- Mog Coin approached the vary highs with bullish intent

- On-chain metrics did replicate agency accumulation that’s needed for a breakout

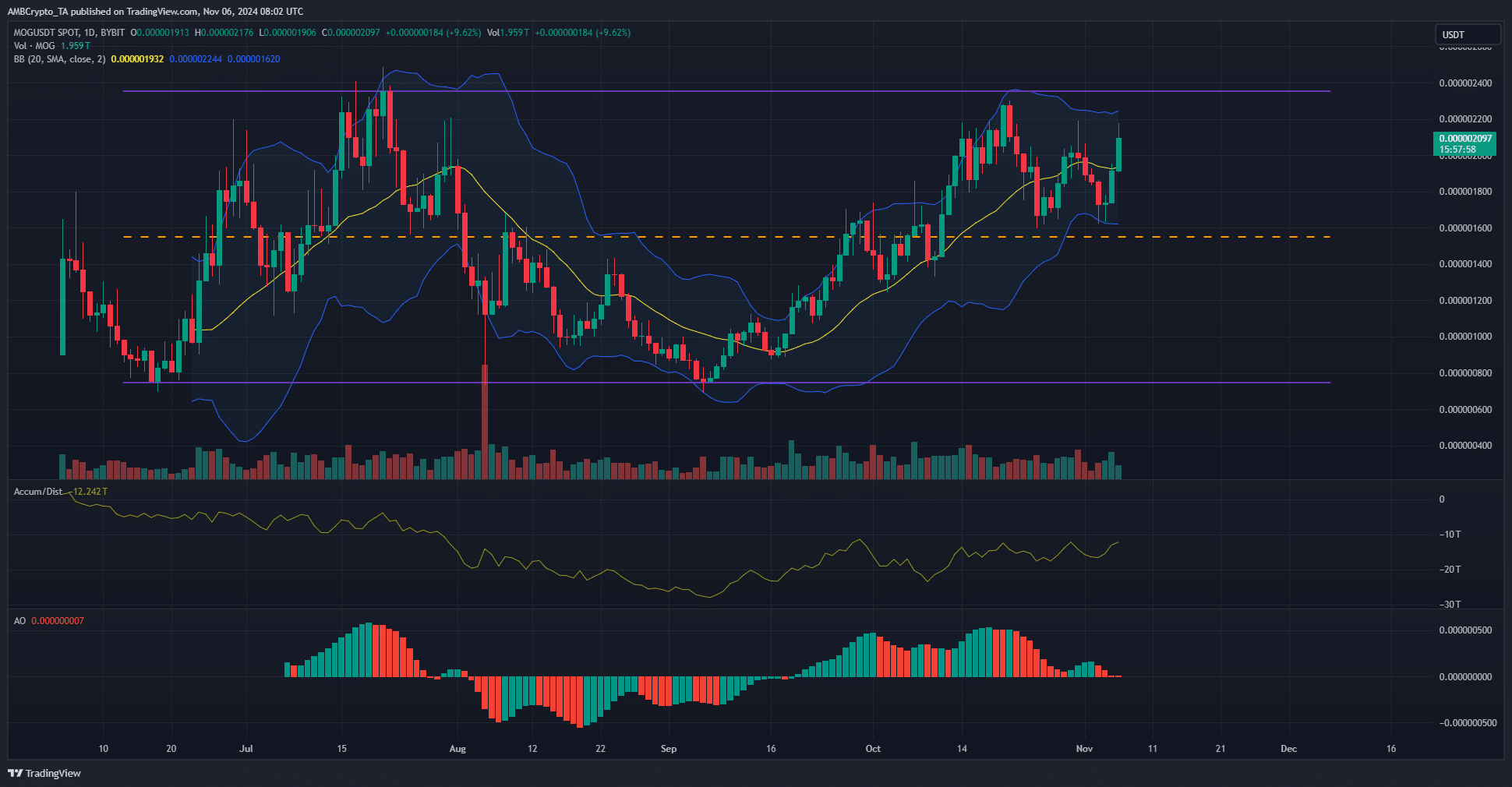

Mog Coin [MOG] was buying and selling inside a variety that prolonged from $0.0000021 to $0.00000075 (MOG costs multiplied by 1000 right here on for legibility). The meme coin value approached the mid-range degree at $0.00156 and rebounded increased from the demand zone.

On Monday, the 4th of November, one other such bounce was seen. Since these lows, Mog Coin is up by 27.5%, and up almost 10% for the day. Will we quickly witness a variety breakout?

Common buying and selling quantity hints at a scarcity of religion

On the every day timeframe, the Superior Oscillator fell towards the zero mark and confirmed that momentum was simply barely bullish. The quantity bars have been hovering on the the previous 20 days’ common buying and selling quantity.

This got here at a time when the bulls managed to defend the $0.00165 assist zone. Moreover, the A/D indicator slowly crept increased to sign patrons had the higher hand.

This benefit on the quantity entrance was sufficient to see beneficial properties within the higher half of the vary formation however was not proof for a breakout past the highs. Subsequently, as issues stand, merchants can look to promote on the $0.0023 area.

A pullback to the mid-range area, or a breakout and retest of the vary highs, can be utilized to re-enter lengthy positions.

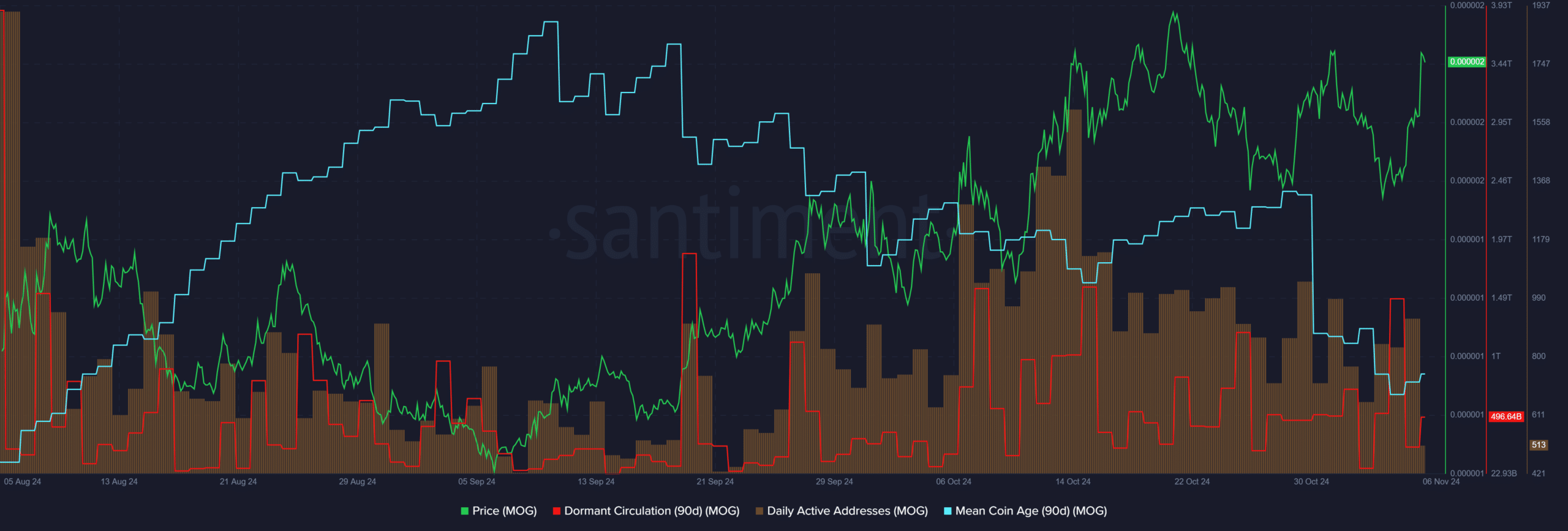

On-chain metrics sign distribution for Mog Coin

Supply: Santiment

The dormant circulation spikes have been of a comparable dimension since late September. One other such spike occurred on the 4th of November when the value made a neighborhood backside on the decrease timeframes.

Reasonable or not, right here’s MOG’s market cap in BTC’s phrases

The every day lively addresses has been in decline over the previous three weeks. Extra regarding to the HODLers was the regular lower within the imply coin age over the previous two months.

This downtrend indicated Mog Coin motion and certain profit-taking exercise. It highlighted a scarcity of bullish perception amongst holders.

Disclaimer: The knowledge introduced doesn’t represent monetary, funding, buying and selling, or different varieties of recommendation and is solely the author’s opinion