Investor Perception

Brazil’s increasing pure fuel market, supported by a pretty and steady regulatory framework and monetary regime presents a novel alternative for Alvopetro Vitality to leverage its high-potential property and development alternatives as an modern pure fuel firm within the state of Bahia.

Overview

Alvopetro Vitality (TSXV:ALV;OTCQX:ALVOF) is a pioneering impartial pure fuel producer in Brazil. The corporate was the primary to ship sales-specified pure fuel onshore to the native distribution community beforehand dominated by the state oil firm. This milestone, achieved on July 5, 2020, marked the start of a brand new period in Brazil’s fuel market.

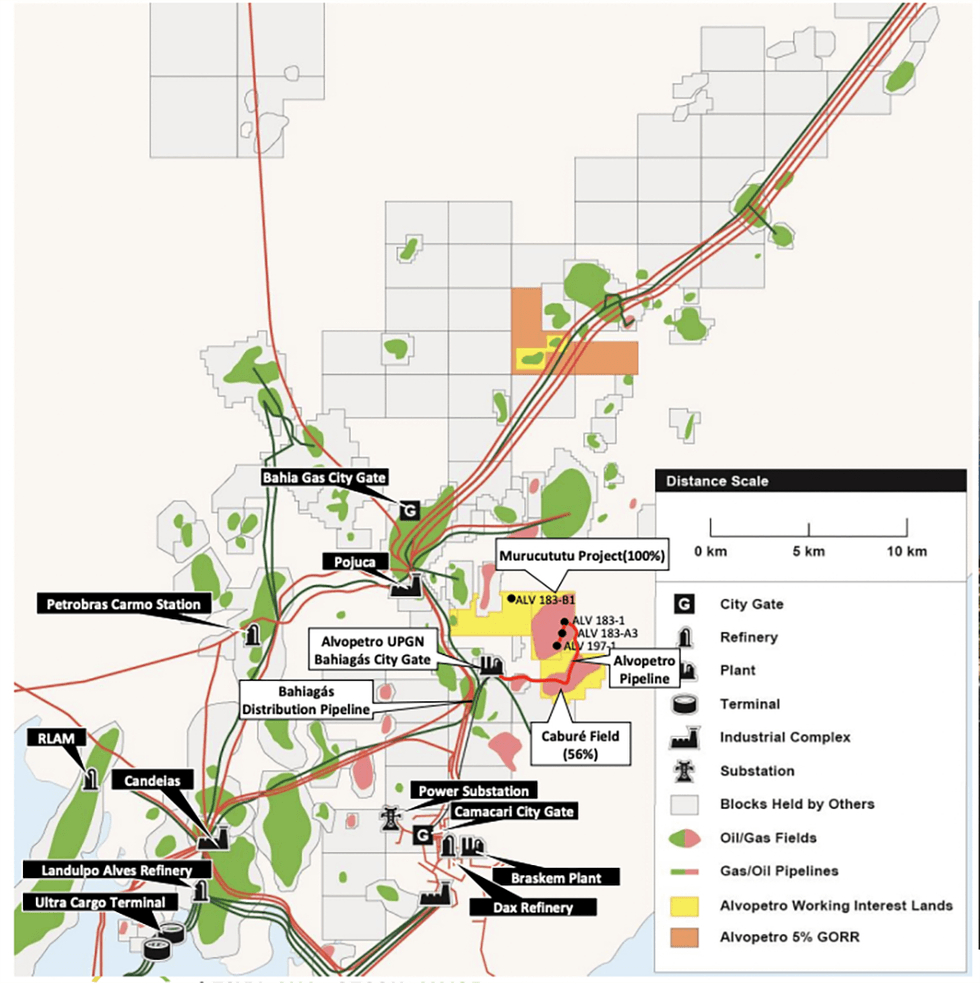

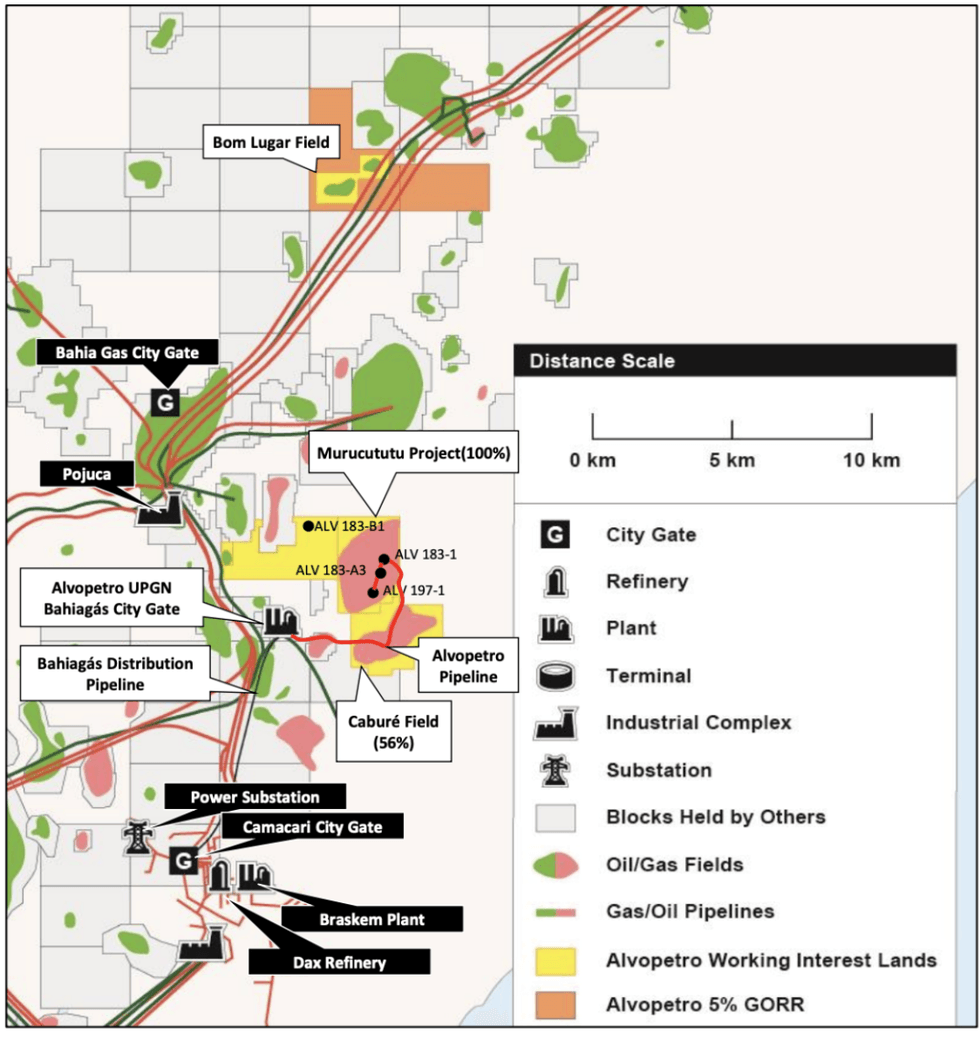

As an impartial upstream and midstream operator, Alvopetro engages within the acquisition, exploration, growth and manufacturing of pure fuel and oil. The corporate holds pursuits within the Caburé and Murucututu pure fuel property, Block 182 and 183 exploration property, and Bom Lugar and Mãe-da-lua oil fields, which cowl an space of over 22,000 acres within the Recôncavo basin onshore Brazil. Alvopetro Vitality was integrated in 2013 and is headquartered in Calgary, Canada.

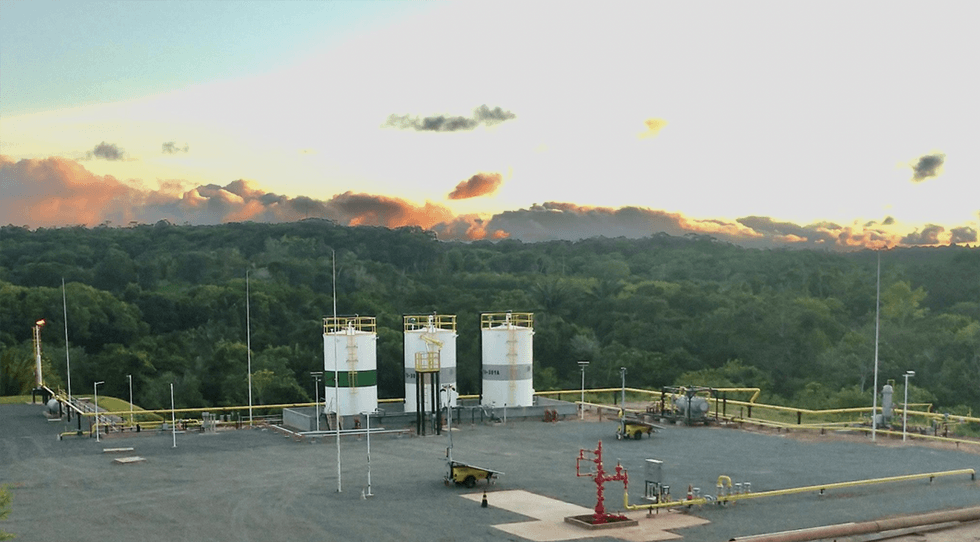

State of Bahia – Reconcavo Basin

Alvopetro adheres to a balanced capital allocation mannequin, reinvesting half of its funds circulate from operations in natural development alternatives whereas returning the remaining 50 % again to stakeholders (via dividends, debt and curiosity funds and capital lease funds). Since manufacturing got here on-line in July of 2020, funds circulate from operations has reached ~$156 million with 43 % being reinvested into capital expenditure initiatives, 48 % being returned to stakeholders, and 9 % going again to strengthening the corporate’s stability sheet.

Alvopetro continues to concentrate on minimizing its environmental impression, responsibly supplying power, and having a constructive affect on the communities the place it operates. Alvopetro at present invests in numerous voluntary social packages which have been nicely obtained by the group. The corporate’s focus has been on the sustainable growth of its rural communities, entrepreneurship, schooling, cultural and sporting actions, in addition to biodiversity preservation.

Firm Highlights

- Alvopetro is a number one impartial upstream and midstream fuel operator within the state of Bahia, Brazil.

- The corporate’s technique is targeted on unlocking Brazil’s on-shore pure fuel potential, constructing off the event of its Caburé and Murucututu pure fuel fields strategic midstream infrastructure.

- Over 95 % of Alvopetro’s manufacturing is from pure fuel and the corporate has a 2P reserve base of 9.6 MMboe.

- The corporate boasts excessive working netbacks and profitability per unit of manufacturing, setting it aside from its Latin American and North American friends. The state of Bahia boasts a positive fiscal regime with low royalties and a 15 % revenue tax charge.

Key Tasks

Caburé

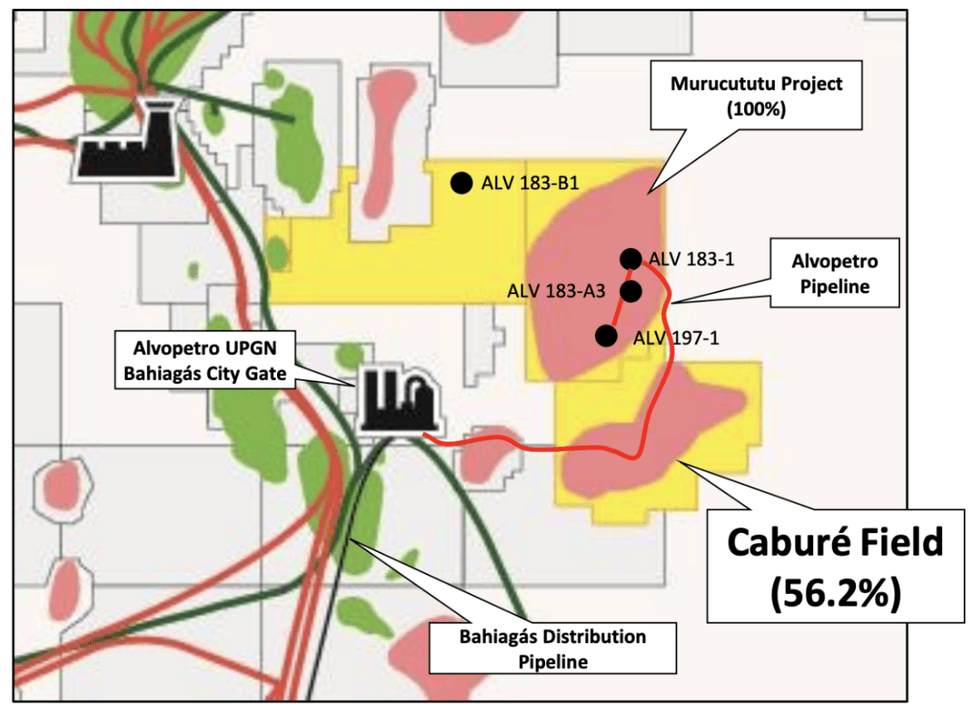

The corporate’s flagship Caburé asset (56.2 % Alvopetro) delivers nearly all of Alvopetro’s present manufacturing. The challenge is a joint growth (the unit) of a standard pure fuel discovery throughout 4 blocks, two of that are held by Alvopetro and two of that are held by its associate, with Alvopetro’s working curiosity being 56.2 % following the primary redetermination. The unit at present contains eight current wells, with all manufacturing services already in place. The useful resource is nicely outlined with 3D seismic surveys, notably on the jap aspect of a fundamental bounding fault that runs roughly north-south via the Caruaçu formation. The corporate plans to drill an extra 5 wells in 2025 to additional enhance the productive capability of the sphere.

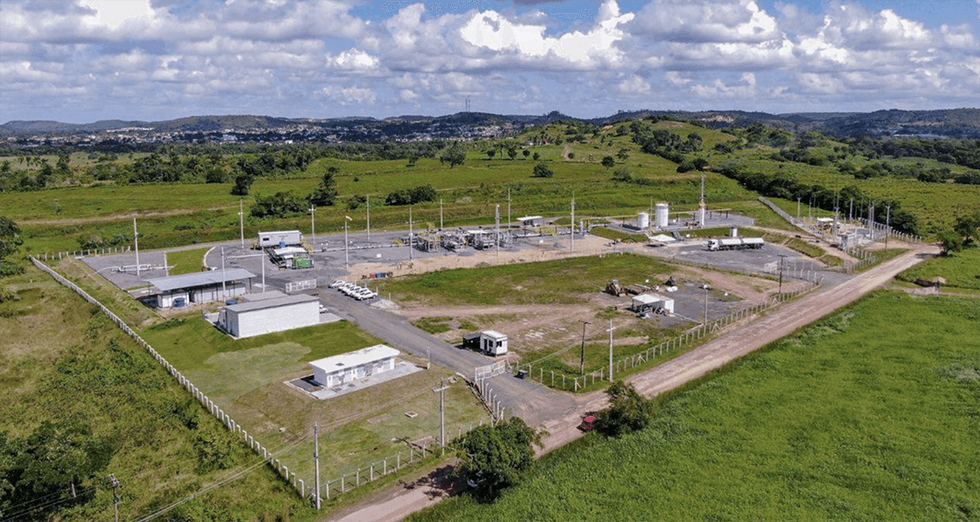

Midstream – Infrastructure and advertising and marketing (100% Alvopetro)

All of Alvopetro’s pure fuel produced from Caburé and Murucututu are shipped through 100% owned and operated pure fuel pipelines to Alvopetro’s pure fuel processing facility (UPGN). On the UPGN, the pure fuel goes via a mechanical refrigeration course of, with condensate and water eliminated in the course of the course of, and condensate then will get trucked out and bought at a premium to Brent. The pure fuel will get delivered to a receiving station (metropolis gate) that was constructed by the corporate’s offtaker, Bahiagás, the distribution firm for the State of Bahia.

The fuel then will get shipped through a newly constructed 15 km distribution pipeline to the Camacari industrial complicated (~17.5 km away), the place the overwhelming majority of the pure fuel within the state of Bahia will get consumed.

Pure fuel is bought to Bahiagas underneath a long-term fuel gross sales settlement, with pricing set quarterly primarily based on Brent and Henry Hub benchmark costs. Alvopetro just lately introduced an up to date fuel gross sales settlement efficient January 1, 2025, rising agency gross sales volumes by 33 %.

Natural Progress Alternatives

Maximizing the Gasoline Plant

Within the near-to-mid time period, Alvopetro has a aim to maximise its fuel plant capability to 18 million cubic ft per day (or 3,000 barrels of oil equal per day), with a plan to double its capability within the coming years via each ongoing growth on the Caburé Unit and a multi-year growth of the Murucututu subject.

Unit Improvement

Alvopetro’s working curiosity within the Caburé Unit was just lately elevated from 49.1 % to 56.2 % and in consequence, Alvopetro is now entitled to increased manufacturing entitlements from the Unit. As well as, with the unit growth drilling actions deliberate to begin in 2025, the general productive capability of the Unit is focused to extend.

Murucututu Gasoline

Alvopetro’s Murucututu asset (100% owned) sits instantly north of Caburé. Impartial reserve estimators, GLJ, spotlight the potential for this subject with 2P reserve totaling 4.6 million barrels of oil equal, risked greatest estimate contingent useful resource of 5.4 million barrels of oil equal and risked greatest estimate potential useful resource of 9.6 million barrels of oil equal representing a big addition to the corporate’s present 2P reserve base.

Alvopetro Vitality completed the recompletion of its 183-A3 nicely within the third quarter of 2024. The nicely got here on manufacturing in September prompting the corporate’s pure fuel gross sales from the Murucututu subject in This autumn 2024 to extend by 262 % in comparison with Q3 2024. The corporate has a follow-up nicely deliberate for the sphere in early 2025.

Administration Crew

Corey C. Ruttan – President, Chief Govt Officer and Director

Corey C. Ruttan is the president, chief government officer and director of Alvopetro. He was the president and CEO of Petrominerales, from Could 2010 till it was acquired by Pacific Rubiales Vitality in November 2013. Previous to that, he was the vice-president of finance and chief monetary officer of Petrominerales. From March 2000 to Could 2010, Ruttan was the senior vice-president and chief monetary officer of Petrobank Vitality and Sources, and held more and more senior positions with Petrobank since its inception in 2000. He additionally served as government vice-president and chief monetary officer of Lightstream Sources from October 2009 to Could 2010; served as vice-president of Caribou Capital from June 1999 to March 2000; and supervisor monetary reporting of Pacalta Sources from Could 1997 to June 1999. He started his profession at KPMG the place he labored from September 1994 to Could 1997. Ruttan obtained his Bachelor of Commerce diploma majoring in accounting from the College of Calgary in 1994 and his chartered accountant designation in 1997.

Alison Howard – Chief Monetary Officer

Alison Howard is a chartered accountant with over 20 years of expertise in Canadian and worldwide taxation, accounting and finance. Howard joined Petrominerales in July 2011 as a tax supervisor and was subsequently promoted to tax director. From Could 2008 to July 2011, Howard was the tax supervisor at Petrobank Vitality and Sources. Previous to that, Howard spent various years at Deloitte LLP in Calgary. She obtained her Bachelor of Commerce diploma from the College of Saskatchewan in 1999.

Adrian Audet – VP, Asset Administration

Adrian Audet joined Petrominerales in 2013 and has held more and more senior roles with Alvopetro since its inception. Audet has spent intensive time in Bahia overseeing the operations, realizing intensive price financial savings and enhancements in effectivity. Beforehand, Audet held engineering roles with rising accountability within the oil and fuel trade. Audet started his profession in 2006 and accomplished his masters and undergraduate levels in mechanical engineering on the College of Alberta. Audet is knowledgeable engineer registered with APEGA and is a CFA charterholder.

Nanna Eliuk – Exploration Supervisor

Nanna Eliuk is knowledgeable geophysicist (M.Sc.) with over 23 years of diversified petroleum exploration and growth expertise. She has experience in typical and unconventional performs in each carbonate and clastic reservoirs in several depositional and structural settings (together with pre-salt) in numerous basins all over the world. Previous to becoming a member of Alvopetro, Eliuk was the senior explorationist of Condor Petroleum (Kazakhstan) for 2 years, and prior thereto, she was the vice-president of geophysics and land for Waldron Vitality. Eliuk began her profession in 1997, holding progressively senior roles at Husky Vitality for 5 years, and at Compton Petroleum for over six years. Her intensive expertise contains geophysical analysis and evaluation for enterprise growth alternatives and new ventures in numerous worldwide basins, together with regional mapping, play fairway evaluation, petroleum system analysis, prospect definition, and seismic attribute evaluation. Eliuk holds a masters diploma in geology and geophysics, and a BSc. in geology.

Frederico Oliveira – Nation Supervisor

Frederico Oliveira has held more and more senior roles since 2008 and has experience in laws, contracts, partnerships, administration and value effectivity. He has held administration roles in massive personal firms in Brazil, performing strategic planning, challenge implementation, course of restructuring, effectivity and productiveness enhancements, and value management. Oliveira obtained an MBA from the Federal College of Minas Gerais in 2004 and a Bachelor of Science diploma in Mechanical Engineering from the Pontificia Universidade Catolica de Minas Gerais.