Let’s speak about insider buying and selling. Not the unlawful sort, however the completely regular – and absolutely authorized – buying and selling by top-level company officers. These are the C-suite residents and the members of the Boards, firm officers who know what’s occurring behind the scenes and are accountable to shareholders for bringing in earnings. They sometimes maintain shares in their very own corporations and make trades primarily based on the information they’ve from behind the scenes.

To maintain the enjoying area stage, federal regulators require that firm insiders publish these transactions – and traders can profit from seeing simply which shares the company officers are shopping for. There’s one factor to recollect: firm brass will promote their shares for a large number of causes, however they’ll solely purchase large after they imagine the inventory is on the way in which up.

So, let’s check out some latest insider trades. Utilizing the Insiders’ Scorching Shares instrument from TipRanks, we’ve pulled up the latest knowledge on two shares which have not too long ago seen multi-million greenback buys from Board members. In every case, that is the primary such buy from the insider. With the numerous outlay of the purchase, that factors to elevated confidence within the firm’s prospects for the near- to mid-term.

Along with the latest high-value insider purchases, the TipRanks knowledge exhibits us that each shares function Robust Purchase scores from the Avenue and stable upside potential for the approaching 12 months. Right here’s a more in-depth take a look at them.

Terns Prescribed drugs (TERN)

First up is Terns Prescribed drugs, a biopharmaceutical analysis agency working at each the early improvement and the scientific trials levels. The corporate has set its sights on the fields of oncology and metabolic illness, and has a scientific program underway in every of those areas, concentrating on persistent myeloid leukemia (CML) within the first and weight problems, a significant well being problem, within the second. The corporate’s pipeline consists of novel small molecule compounds, with clinically validated modes of motion.

That’s a mouthful, but it surely comes all the way down to a pipeline that options two Section 1 scientific trials. The primary of those options TERN-701, an allosteric BCR-ABL tyrosine kinase inhibitor, or TKI, designed to deal with CML. This most cancers begins within the bone marrow, the place blood cells are shaped, and is taken into account a persistent, life-long and life-threatening illness that regularly requires adjustments in therapies. Terns’ drug candidate, TERN-701, is present process the Section 1 CARDINAL trial, a two-part research to guage the security, pharmacokinetics, and efficacy of the drug. Interim knowledge from the primary cohorts of the dose escalation a part of the research is predicted for launch this coming December.

Additionally of be aware on the scientific trial facet is TERN-601, which has simply accomplished a Section 1 trial. This drug is an orally dosed, glucagon-like peptide-1 (GLP-1) receptor agonist, below investigation as an weight problems remedy. The corporate launched constructive trial outcomes from that research earlier this month, exhibiting that TERN-601 produced a statistically important weight reduction in trial members over a 28-day interval. The drug was thought of well-tolerated, and the corporate plans to provoke a Section 2 trial subsequent 12 months.

Additionally on the weight problems monitor, Terns has not too long ago reported constructive pre-clinical knowledge from one other drug candidate, TERN-501. This pre-clinical knowledge helps utilizing TERN-501 together with a GLP-1 receptor agonist as a remedy for weight problems. The information confirmed that TERN-501, within the combo remedy, resulted in larger weight reduction and a greater retention of lean mass.

These scientific applications don’t come low-cost, and Terns not too long ago performed a public inventory providing to lift capital. The corporate providing, which noticed greater than 14 million shares made accessible, closed on September 12. Terns raised roughly $172.7 million in gross proceeds from the sale.

With that in thoughts, we will flip to the insider trades – and we see that Board of Administrators member Lu Hongbo bought 476,190 shares on the day the general public providing closed. Hongbo paid nealy $5 million for this inventory buy.

This inventory has additionally caught the eye of BMO analyst Etzer Darout, who likes the a number of catalysts lined up for it.

“With the weight problems knowledge from TERN-601 (oral GLP-1 agonist), TERN has delivered on a once-daily and clinically aggressive drug profile for 2 of its three scientific applications (TERN-501, TERN-601) which provides us extra confidence forward of Section 1 CML dose escalation knowledge with TERN-701 (BCR-ABL allosteric) in December. With two partially de-risked scientific applications and one other de-risking occasion upcoming, we proceed to love the risk-reward for TERN and its setup for worth creation in oncology and metabolic illnesses,” Darout opined.

These feedback again up Darout’s Outperform (i.e. Purchase) ranking on TERN shares, and his $26 value goal factors towards a possible one-year acquire of 159%. (To observe Darout’s monitor file, click on right here)

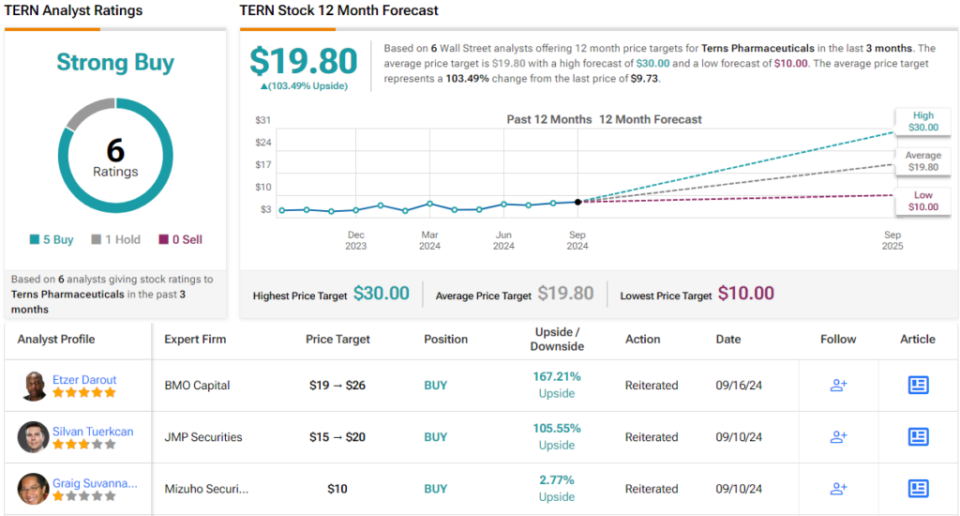

Total, this inventory’s Robust Purchase consensus ranking relies on 6 latest analyst critiques that break up 5 to 1 in favor of Purchase over Maintain. The shares are at present buying and selling at $9.73, and the common goal value, $19.80, implies a 103% upside within the subsequent 12 months. (See TERN inventory forecast)

Permian Assets (PR)

For the second inventory on our record, we’ll shift gears and take a look at the power sector. Permian Assets is an impartial oil and fuel exploration and manufacturing agency working within the wealthy oil fields of Texas. The corporate’s title offers away its sport – Permian’s property are situated within the richest elements of the Permian Basin of Texas-New Mexico. The corporate’s land holdings whole greater than 400,000 internet leasehold acres, which incorporates greater than 68,000 internet royalty acres. These holdings are targeted within the Midland and Delaware Basins of the bigger Permian formation, and a few 45% of the manufacturing on these landholdings is crude oil.

This makes Permian one of many area’s largest pure-play hydrocarbon E&P companies, and on September 17 the corporate introduced the closing of a bolt-on acquisition to its Delaware Basin property. The acquisition, a take care of Occidental, added ~29,500 internet acres and ~9,900 internet royalty acres, together with a big quantity of midstream infrastructure, to Permian’s present Reeves County, Texas positions.

In one other replace that ought to curiosity traders, Permian introduced on September 3 a big improve to its common base dividend. The dividend cost, previously at 6 cents per frequent share, has been elevated by 150% and is now set at 15 cents per share to be paid out beginning in 3Q24. The brand new annualized charge of 60 cents per share will give a ahead yield of 4.3% primarily based on the present share worth.

Permian attracted a latest massive purchase from an insider, firm director William Quinn. Quinn made two purchases, on September 10 and 11, that totaled 312,429 shares – and price greater than $3.99 million.

Turning to the analysts’ view of the inventory, we’ll verify in with Truist’s power sector knowledgeable Neal Dingmann, who sees Permian as the most effective shares that he covers, with loads of capital return and efficient merger actions. In a be aware earlier this month, Dingmann wrote, “We imagine PR operations proceed to be among the many greatest in our protection with enhancing effectively outcomes and reducing of unit prices whereas now including an equally secure monetary plan that may embrace notable share buybacks. Additional, the excessive share overhang has been eradicated with present personal fairness doubtless promoting fewer shares going ahead. The corporate additionally continues to have one of many more practical M&A methods that won’t change going ahead with a concentrate on accretive additions in core areas. As such, we imagine there stays notable share value upside potential with the present valuation not reflective of continued operational and monetary success.”

For Dingmann, PR shares get a Purchase ranking with a $22 value goal that suggests an upside of 55% on the one-year horizon. (To observe Dingmann’s monitor file, click on right here)

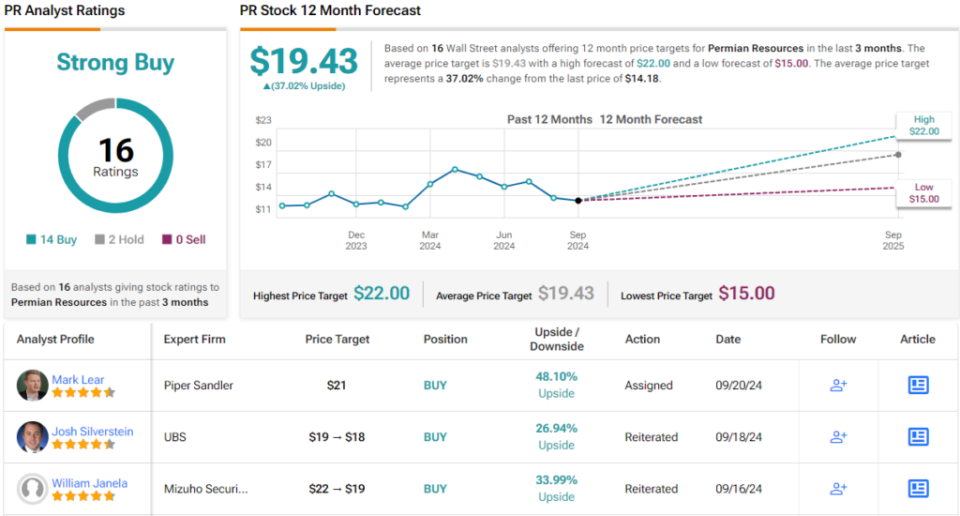

All in all, PR’s Robust Purchase consensus ranking relies on 16 critiques that embrace 14 Buys towards simply 2 Holds. With a buying and selling value of $14.18 and a median goal value of $19.43, Permian’s inventory has a 37% upside this coming 12 months. (See PR inventory forecast)

To seek out good concepts for shares buying and selling at enticing valuations, go to TipRanks’ Finest Shares to Purchase, a instrument that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is extremely vital to do your personal evaluation earlier than making any funding.