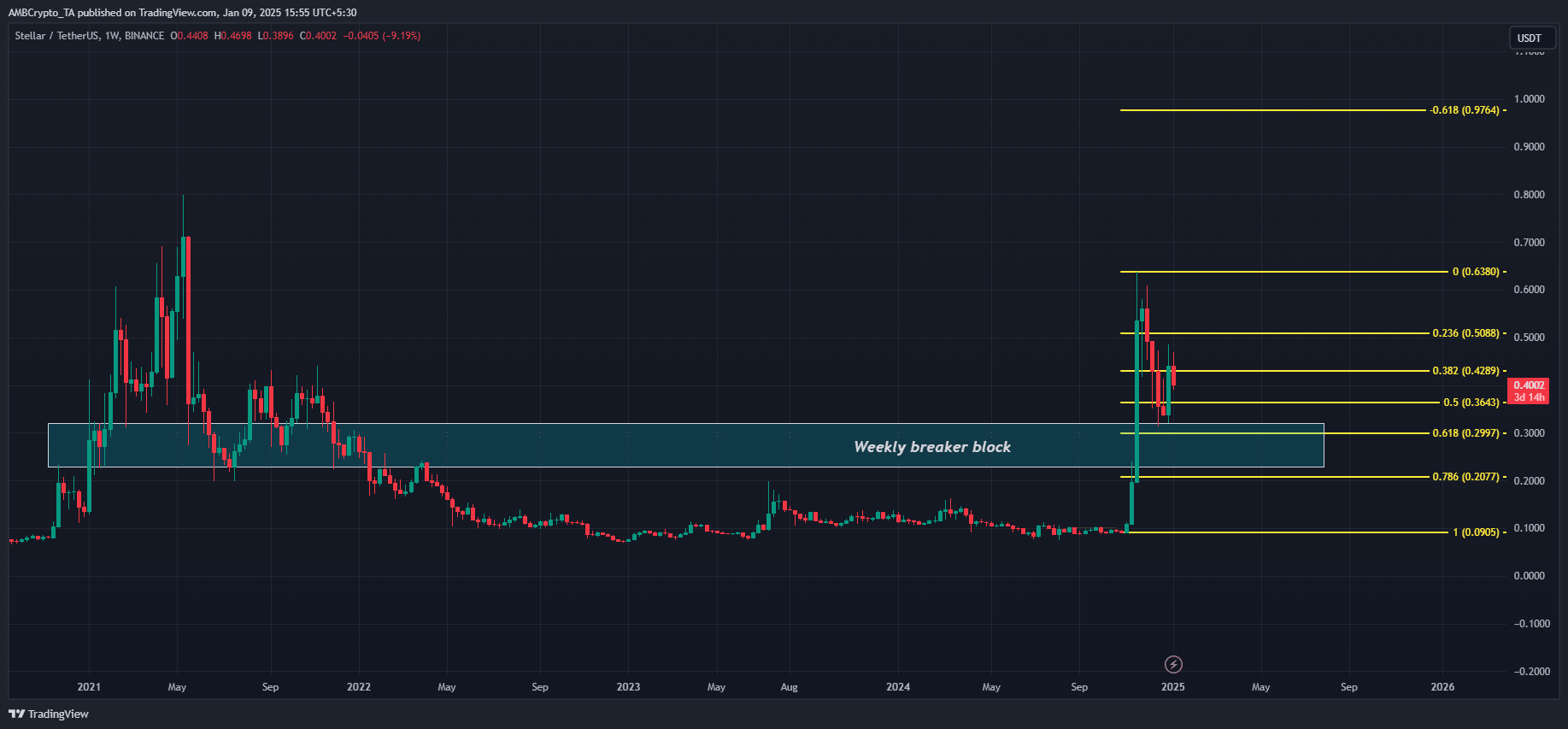

The $0.30 help was additional bolstered by the weekly charts, which marked the cyan space as a breaker block that might set off a value rebound if defended.

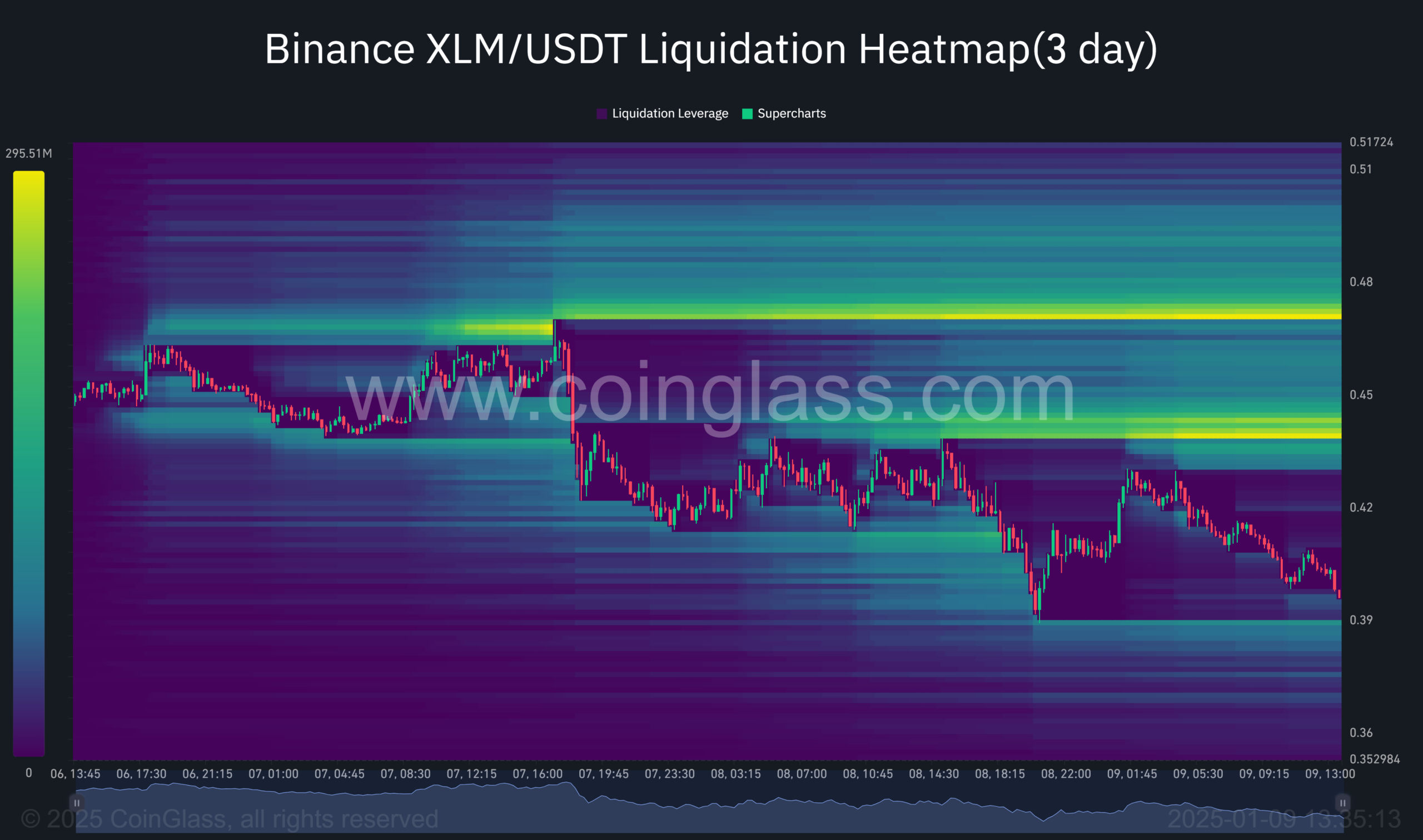

Upside liquidity might entice XLM value

From a liquidity sweep perspective, there have been two upside liquidity ranges price monitoring. The primary was between $0.43 and $0.45, and the second was at $0.48.

Most often, these excessive liquidity zones at all times act as magnets for value motion.

If that’s the case, they might be the subsequent key upside targets to be tapped by a probable XLM rebound. Apparently, the higher liquidity zone aligned with the availability zone beneath $0.50 on the value charts.

In brief, one might guide partial revenue on the first goal and liquidate the remaining when the value faucets the $0.48-$0.50 goal.

Learn Stellar Lumens [XLM] Worth Prediction 2025-2026

In conclusion, XLM’s market construction and liquidation heatmap steered an ideal shopping for alternative if the pullback prolonged to $0.30.

Nonetheless, a sustained sell-off beneath $0.30 would embolden sellers and invalidate the bullish thesis.

Disclaimer: The data offered doesn’t represent monetary, funding, buying and selling, or different kinds of recommendation and is solely the author’s opinion