- FET ended its extended downtrend, and eyed the next excessive of above $1.60.

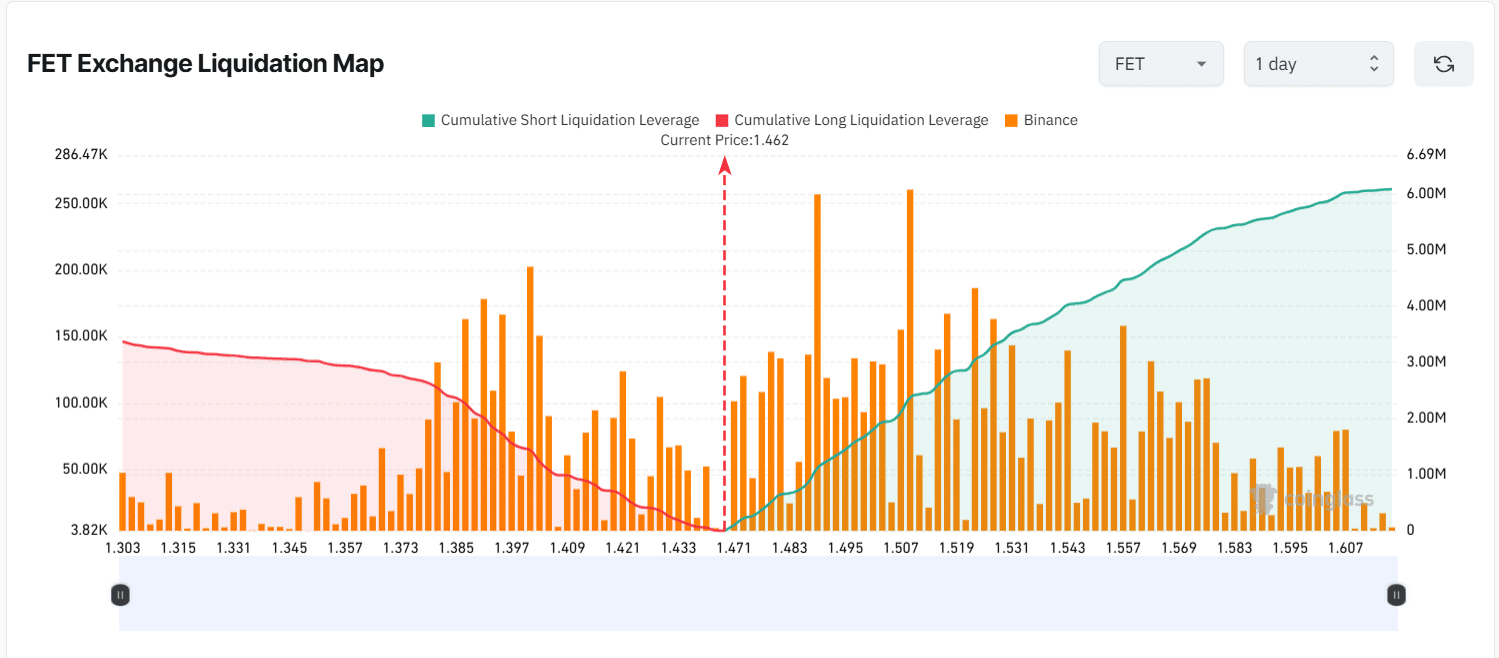

- Liquidation clusters at $1.50-$1.60 signaled leverage-driven volatility.

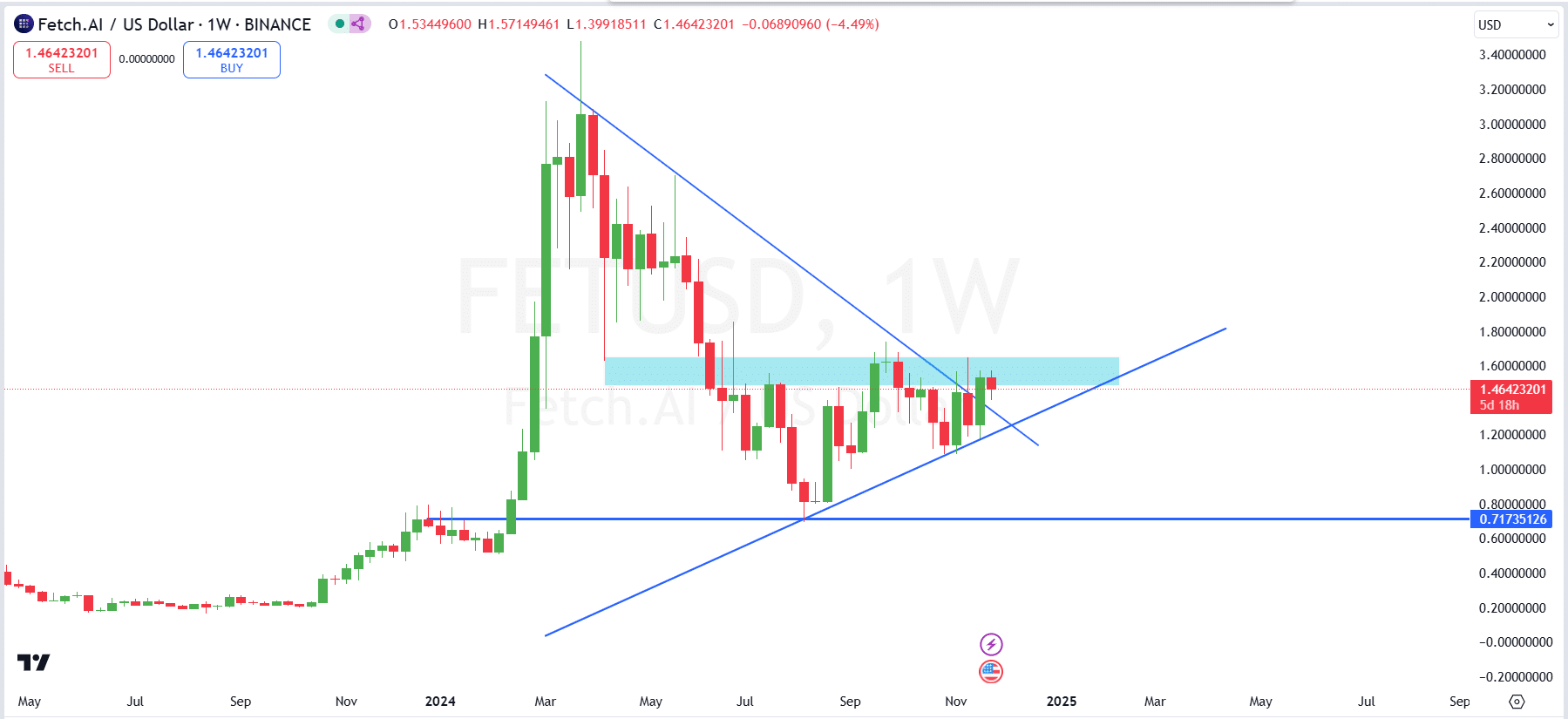

Synthetic Superintelligence Alliance [FET] has not too long ago damaged a 266-day downtrend, signaling a possible pattern reversal. The token’s worth has elevated by 7.88% over the previous week, with a market cap of $3.46 billion.

Nonetheless, analysts cautioned that FET confronted a major resistance on the $1.60 stage.

A failure to surpass this threshold may result in a double-bottom formation, particularly if Bitcoin [BTC] experiences a correction towards $80,000.

Decrease timeframe evaluation

After a chronic 266-day downtrend, FET has lastly damaged out, shifting above a descending pattern line resistance with vital quantity, signaling sturdy purchaser curiosity.

Buying and selling at $1.42 at press time, the breakout marks a serious step ahead, however the worth now faces sturdy resistance within the $1.60-$1.65 zone.

Attaining the next excessive with an in depth above this stage is essential to verify a sustained uptrend and open the trail towards the $2.20-$2.50 vary over the subsequent few months.

Nonetheless, till FET clears this resistance, there stays the opportunity of a Double Backside formation, which might be triggered by a market pullback, probably shaking out leveraged positions.

Failure to interrupt $1.60 could result in a pullback towards $1.20 and even $0.72, the place sturdy assist lies.

The subsequent few weeks will likely be pivotal in figuring out whether or not FET continues its bullish momentum or consolidates at decrease ranges.

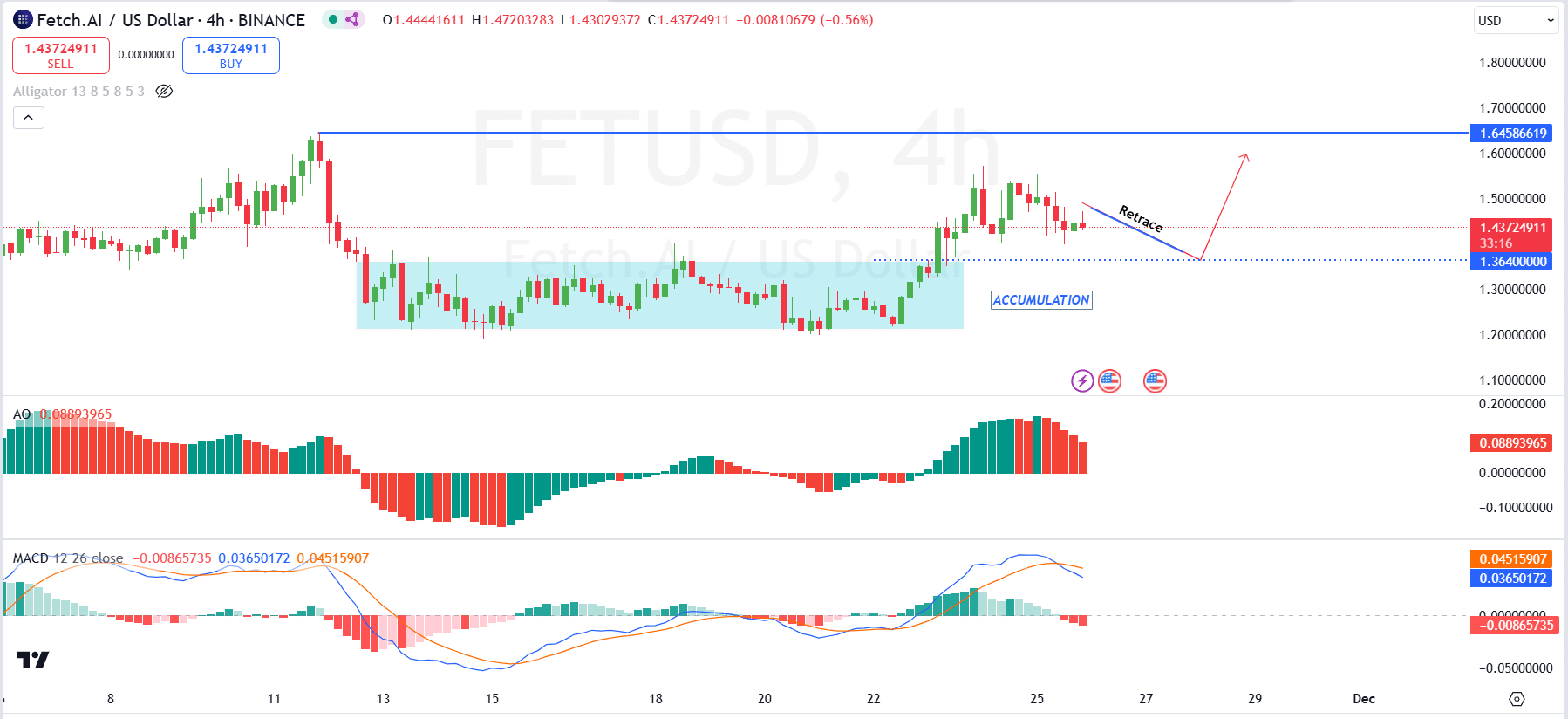

Wanting on the 4- hour chart, the value is retracing to the preliminary accumulation vary close to $1.36, the place consumers beforehand amassed and pushed the value larger.

A retrace to this stage will provide merchants a chance to align with good cash and probably journey the wave once more to the upside.

If the value efficiently bounces from $1.36 and shifts momentum, the subsequent key stage of resistance to observe is $1.645.

Indicators just like the MACD, which exhibits weakening bullish momentum with a possible bearish crossover, and the Superior Oscillator (AO), reflecting declining optimistic momentum, recommend a short-term pullback.

FET exhibits sturdy community progress

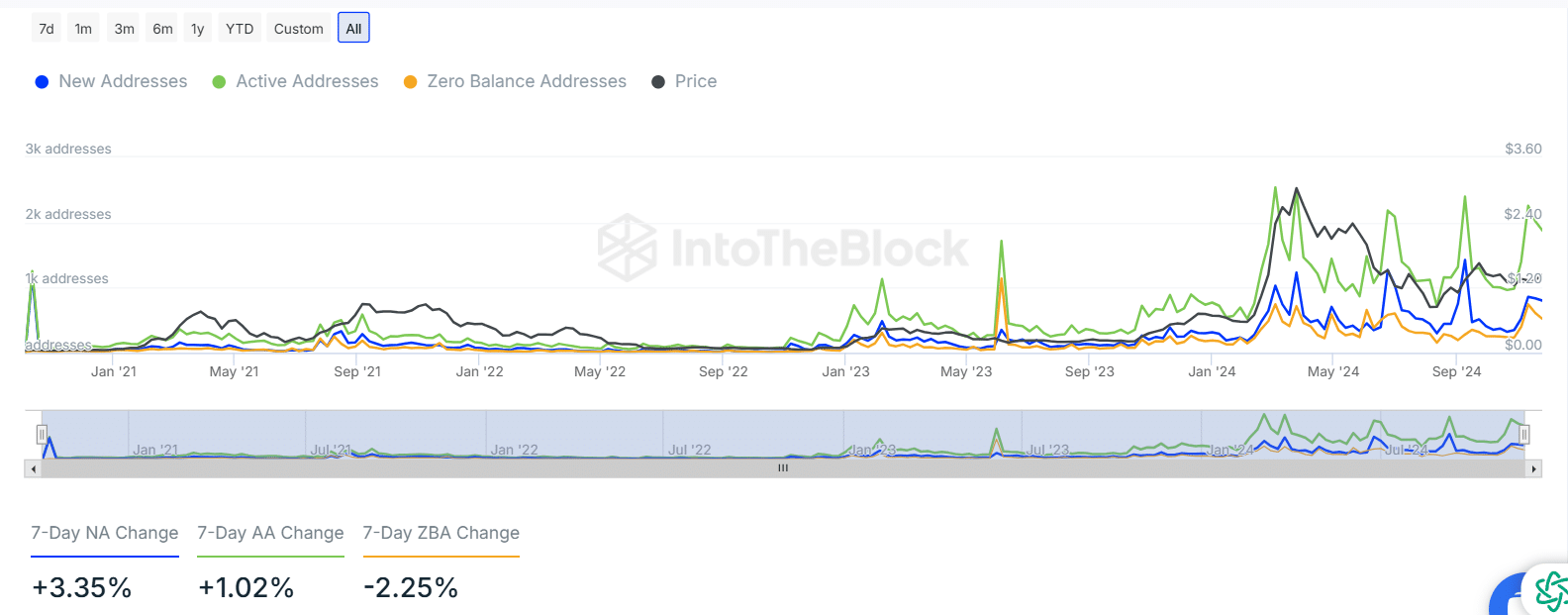

There was a major improve in exercise for Fetch.ai, with every day lively addresses (inexperienced) reaching over 2,400 throughout current peaks, whereas new addresses (blue) climbed above 1,200, signaling rising consumer engagement.

Zero-balance addresses (orange) have additionally risen constantly, indicating an inflow of latest customers getting ready to interact with the community.

Over the previous seven days, new addresses elevated by 3.35%, and lively addresses rose by 1.02%, additional emphasizing rising adoption.

Nonetheless, zero-balance addresses decreased by 2.25%, reflecting some accounts transitioning to lively use.

This exercise correlates intently with worth actions, because the current peak of $1.70 coincided with spikes in each new and lively addresses.

The constant rise in lively addresses underscores ongoing adoption, whereas the decline in zero-balance addresses suggests a shift from speculative curiosity to precise utility and transactions.

On the upside, vital lengthy liquidations start to build up above $1.50, peaking close to $1.60, indicating elevated threat for over-leveraged lengthy positions in case of a retracement.

Conversely, brief liquidations are concentrated under $1.40, with the depth rising as the value strikes nearer to $1.30.

Learn Synthetic Superintelligence Alliance’s [FET] Value Prediction 2024 – 2025

This means {that a} worth drop under $1.40 may set off cascading liquidations of brief positions.

The map confirmed a excessive stage of leveraged exercise, which may result in volatility spikes as worth strikes towards liquidation-heavy zones.