- Jupiter rocketed previous the native resistance zone at $0.95, and the worth was just under the $1.15 resistance at press time

- There may be potential for a drop to $1.06 within the close to future

Jupiter [JUP] noticed a 36.76% hie on Saturday, 18 January. The final 24 hours of buying and selling noticed 34% positive factors and a 678% hike within the each day buying and selling quantity for Jupiter. This appeared to be a strongly bullish signal for the altcoin.

The altcoin’s market construction was bullish on the each day and that 4-hour charts. Nonetheless, there could also be potential for a retracement in the direction of $1. How deep might this dip go? Robust help was at $1.06, almost 9% beneath the market worth at press time.

JUP bulls problem the $1.15 resistance

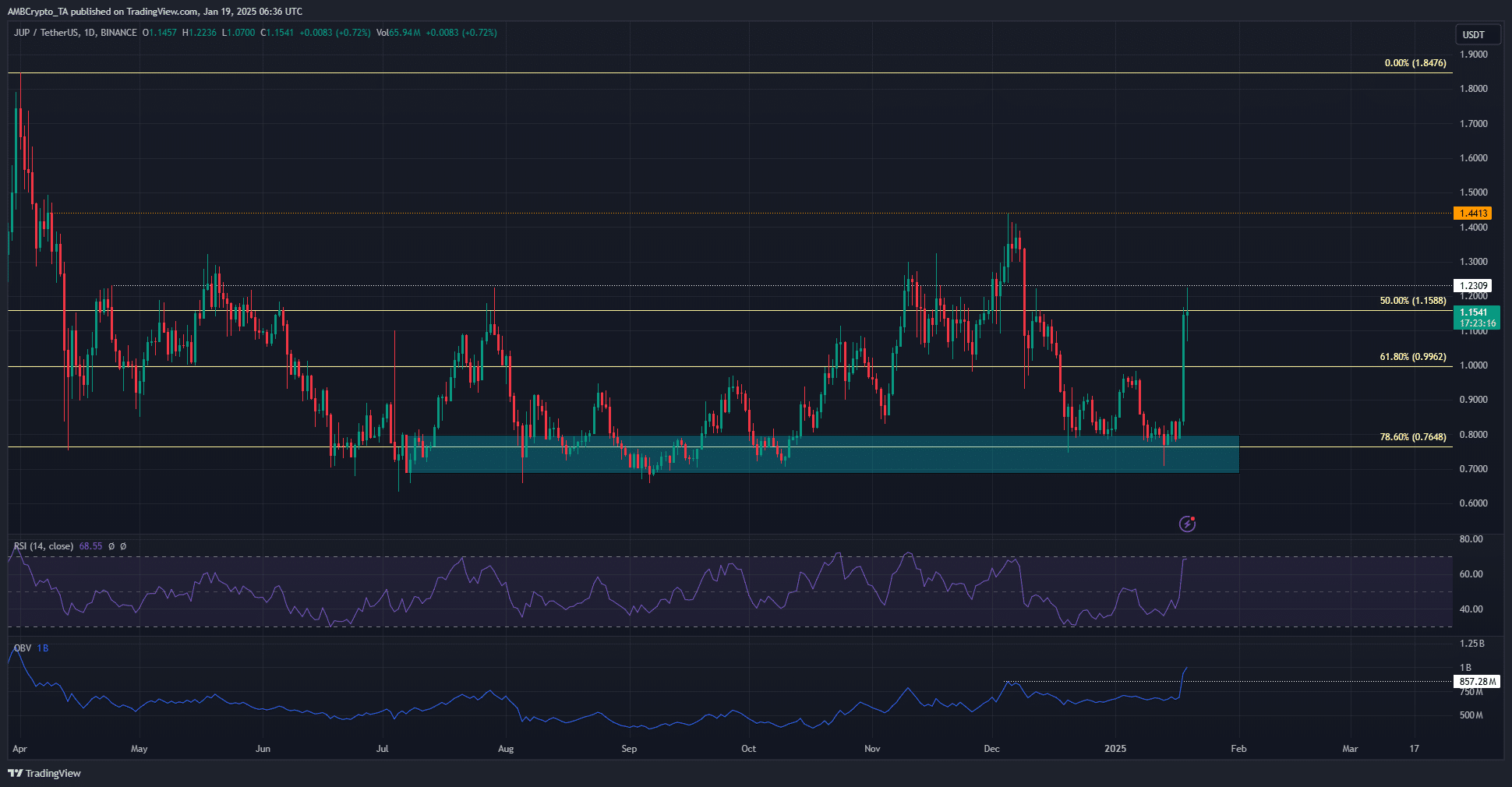

During the last 9 months, the bulls have stoutly defended the 78.6% retracement degree at $0.76. These retracement ranges had been plotted primarily based on Jupiter’s rally in March from $0.47 to $1.84.

The bullish each day construction was encouraging, and the RSI was nicely above impartial 50, indicating robust upward momentum. This momentum was accompanied by heightened demand. The OBV shot previous an area excessive to mirror elevated shopping for strain too.

Surging demand and momentum may very well be sufficient to hold JUP previous its native resistances at $1.15 and $1.23. Over the subsequent week or two, it’s doubtless that the $1.44 native highs will probably be challenged as soon as once more.

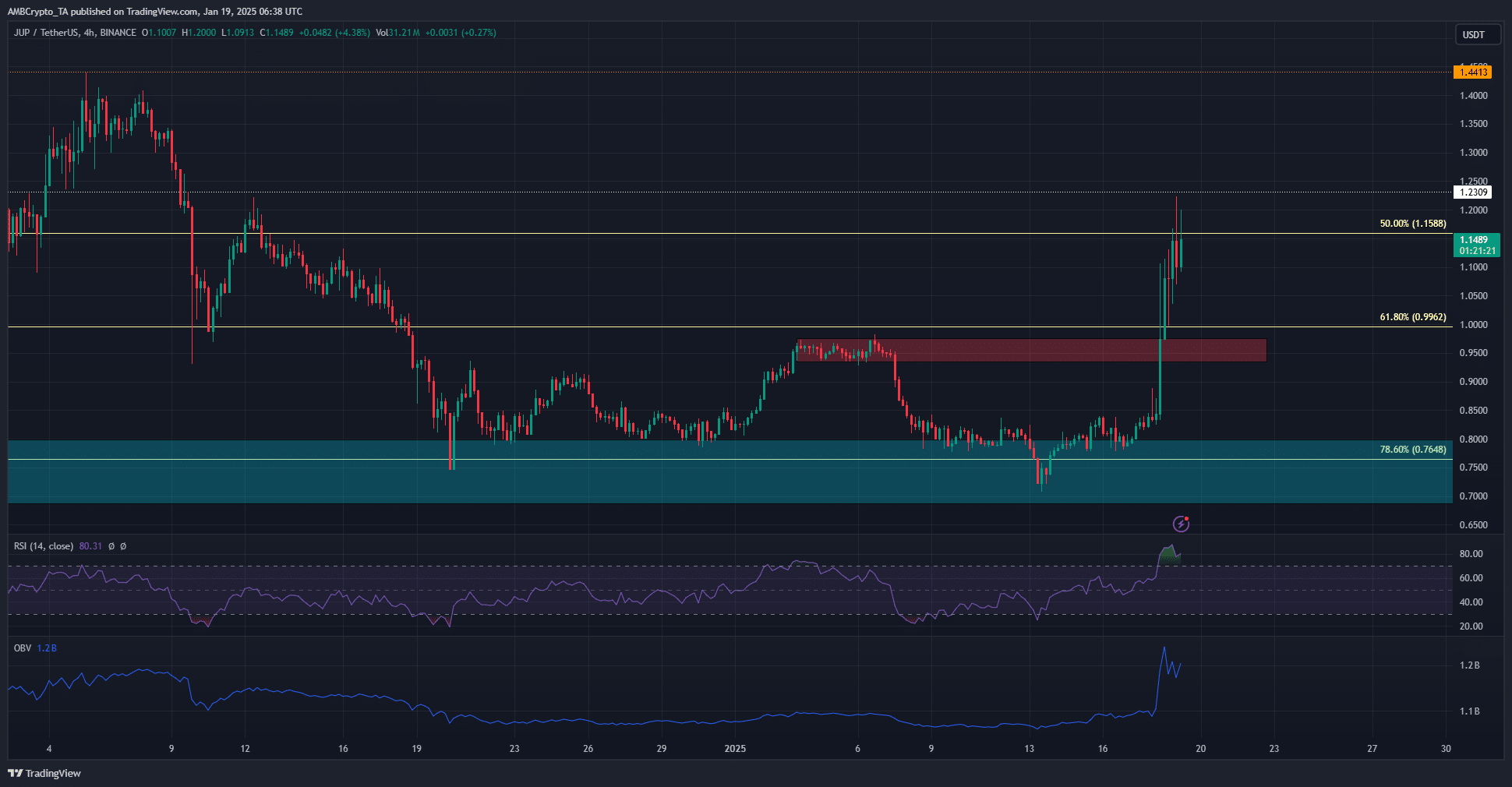

The H4 chart highlighted the extreme momentum of the previous couple of days. The native resistance at $0.95 and $0.99 had been swept apart with ease and barely confronted a retest because the crypto’s worth raced increased.

The 4-hour chart’s momentum was oversold, which was not essentially bearish. Nonetheless, the OBV dip over the previous couple of periods indicated some profit-taking. A transfer in the direction of the $0.95-$1 help zone is perhaps doable within the coming days. If examined, this space would current a shopping for alternative.

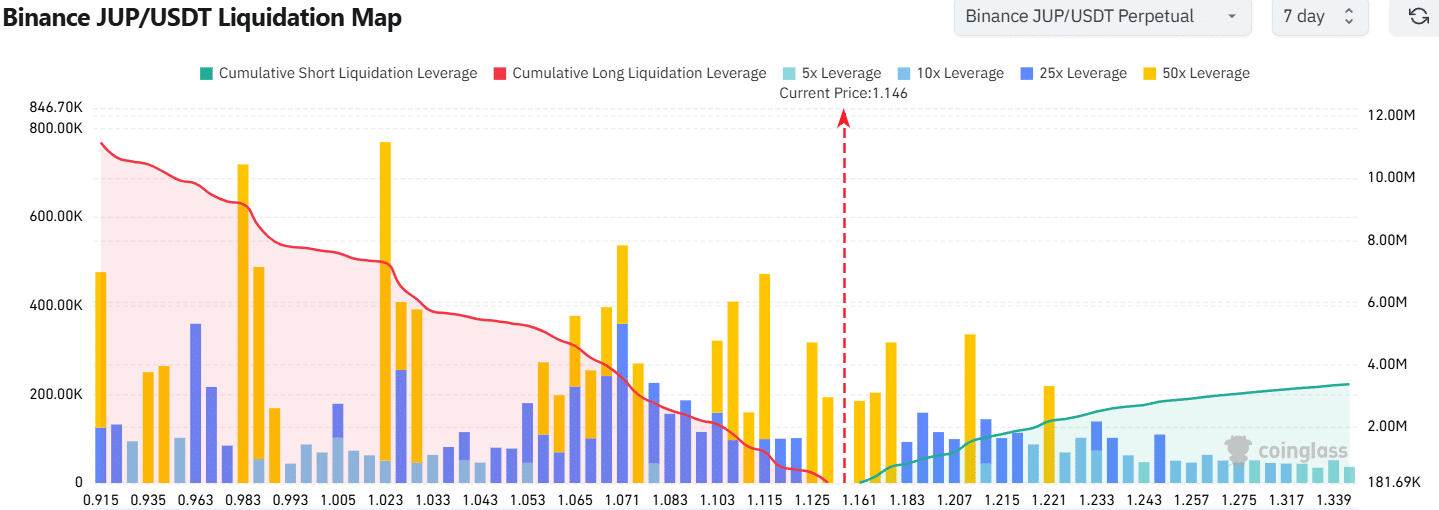

Supply: Coinglass

Learn Jupiter’s [JUP] Value Prediction 2025-26

The liquidation map famous extra cumulative liquidation leverage to the south, than to the north. Subsequently, it’s doable {that a} liquidity hunt and a short-term worth dip might begin. The $1.11 and $1.06 ranges can be the short-term targets in case of such a dip.

Disclaimer: The data offered doesn’t represent monetary, funding, buying and selling, or different forms of recommendation and is solely the author’s opinion

![Jupiter [JUP] worth prediction – 36% hike, however is the chance of profit-taking nonetheless there?](https://webtradetalk.com/wp-content/uploads/2025/01/Jupiter-Featured-1000x600.webp-750x375.webp)