- BNB has marked a key milestone this cycle by breaching the $600 resistance.

- Nonetheless, it nonetheless seems undervalued – a situation bulls should seize to gasoline additional positive aspects.

The previous week has been a rollercoaster for Bitcoin [BTC] traders, with anticipation constructing as BTC inches nearer to the long-awaited $100K milestone.

But, regardless of the rising pleasure, the weekend fell in need of delivering the breakthrough, leaving the market on edge.

Traditionally, at any time when Bitcoin encounters resistance close to psychologically important targets, altcoins are inclined to reap the advantages.

Retail traders usually shift capital to mitigate dangers, a pattern that Binance Coin [BNB] leveraged to hit its all-time excessive of $717 again in early June.

Since then, BNB has engaged in a persistent ‘tug-of-war’ to interrupt by way of the $600 rejection, a stage it lastly conquered through the post-election cycle after 5 failed makes an attempt.

Now buying and selling at $660, with a bullish MACD crossover signaling upward momentum and BTC nonetheless shy of its milestone, can BNB put up a brand new all-time excessive earlier than this cycle concludes?

Broader market alerts BNB could also be undervalued

Apparently, a retracement to $600 remains to be potential, as BNB has surged by over 10% in beneath 4 buying and selling days, which could sign an upcoming correction.

If bulls fail to defend this stage, panic might set in, prompting traders to exit to keep away from additional losses.

Nonetheless, this situation seems unlikely given the broader altcoin rally, with some posting triple-digit positive aspects. Traditionally, BTC nearing a peak has usually benefited BNB.

Moreover, its day by day chart hinted on the coin being undervalued, suggesting potential for additional upside.

If this pattern persists, BNB may very well be on observe to hit $700 first, which might act as a psychological catalyst for bulls to push the coin in direction of a brand new all-time excessive.

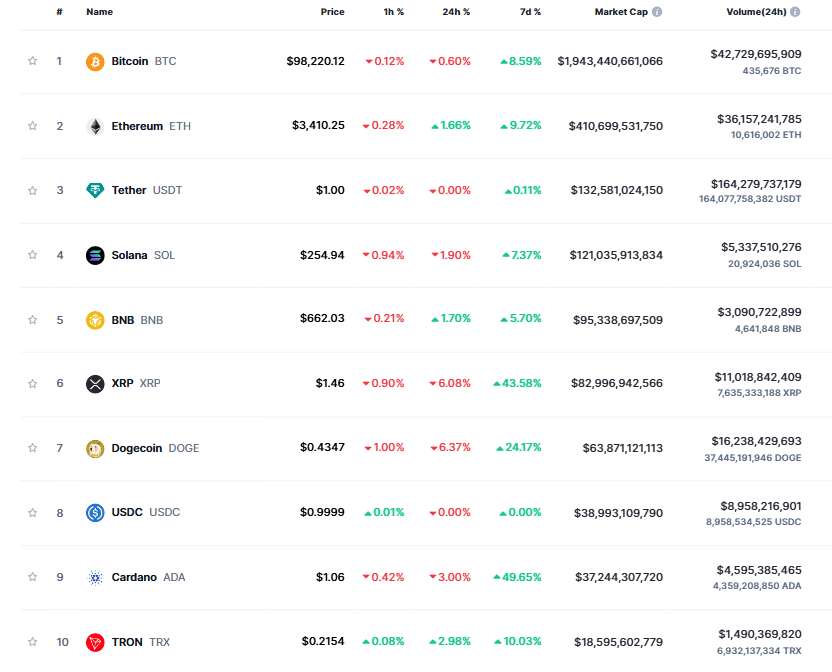

With a 5% weekly surge, BNB has lagged behind on this bull cycle, whereas its counterparts – reminiscent of Cardano [ADA] and Ripple [XRP] – have each reclaimed the $1 benchmark after years of consolidation.

Though BNB has posted a milestone by breaking the important thing $600 resistance, its undervaluation in comparison with its rivals would possibly turn into its greatest energy.

On account of the intense pumps, many cash have acquired because the kickstart of this cycle, there’s a excessive chance that an imminent reversal might shake up most of those cash.

Traders, having secured huge positive aspects, might look to exit and refocus on Bitcoin, which might create a possibility for BNB to catch up.

So, is $700 simply across the nook?

Trying on the day by day worth chart, BNB has been in a hunch for over 4 months, struggling to interrupt the $600 barrier. Nonetheless, it has just lately pulled itself out of this part, with the RSI nonetheless within the impartial zone.

Thus, its present undervaluation units a promising stage for bulls to provoke an accumulation part, doubtlessly driving BNB towards $670 subsequent, aligning with a number of different bullish indicators.

But, a rally all the way in which to $700 may appear overly bold beneath the present market situations, the place the highlight stays on different altcoins, signaling an underlying shift in investor curiosity.

Not like its earlier climb to an all-time excessive of over $715 – achieved with day by day positive aspects exceeding 9% amid Bitcoin consolidating under $70K – BNB’s latest day by day positive aspects haven’t even surpassed 2%.

This muted momentum should shift dramatically for a parabolic run to take form.

Whereas spot merchants are eyeing the present worth as a believable backside, a extra decisive and aggressive effort by bulls will probably be important to shatter the $700 barrier.

Subsequently, the potential for $670 stays tangible, supported by sturdy bullish indicators.

Learn Binance Coin’s [BNB] Worth Prediction 2024–2025

Nonetheless, attaining a brand new all-time excessive would require bulls to considerably ramp up shopping for strain to push BNB past the essential $700 threshold.

Crossing this milestone might act as a psychological set off, encouraging new patrons to enter the market and current holders to keep up their positions, creating the momentum wanted for a contemporary ATH.