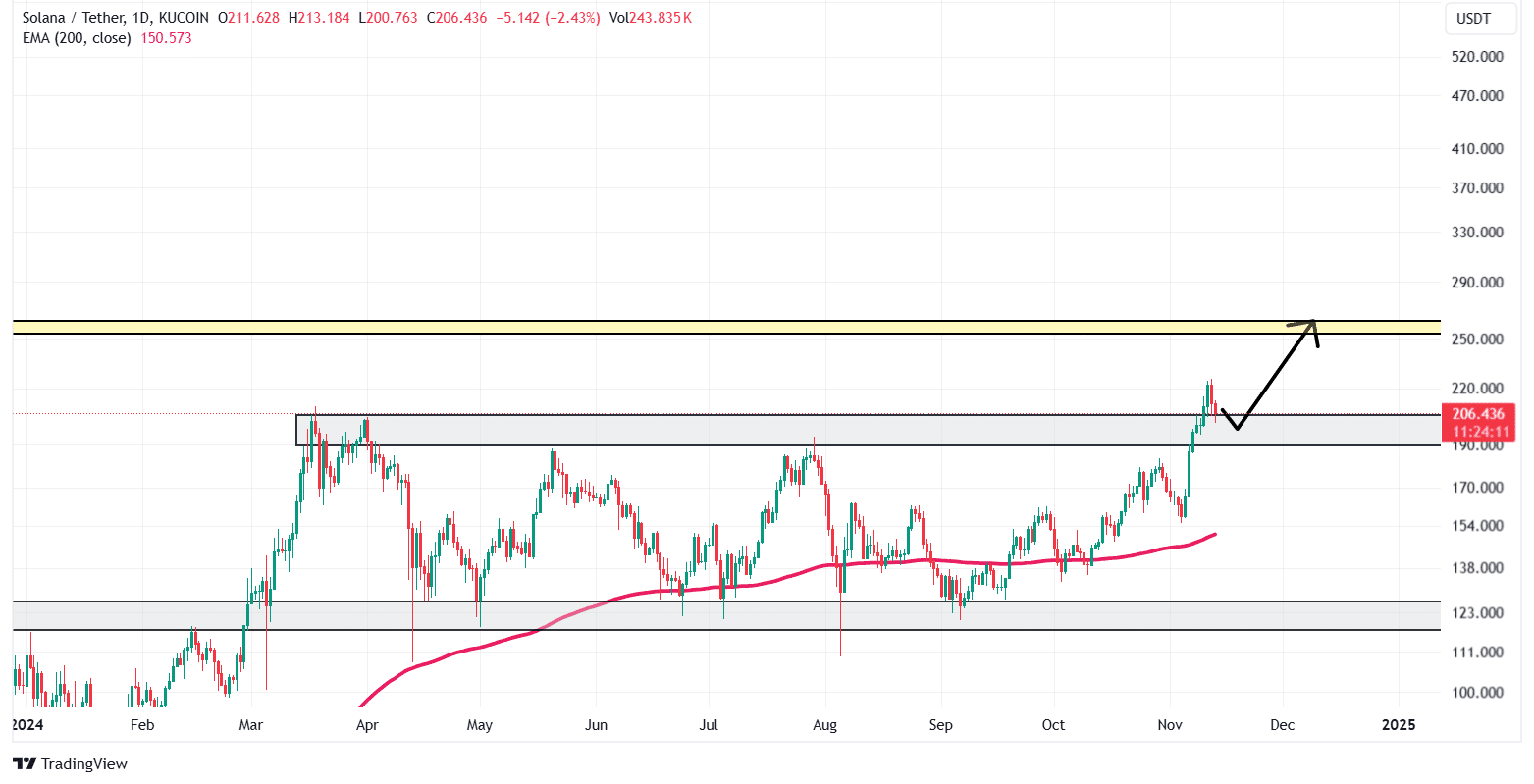

- Following the affirmation of the breakout, Solana might probably rise by 25% to hit the $260 stage.

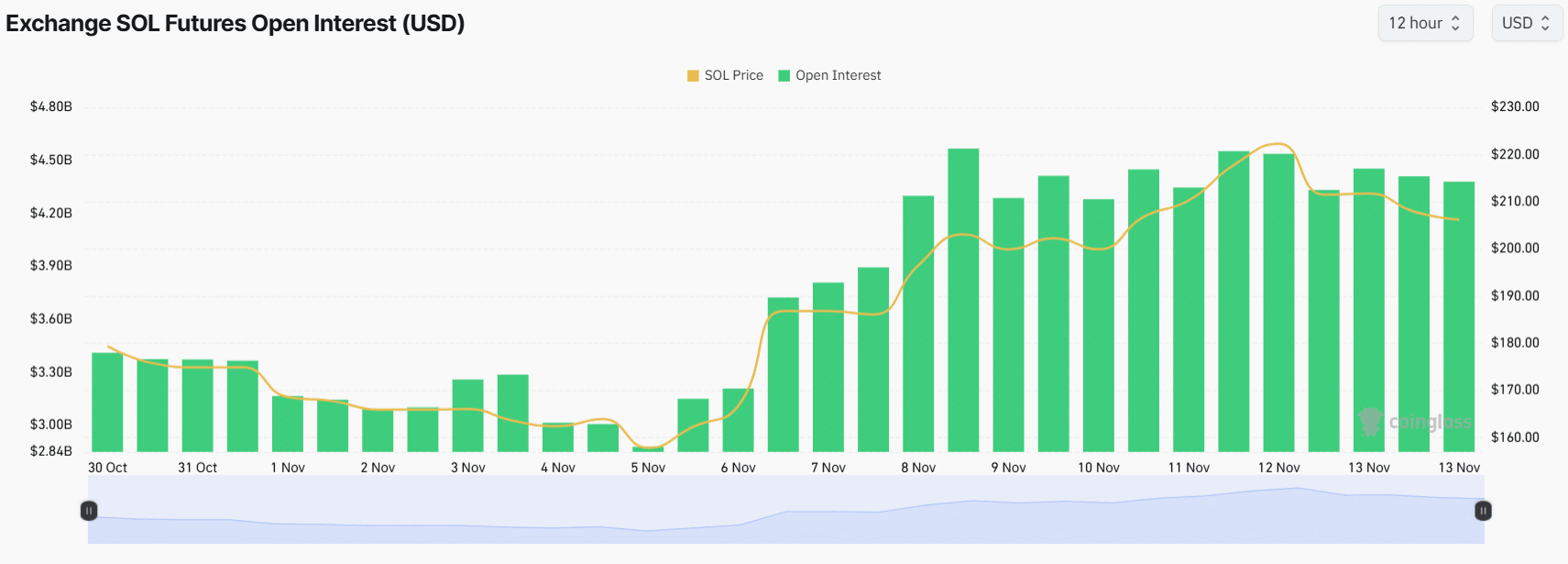

- SOL’s Open Curiosity has surged aggressively, indicating elevated participation from merchants.

The general cryptocurrency market seemed to be experiencing a worth correction during the last 24 hours.

Amidst this, Solana [SOL], the fourth-largest cryptocurrency, has efficiently retested its breakout stage, and there’s a sturdy chance of upside momentum within the coming days.

The potential causes behind this bullish hypothesis are optimistic worth motion, bullish on-chain metrics, and heightened participation from merchants and whales.

Solana technical evaluation

Solana’s worth was at an important help stage of $200 at press time. Primarily based on current worth motion and historic momentum, there’s a sturdy chance that the asset might soar by 25% to succeed in the $260 stage quickly.

At press time, SOL was buying and selling above the 200 Exponential Transferring Common (EMA) on the every day time-frame.

In the meantime, its Relative Power Index (RSI) hinted at a possible upside rally, with its worth close to the oversold territory.

Bullish on-chain metrics

Along with SOL’s optimistic outlook, on-chain metrics additional help the asset’s bullish habits. In accordance with the on-chain analytics agency Coinglass, SOL’s Open Curiosity has seen an aggressive rise.

Over the previous few hours, the Open Curiosity (OI) has elevated by 3.5%, and prior to now 4 hours, it has risen by 5.2%. This indicated notable dealer participation within the asset as it’s poised for upside momentum.

Main liquidation ranges

At press time, the key liquidation ranges had been at $199.5 on the decrease facet and $210.8 on the higher facet, with merchants being over-leveraged at these factors, in keeping with Coinglass knowledge.

If the sentiment stays unchanged and the value rises to $210.8, practically $52.7 million price of brief positions will probably be liquidated.

Learn Solana’s [SOL] Value Prediction 2024–2025

Conversely, if the sentiment shifts and the value drops to $199.5, roughly $110 million price of lengthy positions will probably be liquidated.

So, it seems that bulls are at the moment dominating the asset and will help it in its upcoming rally over the following few days.