Distinguished cryptocurrency analyst Miles Deutscher has pinpointed a listing of altcoins he believes are poised to outperform as retail curiosity surges again into the market.

In response to Deutscher, retail buyers are taking the “path of least resistance,” favoring simply accessible cash listed on main centralized exchanges (CEXs) like Binance, Coinbase, Upbit, and Robinhood.

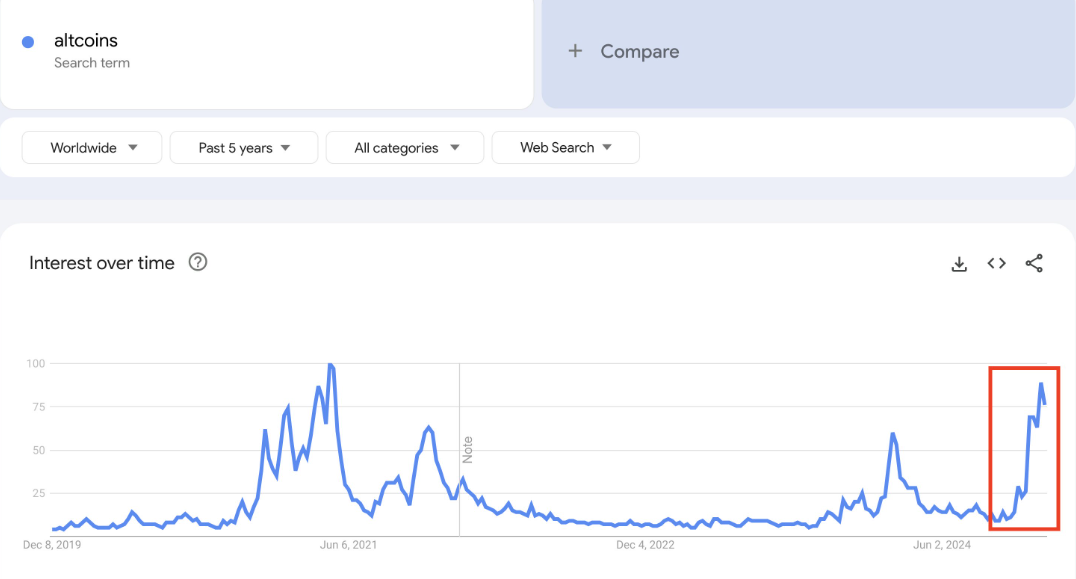

Retail Curiosity Fuels the Crypto Market

Deutscher factors to a spike in Google search volumes for cryptocurrencies as proof of rising retail curiosity. As new buyers flood the market, they have a tendency to gravitate towards well-known platforms and simple funding choices.

Cash like Ripple (XRP), Cardano (ADA), and Algorand (ALGO) are actually gaining consideration as a result of their widespread availability on main exchanges. Of observe is that these altcoins have been underperforming in latest months.

“It’s apparent which altcoins are going to outperform this cycle…There are 16,057 cryptos listed on CoinGecko, however I’ve narrowed it down to simply 90. These are the alts with the BEST likelihood of catching an enormous retail bid,” Deutscher said.

To establish the altcoins with the perfect probabilities of success, Deutscher leveraged knowledge from the APIs of prime exchanges. He then created a customized spreadsheet of 90 tokens. Among the many standout picks are Aptos (APT), Dogecoin (DOGE), Chainlink (LINK), and Close to Protocol (NEAR). Others embrace Solana (SOL), XRP, Ondo Finance (ONDO), Pepe (PEPE), Sei (SEI), and Stacks (STX).

“These cash have most world accessibility as a result of they’re listed throughout all main exchanges. If retail desires to bid on altcoins, these with the simplest entry will carry out the perfect. Cash like APT, DOGE, and SOL test all of the bins for accessibility, quantity, and retail curiosity,” Deutscher emphasised.

Why Accessibility Issues: Danger and Alternative

Deutscher argues that accessibility is essential in driving retail investments. Exchanges like Binance and Coinbase dominate person quantity globally. In the meantime, platforms like Upbit and Robinhood cater to particular regional markets and novice buyers.

“Retail buyers comply with the trail of least resistance. If a coin is listed on all main exchanges, it ensures most publicity and simplifies the shopping for course of for brand spanking new entrants,” he reiterated.

Along with accessibility, Deutscher highlighted the comparatively favorable risk-to-reward (R/R) ratio of many CEX-listed altcoins. Whereas they might not have the acute volatility of smaller, on-chain tokens, many provide vital upside potential within the vary of 5–10x positive factors. He additionally suggested buyers to keep watch over upcoming listings, which may current distinctive alternatives.

“New listings on main exchanges are a catalyst for worth motion. Cash like MOG and MEW, which not too long ago secured some high-profile listings, present how accessibility drives curiosity,” he stated.

Deutscher advises buyers trying to achieve an edge to dive deeper into tasks by taking part in group discussions and monitoring bulletins for hints of potential listings.

“Take heed to mission AMAs and be a part of their Telegram and Discord teams. The extra info you may extract about future trade listings, the higher your probabilities of positioning your self early,” Deutscher steered.

As retail curiosity in cryptocurrency ramps up, Deutscher’s insights provide a roadmap for buying and selling this part of the market cycle. Specializing in accessibility, fundamentals, and community-driven catalysts, the chosen altcoins might be well-positioned for vital positive factors. However, merchants and buyers should additionally conduct their very own analysis.

Disclaimer

In adherence to the Belief Challenge pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nonetheless, readers are suggested to confirm details independently and seek the advice of with an expert earlier than making any selections based mostly on this content material. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.