- Render reveals potential for a bullish reversal because it nears vital resistance at $6.63.

- Market sentiment leans bullish, backed by a long-short ratio favoring longs and excessive buying and selling quantity.

Render [RNDR] continues to say its dominance within the decentralized bodily infrastructure community (DePIN) sector with a formidable $2 billion market cap and a powerful $103 million in each day buying and selling quantity.

At press time, Render trades at $4.89, down by 4.18% over the previous week. Nevertheless, indicators level in direction of a possible reversal, as Render’s technical and market metrics appeal to heightened investor curiosity.

Might this be the turning level that leads Render in direction of a bullish breakout?

RNDR worth motion evaluation: Key ranges to look at

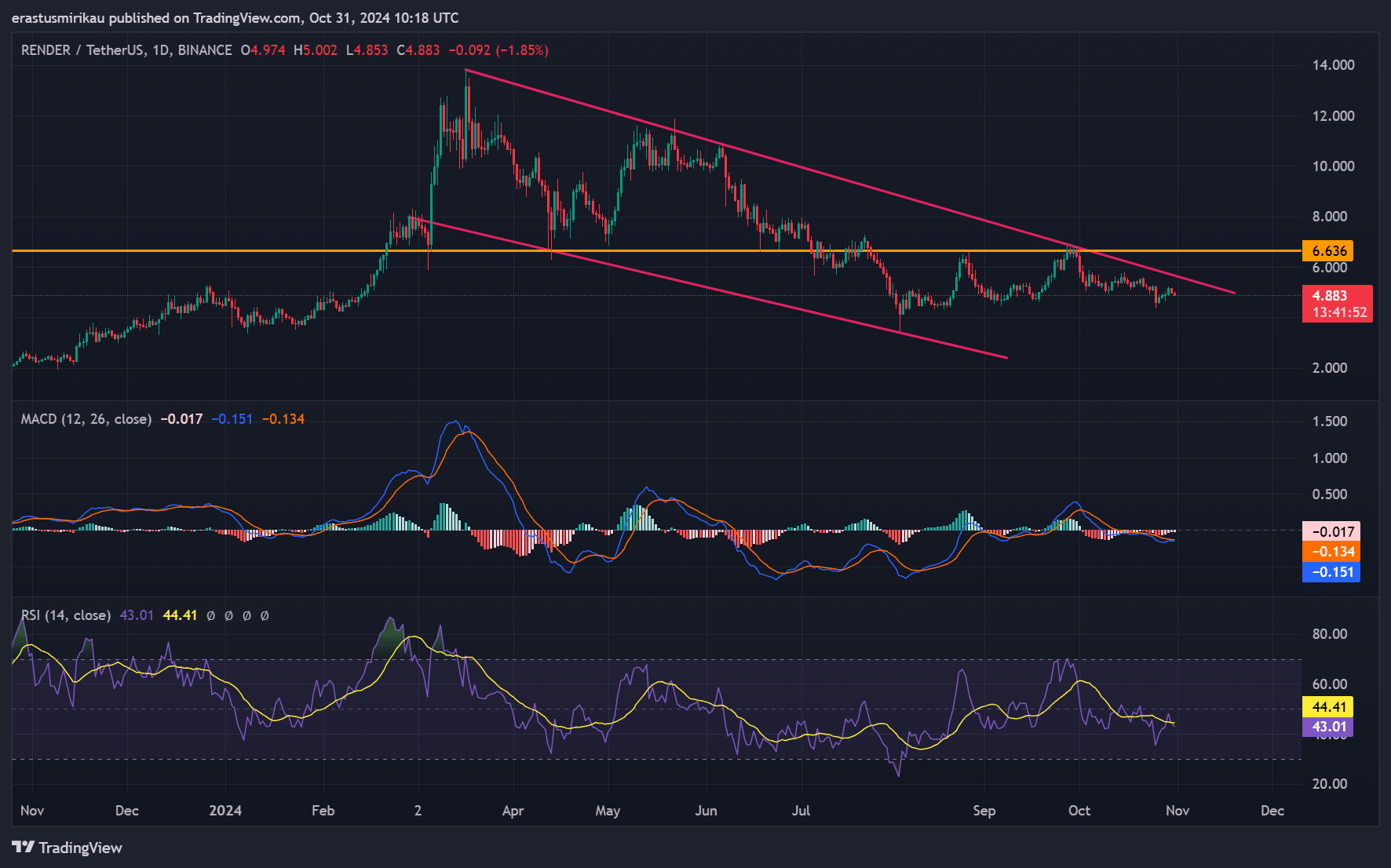

The value chart reveals a consolidation inside a descending channel. The vital resistance degree at $6.63 acts as a formidable barrier.

Subsequently, a decisive break above this degree may sign a bullish reversal. Analyzing the MACD, there’s a convergence sample forming, which hints at easing promoting strain.

Moreover, the RSI at the moment sits at 43.01, barely beneath impartial, suggesting that whereas bears keep management, there could also be room for consumers to step in.

If Render positive factors momentum, it may push towards the $6.63 resistance, setting the stage for a possible uptrend.

RNDR worth DAA divergence: Warning indicators or alternative?

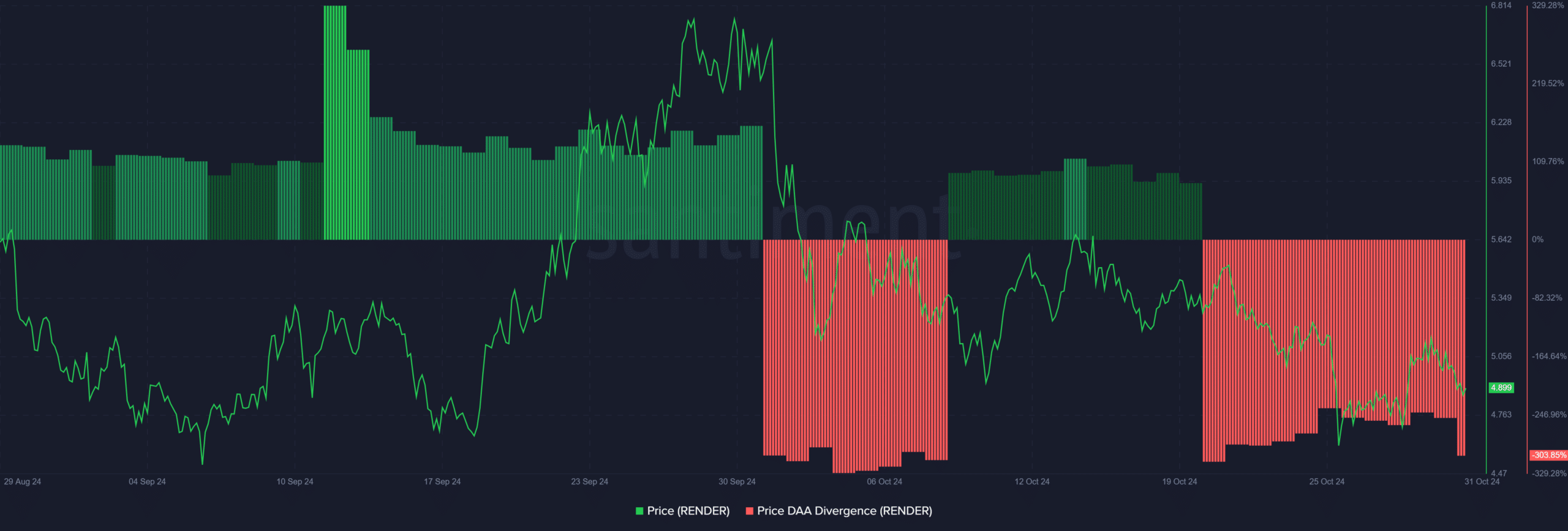

The DAA (Every day Lively Addresses) divergence chart for RNDR highlights durations of serious unfavorable divergence, with current ranges reaching as little as -303.85%.

This divergence signifies a mismatch between worth and lively addresses, implying that current worth makes an attempt lack a corresponding improve in community exercise.

Nevertheless, if Render experiences a surge in lively addresses, this divergence may reverse, lending essential assist to the worth. Subsequently, a shift in community exercise may play a pivotal function in reinforcing RNDR’s worth stability.

Onchain indicators: What do the metrics reveal?

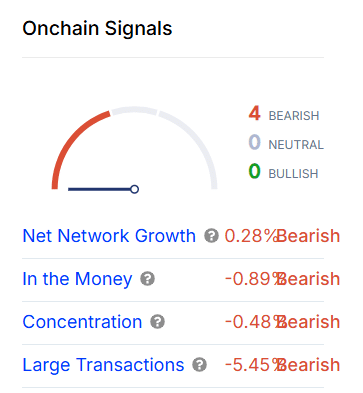

Render’s onchain indicators supply a cautious outlook. Internet Community Progress, “Within the Cash” standing, Focus, and Massive Transactions all current slight bearish readings.

As an illustration, Massive Transactions present a -5.45% drop, suggesting that whale exercise stays restricted.

Nevertheless, RNDR’s substantial each day quantity may present the liquidity obligatory to soak up any promoting strain. Consequently, a change in onchain indicators could shift sentiment and open doorways for upward momentum.

Liquidation: A have a look at lengthy and quick positions

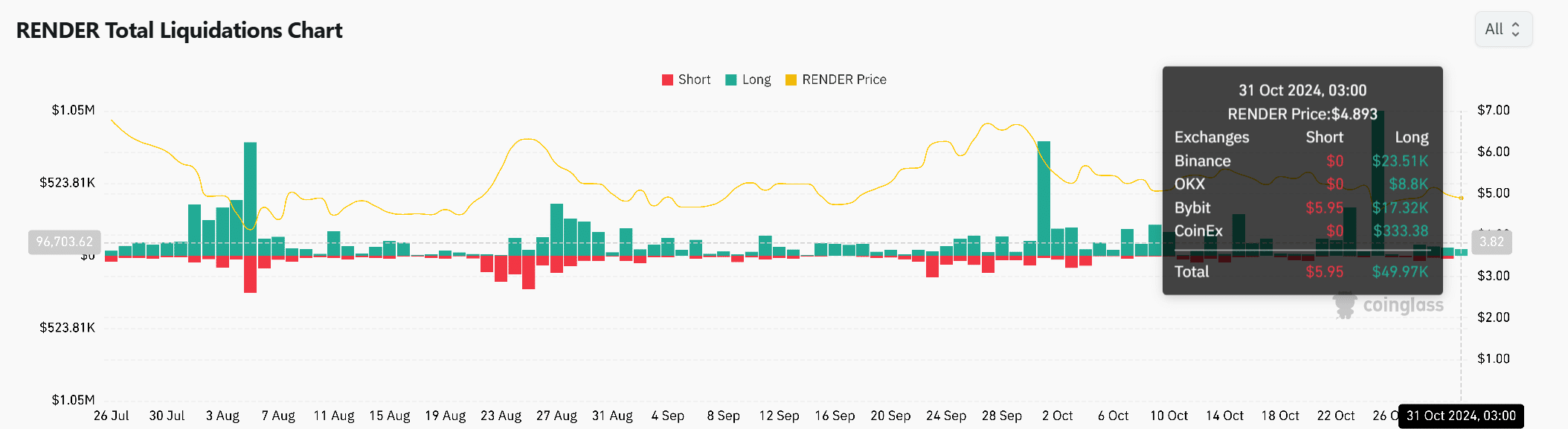

Render’s liquidation knowledge reveals optimism amongst merchants, with lengthy positions reaching $49.97K in comparison with simply $5.95 in shorts. This skew towards longs displays a rising sentiment {that a} reversal is likely to be imminent.

Moreover, with the buying and selling quantity remaining excessive, merchants could also be positioning for a breakout. Subsequently, this bullish long-short ratio indicators that market members anticipate upward strain, supplied Render can clear resistance ranges.

Learn Render’s [RNDR] Value Prediction 2024–2025

Conclusively, Render’s technical and onchain knowledge current a nuanced but promising outlook. With sturdy market positioning and substantial buying and selling quantity, RNDR may certainly be primed for a reversal, supplied it breaches key resistance ranges and community exercise strengthens.

Subsequently, the stage seems set for RNDR to probably get away of its downtrend and lead DePIN’s subsequent development wave.