Many regulators across the world appear to suppose exchanges needs to be doing cost-based pricing.

As any accountant will know, cost-based pricing isn’t as straightforward in follow because it appears in concept.

Even the SEC can’t get cost-based pricing to work

Working example: The U.S. Securities and Alternate Fee (SEC) is operated as an unbiased federal company, and its annual prices are paid for utilizing transaction-based charges known as Part 31 charges.

The “value base” of the SEC is fairly easy to calculate. It’s a reasonably constant group of presidency workers regulating the U.S. securities markets. The company has a funds that’s accepted by congress. The prices added to $1.97 billion, based on the 2023 SEC annual report.

From the face of it, this sounds easy. SEC prices are predictable and alter fairly slowly.

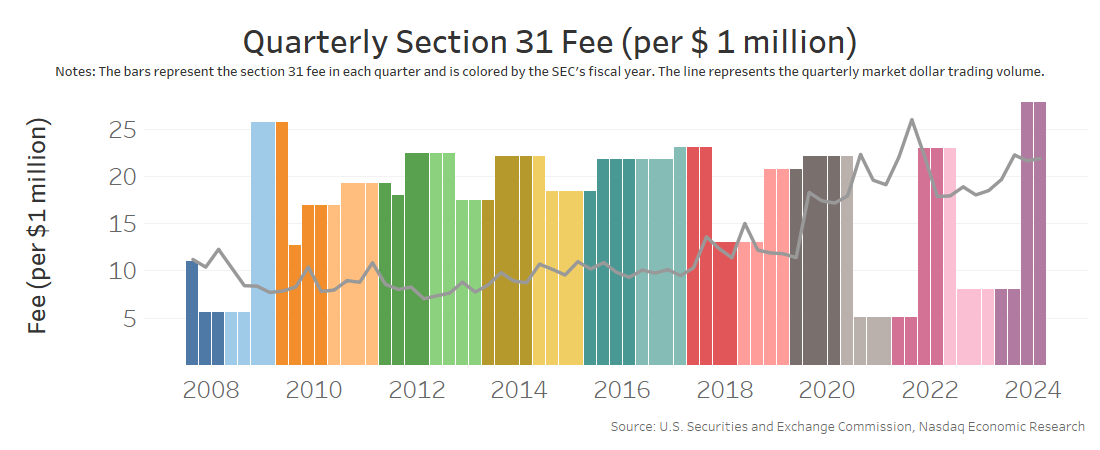

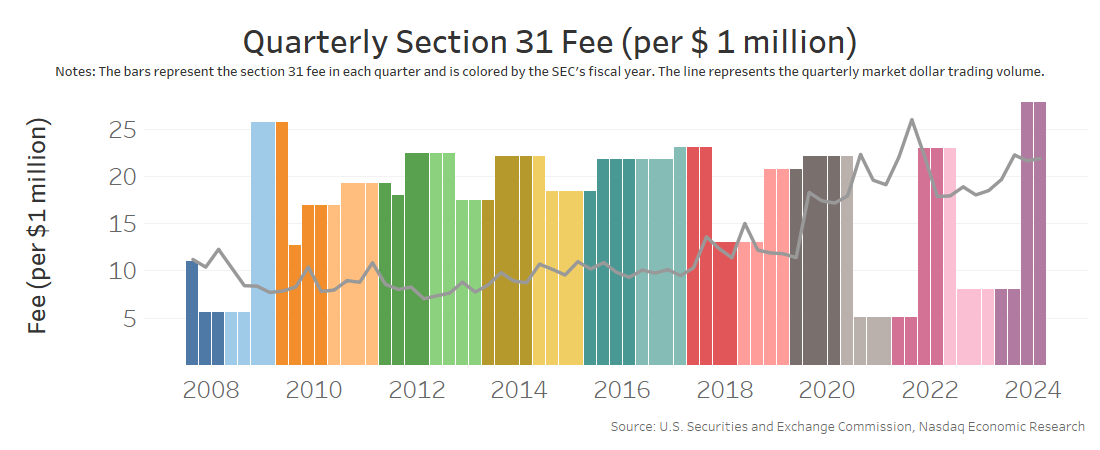

But, the common price charged varies considerably over time (Chart 1) and even inside a 12 months.

Chart 1: The speed of Part 31 price is risky (coloured by funds cycle)

The principle drawback is the SEC doesn’t management the “divisor” in its “common prices” calculation.

The company determined to cost based mostly on worth traded. Which may be extra steady than volumes (shares traded), nevertheless it additionally ends in very completely different prices per commerce. Actually, generally, for high-priced shares, it may well add to greater than a typical mutual fund fee (which is charged in cents-per-share).

Consequently, the “common value” that its accountants budgeted for initially of the 12 months usually must be modified – generally by so much. For instance, the price rose from $8 per million {dollars} traded to $27.8 per million {dollars} traded in Q2 of 2024 – a rise of virtually 350%.

Equal will not be honest (or equitable)

These issues have an effect on accountants in every single place.

From an economist’s perspective, it’s unimaginable to know what the precise “divisor” is for creating your common. Is it extra economical to cost a variable price? (And if that’s the case, per commerce or message or share?) However all of which penalize those that commerce so much and might have economies of scale to be worthwhile.

The choice is likely to be a hard and fast price per dealer (or connection), which could make it troublesome for small merchants to compete with bigger merchants.

Each fail to account for financial advantages that maybe the market ought to reward. For instance, a market maker may commerce so much, and ship a variety of messages, resulting in a excessive value to commerce. Nonetheless, their buying and selling may assist set high-quality NBBO that others out there profit from (generally with out even buying and selling on trade and crossing the spreads that the market makers are setting).

Even with quantity tiers, it is exhausting for exchanges to reward prospects whose exercise advantages others out there. Though paradoxically (given the SEC’s most up-to-date adjustments to NMS), rebate markets might do that higher than most different options – as they pay a rebate to any and all quote-providers – however solely on a quote that really trades.

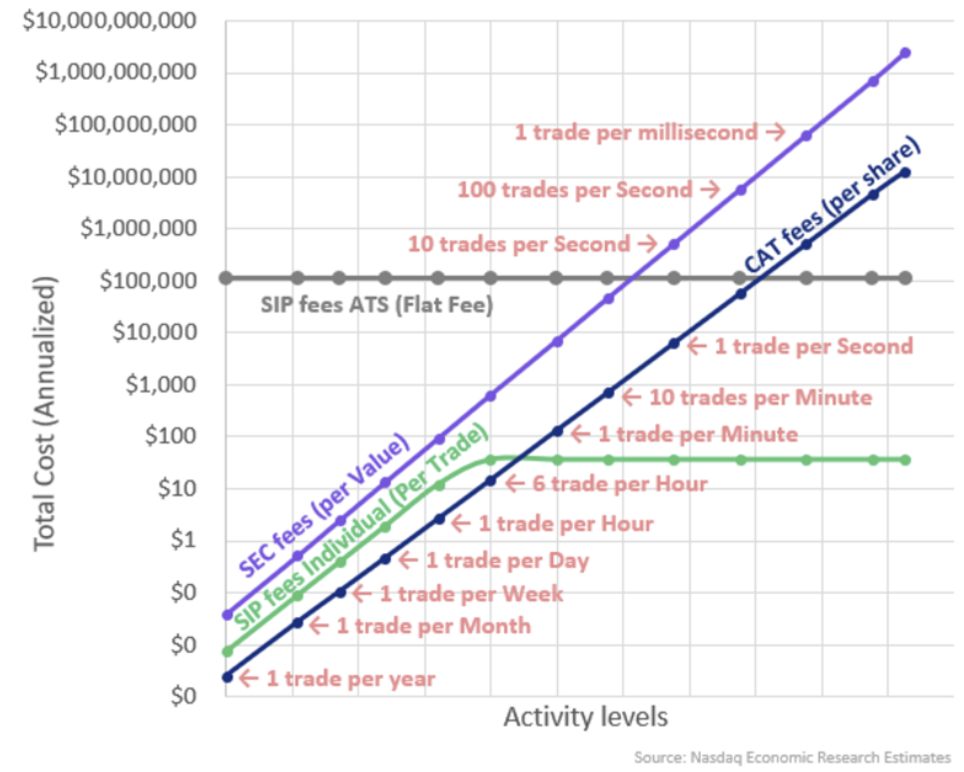

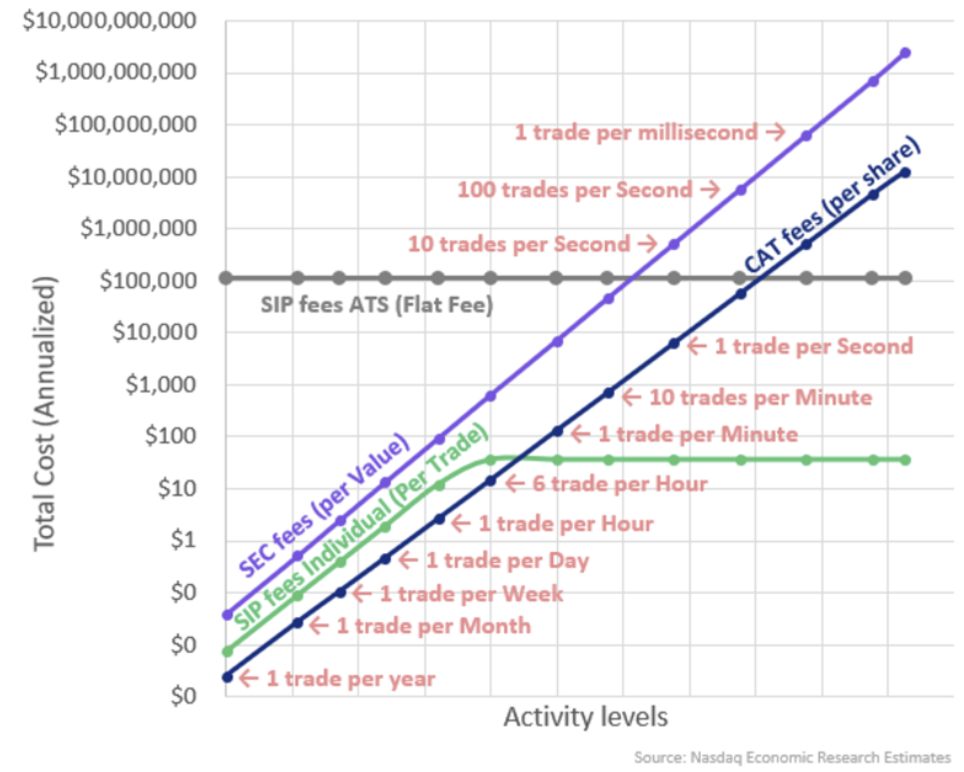

In actuality, the U.S. market already has quite a few equal options. Chart 2 reveals that every impacts completely different sorts of merchants otherwise – noting that even the variable prices are charged based mostly on trades, shares and worth. For people, there’s a fastened base price of $0.0075 per “view” of the NBBO. For simplicity, within the charts beneath, we assume that every retail dealer views the NBBO solely as soon as per commerce. Importantly, none of them account for these constructive externalities we talked about above.

Chart 2: There are already a number of makes an attempt to do “equal” charges within the U.S. markets

Platforms make it unimaginable to allocate prices utilizing guidelines

One other drawback is understanding what the “prices” are within the first place.

It might be argued that even the SEC has this drawback. The company has no SEC price for bond trades or different “securities” that they oversee. That doesn’t suggest there aren’t any prices for overseeing them, nevertheless it does save the trouble of making an attempt to allocate the prices of the commissioners throughout every completely different safety and investor kind.

Most members within the world inventory markets function (and compete in opposition to) platforms – in that they’ve multiple product produced by the identical course of. We are able to clearly see this once we’ve in contrast all-in prices to commerce. All exchanges cost a special mixture of itemizing, information, connection and buying and selling charges. However we additionally see completely different prospects drawn to at least one platform over one other as a result of their exercise is best suited to a selected price construction. For instance, fading an incoming take order may enhance buying and selling earnings – even when buying and selling charges of the trade are greater.

Chart 3: How an trade splits charges throughout joint merchandise varies considerably

The identical may be seen throughout brokers.

Some provide execution-only companies, others are full-service brokers.

Full-service brokers have greater prices, as they provide companies like prime (financing of positions) and analysis. Nonetheless, their merchandise are usually bundled right into a single fee, which itself is often “cents per share” value.

In distinction, execution-only brokers are in a position to streamline their enterprise mannequin, lowering prices – regardless that they could doubtlessly compete utilizing decrease commissions. Though even these execution-only brokers might select to pay extra for his or her buying and selling infrastructure so as to differentiate themselves. Including co-location or sooner information feeds ought to cut back the chance prices for his or her prospects, lowering the prices of their buying and selling. That will increase their “value base,” which they are able to recoup by way of greater commissions, however that would cut back their value benefits in opposition to full-service brokers.

In fact, not all their prospects profit from these investments in sooner buying and selling (or analysis, or financing). It will appear unfair to power all merchants to pay the identical commissions.

In nearly all industries, it is dangerous economics to power all prospects to pay the identical.

If we actually need cost-based pricing – are we prepared to help shrinking companies?

Accounting for, and allocating, prices in the actual world is sophisticated. Price-based pricing is difficult, one thing even the SEC’s funds course of tells us.

Maybe the obvious flaw within the “cost-based” argument is that this: Must you pay double the unique value of the product if half the shoppers cancel it?

To anybody within the markets that ought to sound foolish — falling demand ought to make costs fall, not rise — and but that’s precisely what regulators are supporting after they deal with restoration of prices.

Many regulators across the world appear to suppose exchanges needs to be doing cost-based pricing.

As any accountant will know, cost-based pricing isn’t as straightforward in follow because it appears in concept.

Even the SEC can’t get cost-based pricing to work

Working example: The U.S. Securities and Alternate Fee (SEC) is operated as an unbiased federal company, and its annual prices are paid for utilizing transaction-based charges known as Part 31 charges.

The “value base” of the SEC is fairly easy to calculate. It’s a reasonably constant group of presidency workers regulating the U.S. securities markets. The company has a funds that’s accepted by congress. The prices added to $1.97 billion, based on the 2023 SEC annual report.

From the face of it, this sounds easy. SEC prices are predictable and alter fairly slowly.

But, the common price charged varies considerably over time (Chart 1) and even inside a 12 months.

Chart 1: The speed of Part 31 price is risky (coloured by funds cycle)

The principle drawback is the SEC doesn’t management the “divisor” in its “common prices” calculation.

The company determined to cost based mostly on worth traded. Which may be extra steady than volumes (shares traded), nevertheless it additionally ends in very completely different prices per commerce. Actually, generally, for high-priced shares, it may well add to greater than a typical mutual fund fee (which is charged in cents-per-share).

Consequently, the “common value” that its accountants budgeted for initially of the 12 months usually must be modified – generally by so much. For instance, the price rose from $8 per million {dollars} traded to $27.8 per million {dollars} traded in Q2 of 2024 – a rise of virtually 350%.

Equal will not be honest (or equitable)

These issues have an effect on accountants in every single place.

From an economist’s perspective, it’s unimaginable to know what the precise “divisor” is for creating your common. Is it extra economical to cost a variable price? (And if that’s the case, per commerce or message or share?) However all of which penalize those that commerce so much and might have economies of scale to be worthwhile.

The choice is likely to be a hard and fast price per dealer (or connection), which could make it troublesome for small merchants to compete with bigger merchants.

Each fail to account for financial advantages that maybe the market ought to reward. For instance, a market maker may commerce so much, and ship a variety of messages, resulting in a excessive value to commerce. Nonetheless, their buying and selling may assist set high-quality NBBO that others out there profit from (generally with out even buying and selling on trade and crossing the spreads that the market makers are setting).

Even with quantity tiers, it is exhausting for exchanges to reward prospects whose exercise advantages others out there. Though paradoxically (given the SEC’s most up-to-date adjustments to NMS), rebate markets might do that higher than most different options – as they pay a rebate to any and all quote-providers – however solely on a quote that really trades.

In actuality, the U.S. market already has quite a few equal options. Chart 2 reveals that every impacts completely different sorts of merchants otherwise – noting that even the variable prices are charged based mostly on trades, shares and worth. For people, there’s a fastened base price of $0.0075 per “view” of the NBBO. For simplicity, within the charts beneath, we assume that every retail dealer views the NBBO solely as soon as per commerce. Importantly, none of them account for these constructive externalities we talked about above.

Chart 2: There are already a number of makes an attempt to do “equal” charges within the U.S. markets

Platforms make it unimaginable to allocate prices utilizing guidelines

One other drawback is understanding what the “prices” are within the first place.

It might be argued that even the SEC has this drawback. The company has no SEC price for bond trades or different “securities” that they oversee. That doesn’t suggest there aren’t any prices for overseeing them, nevertheless it does save the trouble of making an attempt to allocate the prices of the commissioners throughout every completely different safety and investor kind.

Most members within the world inventory markets function (and compete in opposition to) platforms – in that they’ve multiple product produced by the identical course of. We are able to clearly see this once we’ve in contrast all-in prices to commerce. All exchanges cost a special mixture of itemizing, information, connection and buying and selling charges. However we additionally see completely different prospects drawn to at least one platform over one other as a result of their exercise is best suited to a selected price construction. For instance, fading an incoming take order may enhance buying and selling earnings – even when buying and selling charges of the trade are greater.

Chart 3: How an trade splits charges throughout joint merchandise varies considerably

The identical may be seen throughout brokers.

Some provide execution-only companies, others are full-service brokers.

Full-service brokers have greater prices, as they provide companies like prime (financing of positions) and analysis. Nonetheless, their merchandise are usually bundled right into a single fee, which itself is often “cents per share” value.

In distinction, execution-only brokers are in a position to streamline their enterprise mannequin, lowering prices – regardless that they could doubtlessly compete utilizing decrease commissions. Though even these execution-only brokers might select to pay extra for his or her buying and selling infrastructure so as to differentiate themselves. Including co-location or sooner information feeds ought to cut back the chance prices for his or her prospects, lowering the prices of their buying and selling. That will increase their “value base,” which they are able to recoup by way of greater commissions, however that would cut back their value benefits in opposition to full-service brokers.

In fact, not all their prospects profit from these investments in sooner buying and selling (or analysis, or financing). It will appear unfair to power all merchants to pay the identical commissions.

In nearly all industries, it is dangerous economics to power all prospects to pay the identical.

If we actually need cost-based pricing – are we prepared to help shrinking companies?

Accounting for, and allocating, prices in the actual world is sophisticated. Price-based pricing is difficult, one thing even the SEC’s funds course of tells us.

Maybe the obvious flaw within the “cost-based” argument is that this: Must you pay double the unique value of the product if half the shoppers cancel it?

To anybody within the markets that ought to sound foolish — falling demand ought to make costs fall, not rise — and but that’s precisely what regulators are supporting after they deal with restoration of prices.