We just lately talked about how off-exchange buying and selling hit new report ranges in 2024, topping 50%.

In reality, in November 2024, the U.S. equities market noticed the primary month ever the place extra quantity executed off-exchange than on. Off-exchange quantity share additionally stayed above 50% in December 2024 and January 2025.

Some suppose the rise in off-exchange quantity is due to the rise in “sub-dollar” inventory buying and selling, which are usually microcap shares traded principally by retail traders, suggesting that this isn’t an issue mutual funds want to fret about.

Nonetheless, right now’s information exhibits that’s not true.

Off-exchange buying and selling is excessive throughout the board

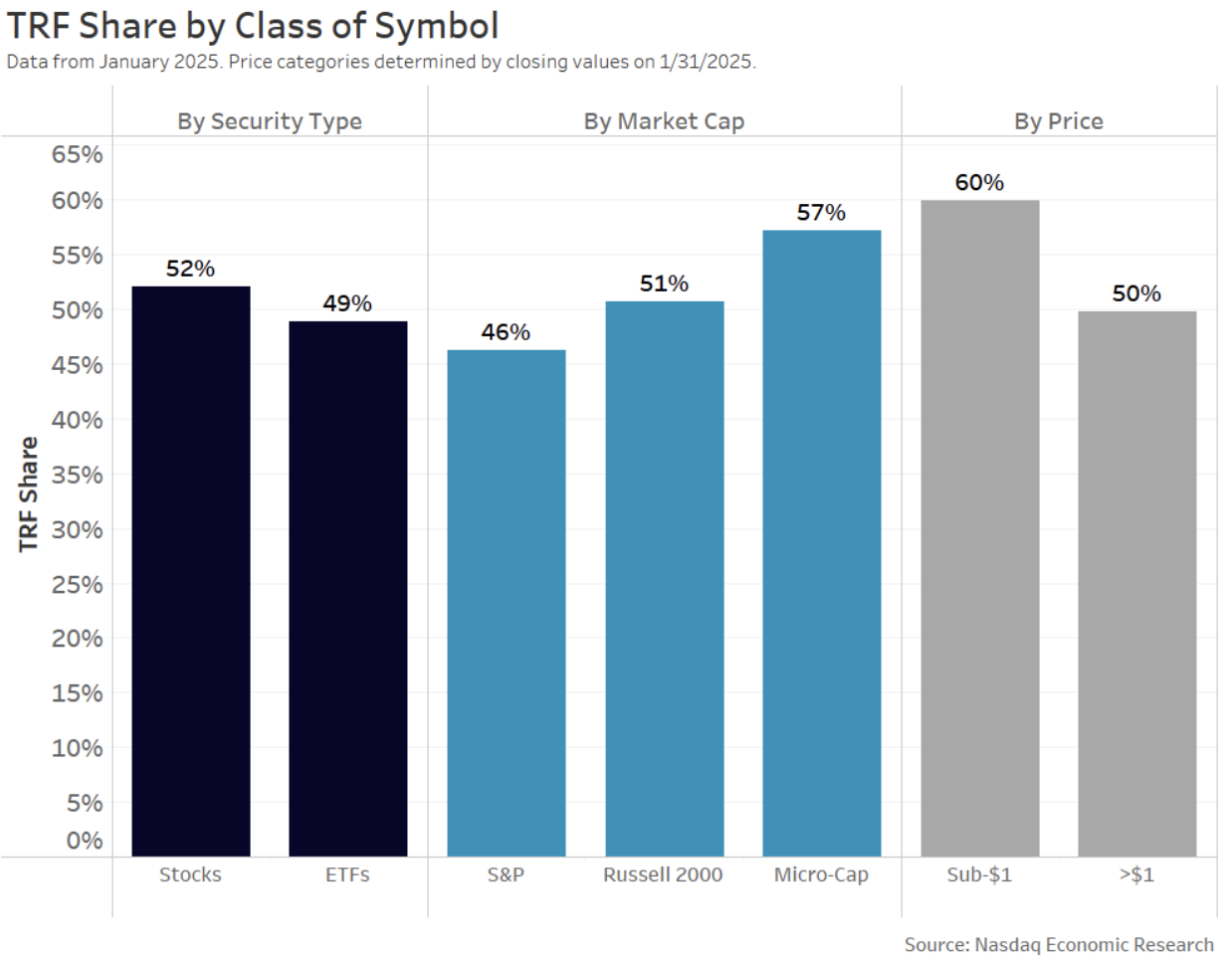

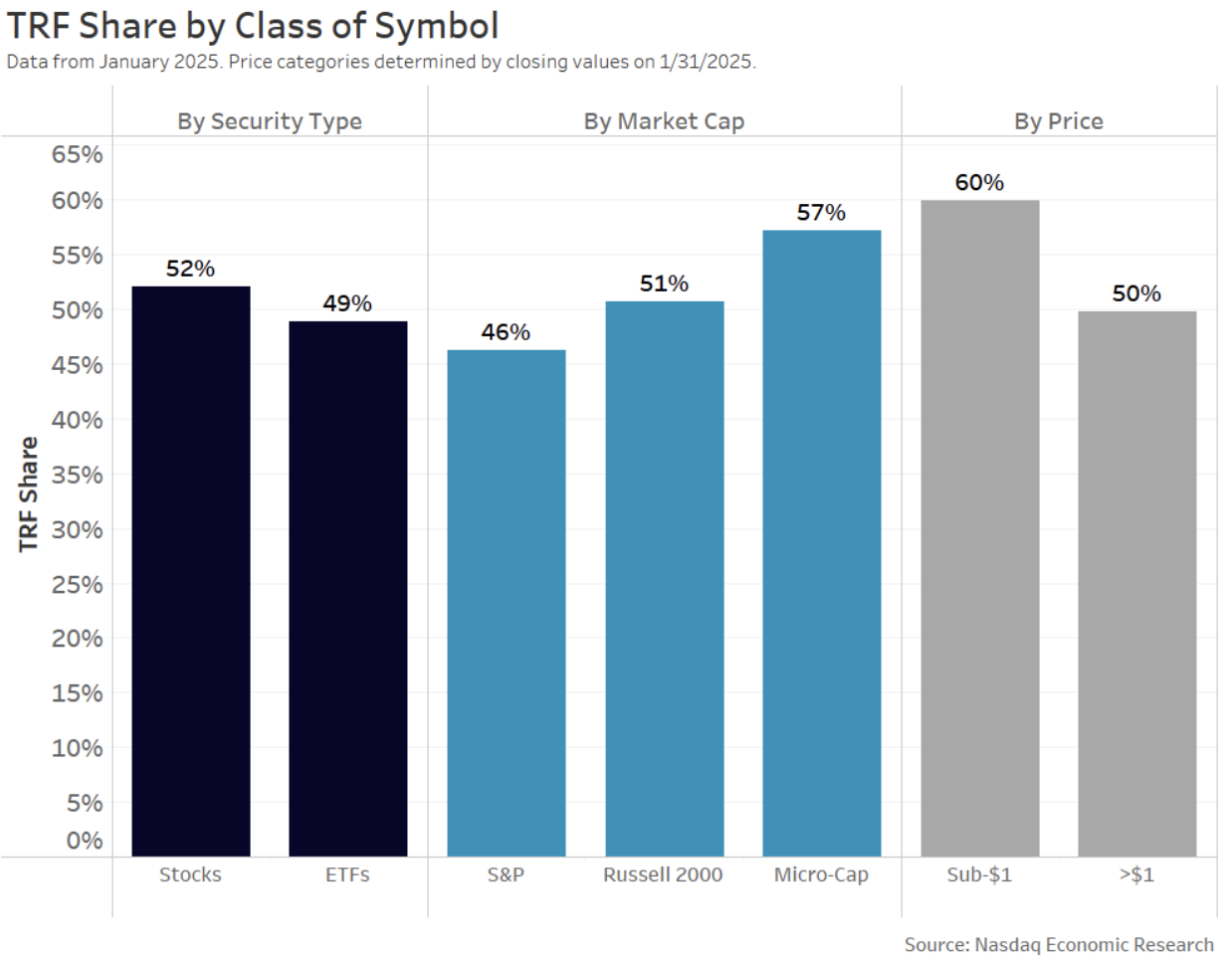

In reality, the rise of off-exchange buying and selling is widespread, affecting a number of shares that mutual funds are additionally attempting to purchase in giant portions. Off-exchange buying and selling is over 45% for all market caps, together with for shares of all costs and exchange-traded funds.

Regardless of the way you slice it, off-exchange share is up considerably since 2019.

Chart 1: Off-exchange share has risen throughout all teams of inventory since 2019

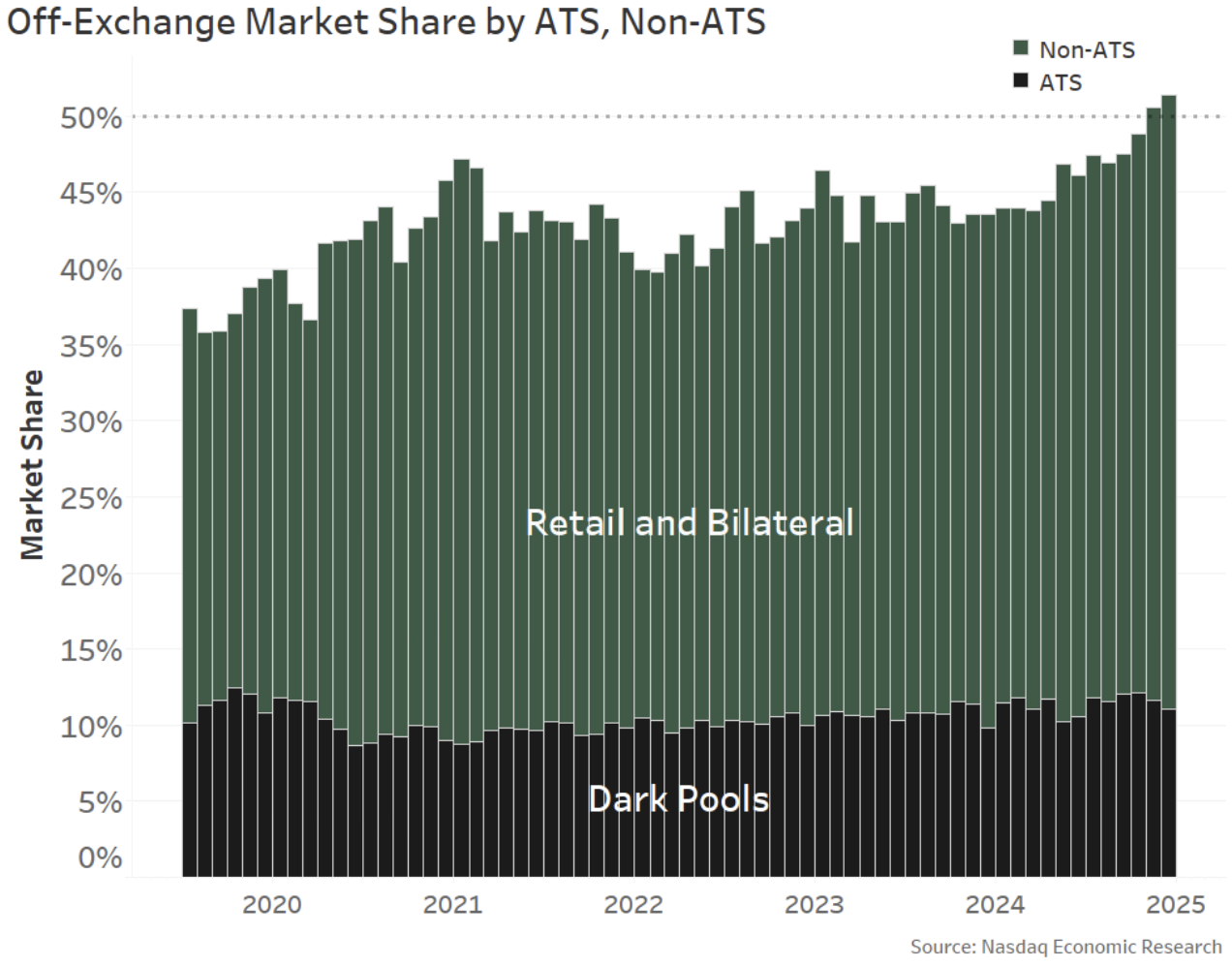

The rise is essentially pushed by bilateral buying and selling – not darkish swimming pools

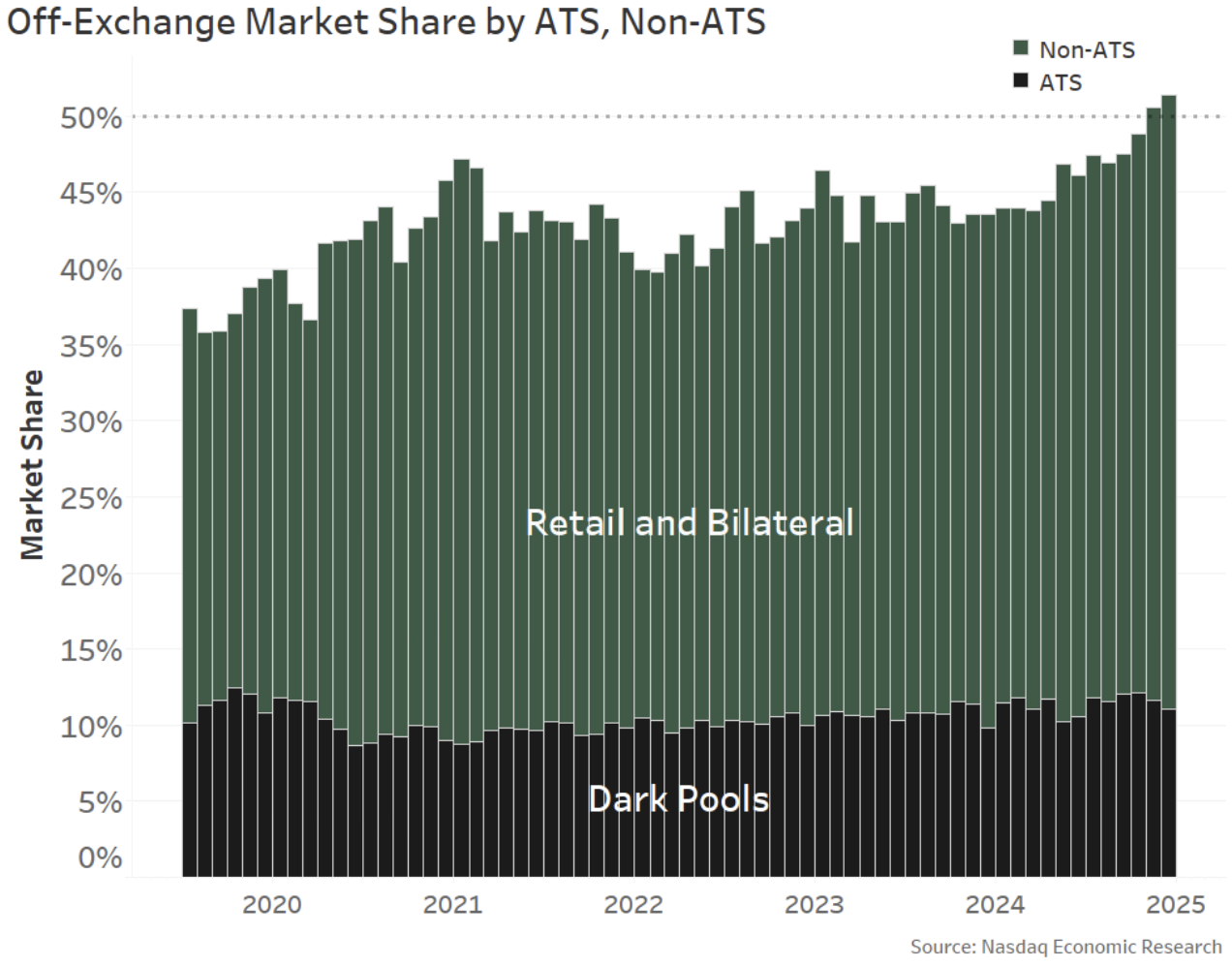

Curiously, if we glance individually at darkish swimming pools (ATSs) and different off-exchange (principally bilateral) buying and selling, we see that the darkish swimming pools market share has remained rangebound since a minimum of 2019.

Meaning the expansion is coming from corporations filling unfold crossing orders (typically with worth enchancment) and negotiated trades.

To be honest, a lot of this buying and selling is retail, which has grown considerably since Covid and free commissions. However retail doesn’t account for all the non-ATS trades printed off-exchange.

Chart 2: Bilateral (non-ATS) has seen virtually all of the off-exchange share improve since (a minimum of) mid-2019

Asset managers have much less move to work together with

Importantly, for mutual fund managers, these bilateral trades signify liquidity that they sometimes can’t work together with.

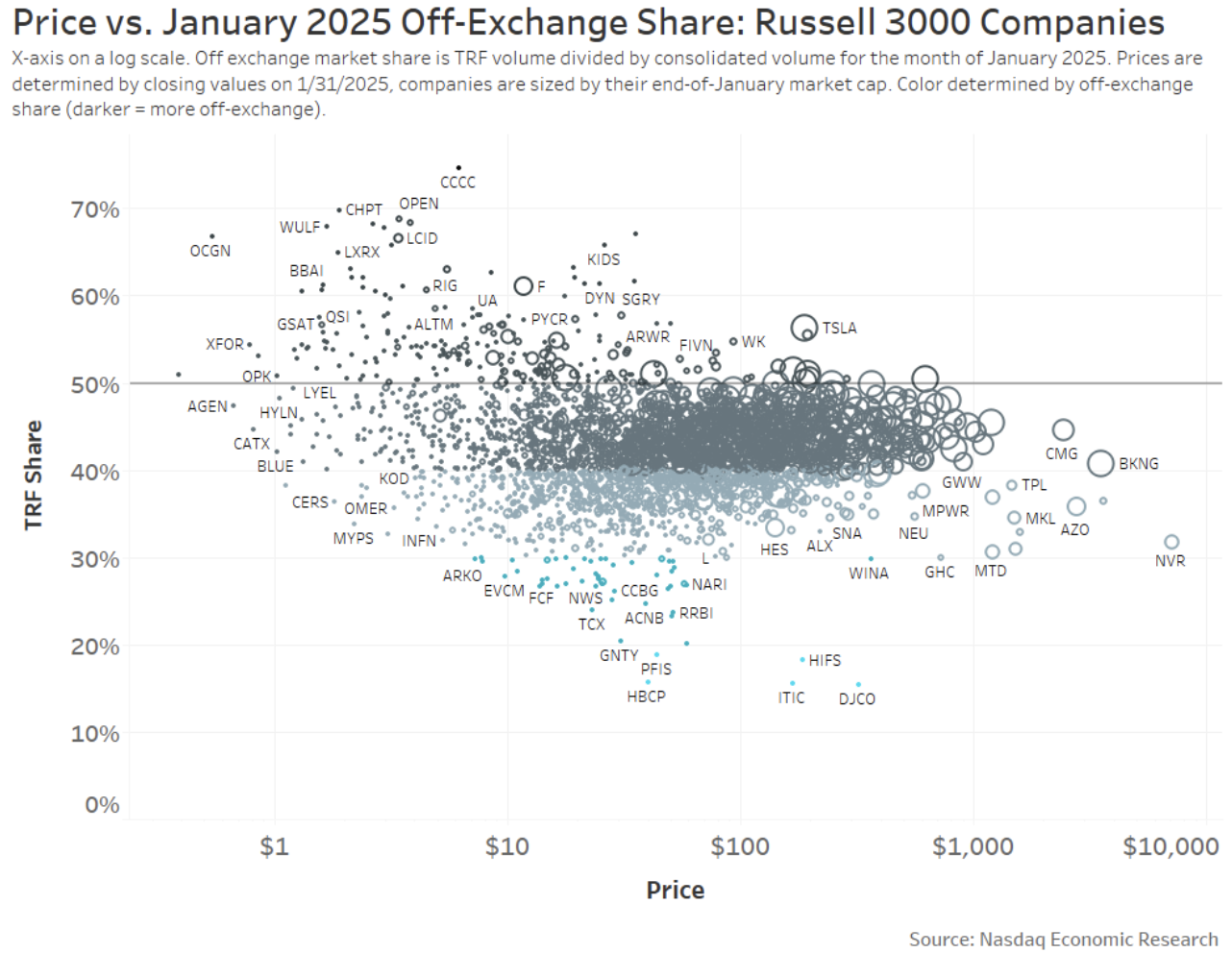

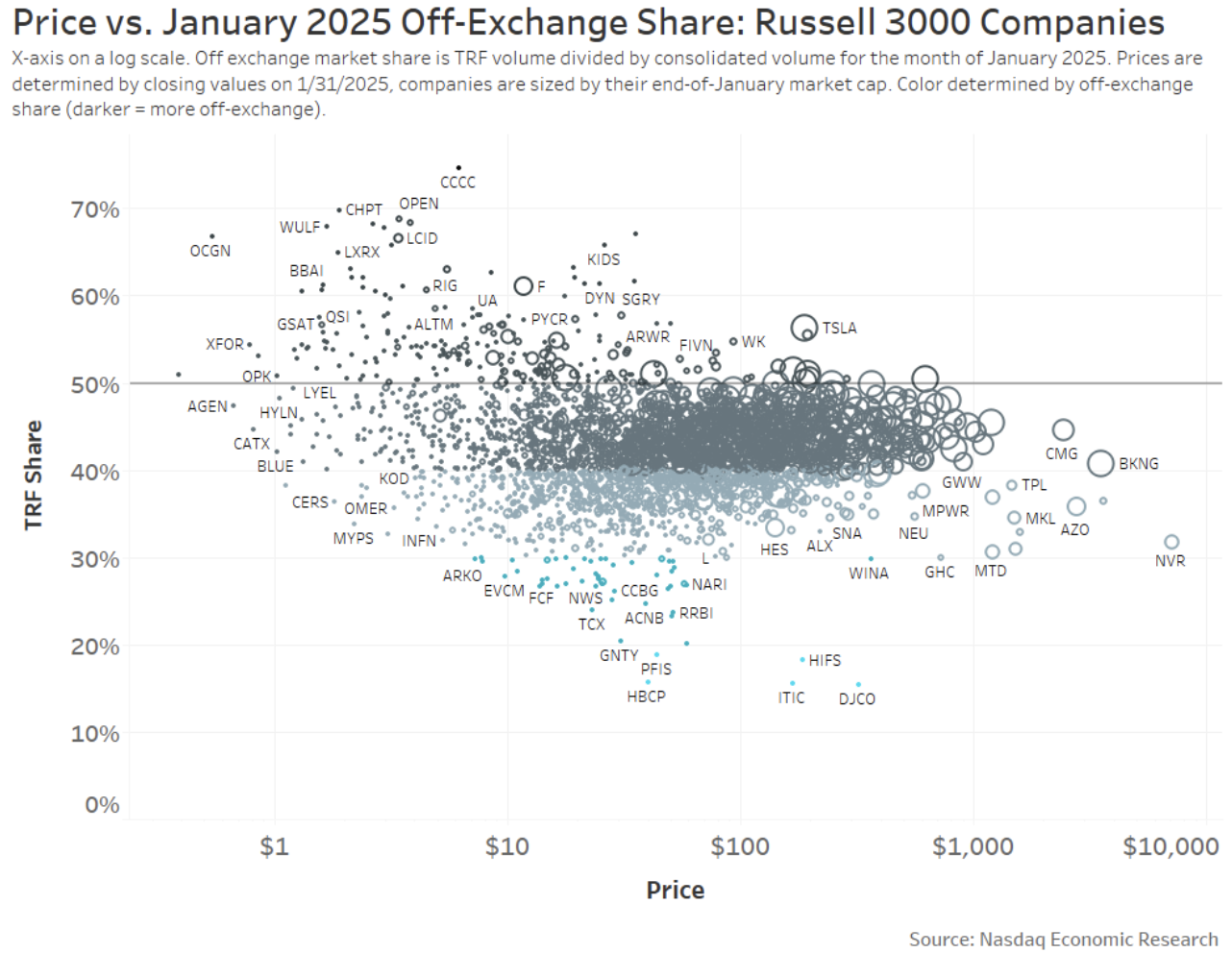

You would possibly suppose it’s just some “retail darlings” pulling the averages up. However in actual fact, all shares within the Russell 3000 Index, we see that only a few now have off-exchange share under 30% (or, mentioned one other means, on alternate above 70%).

The vast majority of shares see off-exchange buying and selling between 40%-50%, and that’s true whatever the inventory worth (horizontal axis) or market cap (circle measurement).

Chart 3: Accessible move for asset managers

On the very least, that may imply buy-side orders utilizing a “VWAP” or participation algorithm will really be buying and selling extra aggressively available in the market than they appear, which might improve the prices of buying and selling.

It might additionally add to go looking and signaling prices, as routers navigate the fragmented hidden liquidity, and alternative prices as fills are missed.

It may be time to scale back laws that create pointless fragmentation

Lit costs, honest entry and aggressive NBBO are options that make inventory markets completely different to different markets. U.S. households rely upon a vibrant public fairness marketplace for their monetary safety.

It’s attainable regulators have taken without any consideration the costs that lit markets present. Due to economics that favor darkish over lit markets, lit market share has been falling globally.

For institutional merchants attempting to navigate fragmented markets with giant trades, fragmentation makes discovering liquidity tougher. Segmented markets imply there’s much less liquidity than a dealer would possibly suppose. Each can improve commerce prices and cut back lively mutual fund returns.

Analysis additionally means that corporations with wider spreads may also have larger prices of capital, which can cut back their funding again into the U.S. and world economic system.

Educational research point out that there’s a tipping level above which market high quality and spreads worsen, doubtlessly between 10% to 46.7% darkish. The U.S. market has now breached all these ranges.

We just lately talked about how off-exchange buying and selling hit new report ranges in 2024, topping 50%.

In reality, in November 2024, the U.S. equities market noticed the primary month ever the place extra quantity executed off-exchange than on. Off-exchange quantity share additionally stayed above 50% in December 2024 and January 2025.

Some suppose the rise in off-exchange quantity is due to the rise in “sub-dollar” inventory buying and selling, which are usually microcap shares traded principally by retail traders, suggesting that this isn’t an issue mutual funds want to fret about.

Nonetheless, right now’s information exhibits that’s not true.

Off-exchange buying and selling is excessive throughout the board

In reality, the rise of off-exchange buying and selling is widespread, affecting a number of shares that mutual funds are additionally attempting to purchase in giant portions. Off-exchange buying and selling is over 45% for all market caps, together with for shares of all costs and exchange-traded funds.

Regardless of the way you slice it, off-exchange share is up considerably since 2019.

Chart 1: Off-exchange share has risen throughout all teams of inventory since 2019

The rise is essentially pushed by bilateral buying and selling – not darkish swimming pools

Curiously, if we glance individually at darkish swimming pools (ATSs) and different off-exchange (principally bilateral) buying and selling, we see that the darkish swimming pools market share has remained rangebound since a minimum of 2019.

Meaning the expansion is coming from corporations filling unfold crossing orders (typically with worth enchancment) and negotiated trades.

To be honest, a lot of this buying and selling is retail, which has grown considerably since Covid and free commissions. However retail doesn’t account for all the non-ATS trades printed off-exchange.

Chart 2: Bilateral (non-ATS) has seen virtually all of the off-exchange share improve since (a minimum of) mid-2019

Asset managers have much less move to work together with

Importantly, for mutual fund managers, these bilateral trades signify liquidity that they sometimes can’t work together with.

You would possibly suppose it’s just some “retail darlings” pulling the averages up. However in actual fact, all shares within the Russell 3000 Index, we see that only a few now have off-exchange share under 30% (or, mentioned one other means, on alternate above 70%).

The vast majority of shares see off-exchange buying and selling between 40%-50%, and that’s true whatever the inventory worth (horizontal axis) or market cap (circle measurement).

Chart 3: Accessible move for asset managers

On the very least, that may imply buy-side orders utilizing a “VWAP” or participation algorithm will really be buying and selling extra aggressively available in the market than they appear, which might improve the prices of buying and selling.

It might additionally add to go looking and signaling prices, as routers navigate the fragmented hidden liquidity, and alternative prices as fills are missed.

It may be time to scale back laws that create pointless fragmentation

Lit costs, honest entry and aggressive NBBO are options that make inventory markets completely different to different markets. U.S. households rely upon a vibrant public fairness marketplace for their monetary safety.

It’s attainable regulators have taken without any consideration the costs that lit markets present. Due to economics that favor darkish over lit markets, lit market share has been falling globally.

For institutional merchants attempting to navigate fragmented markets with giant trades, fragmentation makes discovering liquidity tougher. Segmented markets imply there’s much less liquidity than a dealer would possibly suppose. Each can improve commerce prices and cut back lively mutual fund returns.

Analysis additionally means that corporations with wider spreads may also have larger prices of capital, which can cut back their funding again into the U.S. and world economic system.

Educational research point out that there’s a tipping level above which market high quality and spreads worsen, doubtlessly between 10% to 46.7% darkish. The U.S. market has now breached all these ranges.