- AVAX may soar by 12% to hit $28.50 if it holds itself above the $24.50-level

- On-chain metrics and technical evaluation prompt that bulls have been dominating the asset

AVAX’s market sentiment and its worth motion have ordinarily been vital to the altcoin’s fortunes. During the last two days, as an illustration, the broader sentiment throughout the crypto-market has been fairly unfavorable. Nevertheless, it might appear that AVAX could also be poised for a brand new rally once more.

AVAX technical evaluation and key ranges

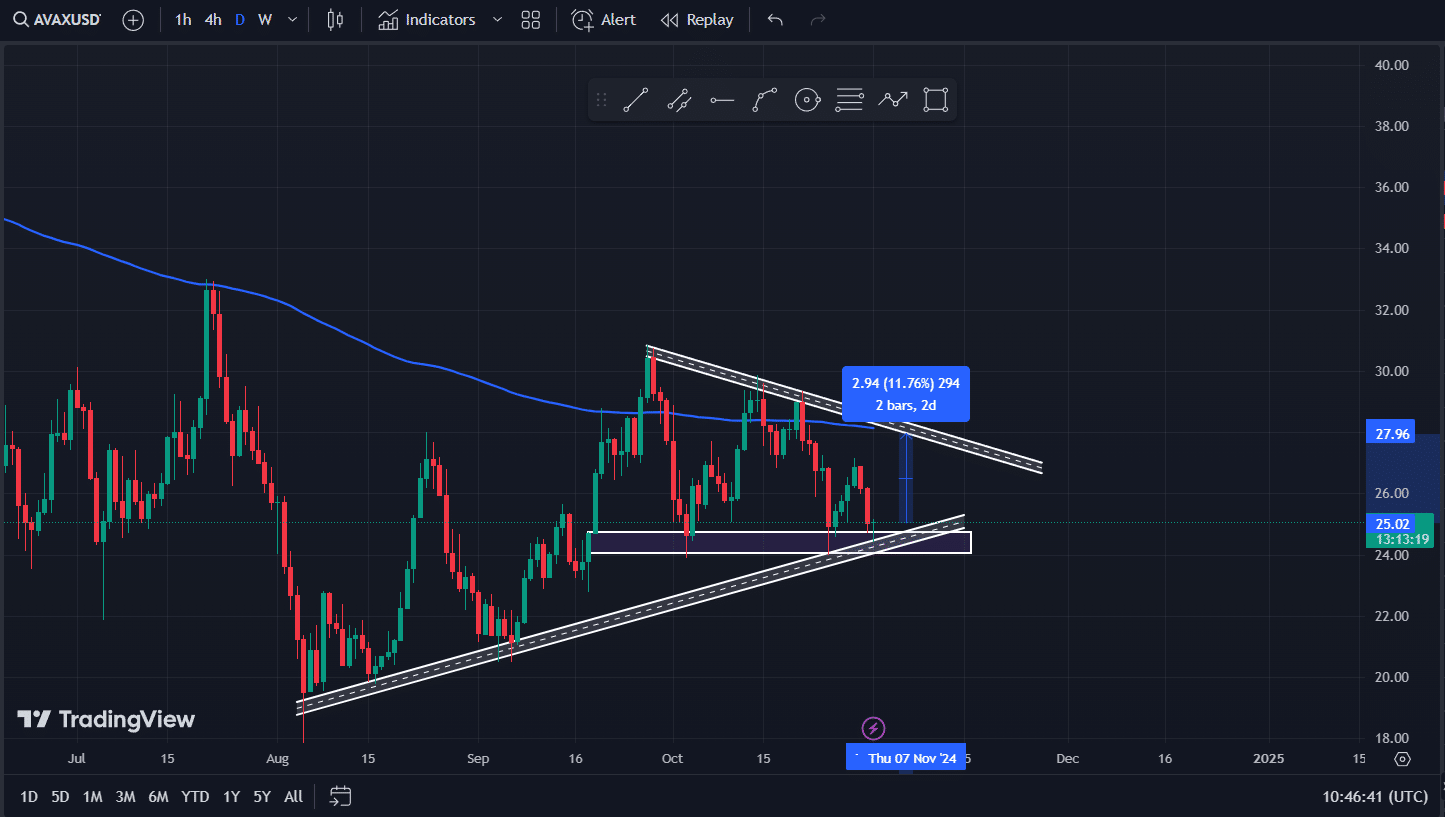

In accordance with AMBCrypto’s technical evaluation, AVAX stays fairly bullish and will soar by 12% to achieve the $28.50 degree within the coming days.

In actual fact, its current worth motion indicated that every time the asset’s worth approaches the assist degree of $24.50, it encounters some shopping for strain and a worth reversal.

Aside from this horizontal assist degree, AVAX, at press time, was supported by an upward-sloping trendline, which has been in place for the reason that starting of August 2024. Just like the horizontal assist degree, every time the asset’s worth hits this trendline, it tends to report a notable upward rally.

On the time of writing, AVAX gave the impression to be buying and selling beneath the 200 Exponential Shifting Common (EMA) on the each day timeframe, indicating an uptrend. In the meantime, its Relative Energy Index (RSI) prompt a doable upward rally, because it was within the oversold space.

AVAX’s bullish thesis will maintain provided that it stays above the $24.50-level. In any other case, it should fail.

Bullish on-chain metrics

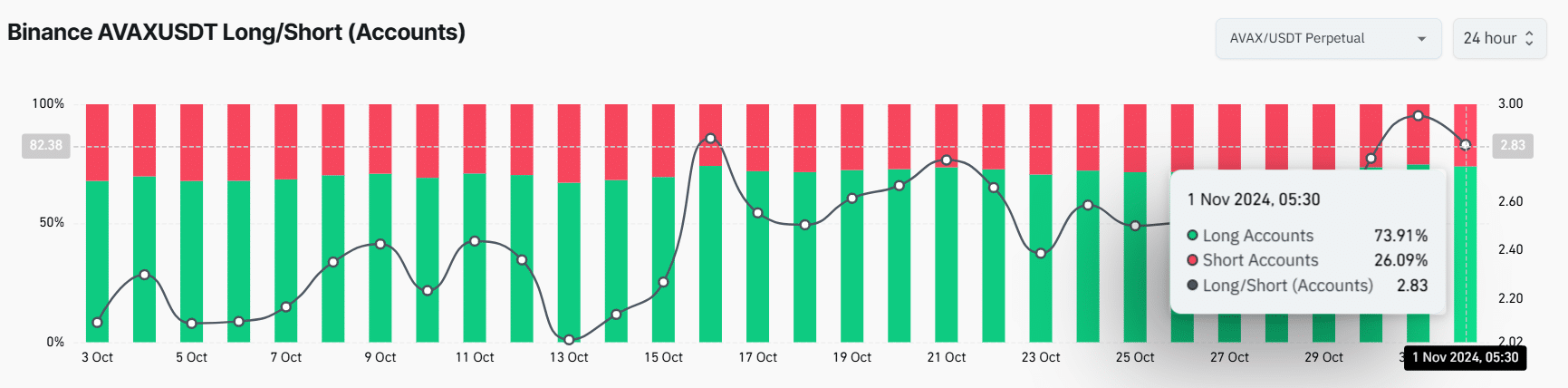

Along with this constructive technical evaluation, on-chain metrics reminiscent of key liquidation ranges and the Lengthy/Brief ratio additional supported this bullish outlook. In accordance with the on-chain analytics agency CoinGlass, as an illustration, Binance’s AVAX Lengthy/Brief ratio had a worth of two.83 at press time.

This discovering alluded to a powerful bullish sentiment amongst merchants. Moreover, 73.91% of prime merchants on Binance appeared to carry lengthy positions, whereas 26.09% of them held quick positions.

Main liquidation ranges

Proper now, the main liquidation ranges are at $24.35 on the decrease facet and $25.45 on the higher facet, with merchants over-leveraged at these ranges, in accordance with Coinglass.

If the sentiment stays bullish and the value rises to the $25.45-level, almost $875,300 value of quick positions will likely be liquidated. Conversely, if the sentiment shifts and the value falls to the $24.35-level, roughly $2.94 million value of lengthy positions will likely be liquidated.

Combining these on-chain metrics with technical evaluation prompt that AVAX bulls are presently dominating the asset and should assist an upcoming rally.

- AVAX may soar by 12% to hit $28.50 if it holds itself above the $24.50-level

- On-chain metrics and technical evaluation prompt that bulls have been dominating the asset

AVAX’s market sentiment and its worth motion have ordinarily been vital to the altcoin’s fortunes. During the last two days, as an illustration, the broader sentiment throughout the crypto-market has been fairly unfavorable. Nevertheless, it might appear that AVAX could also be poised for a brand new rally once more.

AVAX technical evaluation and key ranges

In accordance with AMBCrypto’s technical evaluation, AVAX stays fairly bullish and will soar by 12% to achieve the $28.50 degree within the coming days.

In actual fact, its current worth motion indicated that every time the asset’s worth approaches the assist degree of $24.50, it encounters some shopping for strain and a worth reversal.

Aside from this horizontal assist degree, AVAX, at press time, was supported by an upward-sloping trendline, which has been in place for the reason that starting of August 2024. Just like the horizontal assist degree, every time the asset’s worth hits this trendline, it tends to report a notable upward rally.

On the time of writing, AVAX gave the impression to be buying and selling beneath the 200 Exponential Shifting Common (EMA) on the each day timeframe, indicating an uptrend. In the meantime, its Relative Energy Index (RSI) prompt a doable upward rally, because it was within the oversold space.

AVAX’s bullish thesis will maintain provided that it stays above the $24.50-level. In any other case, it should fail.

Bullish on-chain metrics

Along with this constructive technical evaluation, on-chain metrics reminiscent of key liquidation ranges and the Lengthy/Brief ratio additional supported this bullish outlook. In accordance with the on-chain analytics agency CoinGlass, as an illustration, Binance’s AVAX Lengthy/Brief ratio had a worth of two.83 at press time.

This discovering alluded to a powerful bullish sentiment amongst merchants. Moreover, 73.91% of prime merchants on Binance appeared to carry lengthy positions, whereas 26.09% of them held quick positions.

Main liquidation ranges

Proper now, the main liquidation ranges are at $24.35 on the decrease facet and $25.45 on the higher facet, with merchants over-leveraged at these ranges, in accordance with Coinglass.

If the sentiment stays bullish and the value rises to the $25.45-level, almost $875,300 value of quick positions will likely be liquidated. Conversely, if the sentiment shifts and the value falls to the $24.35-level, roughly $2.94 million value of lengthy positions will likely be liquidated.

Combining these on-chain metrics with technical evaluation prompt that AVAX bulls are presently dominating the asset and should assist an upcoming rally.