- Whale exercise and rising metrics sign bullish momentum as VIRTUAL targets $3.58 resistance.

- Market fundamentals strengthened with 1,290 energetic addresses and a transaction rely of 763.

In a dramatic transfer, an unknown investor withdrew 854 Ethereum [ETH], value $2.9 million, from Coinbase, buying 851,387 VIRTUALs, sparking hypothesis in regards to the token’s future potential.

This important buy raises questions on whether or not Digital Protocol [VIRTUAL] is gearing up for a breakout.

With the crypto market exhibiting blended developments, the surge in exercise and key metrics of VIRTUAL have captured the eye of merchants and analysts alike.

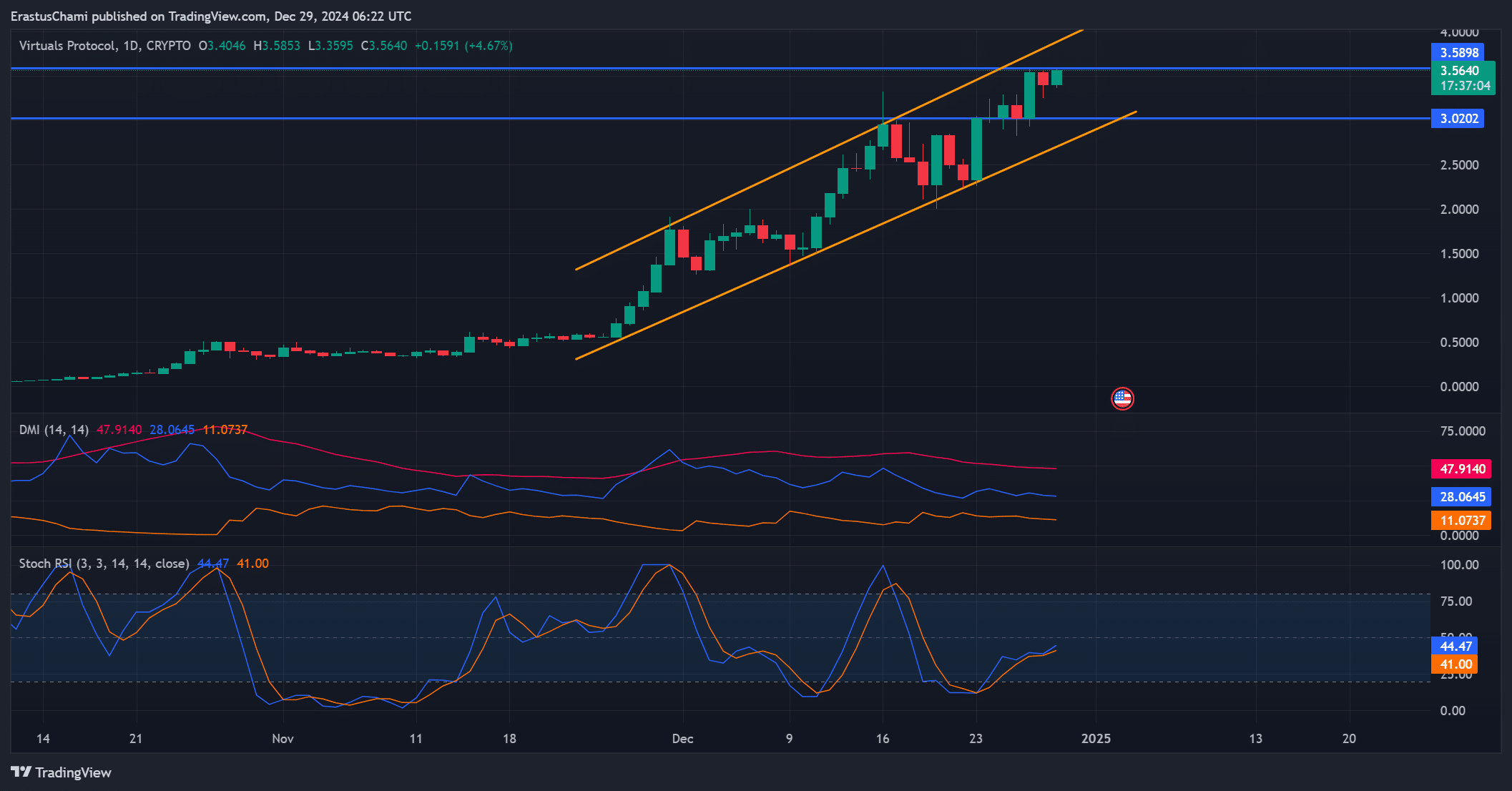

VIRTUAL worth evaluation reveals regular energy

At press time, VIRTUAL was buying and selling at $3.57, reflecting a 3.40% rise prior to now 24 hours.

The token continued to observe a bullish trajectory inside an ascending channel, with key resistance at $3.58.

The Directional Motion Index (DMI) confirmed a robust shopping for pattern, with the +DI at 28 considerably outpacing the -DI at 11.

Moreover, the Common Directional Index (ADX), at 47, indicated strong pattern energy. Moreover, the stochastic RSI at 44.47 steered that the token was nearing overbought territory, signaling potential short-term warning.

Nevertheless, the constant upward motion indicated momentum, and any corrections may present alternatives for accumulation.

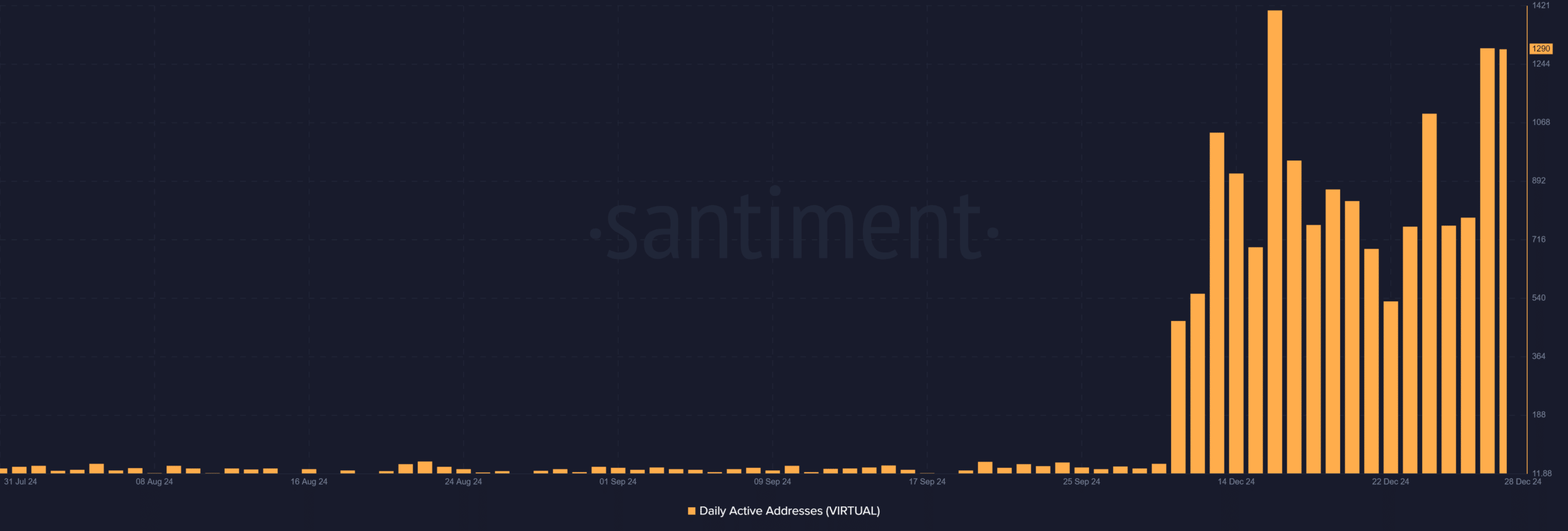

Each day energetic addresses present important progress

The surge in each day energetic addresses mirrored rising community exercise, with a current excessive of 1,290 addresses.

This sharp rise indicated rising consumer engagement, which may stem from speculative curiosity or increasing use circumstances inside the Digital Protocol ecosystem.

Sustained will increase in energetic addresses usually signify strengthening fundamentals for a token. Consequently, the rising on-chain exercise supported the narrative of a possible bullish breakout for VIRTUAL.

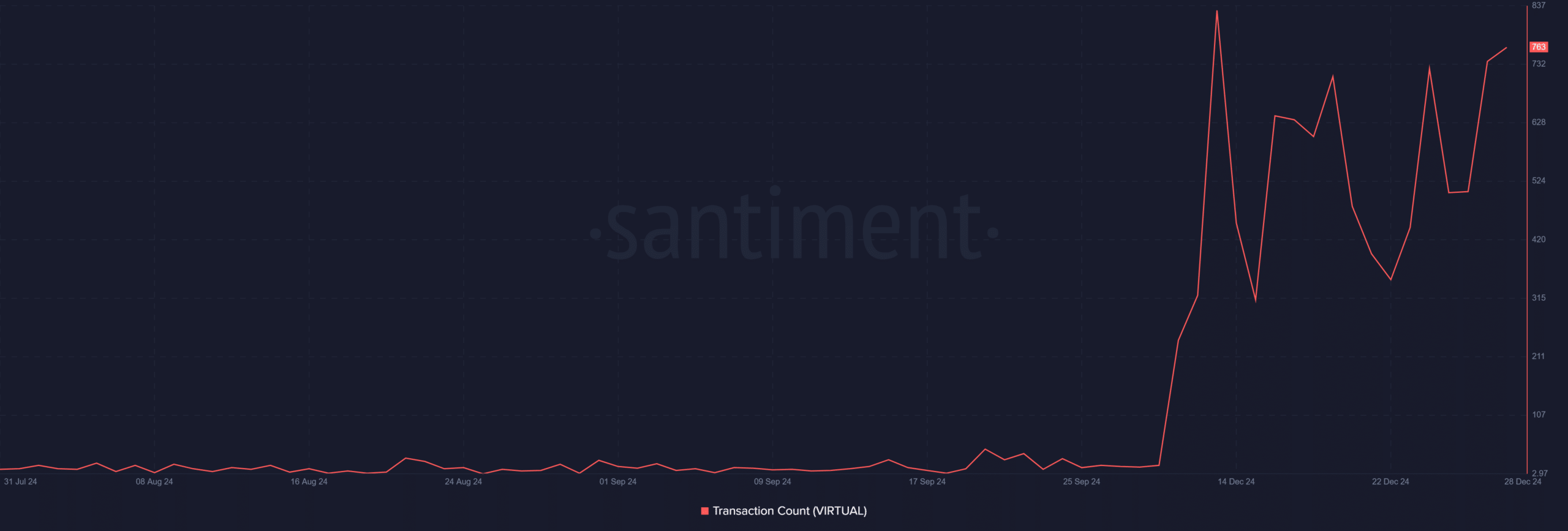

Rising community utility

Transaction exercise for VIRTUAL has skilled a big enhance, with the transaction rely reaching 763 as of the newest information.

This marks a considerable rise from ranges beneath 200 in early December, showcasing a close to fourfold enhance in exercise.

The sharp spike displays a rising community utility, pushed by heightened buying and selling and interplay on the Digital Protocol.

The surge means that each speculative and real use circumstances are gaining traction.

Due to this fact, the constant rise in transaction quantity aligns with different bullish indicators, reinforcing optimism for additional worth momentum.

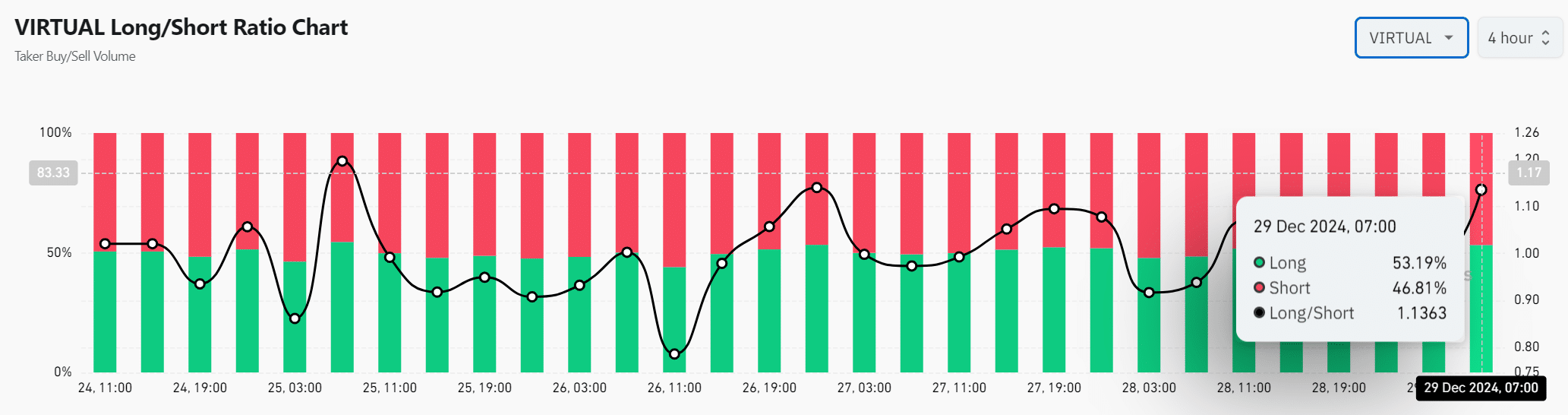

Lengthy/Brief Ratio signifies cautious optimism

The Lengthy/Brief ratio added one other layer to the evaluation, with 53.19% of positions favoring longs in comparison with 46.81% shorts.

This information demonstrated a cautiously optimistic outlook from merchants, who anticipated VIRTUAL to take care of its upward pattern.

Moreover, the regular accumulation of lengthy positions highlighted rising confidence regardless of resistance ranges.

Nevertheless, merchants ought to stay vigilant for sudden sentiment shifts, as exterior market elements may have an effect on momentum.

Is your portfolio inexperienced? Try the VIRTUAL Revenue Calculator

Thus, VIRTUAL seems to be on observe for a breakout. The whale buy, rising each day exercise to 1,290 addresses, and powerful market sentiment suggests a bullish outlook.

If VIRTUAL efficiently breaks resistance at $3.58, it may provoke a big rally within the close to time period.

![MANTRA [OM] – Up by 20x since March, altcoin’s subsequent step shall be…](https://webtradetalk.com/wp-content/uploads/2025/02/OM-Featured-1000x600.webp-360x180.webp)