As we’ve famous earlier than, index rebalance days are inclined to lead to a lot bigger closing auctions. That’s as a result of most index funds attempt to precisely match what their index supplier does – and index adjustments occur utilizing the official closing value.

For instance, a typical shut accounts for lower than 10% of quantity traded in the course of the day; in the meantime, some index rebalance dates see over 30% of quantity traded within the shut.

Primarily based on this information, we will use the dimensions of the closing trades on index addition days to estimate whole index fund monitoring. The outcomes present that many corporations may need round 1 / 4 of all float-shares purchased by totally different index funds.

It’s necessary to notice that corporations profit from being added to main indexes as they see vital new (and sometimes long-term) traders.

Index rebalance days have massive shut volumes

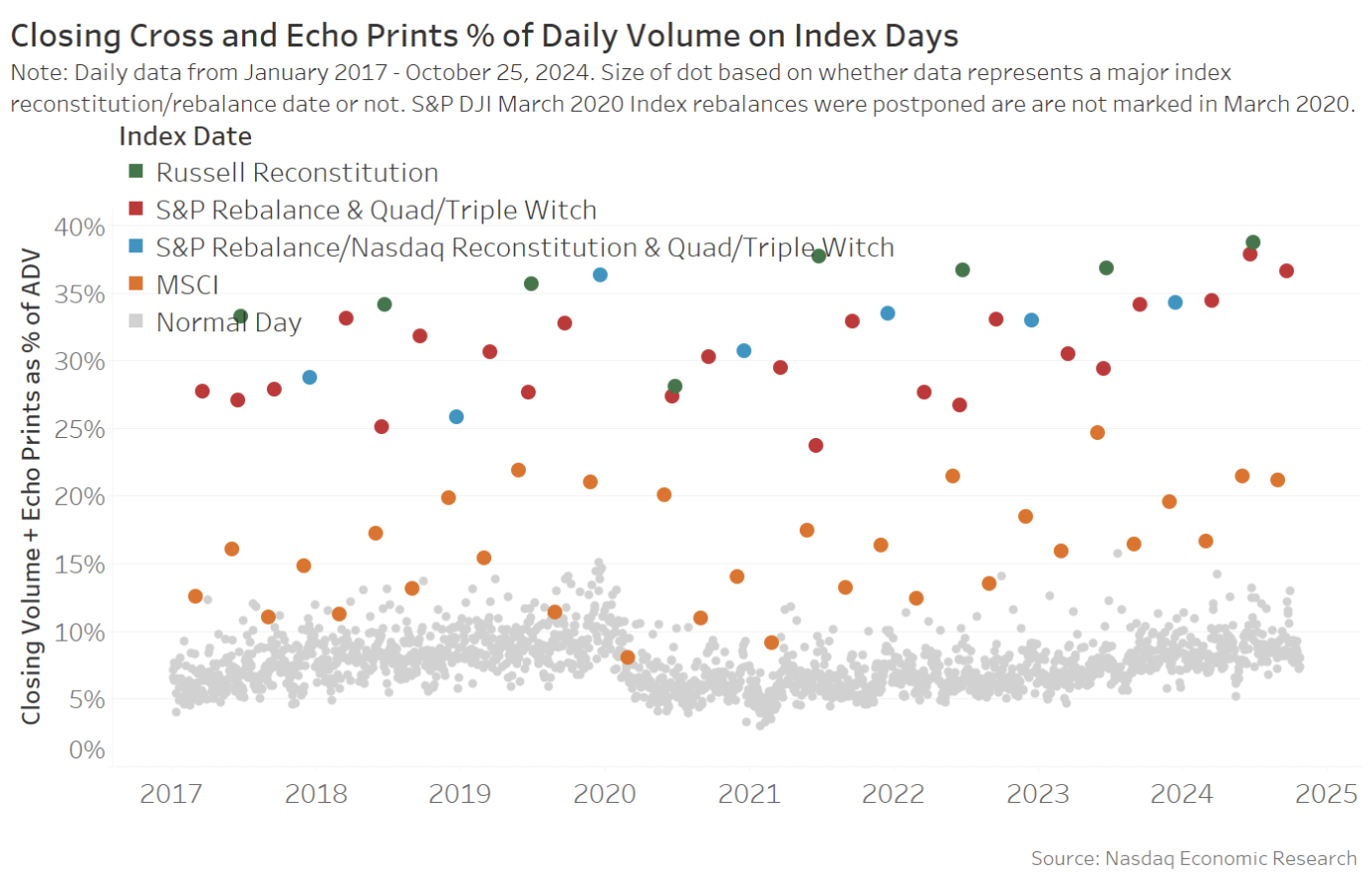

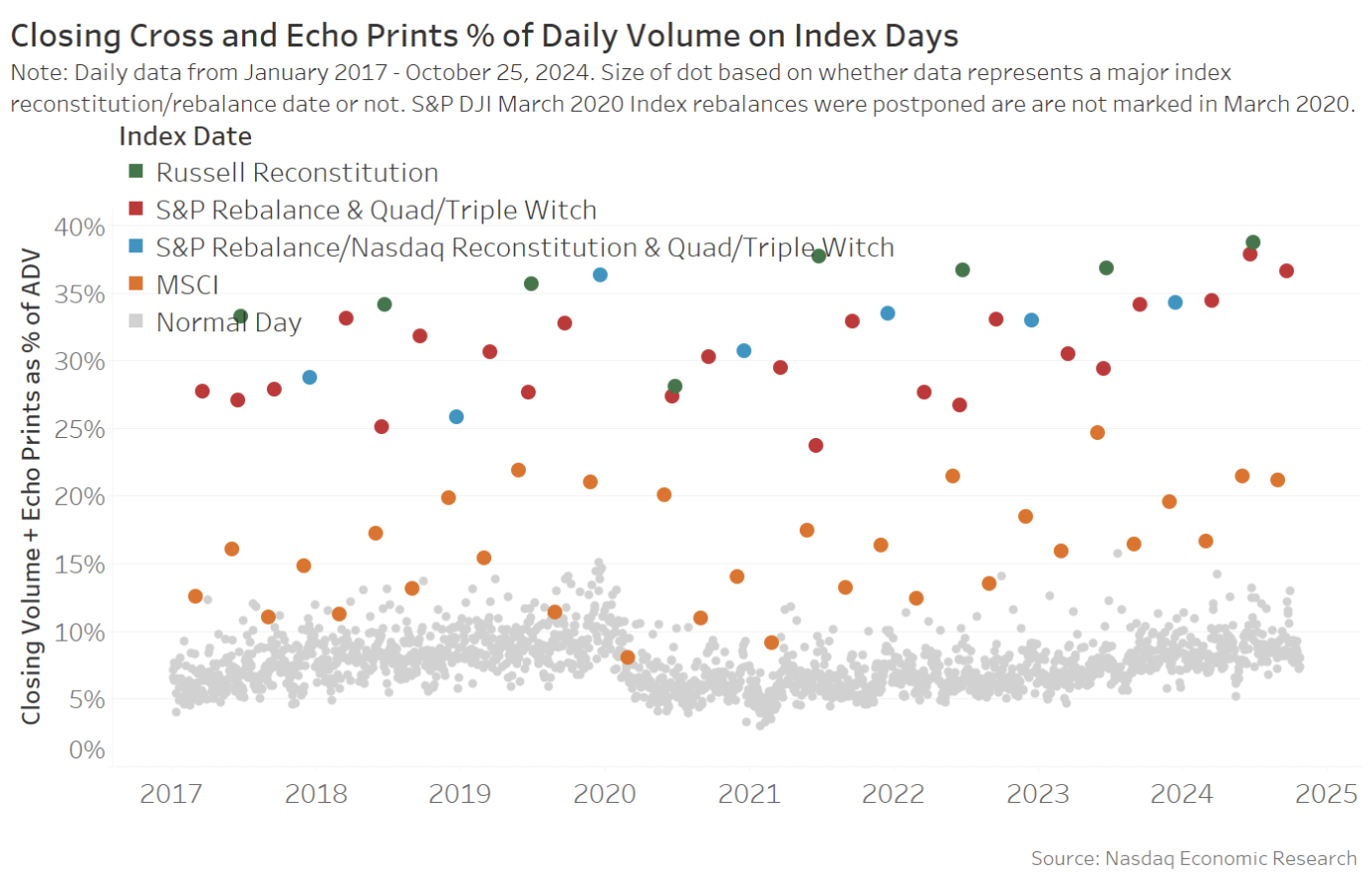

As the information within the chart beneath exhibits, there are only a few dates every year index trades sometimes occur:

- MSCI is (sometimes) on the finish of Could and November. S&P, Nasdaq and FTSE indexes rebalance on the third Friday of the final month within the quarter. That’s additionally “quad witch” day, which makes the shut volumes even larger.

- Russell rebalances their indexes yearly, often on the final Friday in June that’s not quarter finish.

Chart 1: Index rebalance days see exceptionally massive closing volumes

A typical shut at present provides to round $40 billion in buying and selling, which is lower than 10% of the amount traded in the course of the day (gray dots).

In distinction, S&P and Russell index dates see a mean $240 billion buying and selling within the shut, including to over 30% of the day’s closing quantity, and considerably elevating the whole buying and selling in the course of the day (ADV), too. Even MSCI rebalances trigger the shut to extend to round 20% of ADV.

Utilizing closing buying and selling to estimate index monitoring

There are two methods we will estimate how a lot index funds monitoring every index provides:

- High down: Generally index suppliers disclose how a lot cash tracks their indexes. Some lecturers have additionally added up all of the index fund holdings from 13F filings. You can even attempt to reconcile that to ICI disclosures that these days say index funds are round 50% of all mutual funds.

- Bottoms up: One other means is behavioral – to take a look at what number of shares really commerce on the index rebalance dates. Figuring out that index funds solely really want to commerce on the rebalance date, and that to be able to precisely monitor the index earlier than market open the subsequent day, many funds favor to commerce concurrently the benchmark is modified (which is the shut!), representing one other method to see how massive index funds is perhaps.

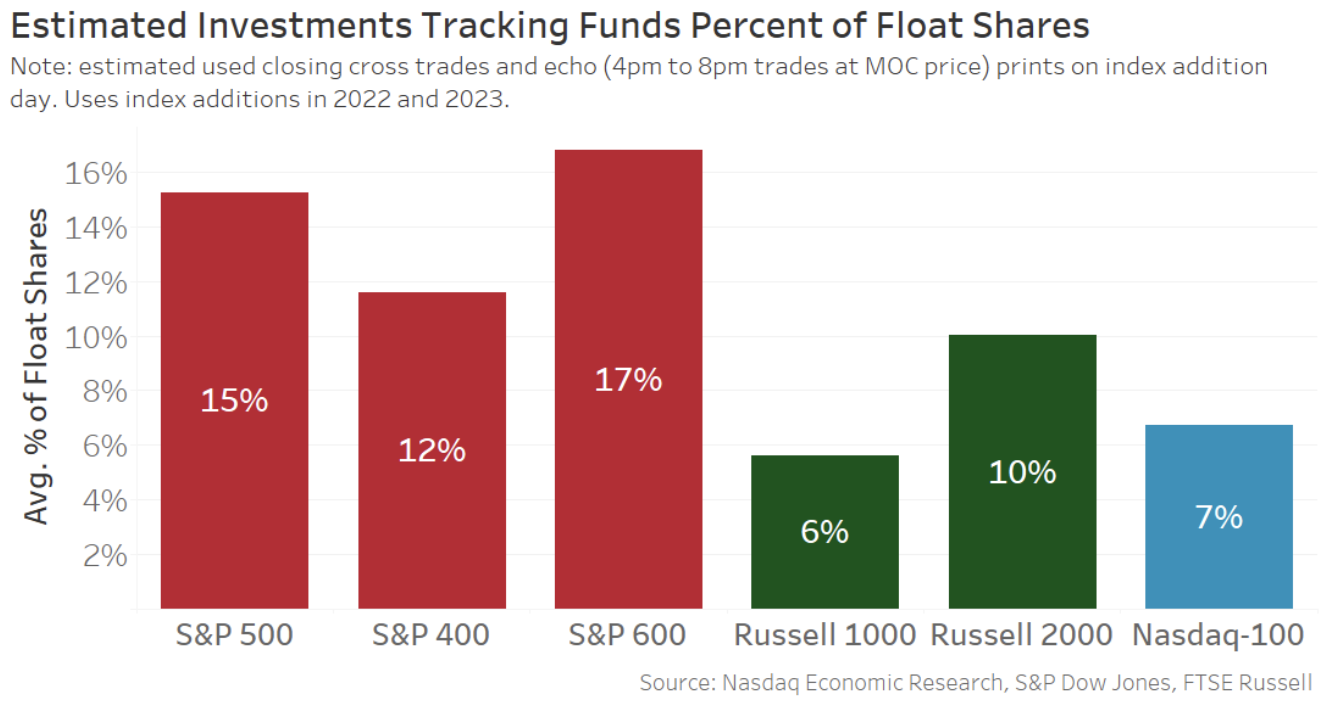

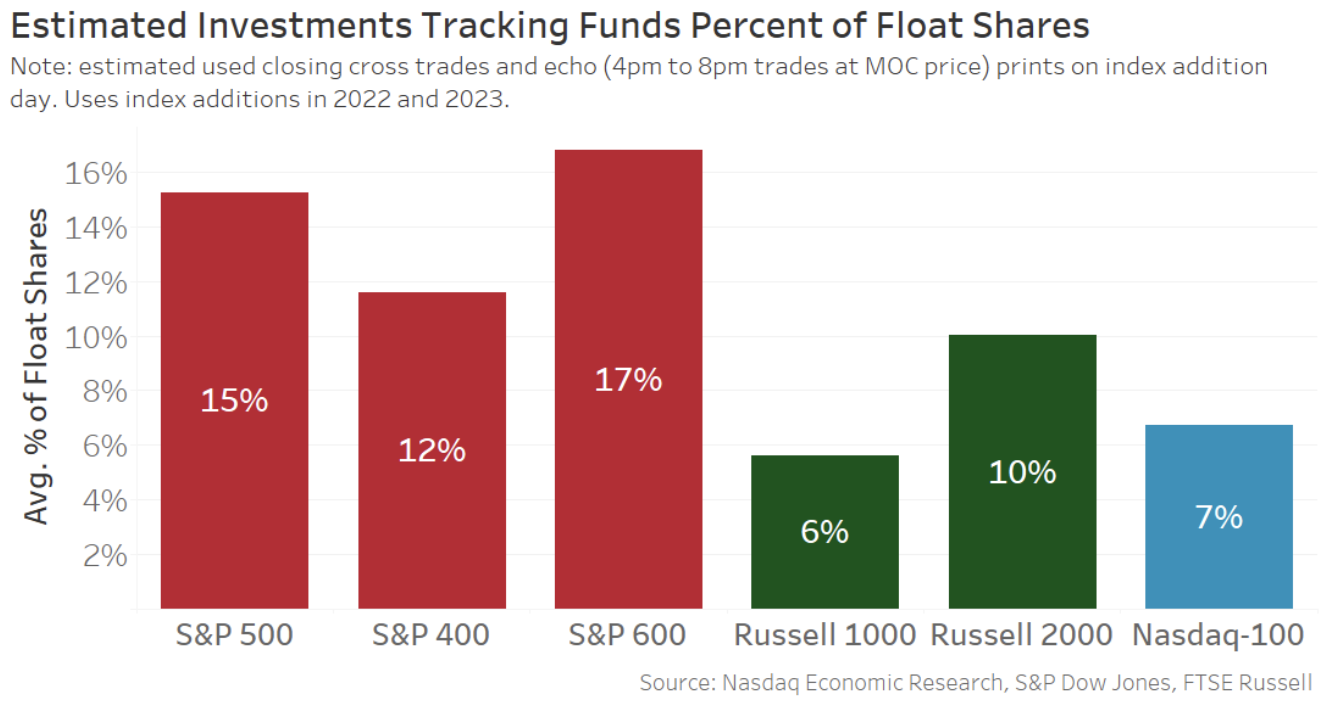

Immediately, we use the bottoms up strategy to see what number of float-shares really commerce on rebalance dates throughout the most important U.S. indexes. The outcomes (Chart 2) present that:

- Small caps even have vital proportion of index monitoring, 27% whole within the S&P 600 and Russell 2000.

- Though, a big cap can qualify for all three main indexes, together with the Nasdaq-100®, it might have as much as 28% of its float shares held by index funds.

Though way more {dollars} are listed to the S&P 500, as a lot as $7.5 trillion, it’s the proportion of every firm’s float shares that we’re measuring right here – and that needs to be constant throughout all corporations in every index.

Chart 2: Index day shut buying and selling signifies index monitoring funds might personal round 25% of float shares in lots of corporations

Importantly, neither the top-down nor bottom-up strategy is ideal. Some futures and choices hedges would possibly commerce like index funds, whereas precise index funds would possibly pre-position to attempt to restrict market influence from the predictable index commerce. Some additionally declare that some energetic funds commerce like “closet indexers.”

Closing volumes want to incorporate some off change trades now too

Off-exchange buying and selling is turning into bigger and bigger. That’s additionally true within the shut.

Exchanges and brokers can each publish so-called “echo prints” that replicate the official shut value (MOC) however print to the “tape” after they discover out what the official shut value is.

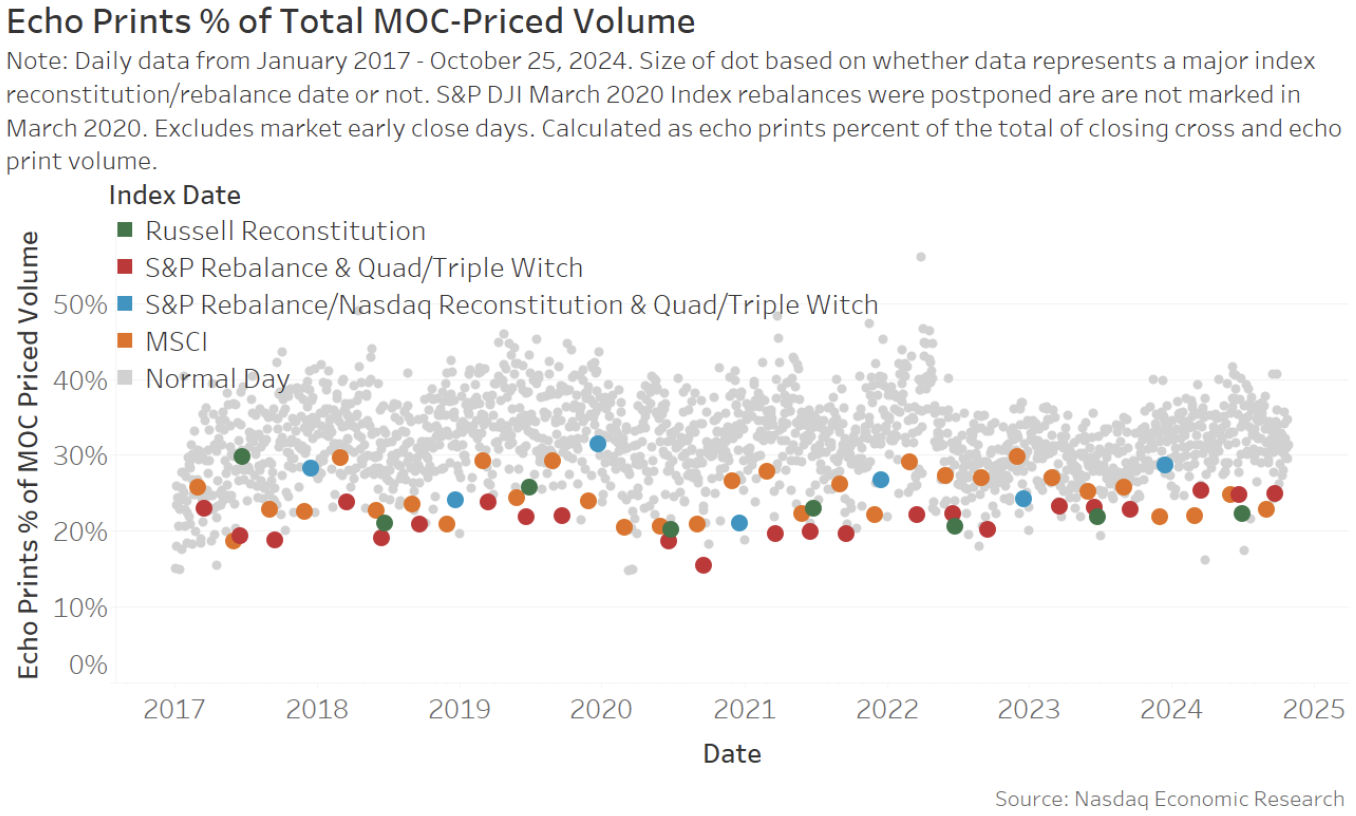

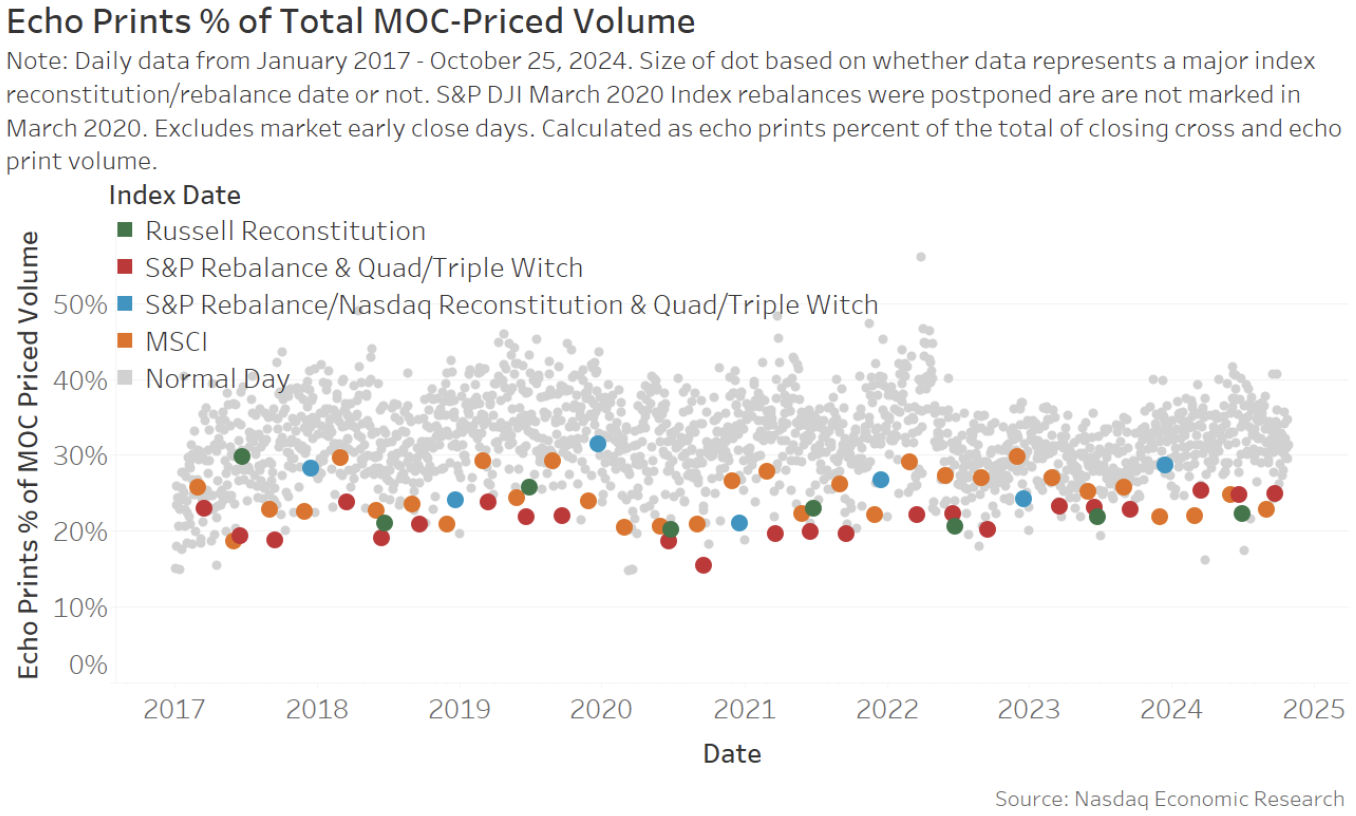

On this examine, we add the echo print trades that happen from 4 p.m. to eight p.m. and are on the MOC value – to the “MOC volumes” we use above. Apparently:

- On a typical day, we see the echo prints common round 30% of the MOC volumes (gray dots in Chart 3).

- On an index rebalance day, the official shut appears extra necessary, with echo prints including to round 20% of all trades.

Chart 3: Echo prints contribute a constant proportion of whole MOC-priced buying and selling

Regular shut buying and selling is probably going a fraction of buying and selling on index rebalance dates

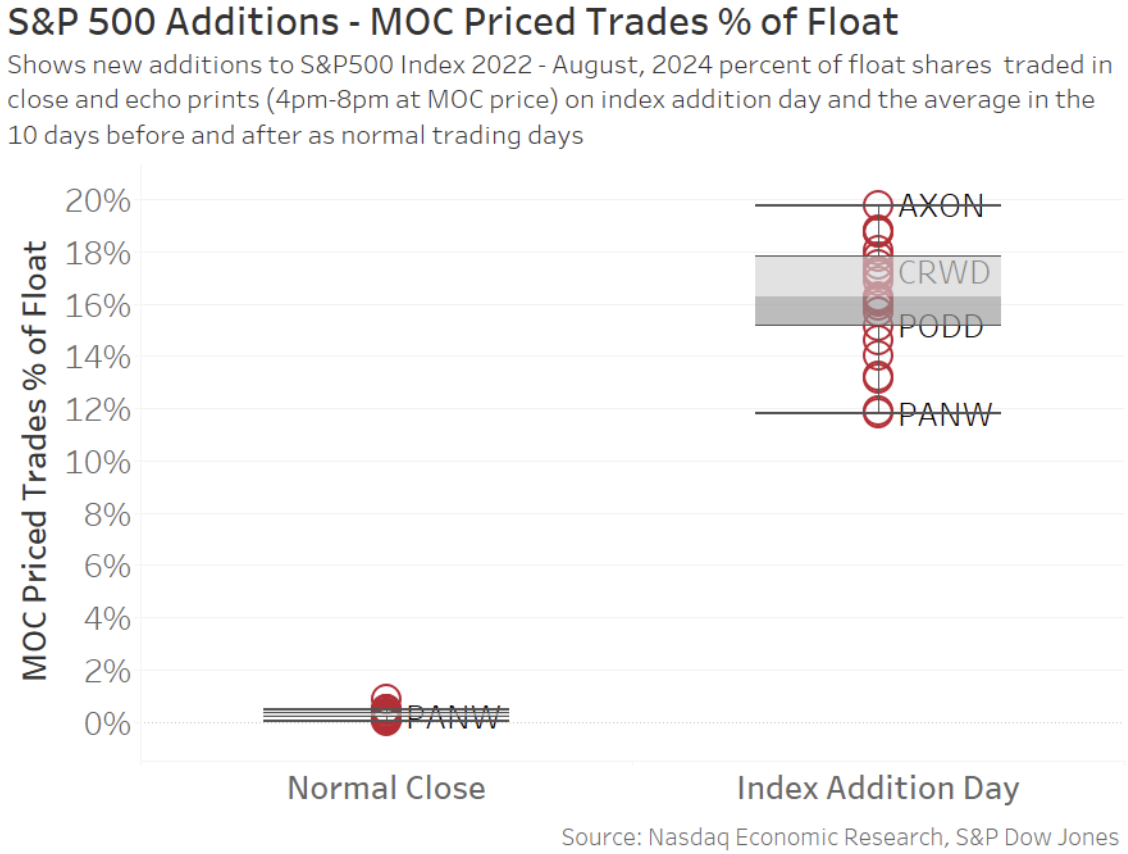

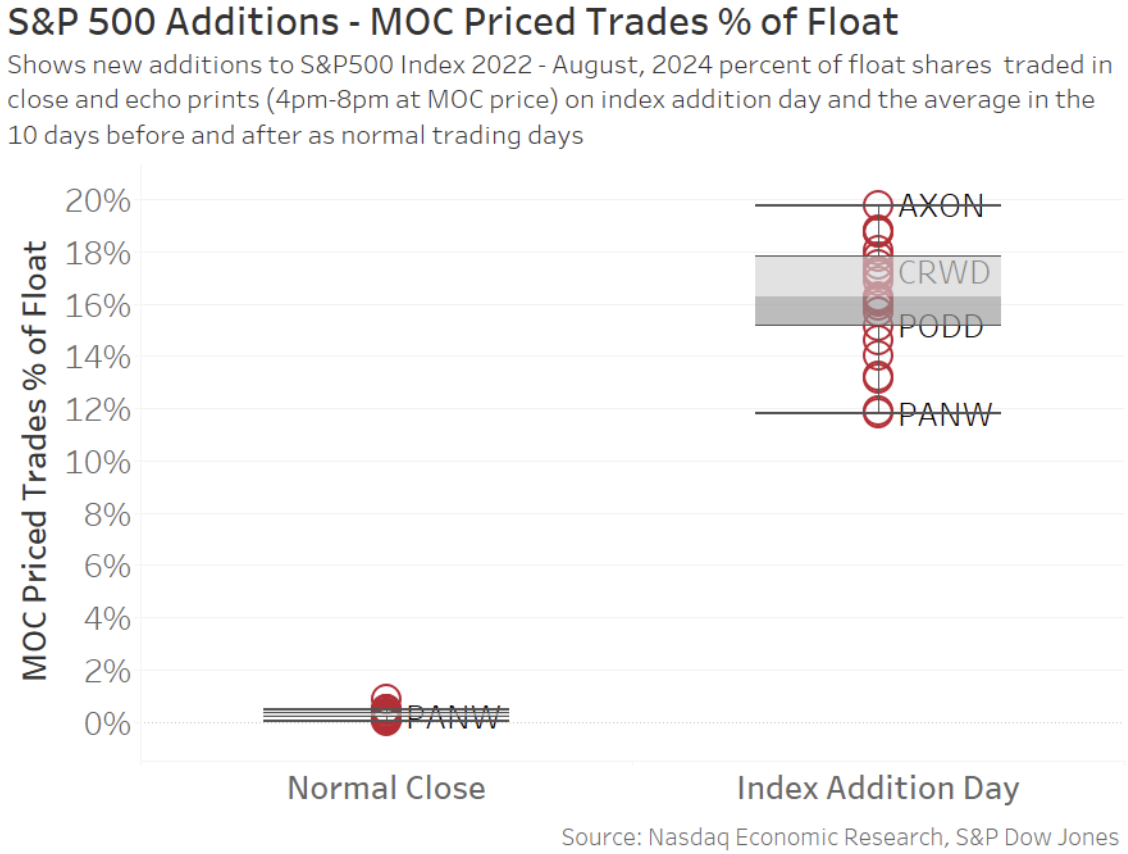

Some may also marvel if we shouldn’t take away “regular”, or non-index, MOC quantity from the totals above. Particularly given we’ve beforehand stated that the MOC is often extra energetic (and much less index) than individuals assume.

Nonetheless, after we take a look at how a lot quantity trades in a “regular” shut – and examine it to how a lot buying and selling that we see on index addition dates – we see that any adjustment can be a rounding error (as Chart 4 exhibits).

The explanation index trades seem a lot bigger on this view is as a result of the information in chart 1 is for the complete market – whereas index trades sometimes have an effect on simply the added shares – so the impact is magnified (or centered) on the index add inventory.

This additionally highlights how necessary index additions are for corporations. They lead to a fabric fraction of whole float shares being purchased by index funds – and index funds are sometimes long-term holders.

Chart 4: The “regular” MOC exercise is a fraction of the index buying and selling on a rebalance day

The information in Chart 4 additionally exhibits the everyday dispersion of outcomes that we common in Chart 2. Though the typical S&P 500 addition provides to 16% of an organization’s float shares the precise commerce sometimes ranges from 14% to 18%, and typically rather more.

It is also price noting that almost all S&P additions occur away from quad witch. That’s necessary, as quad witch buying and selling would possibly in any other case exaggerate the S&P outcomes.

Usually, the S&P quarterly rebalance contains “different” index adjustments, like float, type and shares excellent updates. As a result of the S&P 500 is a “500 firm” index always, additions are sometimes made at any time when one other firm leaves the index (typically by M&A). Though, to be honest, the previous few quarterly rebalances have included some promotions and demotions to reallocate shares to extra applicable market cap teams.

Index addition is nice for corporations

We all know that index addition creates a major quantity of liquidity in an added inventory.

This analysis exhibits simply what quantity of float shares change palms, and are seemingly purchased by index funds, on these dates.

Importantly, index addition is generally good for corporations. Index funds are a big, long-term, new investor base. Index inclusion additionally will increase curiosity from energetic mutual funds, which can enhance entry to U.S. capital for future investments.

Nicole Torskiy, Financial Analysis Senior Specialist, contributed to this text.

As we’ve famous earlier than, index rebalance days are inclined to lead to a lot bigger closing auctions. That’s as a result of most index funds attempt to precisely match what their index supplier does – and index adjustments occur utilizing the official closing value.

For instance, a typical shut accounts for lower than 10% of quantity traded in the course of the day; in the meantime, some index rebalance dates see over 30% of quantity traded within the shut.

Primarily based on this information, we will use the dimensions of the closing trades on index addition days to estimate whole index fund monitoring. The outcomes present that many corporations may need round 1 / 4 of all float-shares purchased by totally different index funds.

It’s necessary to notice that corporations profit from being added to main indexes as they see vital new (and sometimes long-term) traders.

Index rebalance days have massive shut volumes

As the information within the chart beneath exhibits, there are only a few dates every year index trades sometimes occur:

- MSCI is (sometimes) on the finish of Could and November. S&P, Nasdaq and FTSE indexes rebalance on the third Friday of the final month within the quarter. That’s additionally “quad witch” day, which makes the shut volumes even larger.

- Russell rebalances their indexes yearly, often on the final Friday in June that’s not quarter finish.

Chart 1: Index rebalance days see exceptionally massive closing volumes

A typical shut at present provides to round $40 billion in buying and selling, which is lower than 10% of the amount traded in the course of the day (gray dots).

In distinction, S&P and Russell index dates see a mean $240 billion buying and selling within the shut, including to over 30% of the day’s closing quantity, and considerably elevating the whole buying and selling in the course of the day (ADV), too. Even MSCI rebalances trigger the shut to extend to round 20% of ADV.

Utilizing closing buying and selling to estimate index monitoring

There are two methods we will estimate how a lot index funds monitoring every index provides:

- High down: Generally index suppliers disclose how a lot cash tracks their indexes. Some lecturers have additionally added up all of the index fund holdings from 13F filings. You can even attempt to reconcile that to ICI disclosures that these days say index funds are round 50% of all mutual funds.

- Bottoms up: One other means is behavioral – to take a look at what number of shares really commerce on the index rebalance dates. Figuring out that index funds solely really want to commerce on the rebalance date, and that to be able to precisely monitor the index earlier than market open the subsequent day, many funds favor to commerce concurrently the benchmark is modified (which is the shut!), representing one other method to see how massive index funds is perhaps.

Immediately, we use the bottoms up strategy to see what number of float-shares really commerce on rebalance dates throughout the most important U.S. indexes. The outcomes (Chart 2) present that:

- Small caps even have vital proportion of index monitoring, 27% whole within the S&P 600 and Russell 2000.

- Though, a big cap can qualify for all three main indexes, together with the Nasdaq-100®, it might have as much as 28% of its float shares held by index funds.

Though way more {dollars} are listed to the S&P 500, as a lot as $7.5 trillion, it’s the proportion of every firm’s float shares that we’re measuring right here – and that needs to be constant throughout all corporations in every index.

Chart 2: Index day shut buying and selling signifies index monitoring funds might personal round 25% of float shares in lots of corporations

Importantly, neither the top-down nor bottom-up strategy is ideal. Some futures and choices hedges would possibly commerce like index funds, whereas precise index funds would possibly pre-position to attempt to restrict market influence from the predictable index commerce. Some additionally declare that some energetic funds commerce like “closet indexers.”

Closing volumes want to incorporate some off change trades now too

Off-exchange buying and selling is turning into bigger and bigger. That’s additionally true within the shut.

Exchanges and brokers can each publish so-called “echo prints” that replicate the official shut value (MOC) however print to the “tape” after they discover out what the official shut value is.

On this examine, we add the echo print trades that happen from 4 p.m. to eight p.m. and are on the MOC value – to the “MOC volumes” we use above. Apparently:

- On a typical day, we see the echo prints common round 30% of the MOC volumes (gray dots in Chart 3).

- On an index rebalance day, the official shut appears extra necessary, with echo prints including to round 20% of all trades.

Chart 3: Echo prints contribute a constant proportion of whole MOC-priced buying and selling

Regular shut buying and selling is probably going a fraction of buying and selling on index rebalance dates

Some may also marvel if we shouldn’t take away “regular”, or non-index, MOC quantity from the totals above. Particularly given we’ve beforehand stated that the MOC is often extra energetic (and much less index) than individuals assume.

Nonetheless, after we take a look at how a lot quantity trades in a “regular” shut – and examine it to how a lot buying and selling that we see on index addition dates – we see that any adjustment can be a rounding error (as Chart 4 exhibits).

The explanation index trades seem a lot bigger on this view is as a result of the information in chart 1 is for the complete market – whereas index trades sometimes have an effect on simply the added shares – so the impact is magnified (or centered) on the index add inventory.

This additionally highlights how necessary index additions are for corporations. They lead to a fabric fraction of whole float shares being purchased by index funds – and index funds are sometimes long-term holders.

Chart 4: The “regular” MOC exercise is a fraction of the index buying and selling on a rebalance day

The information in Chart 4 additionally exhibits the everyday dispersion of outcomes that we common in Chart 2. Though the typical S&P 500 addition provides to 16% of an organization’s float shares the precise commerce sometimes ranges from 14% to 18%, and typically rather more.

It is also price noting that almost all S&P additions occur away from quad witch. That’s necessary, as quad witch buying and selling would possibly in any other case exaggerate the S&P outcomes.

Usually, the S&P quarterly rebalance contains “different” index adjustments, like float, type and shares excellent updates. As a result of the S&P 500 is a “500 firm” index always, additions are sometimes made at any time when one other firm leaves the index (typically by M&A). Though, to be honest, the previous few quarterly rebalances have included some promotions and demotions to reallocate shares to extra applicable market cap teams.

Index addition is nice for corporations

We all know that index addition creates a major quantity of liquidity in an added inventory.

This analysis exhibits simply what quantity of float shares change palms, and are seemingly purchased by index funds, on these dates.

Importantly, index addition is generally good for corporations. Index funds are a big, long-term, new investor base. Index inclusion additionally will increase curiosity from energetic mutual funds, which can enhance entry to U.S. capital for future investments.

Nicole Torskiy, Financial Analysis Senior Specialist, contributed to this text.