- There’s been a surge within the variety of XRP lengthy positions opened available in the market.

- A number of by-product elements have added bullish sentiment, however the rally lacks momentum, which might hinder an upward transfer.

Ripple [XRP] has managed to keep up a minor drop in worth over the previous month, declining by 15.61% throughout this part of the market.

Nonetheless, the present sentiment means that the market tide could possibly be shifting quickly, and the asset might even see a rally forward.

AMBCrypto evaluation explores whether or not the by-product sentiment available in the market will have the ability to counter the shortage of momentum driving an XRP buy-in.

Nearly all of merchants go bullish

Within the derivatives market, the vast majority of bullish merchants have continued to position lengthy bets.

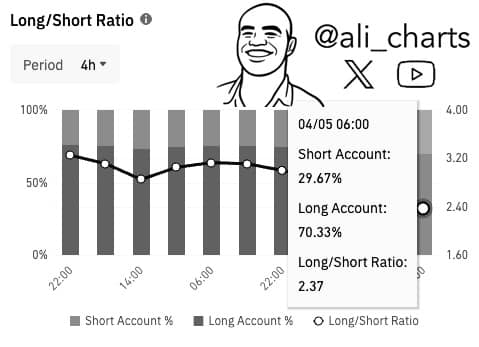

In accordance with accessible knowledge, 70.33% of derivatives merchants on Binance have opened lengthy positions, placing its long-to-short ratio at a excessive 2.37—signifying the market could be very bullish.

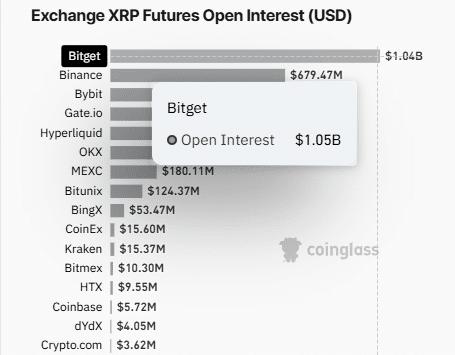

As well as, the open curiosity on Coinglass has elevated to $679.47 million, suggesting that roughly $477.87 million of those positions belong to lengthy merchants anticipating an increase.

However, this bullish sentiment can also be mirrored throughout different exchanges, together with Bitget, which has seen a major rise in open curiosity, now reaching $1.04 billion.

This vital lengthy sentiment usually has a manner of reflecting on potential value motion, with XRP doubtlessly forming larger highs and lows.

The sentiment continues to rise, and the derivatives market total continues to develop, growing the possibilities of a rally.

By-product market sentiment stays sturdy

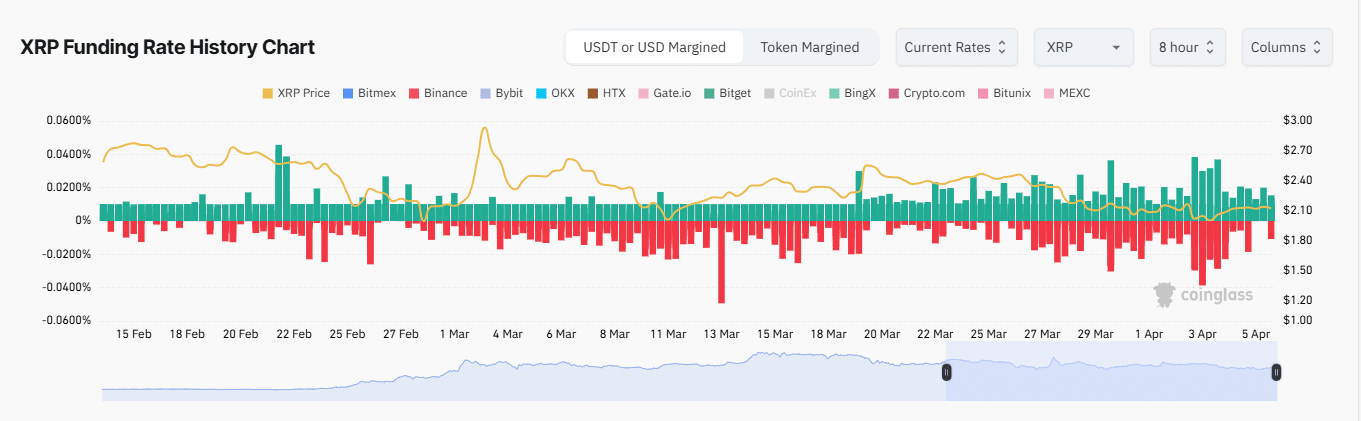

The derivatives market sentiment stays sturdy, supporting the potential for XRP’s efficiency. Lengthy merchants at the moment are paying a premium payment to brief merchants, aiming to bridge the hole between the spot and futures markets.

With a funding charge of 0.0059%, lengthy merchants dominate the market positions, traditionally signaling upside potential.

This exercise has had a refined influence on XRP’s value, which has dropped by 0.99%. Nonetheless, it has resulted in vital brief liquidations over the previous 24 hours.

Throughout this era, $2.4 million value of brief positions have been forcefully closed. These closures occurred as the value moved towards merchants holding these positions.

Though the general sentiment within the derivatives market stays optimistic, it signifies sturdy curiosity in a possible rally. Nonetheless, no vital momentum at present helps a transfer to the upside.

Will the shortage of momentum maintain XRP again?

The market lacks momentum to drive an XRP rally. Prior to now 24 hours, buying and selling quantity dropped by 50.69% to $4.98 billion.

This vital decline, coupled with weak efficiency in elements of the market, signifies damaging sentiment. It’s not a promising signal for an upward transfer.

The falling momentum and declining XRP value counsel weakening sentiment. This will ultimately favor bears available in the market.

Within the choices market, XRP’s buying and selling quantity hit a brand new low, falling by 62.51%. This means lowered curiosity in XRP.

Continued drops in quantity present inadequate assist for an upward motion. XRP may face an extra value lower. Such declines put lengthy merchants within the derivatives market at vital danger of losses.

- There’s been a surge within the variety of XRP lengthy positions opened available in the market.

- A number of by-product elements have added bullish sentiment, however the rally lacks momentum, which might hinder an upward transfer.

Ripple [XRP] has managed to keep up a minor drop in worth over the previous month, declining by 15.61% throughout this part of the market.

Nonetheless, the present sentiment means that the market tide could possibly be shifting quickly, and the asset might even see a rally forward.

AMBCrypto evaluation explores whether or not the by-product sentiment available in the market will have the ability to counter the shortage of momentum driving an XRP buy-in.

Nearly all of merchants go bullish

Within the derivatives market, the vast majority of bullish merchants have continued to position lengthy bets.

In accordance with accessible knowledge, 70.33% of derivatives merchants on Binance have opened lengthy positions, placing its long-to-short ratio at a excessive 2.37—signifying the market could be very bullish.

As well as, the open curiosity on Coinglass has elevated to $679.47 million, suggesting that roughly $477.87 million of those positions belong to lengthy merchants anticipating an increase.

However, this bullish sentiment can also be mirrored throughout different exchanges, together with Bitget, which has seen a major rise in open curiosity, now reaching $1.04 billion.

This vital lengthy sentiment usually has a manner of reflecting on potential value motion, with XRP doubtlessly forming larger highs and lows.

The sentiment continues to rise, and the derivatives market total continues to develop, growing the possibilities of a rally.

By-product market sentiment stays sturdy

The derivatives market sentiment stays sturdy, supporting the potential for XRP’s efficiency. Lengthy merchants at the moment are paying a premium payment to brief merchants, aiming to bridge the hole between the spot and futures markets.

With a funding charge of 0.0059%, lengthy merchants dominate the market positions, traditionally signaling upside potential.

This exercise has had a refined influence on XRP’s value, which has dropped by 0.99%. Nonetheless, it has resulted in vital brief liquidations over the previous 24 hours.

Throughout this era, $2.4 million value of brief positions have been forcefully closed. These closures occurred as the value moved towards merchants holding these positions.

Though the general sentiment within the derivatives market stays optimistic, it signifies sturdy curiosity in a possible rally. Nonetheless, no vital momentum at present helps a transfer to the upside.

Will the shortage of momentum maintain XRP again?

The market lacks momentum to drive an XRP rally. Prior to now 24 hours, buying and selling quantity dropped by 50.69% to $4.98 billion.

This vital decline, coupled with weak efficiency in elements of the market, signifies damaging sentiment. It’s not a promising signal for an upward transfer.

The falling momentum and declining XRP value counsel weakening sentiment. This will ultimately favor bears available in the market.

Within the choices market, XRP’s buying and selling quantity hit a brand new low, falling by 62.51%. This means lowered curiosity in XRP.

Continued drops in quantity present inadequate assist for an upward motion. XRP may face an extra value lower. Such declines put lengthy merchants within the derivatives market at vital danger of losses.