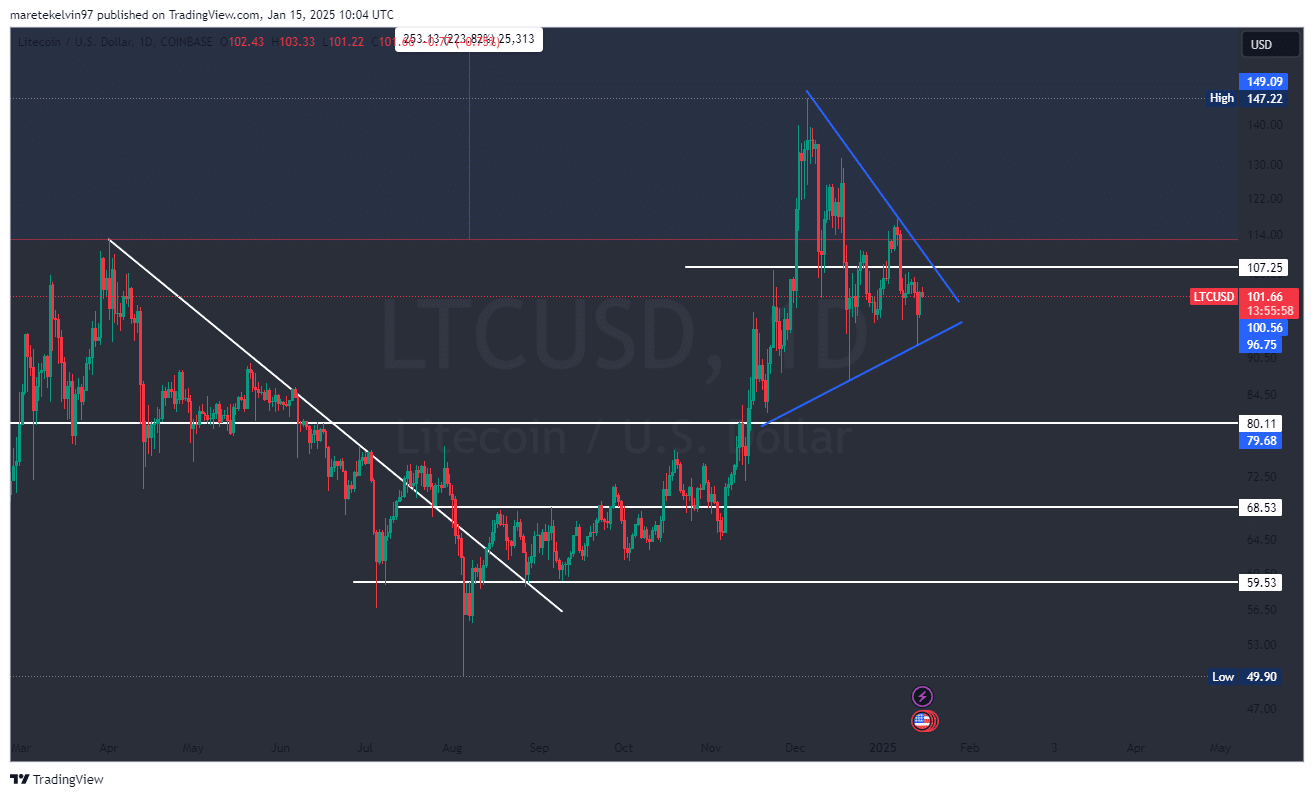

- LTC costs had been consolidating inside a symmetrical triangle.

- Metrics confirmed heightened exercise, with massive transactions hinting a surging whale exercise.

Litecoin [LTC] costs have been consolidating inside a symmetrical triangle sample since mid-November as seen on the day by day chart, indicating an indication of market indecision.

This sample typically precedes important value actions as consumers and sellers battle for dominance. On the time of writing, LTC was buying and selling at $101, a ten% surge since its latest rebound from the important thing triangle assist degree within the final 48 hours.

Curiously, this consolidation comes at a time when the market is awaiting a transparent sign. A breakout might be imminent, however its route is dependent upon the amount and general market sentiment.

Continued bullish momentum may push LTC past the vital triangle resistance, whereas bearish strain may lead the altcoin to drop additional.

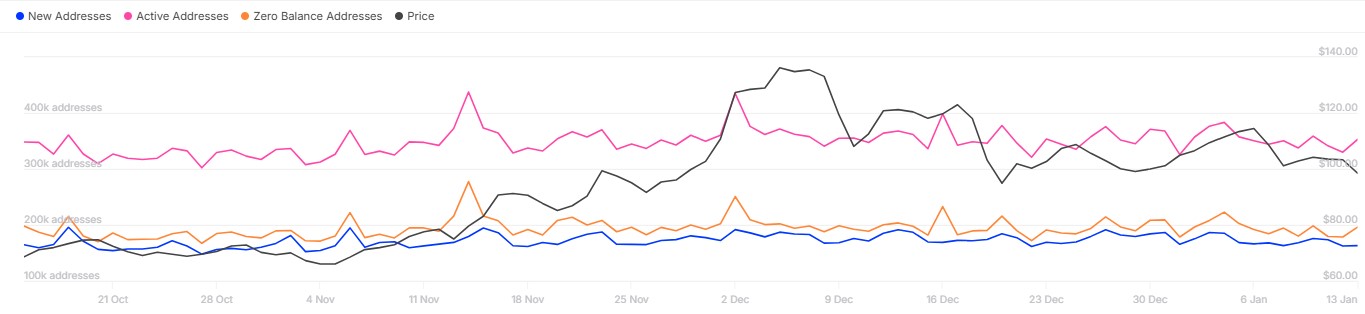

LTC lively addresses paint a bullish image

Digging deeper into on-chain metrics, Litecoin’s community is displaying robust engagement. IntoTheBlock on-chain information highlights that the altcoin’s community continues to be buzzing. The variety of lively addresses surged just lately by round 7%, suggesting continued LTC person exercise.

In addition to the lively addresses, the latest surge within the altcoin’s new pockets creations provides to the bullish outlook. Elevated adoption usually happens with robust buying and selling exercise that would amplify any breakout.

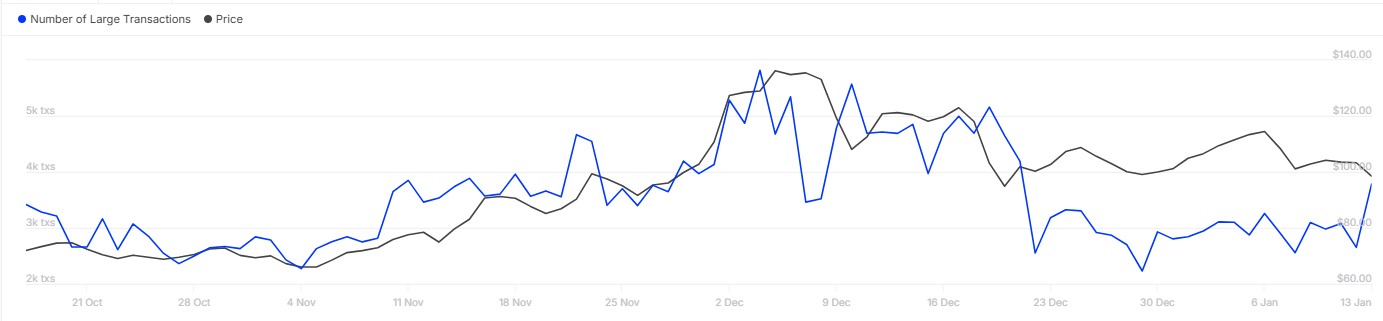

Whales are making strikes

Additionally, there was a noticeable spike in massive transactions on the Litecoin community. This pattern means that institutional gamers or high-net-worth people are taking an curiosity in LTC value developments.

Such actions normally coincide with intervals of value consolidation, hinting at accumulation or strategic positioning for Litecoin.

When considered alongside rising handle exercise, the presence of whales strengthens the case for a significant value transfer. These components make Litecoin’s present consolidation section much more compelling, as they typically foreshadow market volatility.

It stays to be seen whether or not the breakout will favor the bulls or the bears.

Learn Litecoin’s [LTC] Value Prediction 2025–2026

All eyes are on Litecoin’s buying and selling volumes and value motion, as their improvement will dictate the breakout route.

If the accumulating bullish momentum continues with optimistic on-chain sentiments, LTC will escape and rally additional.