- DOT breaks out of a falling wedge sample and exhibits a bullish hammer candlestick, indicating a attainable value rally.

- Open curiosity rises, whereas RSI stays impartial, supporting potential upward motion with out quick danger of pullback.

Polkadot [DOT] is at the moment experiencing a gentle value rebound, registering consecutive weeks of features.

Over the previous two weeks, DOT has risen by 14.2%, and inside the previous week alone, it has seen an 11% enhance. On the time of writing, the token trades at $4.90, reflecting a 2.3% rise during the last 24 hours.

This constant upward motion in value is supported by varied technical indicators suggesting that DOT could possibly be on the verge of a extra important rally.

The $11 rally potential

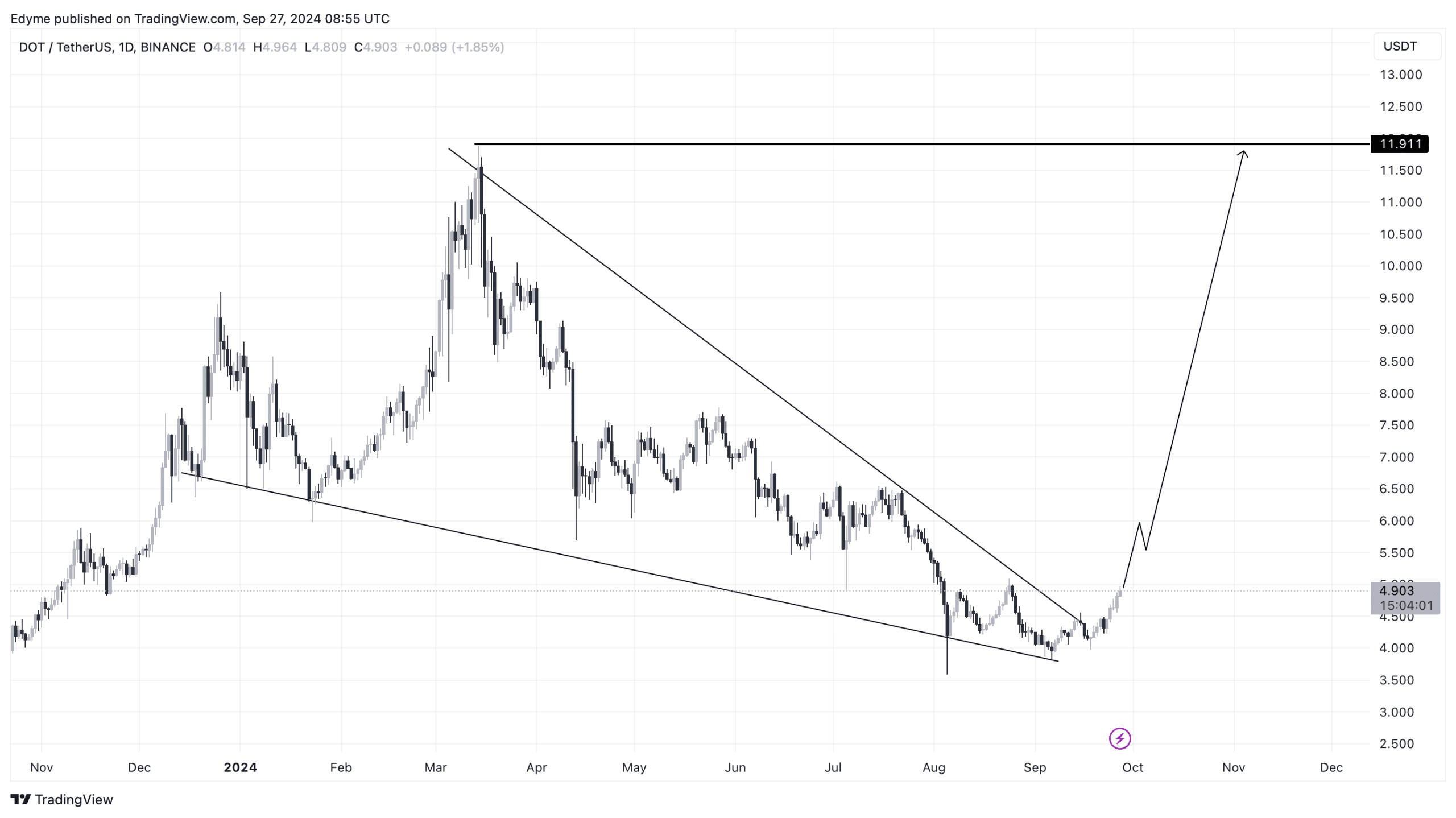

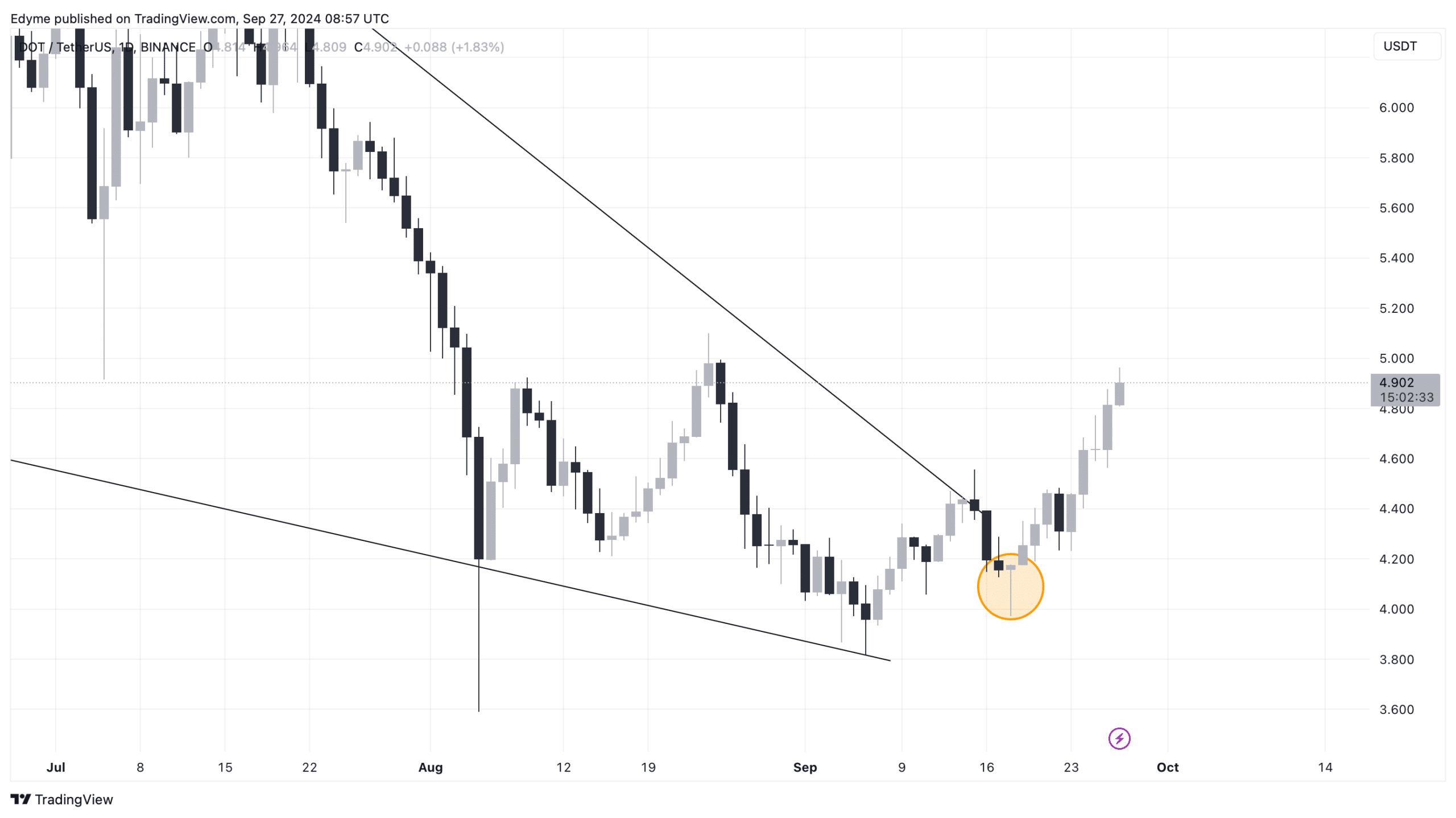

Technical evaluation revealed that the present value surge in DOT is linked to a breakout from a falling wedge sample, a bullish indicator generally seen in monetary markets.

A falling wedge sample kinds when value motion exhibits a narrowing downtrend, which is usually adopted by a breakout upward, indicating a possible reversal in development.

Now that DOT has damaged out of this wedge, additional upward momentum is anticipated.

Though the token stays beneath the $5 mark, the technical implications of the breakout level in the direction of the potential of DOT climbing to costs above $11 to validate this sample totally.

Including additional weight to DOT’s bullish outlook is the looks of a hammer candlestick sample on its day by day chart.

In technical evaluation, a hammer sample is a reversal indicator characterised by a small physique and a protracted decrease shadow, signifying that patrons pushed the value again up after a interval of downward strain.

That is usually interpreted as a optimistic signal for potential value will increase.

The formation of this sample on the heels of DOT’s breakout from the falling wedge supplies extra affirmation of bullish sentiment, reinforcing the probability of a big rally within the close to time period.

Elementary outlook on DOT

Whereas these technical indicators are encouraging, the query stays whether or not DOT’s underlying fundamentals assist this bullish momentum. To gauge this, it’s price analyzing a number of key metrics.

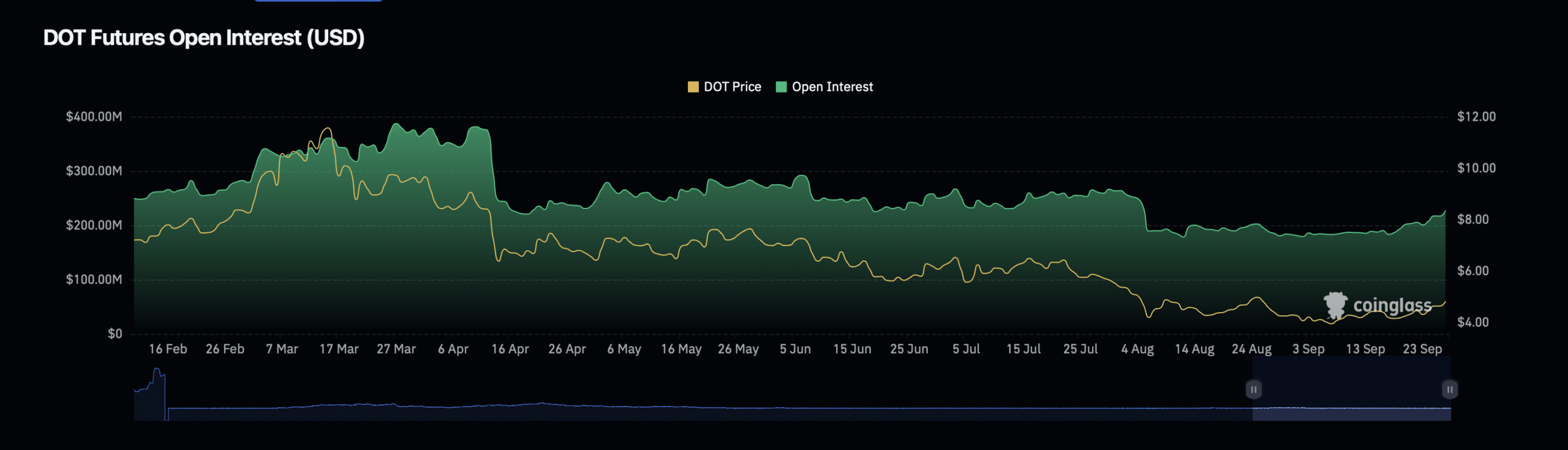

Information from Coinglass signifies that DOT’s Open Curiosity — a measure of the entire variety of excellent by-product contracts — has risen by 3.20% to achieve $233.03 million.

This uptick in Open Curiosity usually suggests elevated market exercise and curiosity from merchants.

Nonetheless, contrasting this, DOT’s Open Curiosity quantity has seen a decline of 15.16%, now standing at $190.48 million.

An increase in Open Curiosity mixed with a drop in quantity might suggest that whereas extra by-product positions are being established, the depth of buying and selling is cooling down, probably reflecting cautious investor sentiment.

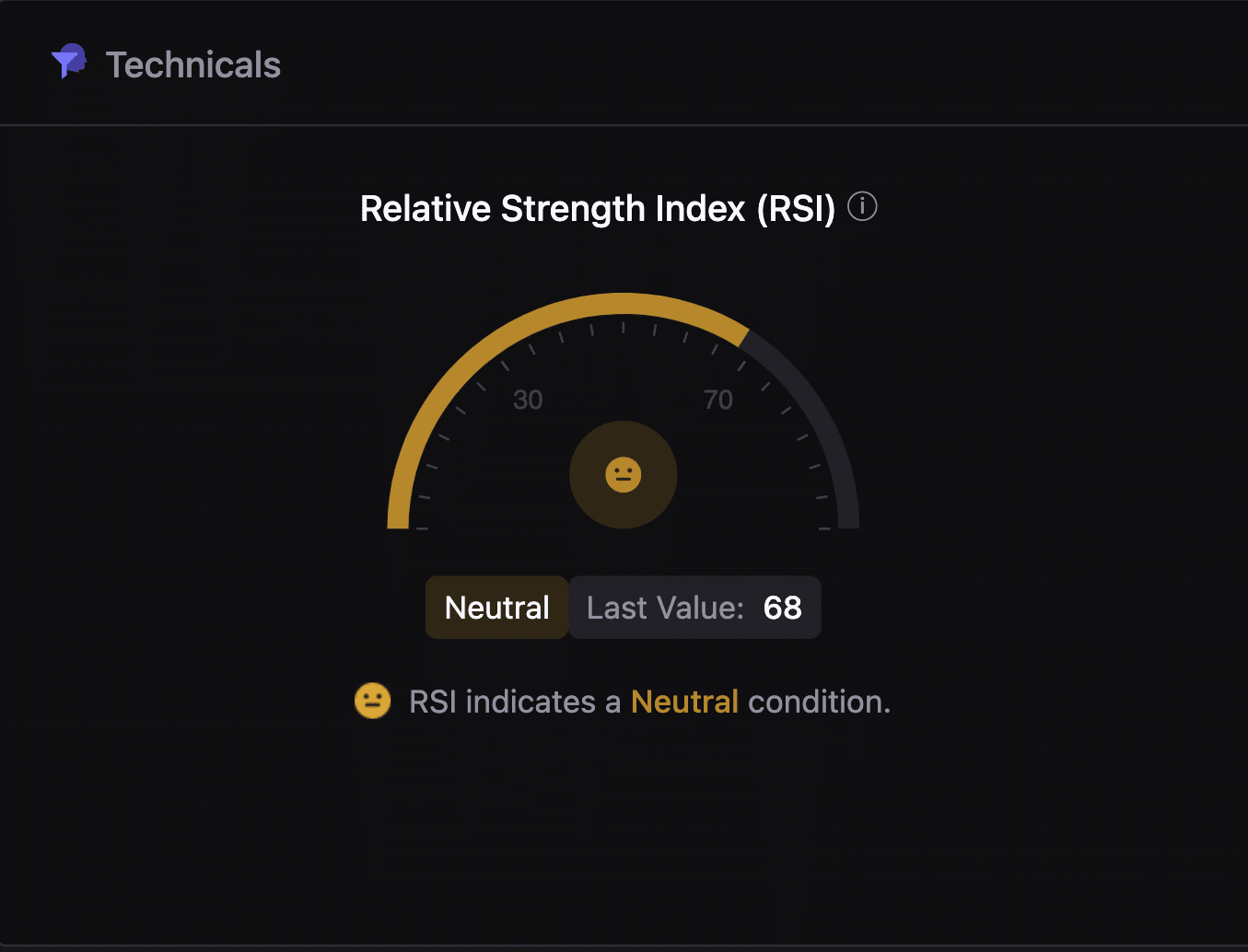

One other vital issue to think about is the Relative Energy Index (RSI), a momentum oscillator that measures the velocity and alter of value actions.

Information from CryptoQuant revealed that DOT’s RSI was a determine of 68 at press time. This worth, being beneath the overbought threshold of 70, advised that the asset is at the moment in impartial territory.

Learn Polkadot’s [DOT] Worth Prediction 2024–2025

Sometimes, an RSI beneath 70 indicated that the value has room for additional upward motion with out getting into an overbought situation that might set off a pullback.

Therefore, the impartial RSI supported the potential for added value features, aligning with the technical patterns noticed on DOT’s chart.