The know-how inventory selloff after DeepSeek’s stunning launch is elevating many questions on what might occur to shares subsequent.

It is definitely been good occasions for buyers. The S&P 500 has delivered back-to-back 20% plus annual returns, and regardless of a swoon within the first week of January and the DeepSeek sell-off this week, the benchmark continues to be on tempo to complete January with beneficial properties.

💰💸 Don’t miss the transfer: SIGN UP for TheStreet’s FREE Each day publication 💰💸

In fact, whether or not that development continues all through 2025 is anybody’s guess, but when historical past is our information, the chances seem good.

Associated: Fed choice cements rate of interest case

Usually, extra returns comply with when shares rally between election day and the inauguration. If that development holds, then analysis from CFRA suggests it is sensible to give attention to some shares greater than others.

What previous efficiency might inform us concerning the future

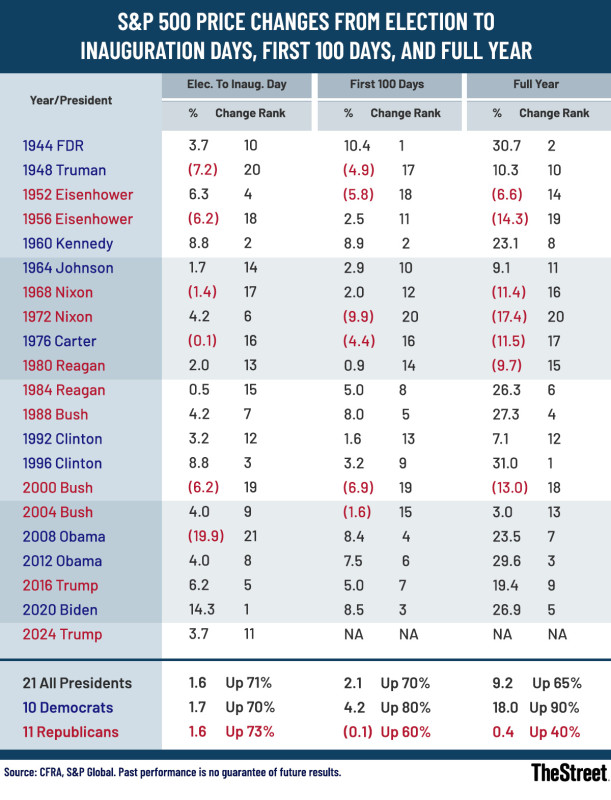

This time round, from election day by inauguration day, the S&P 500 gained nearly 4% (truly 3.7%) versus a mean of 1.6% in all years relationship again to 1944.

Because of this, the market’s efficiency from election day to inauguration day ranks eleventh out of 21 intervals over the previous a number of a long time.

Associated: High analyst revisits Nvidia inventory worth goal amid DeepSeek menace

The very best return throughout this era got here from the Biden administration (+14.3%), whereas the worst market efficiency got here from President Obama (-19.9%) because of the monetary disaster that came about from 2007 to 2009.

The excellent news is that primarily based on previous intervals, when returns have been constructive from election day by inauguration day, that led to constructive returns over the subsequent 100 days and the remainder of the total calendar yr nearly 80% of the time.

TheStreet/CFRA

As well as, primarily based on information from 1993, the highest 4 sectors within the S&P 500 that outperformed the market throughout this era went on to outperform the market over the rest of the yr, about 75% of the time.

They delivered calendar-year beneficial properties of 17.0% on common, in comparison with the S&P

500’s common return of 15.9%, based on CFRA.

The highest 10 S&P

500 industries in the course of the interval did even higher, growing by 26.8% for the total yr.

In fact, what labored up to now shouldn’t be assured to work once more sooner or later, however the information is intriguing.

Which S&P 500 sectors outperformed and underperformed after the election

This time round, the 4 sectors that generated the most effective efficiency between election and inauguration day have been

- Shopper discretionary: Up 13.5%

- Communication providers: Up 8.7%

- Financials: Up 7.3%

- Vitality: Up 4.3%

Shopper staples, well being care, supplies, and actual property all posted declines.

The 4 industries that generated the most effective efficiency between election and inauguration day have been

- Auto producers: Up 59.5%

- House furnishing retail: Up 46.9%

- Safety & alarm providers: Up 40.4%

- Drug retail: Up 30.1%

One other a part of the puzzle is the outlook for company earnings. Primarily based on latest information from JP Morgan (supply: IBES as of January twentieth, 2025), all 11 S&P 500 sectors are at present forecast to put up constructive EPS progress in 2025 (versus 9 out of 11 sectors in 2024).

Six sectors are at present forecast to put up double-digit year-over-year EPS progress in 2025 (versus 5 in 2024).

Associated: These agentic AI shares might soar in 2025

The sectors at present forecast to generate the very best 2025 year-over-year EPS progress embrace:

- Expertise: Up 22.3%

- Healthcare: Up 20.2%

Then again, vitality, client staples, and actual property are the three sectors forecast to put up the weakest year-over-year EPS progress this yr.

This is what might occur to those sectors now

Many elements can affect predictions of which shares will doubtless outperform the market over a selected interval. One listing would possibly embrace adjustments in earnings, revenues, margins, free money move, profitability, administration, the introduction of recent merchandise, the macro-economy, stability sheets, currencies, and so forth.

Extra 2025 inventory market forecasts:

- Veteran dealer who accurately picked Palantir as prime inventory in ‘24 reveals greatest inventory for ‘25

- 5 quantum computing shares buyers are focusing on in 2025

- Goldman Sachs picks prime sectors to personal in 2025

- Each main Wall Road analyst’s S&P 500 forecast for 2025

For our functions, let’s take a look at:

1) The highest three sectors that outperformed the market from election day to inauguration day.

2) The best upside to the typical analyst goal worth estimate over the subsequent 12 months for shares inside these sectors, based on YCharts.

The outcomes:

Communications Sector: Digital Arts (EA) (30.1%), Comcast (CMCSA) (26.8%) and Warner Brothers (WBD) (23.9%).

Shopper Discretionary Sector: MGM Resorts (MGM) (48.1%), Caesars Leisure (CZR) (46.3%) and Las Vegas Sands (LVS) (36.6%)

Financials Sector: Arch Capital Group (ACGL) (26.7%), International Funds (GPN) (21.2%) and Allstate (ALL) (21.3%).

Associated: Veteran fund supervisor points dire S&P 500 warning for 2025