After we launched the Nasdaq IPO Pulse a yr in the past, we mentioned it prompt that U.S. “IPO exercise… ought to stay in an uptrend” as we headed into 2024.

Then, once we launched the Nasdaq Stockholm IPO Pulse in September, we wrote that it “suggests [Stockholm] IPO exercise… is more likely to stay in an uptrend within the coming months.”

And now, it appears to be like like our IPO Pulses had been proper!

2024 was a yr of restoration for IPO exercise within the U.S. and Stockholm

Following the sooner upturns in our U.S. and Stockholm IPO Pulses, precise IPO exercise additionally recovered – in each the U.S. and Stockholm – in 2024.

In line with Nasdaq’s information, the U.S. noticed 179 non-SPAC IPOs in 2024 – probably the most since 2021, and a 40% improve over 2023 (127). By worth raised (ex SPACs), it was a good higher yr, with worth raised rising over 50% from 2023 to $30 billion – additionally probably the most since 2021.

Plus, the yr ended sturdy, with This fall having probably the most non-SPAC IPOs in 1 / 4 (53) in three years.

Sweden noticed a greater than 60% soar in IPOs in 2024 (23) in comparison with 2023 (14 IPOs). Sweden additionally closed the yr sturdy, with This fall having probably the most IPOs in 1 / 4 (10) in 2½ years.

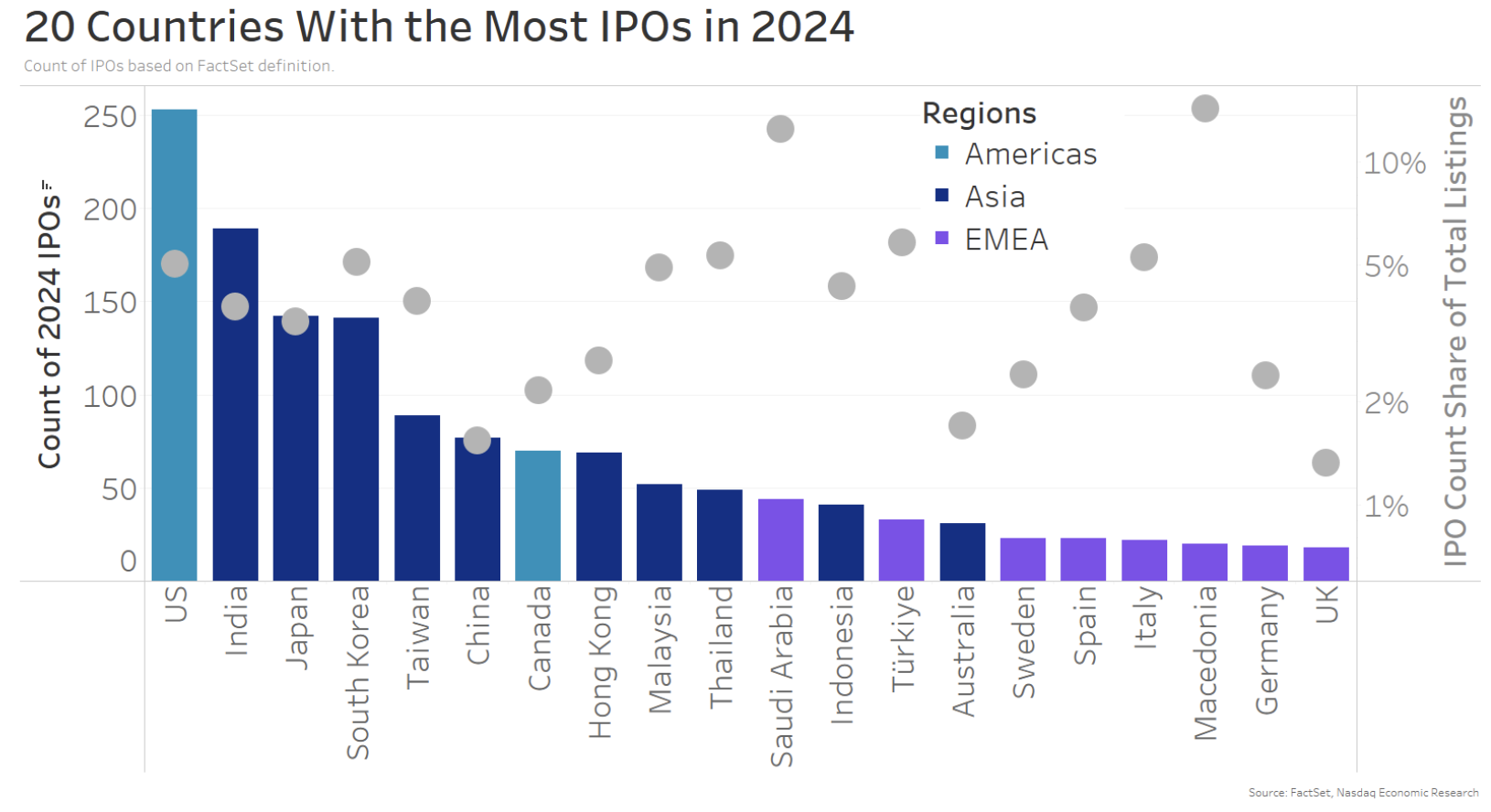

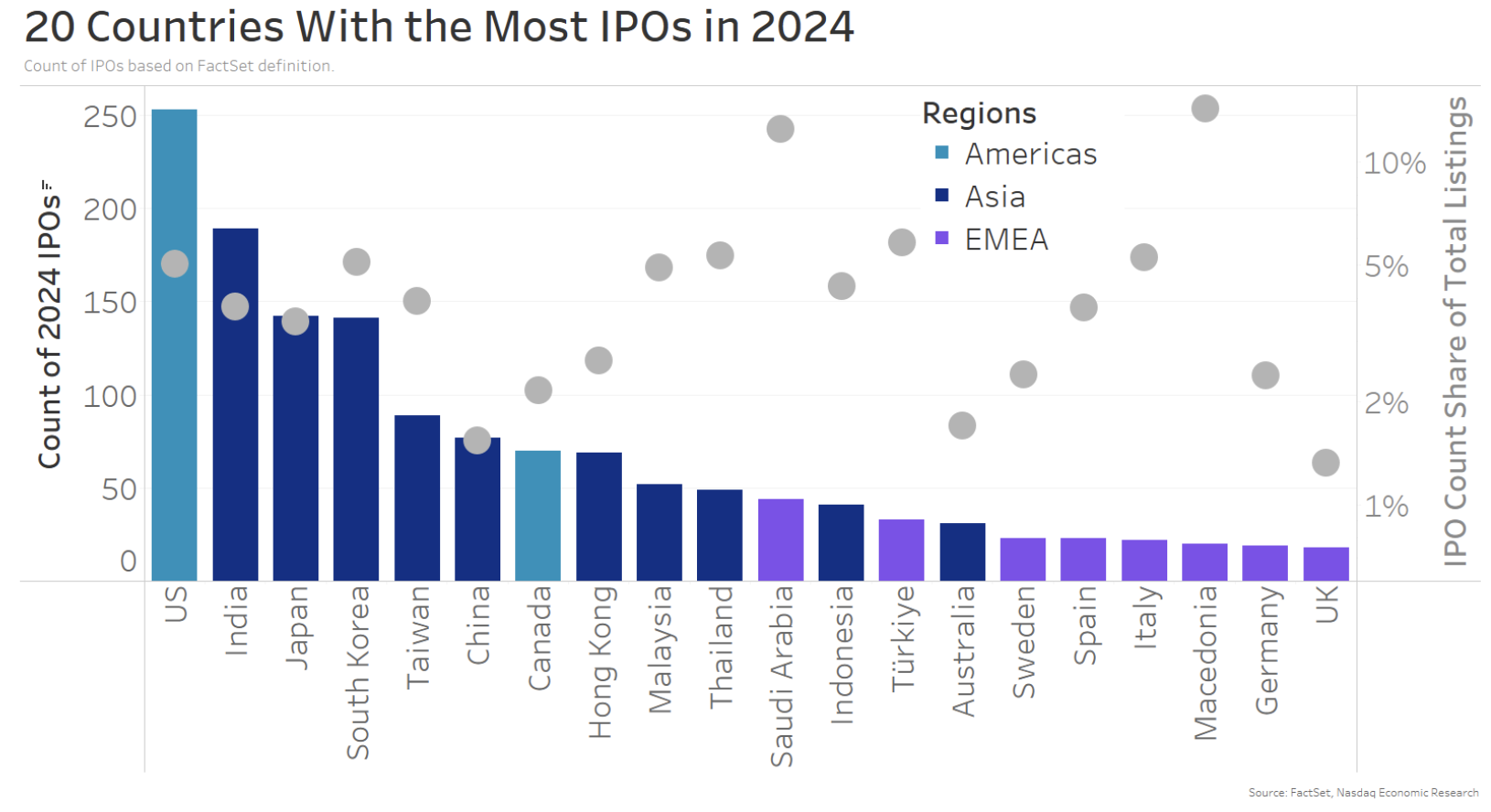

U.S. led world IPOs, adopted by Asia, whereas some main markets lagged

Not solely did the U.S. have a powerful yr for IPOs when in comparison with current years, but additionally when in comparison with the remainder of the world.

In line with FactSet information (together with SPACs), the U.S. had over 250 IPOs in 2024.

After the U.S., the listing was dominated by Asian (and Rising) Markets, which took 12 of the highest 14 spots.

European markets rounded out the highest 20 within the chart (Sweden took fifteenth place), however there are some main European economies lacking from this listing, together with France and the Netherlands, which each fell exterior the highest 20.

Chart 1: U.S. leads world IPO exercise in 2024, adopted by Asian markets

Since most nations have very totally different sized economies and inventory markets, it’s somewhat unfair to check nations by a easy depend of IPOs.

A “fairer” comparability is to take a look at the share improve in listings as a result of IPOs in every nation. We present that within the gray circles. By that measure, 11 nations – together with the U.S. (5%) – had been clustered within the 4%-6% vary. The clear winners in 2024 had been Macedonia (14%) and Saudi Arabia (12%). Whereas China, Australia and the U.Ok. scored the bottom.

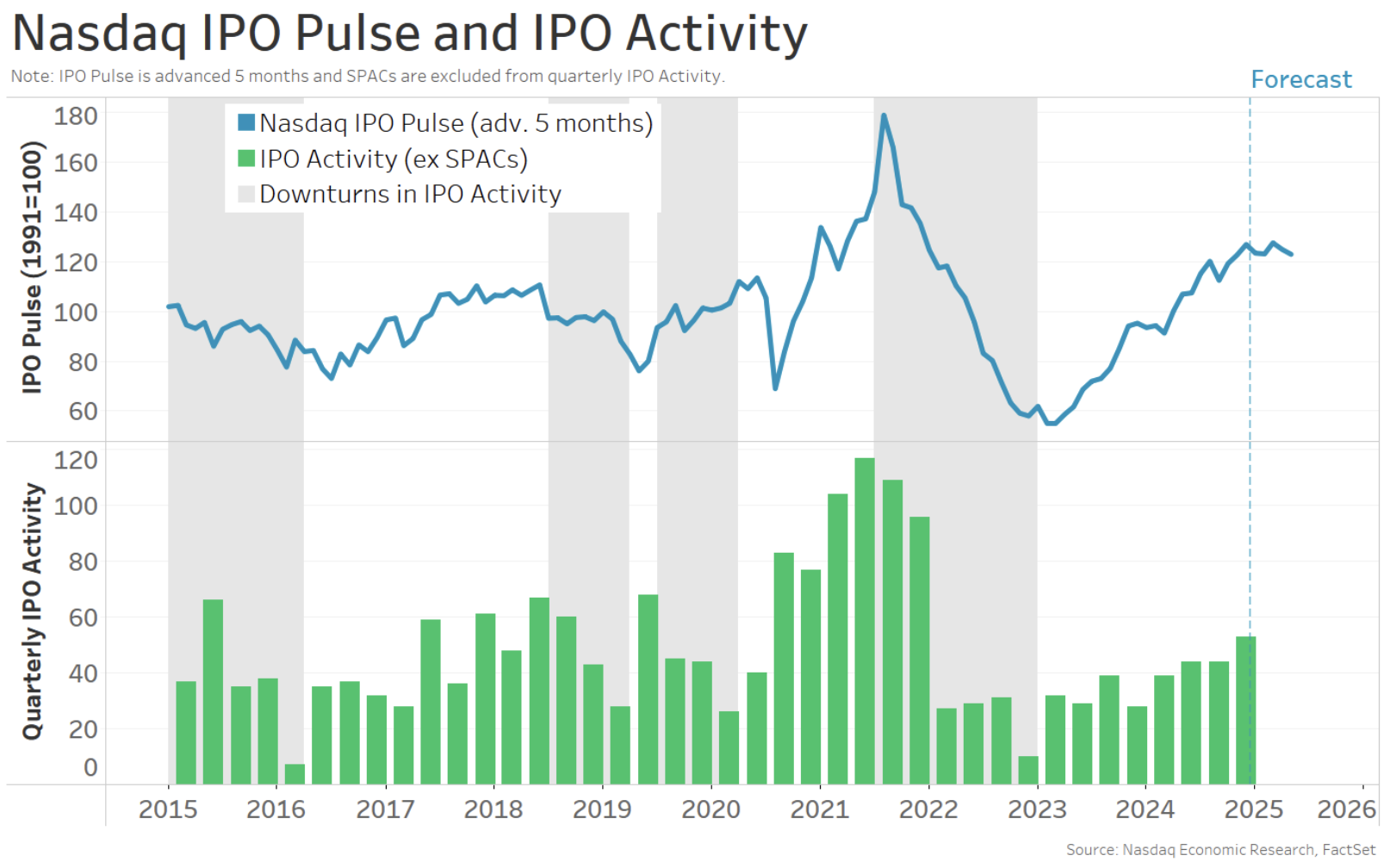

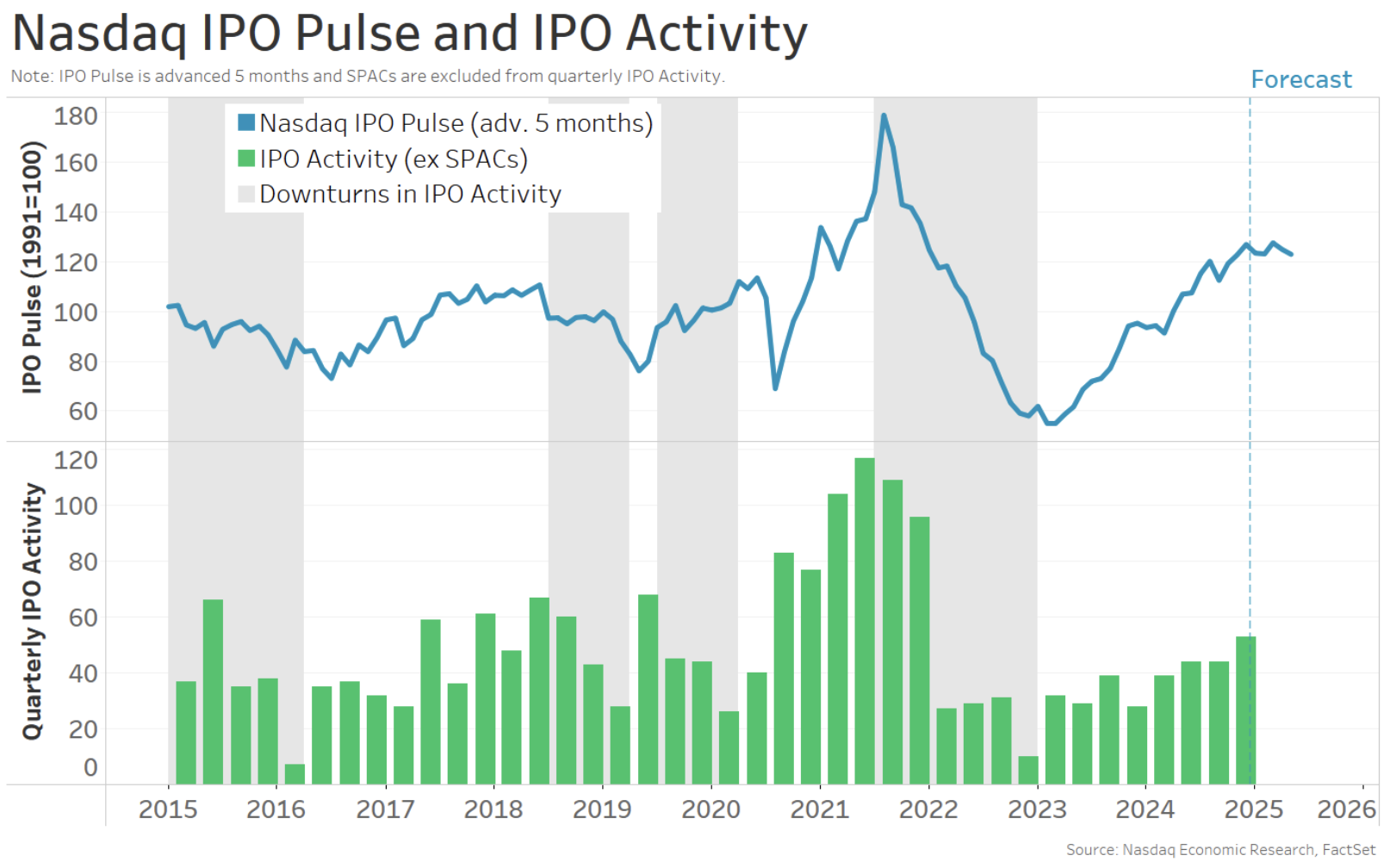

Nasdaq IPO Pulse close to excessive, indicating continued uptrend in U.S. IPOs

Though 2024 was one of the best yr for U.S. IPOs in three years, some commenters assume 2025 shall be a good higher yr. Proper now, the cyclical drivers of future IPO exercise captured by the Nasdaq IPO Pulse look fairly supportive.

Whereas the IPO Pulse ticked down in December, it’s simply off October’s 3¼-year excessive, suggesting U.S. IPO exercise ought to stay in an uptrend into mid-year.

Chart 2: The Nasdaq IPO Pulse suggests IPO exercise will maintain up into mid-2025

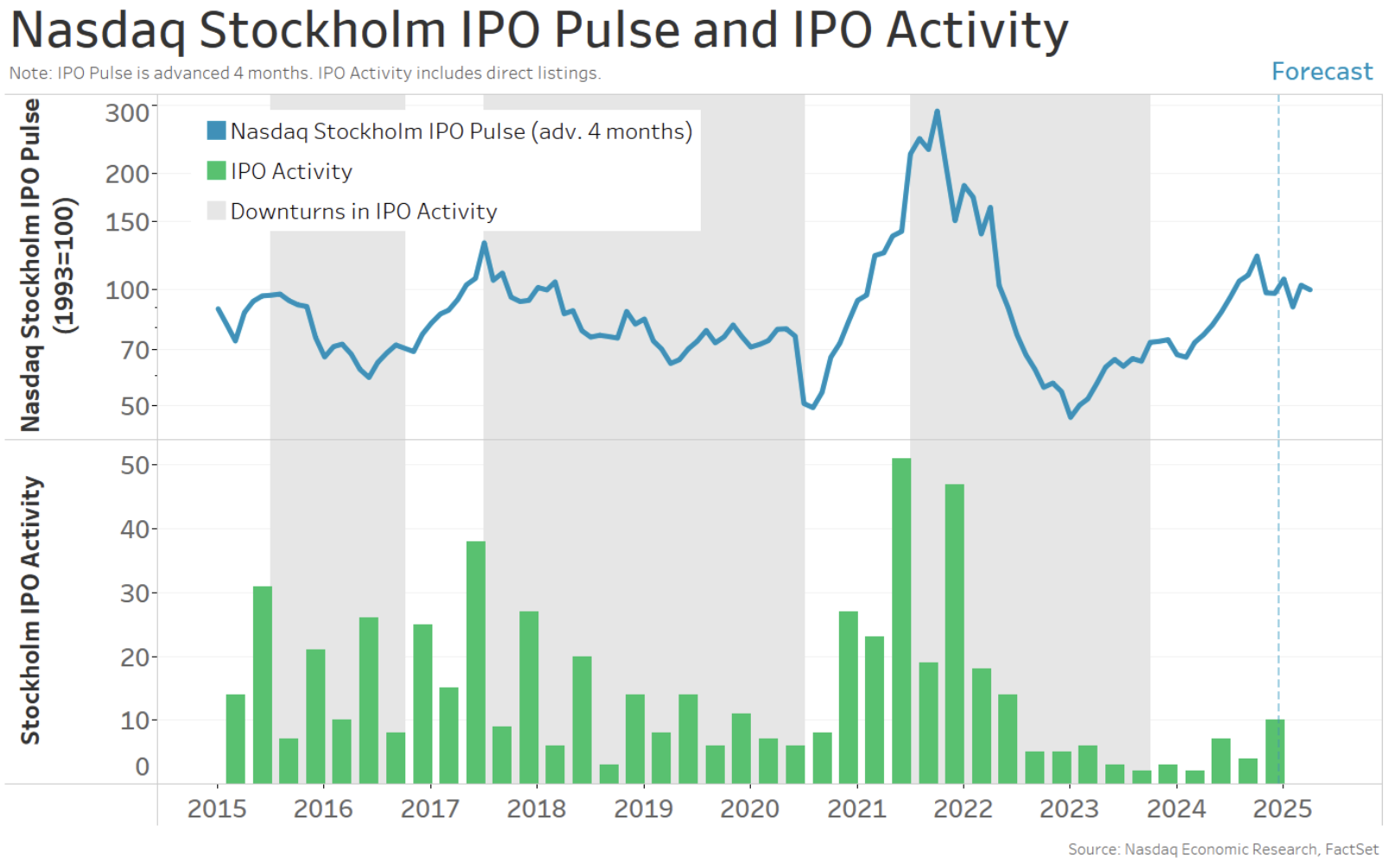

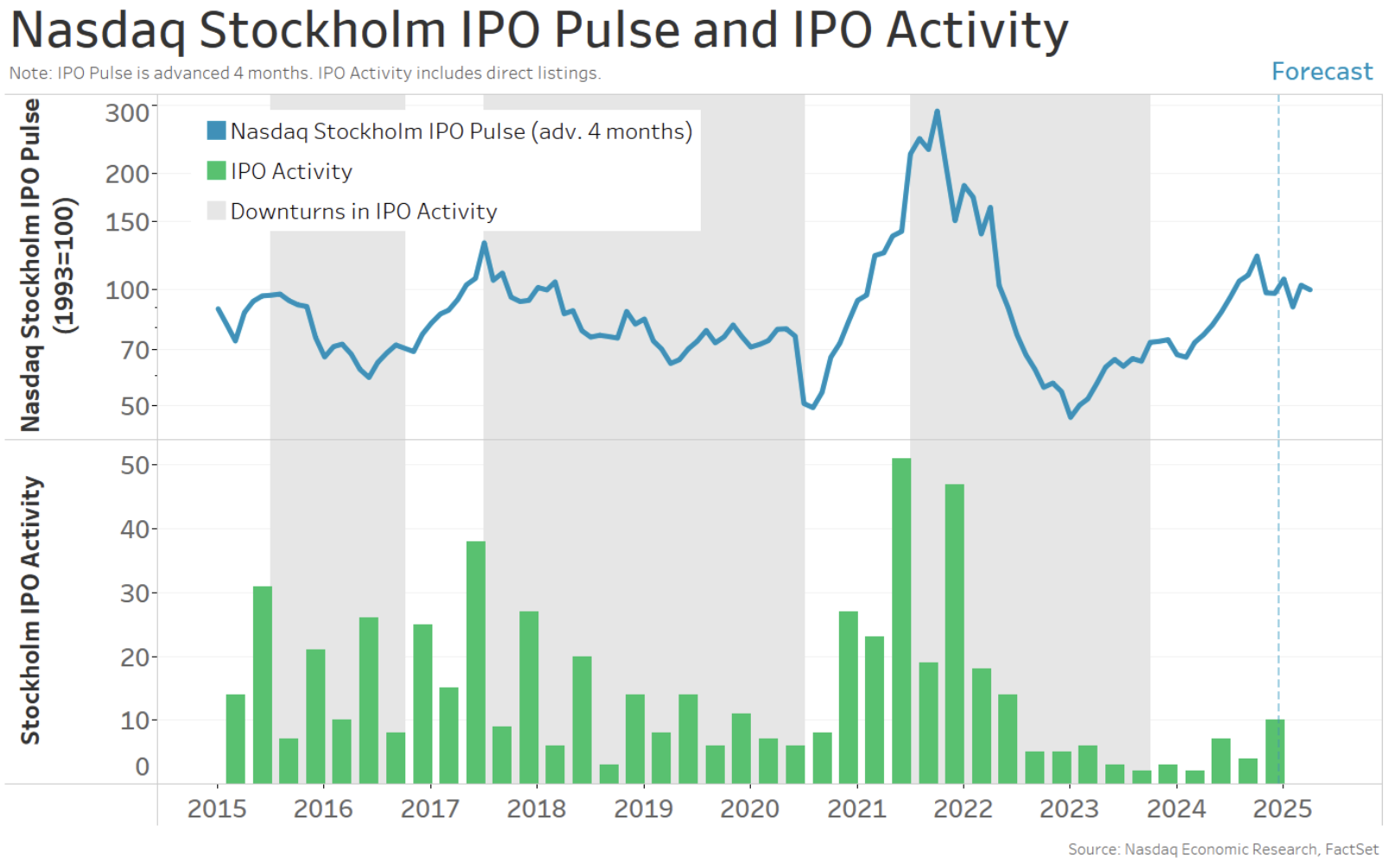

Nasdaq Stockholm IPO Pulse off its excessive, however not but signaling a downturn

For Stockholm, the IPO Pulse upturn has pale, however isn’t but on the level that it’s clearly indicating a downturn is forward.

The Nasdaq Stockholm IPO Pulse was in an unambiguous upturn by the primary half of 2024, reaching a 2½-year excessive in June (chart under, blue line). Since then, it’s come off that prime, but it surely remained above October’s eight-month low in December.

Chart 3: The Stockholm IPO Pulse sees a continued upturn in IPO exercise into the spring

Given this current softening, we are able to take a look at whether or not it’s really signaling a downturn in IPO exercise by evaluating it to its previous downturns. That’s as a result of most of these previous downturns genuinely anticipated downtrends in IPO exercise, whereas a pair had been false alarms.

Thankfully, based mostly on that comparability, this current slowing at the moment appears to be like barely extra much like historic false alarms, so the Stockholm IPO Pulse is not but conclusively indicating a directional shift in IPO exercise.

Which means we must always count on Stockholm IPO exercise to remain in an uptrend for now, however our subsequent replace in April ought to assist make clear whether or not a near-term downturn is probably going.

U.S. and Stockholm IPO Exercise more likely to keep in uptrends into Q2 2025

2024 was a yr of restoration for IPO exercise within the U.S. and Stockholm. And based mostly on our IPO Pulses, IPO exercise appears to be like more likely to keep in an uptrend into mid-year – particularly within the U.S.

In fact, lots can change over the course of a yr, so we’ll be updating our Nasdaq IPO Pulses every quarter to see if these uptrends will proceed past mid-year, or if a directional shift lies forward.

After we launched the Nasdaq IPO Pulse a yr in the past, we mentioned it prompt that U.S. “IPO exercise… ought to stay in an uptrend” as we headed into 2024.

Then, once we launched the Nasdaq Stockholm IPO Pulse in September, we wrote that it “suggests [Stockholm] IPO exercise… is more likely to stay in an uptrend within the coming months.”

And now, it appears to be like like our IPO Pulses had been proper!

2024 was a yr of restoration for IPO exercise within the U.S. and Stockholm

Following the sooner upturns in our U.S. and Stockholm IPO Pulses, precise IPO exercise additionally recovered – in each the U.S. and Stockholm – in 2024.

In line with Nasdaq’s information, the U.S. noticed 179 non-SPAC IPOs in 2024 – probably the most since 2021, and a 40% improve over 2023 (127). By worth raised (ex SPACs), it was a good higher yr, with worth raised rising over 50% from 2023 to $30 billion – additionally probably the most since 2021.

Plus, the yr ended sturdy, with This fall having probably the most non-SPAC IPOs in 1 / 4 (53) in three years.

Sweden noticed a greater than 60% soar in IPOs in 2024 (23) in comparison with 2023 (14 IPOs). Sweden additionally closed the yr sturdy, with This fall having probably the most IPOs in 1 / 4 (10) in 2½ years.

U.S. led world IPOs, adopted by Asia, whereas some main markets lagged

Not solely did the U.S. have a powerful yr for IPOs when in comparison with current years, but additionally when in comparison with the remainder of the world.

In line with FactSet information (together with SPACs), the U.S. had over 250 IPOs in 2024.

After the U.S., the listing was dominated by Asian (and Rising) Markets, which took 12 of the highest 14 spots.

European markets rounded out the highest 20 within the chart (Sweden took fifteenth place), however there are some main European economies lacking from this listing, together with France and the Netherlands, which each fell exterior the highest 20.

Chart 1: U.S. leads world IPO exercise in 2024, adopted by Asian markets

Since most nations have very totally different sized economies and inventory markets, it’s somewhat unfair to check nations by a easy depend of IPOs.

A “fairer” comparability is to take a look at the share improve in listings as a result of IPOs in every nation. We present that within the gray circles. By that measure, 11 nations – together with the U.S. (5%) – had been clustered within the 4%-6% vary. The clear winners in 2024 had been Macedonia (14%) and Saudi Arabia (12%). Whereas China, Australia and the U.Ok. scored the bottom.

Nasdaq IPO Pulse close to excessive, indicating continued uptrend in U.S. IPOs

Though 2024 was one of the best yr for U.S. IPOs in three years, some commenters assume 2025 shall be a good higher yr. Proper now, the cyclical drivers of future IPO exercise captured by the Nasdaq IPO Pulse look fairly supportive.

Whereas the IPO Pulse ticked down in December, it’s simply off October’s 3¼-year excessive, suggesting U.S. IPO exercise ought to stay in an uptrend into mid-year.

Chart 2: The Nasdaq IPO Pulse suggests IPO exercise will maintain up into mid-2025

Nasdaq Stockholm IPO Pulse off its excessive, however not but signaling a downturn

For Stockholm, the IPO Pulse upturn has pale, however isn’t but on the level that it’s clearly indicating a downturn is forward.

The Nasdaq Stockholm IPO Pulse was in an unambiguous upturn by the primary half of 2024, reaching a 2½-year excessive in June (chart under, blue line). Since then, it’s come off that prime, but it surely remained above October’s eight-month low in December.

Chart 3: The Stockholm IPO Pulse sees a continued upturn in IPO exercise into the spring

Given this current softening, we are able to take a look at whether or not it’s really signaling a downturn in IPO exercise by evaluating it to its previous downturns. That’s as a result of most of these previous downturns genuinely anticipated downtrends in IPO exercise, whereas a pair had been false alarms.

Thankfully, based mostly on that comparability, this current slowing at the moment appears to be like barely extra much like historic false alarms, so the Stockholm IPO Pulse is not but conclusively indicating a directional shift in IPO exercise.

Which means we must always count on Stockholm IPO exercise to remain in an uptrend for now, however our subsequent replace in April ought to assist make clear whether or not a near-term downturn is probably going.

U.S. and Stockholm IPO Exercise more likely to keep in uptrends into Q2 2025

2024 was a yr of restoration for IPO exercise within the U.S. and Stockholm. And based mostly on our IPO Pulses, IPO exercise appears to be like more likely to keep in an uptrend into mid-year – particularly within the U.S.

In fact, lots can change over the course of a yr, so we’ll be updating our Nasdaq IPO Pulses every quarter to see if these uptrends will proceed past mid-year, or if a directional shift lies forward.