- HYPE overcame a serious resistance degree up to now 24 hours, however has extra obstacles forward.

- Hyperliquid dominated a number of on-chain metrics, together with rising TVL, charges, and perpetual quantity.

Hyperliquid [HYPE] has seen a major climb up to now 24 hours, gaining over 16%. This continues its weekly achieve of 14.29%.

In accordance with AMBCrypto evaluation, regardless of the present obstacles in place, HYPE has a excessive likelihood of hitting a brand new market excessive as sentiment begins delivering favor of the bulls.

Obstacles forward for HYPE: The place subsequent?

HYPE’s important rally up to now 24 hours got here after breaching a serious resistance degree marked by a Fibonacci degree on the chart at $25.08, with the value now heading for its January excessive at $27.05.

If the present market momentum is sustainable, then HYPE would doubtless cross its month-to-month excessive whereas heading to achieve larger ranges.

Nevertheless, it could face sure resistance on the chart, particularly at $27.115, $29.148, and $32.043, because it rallies larger.

Assuming the pattern stays bullish, these ranges could be minor retraction factors earlier than a continued upward motion.

To find out if the present market sentiment would maintain HYPE establishing new market highs, AMBCrypto seemed into different metrics, suggesting a excessive likelihood.

Liquidity influx and utilization grows

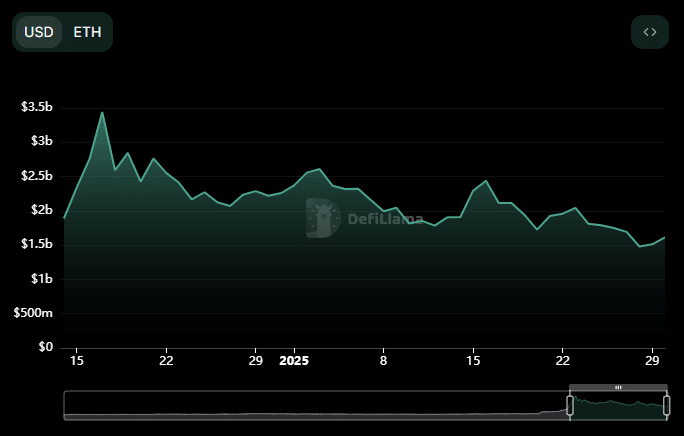

Perception on DeFiLlama exhibits there’s been a constant decline within the development of HYPE’s complete worth locked (TVL) over the times, establishing new lows and sustaining that degree.

TVL measures the liquidity circulation into protocols. It usually displays market sentiment towards an asset. A surge in TVL indicators market confidence, whereas a decline signifies a possible fall.

Within the final 48 hours, nevertheless, a directional shift has occurred, and HYPE’s TVL is trying to set up a brand new excessive, now reaching $1.651 billion from a low of $1.48 billion on the twenty eighth of January.

Equally, there’s been a surge in charges generated over the previous 24 hours, rising from $1.5 million to $2.0 million. When charges develop, it signifies excessive utilization of protocols inside the ecosystem, which HYPE now advantages from.

Extra utilization tends to influence an asset’s value positively and signifies the potential for it to constantly surge even larger.

HYPE stays dominant

In accordance with Artemis’ rating of the highest 10 perpetual protocols available in the market, HYPE takes the lead, pacing forward of others.

Learn Hyperliquid’s [HYPE] Worth Prediction 2025–2026

Prior to now seven days, the full buying and selling quantity throughout these prime perpetual protocols hit $43.6 billion, with Hyperliquid contributing 56.0%, recording a buying and selling quantity of $24.2 billion throughout this era.

Ought to this buying and selling quantity preserve surging, alongside transaction charges and TVL, HYPE is well-positioned for a continued upward transfer available in the market and will probably surpass the key impediment marked on the chart.

![Hyperliquid [HYPE] soars 16% in 24 hours – Is that this the beginning of a bigger rally?](https://webtradetalk.com/wp-content/uploads/2025/01/Editors-58-1000x600.webp-750x375.webp)