- On the time of writing, DOT was buying and selling inside a four-hour consolidation section and at a significant help line, signaling a bullish outlook

- Accumulation and distribution (AD) ratio traded inside a sample that can decide its rally

Polkadot [DOT] has been sluggish for the reason that starting of the month, remaining inside a consolidation section on the charts. The identical was highlighted by its modest worth adjustments – A 0.97% hike over the month, with the crypto gaining by simply 1.57% in 24 hours.

Regardless of these actions, nevertheless, the long run path of DOT relies on a significant breach from the completely different patterns which have surfaced.

Is a significant rally imminent for DOT?

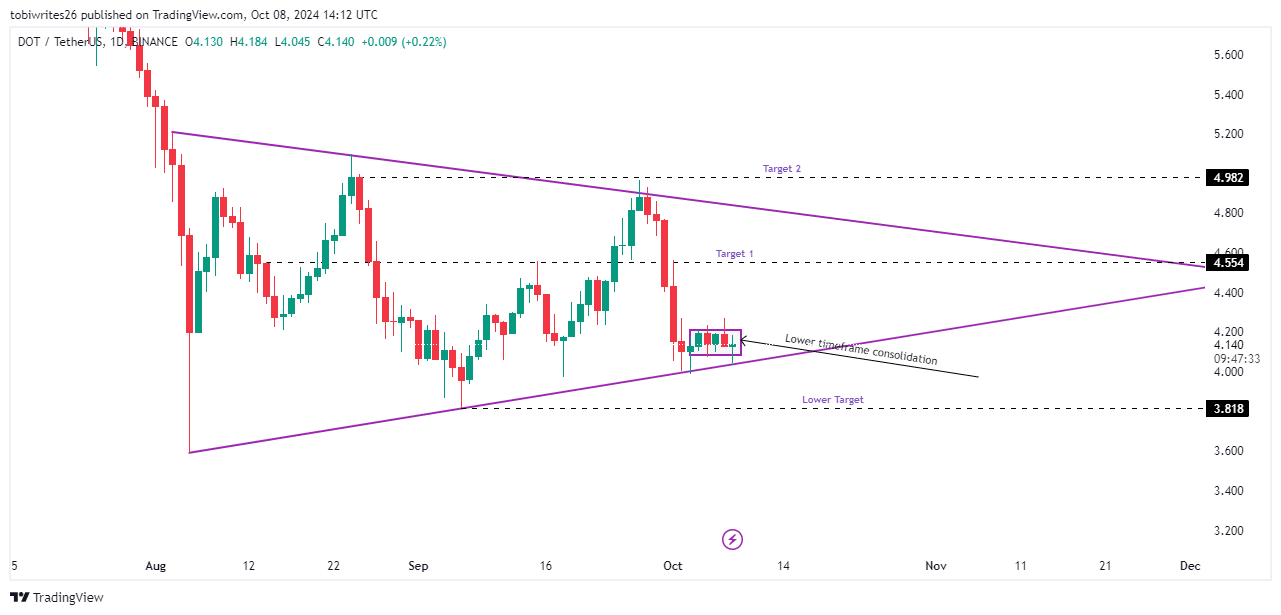

At press time, DOT was buying and selling inside a symmetrical triangle sample, with worth actions oscillating inside an outlined vary. Regardless of historic uptrends from comparable positions, DOT has as a substitute consolidated on the triangle’s backside help since 2 October.

Breaking out of this consolidation section might propel DOT to 2 potential targets – The primary at $4.554 and a subsequent degree at $4.982. And not using a breakout, DOT could revert to its September low of $3.818.

General market sentiment appeared pretty bullish too, suggesting an upward development for DOT in upcoming periods. Extra insights from AMBCrypto supported the probability of DOT’s sustained rise too.

Shopping for exercise is confirmed, but DOT’s rally stays conditional

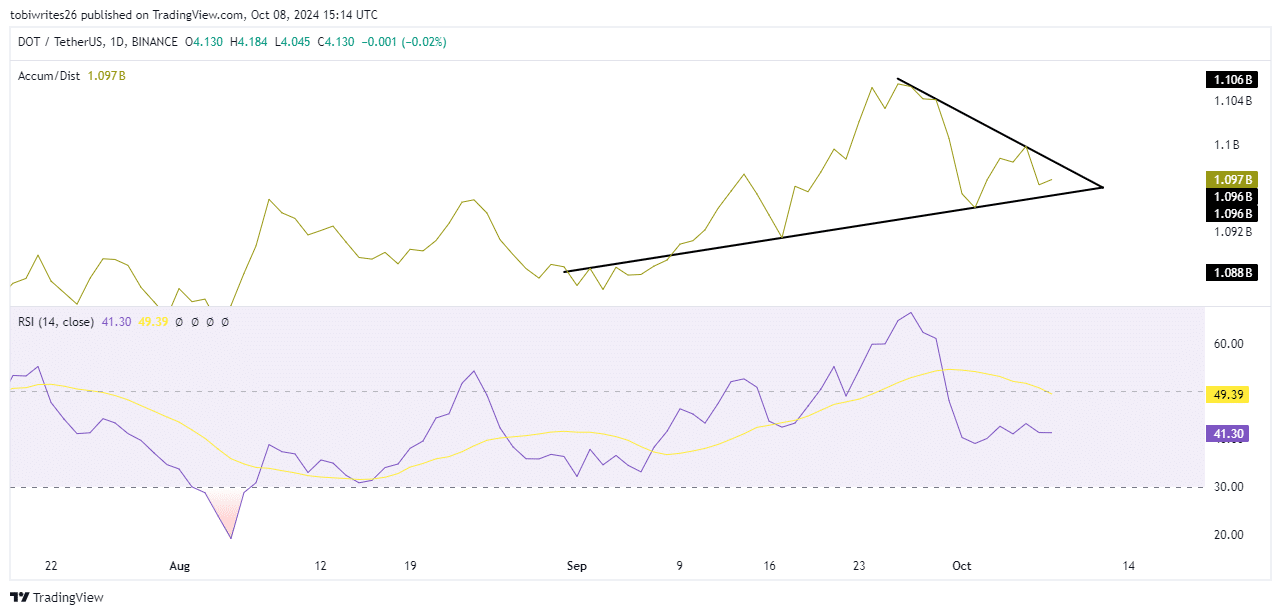

The Accumulation and Distribution (AD) technical indicator was trending upwards, indicating ongoing accumulation. Its findings aligned with the consolidation section recognized earlier on the chart.

For a bullish breakout, the AD line should breach the higher resistance line of the triangle sample inside which it trades. If this happens, higher shopping for exercise may be anticipated, doubtlessly driving DOT’s worth larger.

Furthermore, the Relative Power Index (RSI), which measures the rate of worth adjustments, has been progressing larger. Which means the worth of DOT is prone to proceed its upward development, probably breaking via the higher bounds of the consolidation channel.

Curiosity in DOT shifts in direction of bulls

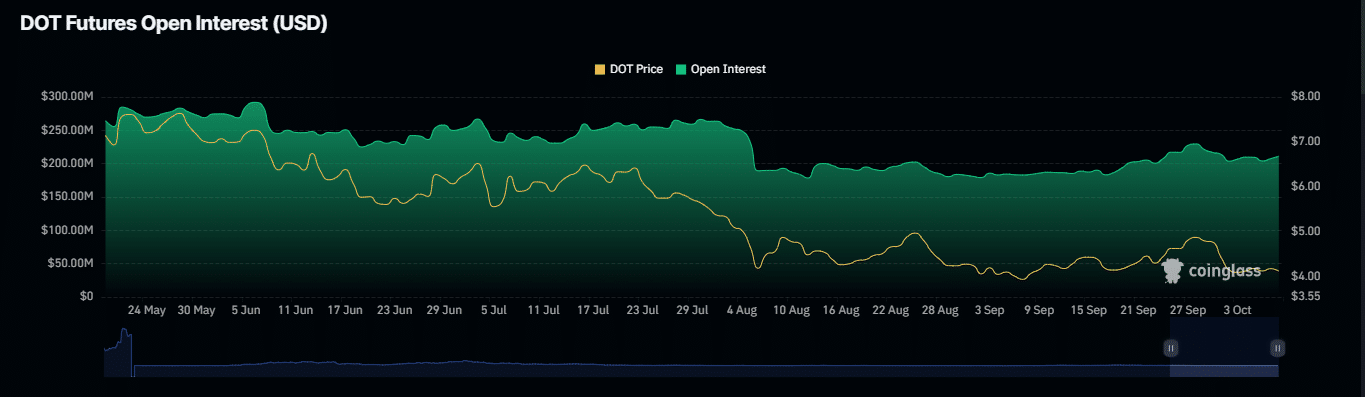

Open curiosity in DOT, which dipped to a month-to-month low on 6 October, has been steadily gaining momentum, as indicated by the charts on Coinglass.

This uptick may be interpreted as an indication of accelerating bullish exercise available in the market, reinforcing the prevailing bullish sentiment.

On the time of writing, Open curiosity had fallen barely by 1.03%, with the identical valued at $209.93 million. If this uptrend continues, it might be set to achieve new highs and enter constructive territory.

Given these situations, DOT may be anticipated to proceed its rally, whereas additionally assembly and doubtlessly exceeding its goal costs.

- On the time of writing, DOT was buying and selling inside a four-hour consolidation section and at a significant help line, signaling a bullish outlook

- Accumulation and distribution (AD) ratio traded inside a sample that can decide its rally

Polkadot [DOT] has been sluggish for the reason that starting of the month, remaining inside a consolidation section on the charts. The identical was highlighted by its modest worth adjustments – A 0.97% hike over the month, with the crypto gaining by simply 1.57% in 24 hours.

Regardless of these actions, nevertheless, the long run path of DOT relies on a significant breach from the completely different patterns which have surfaced.

Is a significant rally imminent for DOT?

At press time, DOT was buying and selling inside a symmetrical triangle sample, with worth actions oscillating inside an outlined vary. Regardless of historic uptrends from comparable positions, DOT has as a substitute consolidated on the triangle’s backside help since 2 October.

Breaking out of this consolidation section might propel DOT to 2 potential targets – The primary at $4.554 and a subsequent degree at $4.982. And not using a breakout, DOT could revert to its September low of $3.818.

General market sentiment appeared pretty bullish too, suggesting an upward development for DOT in upcoming periods. Extra insights from AMBCrypto supported the probability of DOT’s sustained rise too.

Shopping for exercise is confirmed, but DOT’s rally stays conditional

The Accumulation and Distribution (AD) technical indicator was trending upwards, indicating ongoing accumulation. Its findings aligned with the consolidation section recognized earlier on the chart.

For a bullish breakout, the AD line should breach the higher resistance line of the triangle sample inside which it trades. If this happens, higher shopping for exercise may be anticipated, doubtlessly driving DOT’s worth larger.

Furthermore, the Relative Power Index (RSI), which measures the rate of worth adjustments, has been progressing larger. Which means the worth of DOT is prone to proceed its upward development, probably breaking via the higher bounds of the consolidation channel.

Curiosity in DOT shifts in direction of bulls

Open curiosity in DOT, which dipped to a month-to-month low on 6 October, has been steadily gaining momentum, as indicated by the charts on Coinglass.

This uptick may be interpreted as an indication of accelerating bullish exercise available in the market, reinforcing the prevailing bullish sentiment.

On the time of writing, Open curiosity had fallen barely by 1.03%, with the identical valued at $209.93 million. If this uptrend continues, it might be set to achieve new highs and enter constructive territory.

Given these situations, DOT may be anticipated to proceed its rally, whereas additionally assembly and doubtlessly exceeding its goal costs.

![MANTRA [OM] – Up by 20x since March, altcoin’s subsequent step shall be…](https://webtradetalk.com/wp-content/uploads/2025/02/OM-Featured-1000x600.webp-360x180.webp)