- SKI has surged by 5647.94% over the previous month.

- Alternatively, the token has reached a market cap of $131.39 million.

Over the previous month, as altcoins have discovered a brand new path, smaller cash have emerged to make appreciable positive factors.

One among these rising cash is Ski Masks Canine [SKI], which has skilled important positive factors over the previous month.

On the time of this writing, SKI was buying and selling at $0.1321. This marked a 62.57% enhance over the previous 24 hours. Over this era, its market cap has surpassed $100 million, hitting $131.39 million.

Additionally, the memecoin’s each day buying and selling quantity has spiked by 35.12% to $18.47 million.

Equally, SKI has gained on weekly and month-to-month charts, growing by 529.47% and 5647.94% respectively.

This worth pump has strengthened investor’s momentum, with patrons taking a newfound curiosity to enter the markets. As such, SKI is seeing robust upward momentum as patrons scrambled to buy it, fearing to overlook out.

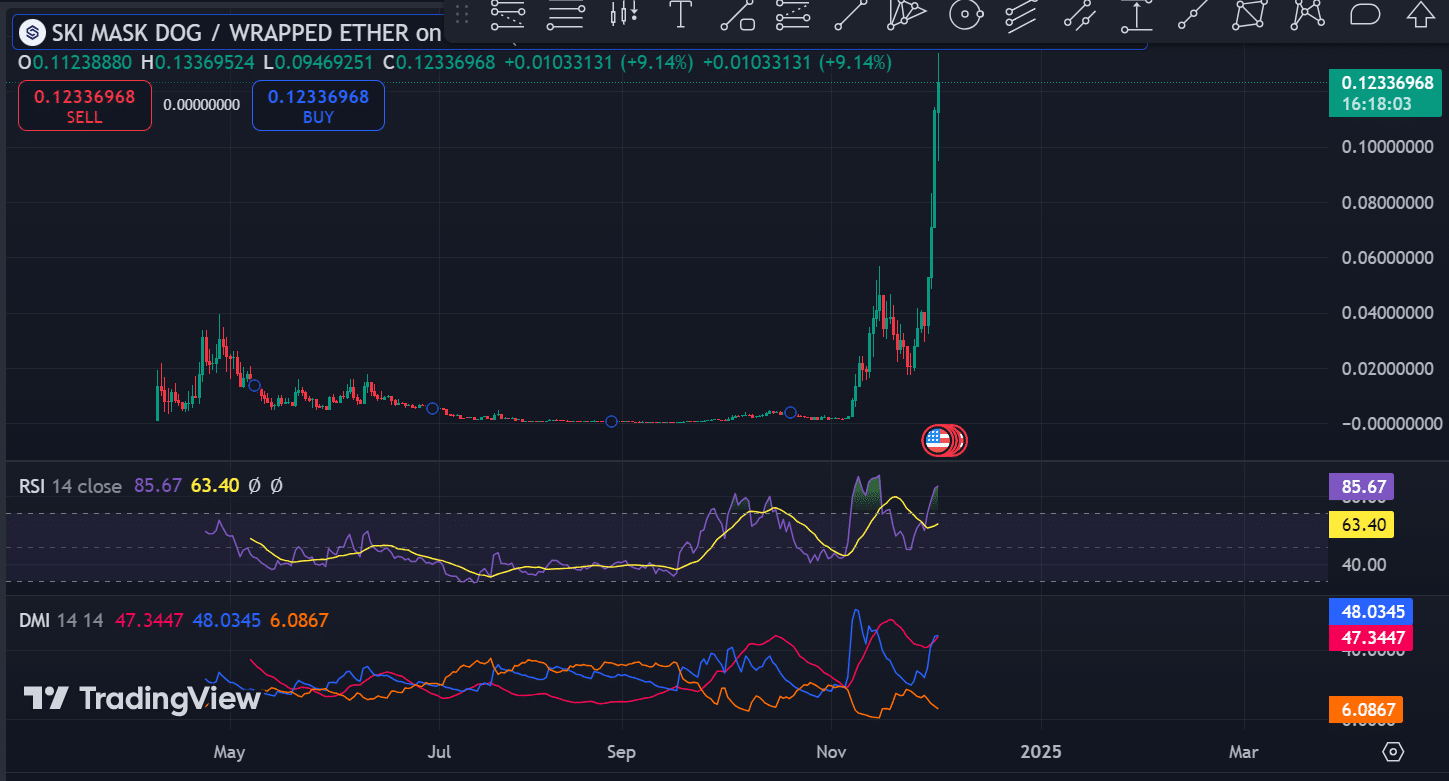

What SKI charts counsel

In response to AMBCrypto’s evaluation, Ski Masks Canine is presently experiencing a robust bullish momentum as patrons proceed to open new positions.

This momentum might be seen with the rising Relative Energy Index (RSI). Since making a bullish crossover 5 days in the past, SKI’s RSI has surged from 64 to 85.

This reveals that over this era, patrons have emerged and brought whole management of the market.

With elevated shopping for strain, the memecoin has strengthened an upward momentum. This momentum is evidenced by the truth that SKI’s Directional Motion Index (DMI) is shut to creating a bullish crossover.

This reveals that +DI is rising whereas the -DI is regularly declining. When an asset’s DMI is ready like this, it reveals that the property are experiencing a robust upward momentum whereas sellers are exhausted.

This phenomenon was additional evidenced by the rising Relative Vigor Index.

When RVGI rises, it signifies that closing costs are greater relative to the worth vary. In an uptrend just like the one SKI is presently experiencing, it confirms the energy of the present development.

- SKI has surged by 5647.94% over the previous month.

- Alternatively, the token has reached a market cap of $131.39 million.

Over the previous month, as altcoins have discovered a brand new path, smaller cash have emerged to make appreciable positive factors.

One among these rising cash is Ski Masks Canine [SKI], which has skilled important positive factors over the previous month.

On the time of this writing, SKI was buying and selling at $0.1321. This marked a 62.57% enhance over the previous 24 hours. Over this era, its market cap has surpassed $100 million, hitting $131.39 million.

Additionally, the memecoin’s each day buying and selling quantity has spiked by 35.12% to $18.47 million.

Equally, SKI has gained on weekly and month-to-month charts, growing by 529.47% and 5647.94% respectively.

This worth pump has strengthened investor’s momentum, with patrons taking a newfound curiosity to enter the markets. As such, SKI is seeing robust upward momentum as patrons scrambled to buy it, fearing to overlook out.

What SKI charts counsel

In response to AMBCrypto’s evaluation, Ski Masks Canine is presently experiencing a robust bullish momentum as patrons proceed to open new positions.

This momentum might be seen with the rising Relative Energy Index (RSI). Since making a bullish crossover 5 days in the past, SKI’s RSI has surged from 64 to 85.

This reveals that over this era, patrons have emerged and brought whole management of the market.

With elevated shopping for strain, the memecoin has strengthened an upward momentum. This momentum is evidenced by the truth that SKI’s Directional Motion Index (DMI) is shut to creating a bullish crossover.

This reveals that +DI is rising whereas the -DI is regularly declining. When an asset’s DMI is ready like this, it reveals that the property are experiencing a robust upward momentum whereas sellers are exhausted.

This phenomenon was additional evidenced by the rising Relative Vigor Index.

When RVGI rises, it signifies that closing costs are greater relative to the worth vary. In an uptrend just like the one SKI is presently experiencing, it confirms the energy of the present development.