- Analysts had beforehand predicted that FET may attain its March excessive after approaching a big help zone.

- Nonetheless, market sentiment is at present at odds with these bullish forecasts.

Synthetic Superintelligence Alliance [FET] has skilled substantial sell-offs, with promoting stress intensifying over the previous week, resulting in a 16.94% value drop, conserving the token close to the $1 mark.

This development has proven slight enchancment over the previous 24 hours, with patrons exerting some stress, leading to a modest 0.69% achieve.

Regardless of this, AMBCrypto evaluation indicated that the broader market trendwas nonetheless pointing towards a possible decline, with FET prone to check decrease ranges within the close to future.

May FET attain 2024 highs?

In response to crypto analyst Mihir, at press time, FET was buying and selling inside an ascending channel sample, which usually alerts an upward development.

This chart sample consisted of value fluctuations between two parallel traces—referred to as the help and resistance ranges—inside which the value tends to maneuver because it developments upward.

In response to the chart, FET has lately touched the help degree of this channel, a typical sign that always precedes a value surge.

Mihir thus anticipated FET to doubtlessly reclaim its March 2024 excessive, stating,

“$FET might get better by mid-to-late December.”

Giant holders are promoting

Additional evaluation confirmed that, regardless of FET reaching a help degree the place important shopping for exercise is usually noticed, the alternative is at present occurring.

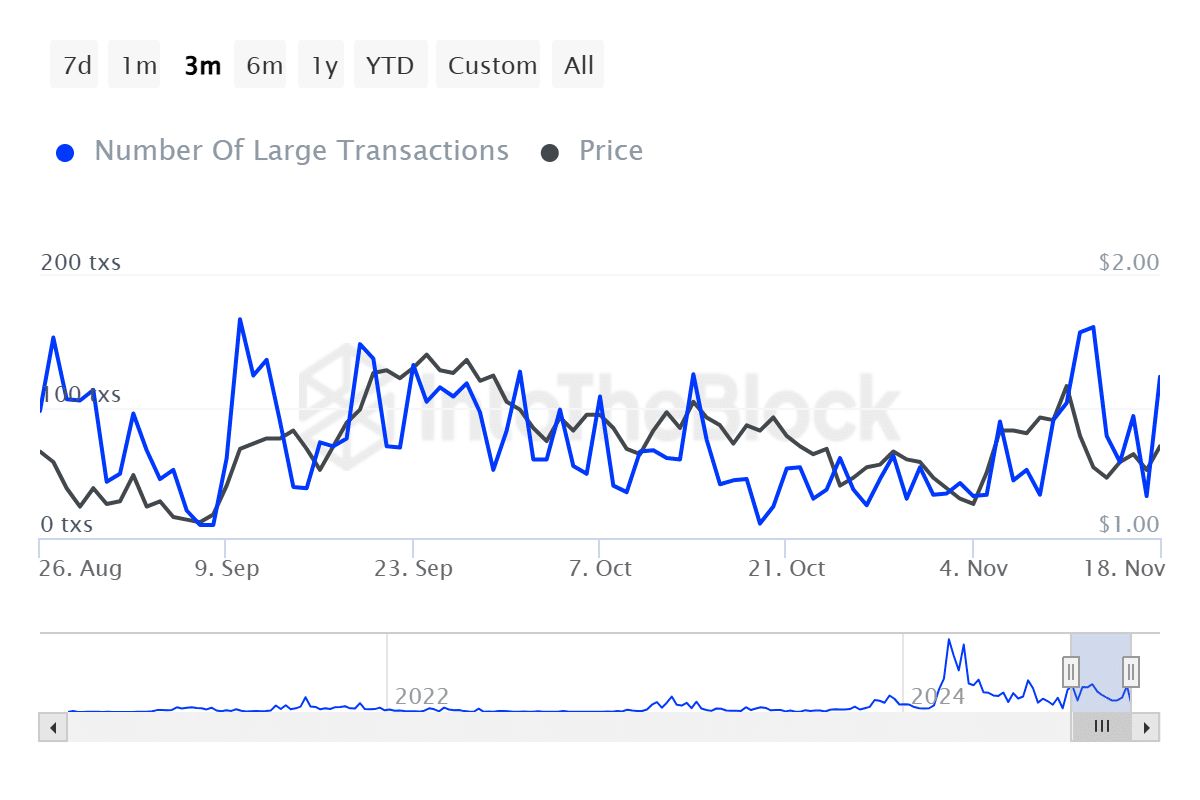

In response to IntoTheBlock, there was a noticeable spike in large-volume transactions, indicating that merchants holding substantial parts of FET are actively partaking available in the market.

This exercise can sign both shopping for or promoting.

Nonetheless, the decline within the variety of lively addresses recommended that this enhance in massive transactions is probably going the results of massive holders promoting off their FET.

This may very well be resulting from a lack of confidence within the asset, with these holders taking income to keep away from additional losses.

Up to now 24 hours, 123 massive transactions had been recorded, involving a complete of 19.05 million FET. In the meantime, the variety of lively addresses has dropped to 1,860, representing a 12.02% decline over the previous week.

Elevated sell-offs available in the market

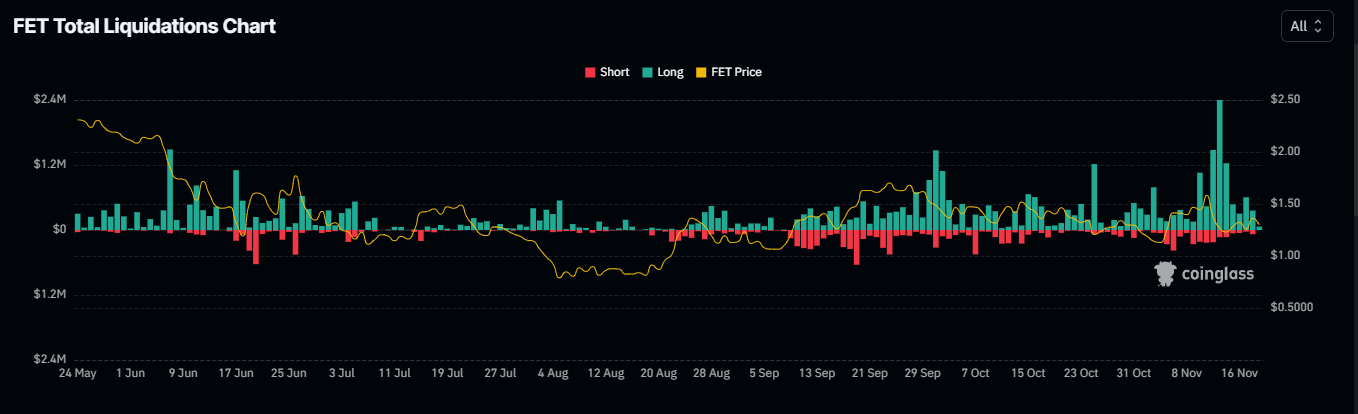

This development has prolonged to by-product merchants, who are actually promoting their FET holdings into the market.

Within the first occasion, Open Curiosity has decreased by 2.42% over the previous 24 hours, bringing the full quantity to 134.25 million FET.

This decline means that the market is at present favoring brief merchants, with fewer open contracts in favor of lengthy positions.

Learn Synthetic Superintelligence Alliance Worth Prediction [FET] 2024–2025

Moreover, the pressured liquidation of $387.17K price of FET lengthy trades indicated that by-product merchants have pushed the market towards the expectations of bullish merchants, contributing to the value drop.

Ought to these sell-offs from massive holders and by-product merchants proceed, it should delay FET’s potential rally.