(Bloomberg) — Asian shares fell to the bottom stage in virtually two months on issues that US President-elect Donald Trump’s proposed tariffs and picks for key administration positions could stoke inflation.

Most Learn from Bloomberg

Fairness benchmarks fell in China, Japan and Australia, with a regional gauge touching the bottom since Sept. 19. The Bloomberg Greenback Spot Index was regular forward of a report on US consumer-price inflation, whereas the yen approached the important thing stage of 155. The MSCI Rising Markets Foreign money Index was near erasing its features for the 12 months.

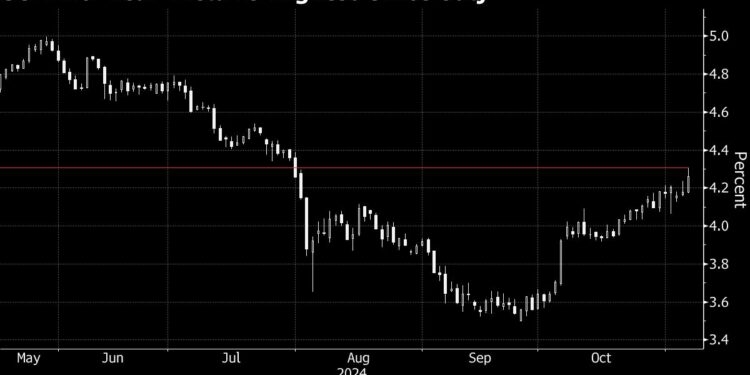

Treasury 10-year yields slipped after surging 12 foundation factors on Tuesday. Merchants are actually pricing in about two US fee cuts by means of June, in opposition to virtually 4 seen at the beginning of final week. US inventory futures slipped.

Asian equities have been below stress since Trump received the election final week, as merchants count on his proposed insurance policies to additional drive up inflation and gradual the tempo of interest-rate cuts. US information due Wednesday could reinforce the narrative, with analysts predicting that the general shopper value index most likely elevated 0.2% for a fourth month.

Chinese language shares continued to retreat after slumping on Tuesday following stories that Trump was poised to choose two males with observe data of harshly criticizing Beijing for key posts in his administration.

“Whereas focus stays on Trump 2.0, there was a slight tilt towards tariff fears that are overpowering the expectations of tax cuts given the bulletins of China hawks being elevated to key positions in Trump’s cupboards,” stated Charu Chanana, chief funding strategist at Saxo Markets.

In the meantime, China indicated its discomfort with yuan weak point by means of its day by day reference fee for the foreign money amid the specter of increased US tariffs below a Trump administration. The yuan edged increased following the transfer.

Beijing began advertising greenback bonds in Saudi Arabia, marking the nation’s first debt sale within the US foreign money since 2021.

Merchants are betting on additional losses in Treasuries in anticipation that Trump’s deliberate insurance policies will rekindle inflation and maintain US rates of interest excessive. Open curiosity, a sign of futures merchants’ positioning within the bond market, rose for a fourth straight session within the two-year word contract, information launched Tuesday present.

Fed Minneapolis President Neel Kashkari on Tuesday stated he’ll be watching the inflation information intently to find out whether or not one other interest-rate lower is acceptable on the US central financial institution’s December assembly.