- Whales purchased 340,000 ETH within the final 3 days price greater than $1 billion.

- ETH might need accomplished its correction because the Lengthy Time period Pattern Instructions is strongly bullish.

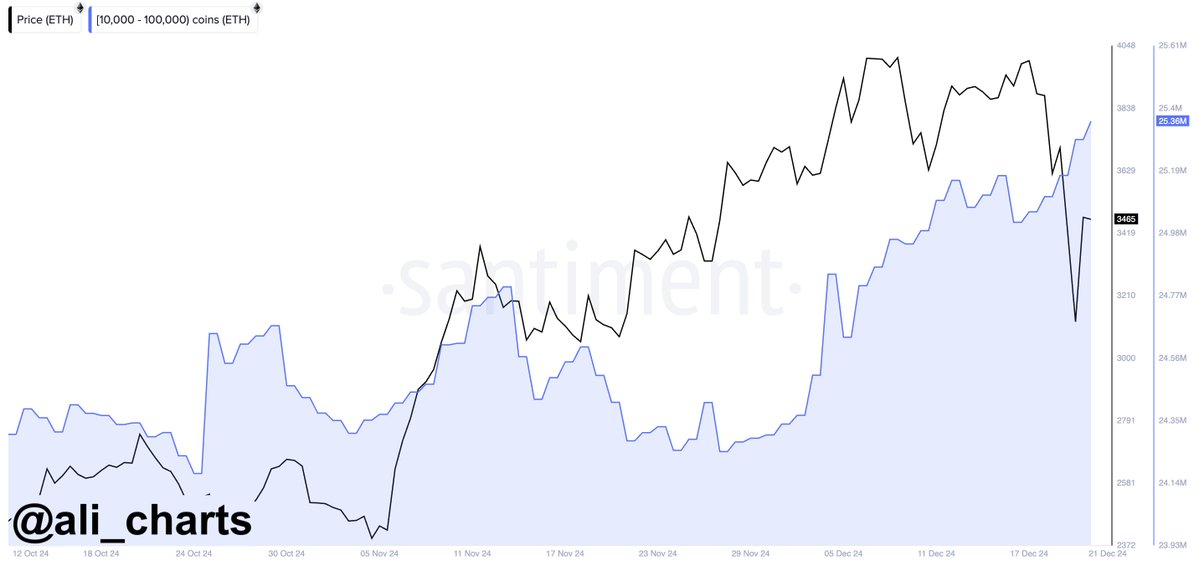

Ethereum’s ([ETH] whale exercise contrasted with its worth, displaying important shopping for in the course of the downturn.

Over three days, whales acquired 340,000 ETH, valued over $1 billion, suggesting strategic bulk purchases throughout worth dips.

This sample in opposition to a backdrop of normal crypto declines, sparked hypothesis about potential market rebound.

The exercise aligned with historic patterns the place substantial buys usually precede market recoveries. This hinted that ETH may quickly expertise a worth improve if this development holds true.

Is correction over amid long run development instructions?

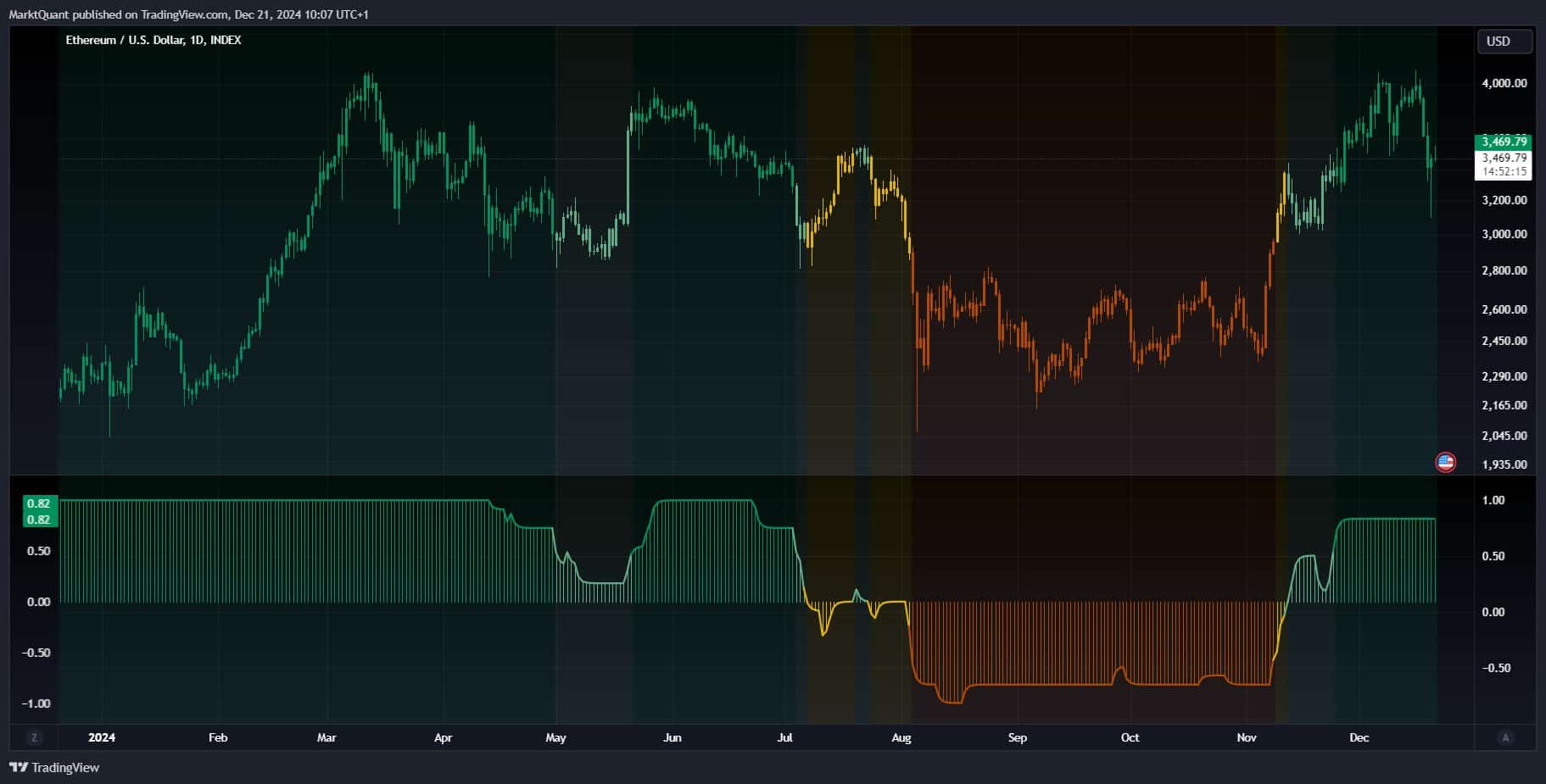

Ethereum weekly chart indicated a possible completion of its correction.

The worth successively retested the Tenkan and Kijun traces of the Ichimoku Kinko Hyo indicator, suggesting a stabilization.

Additional indicators of assist have been evident as ETH interacted with the Kumo Cloud’s Senkou Span A, seen as a preliminary resistance turned assist.

Moreover, the lagging span retraced to its Tenkan line, reinforcing the resilience of present worth ranges. Regardless of these bullish indicators, there remained warning with a attainable retest of the Kumo Cloud’s Senkou Span B.

If Ethereum’s worth approaches this line, it will doubtless signify a crucial take a look at of market sentiment and energy.

Once more, the Lengthy Time period Pattern Instructions (LTTD) rating the 12 months might finish at a robust bullish degree of 0.82, suggesting a constructive long-term outlook.

Regardless of a short dip in mid-year, the LTTD returned to bullish territory.

Ethereum began a constant climb, coinciding with the LTTD rating sustaining above 0.5, indicating sustained purchaser curiosity.

The sharp decline within the LTTD rating in July corresponded with a worth drop, displaying a short-term bearish part.

Nonetheless, the fast restoration in LTTD by October and a corresponding worth rise instructed the correction part ended, and ETH was resuming its long-term upward development.

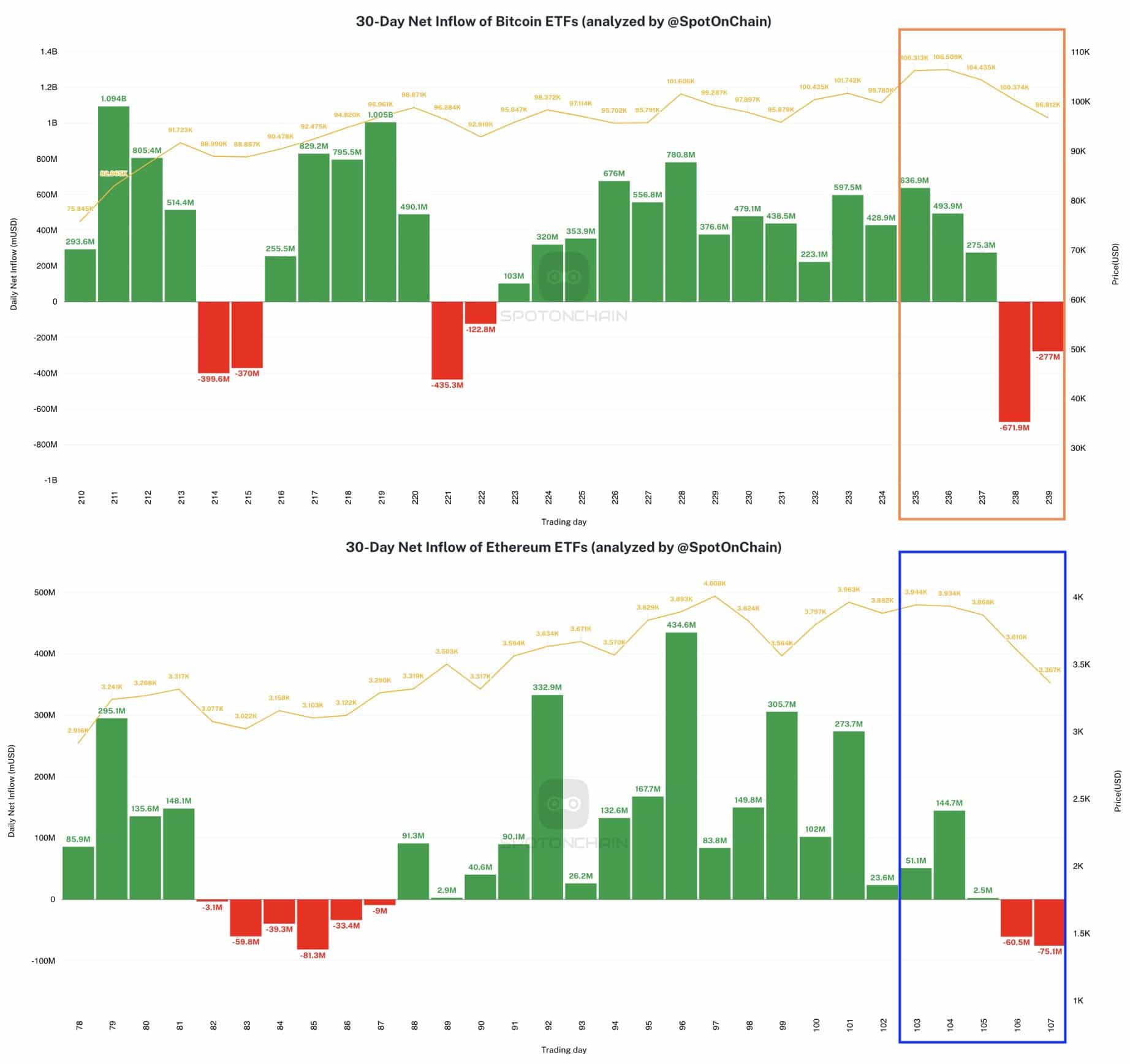

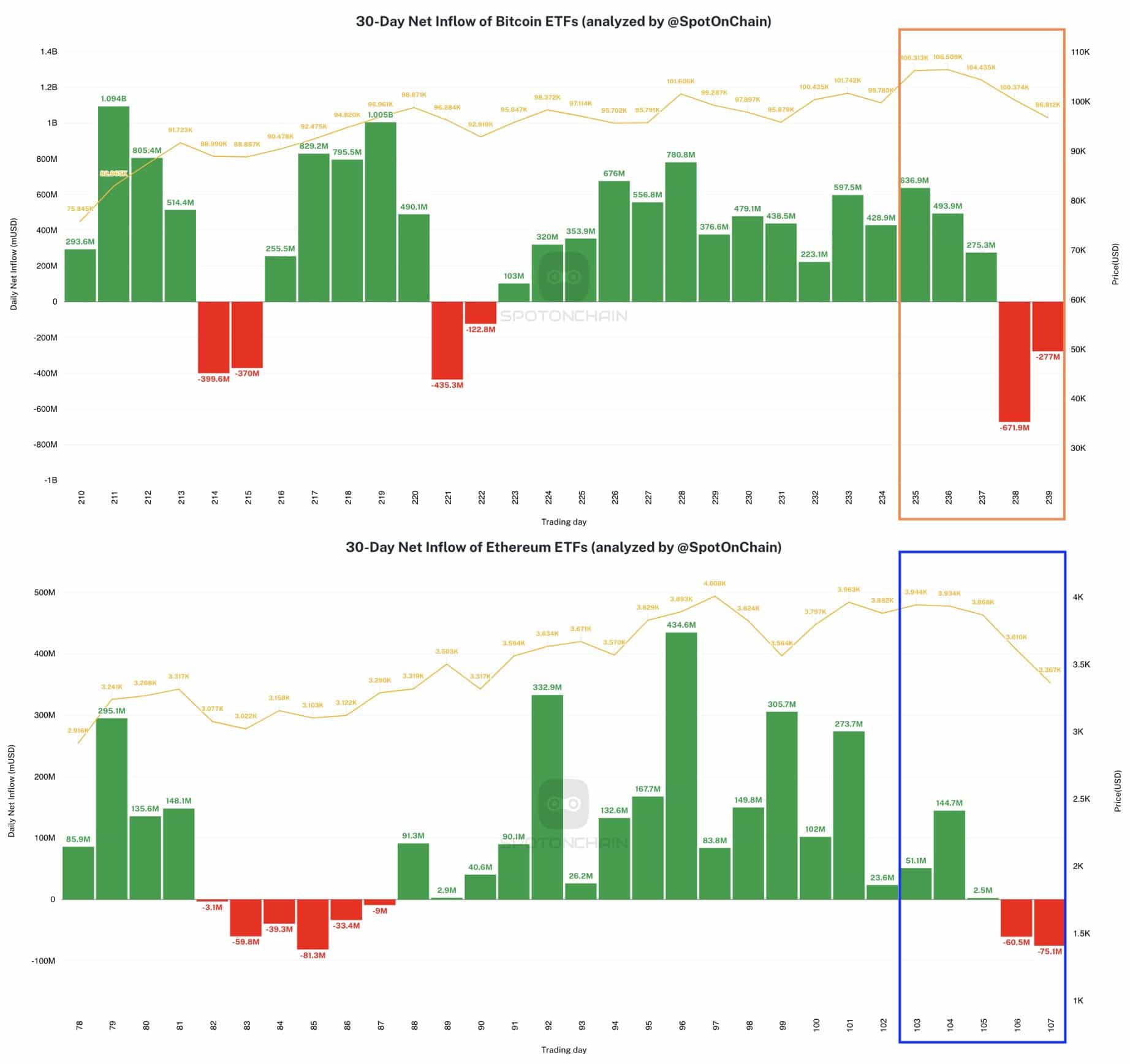

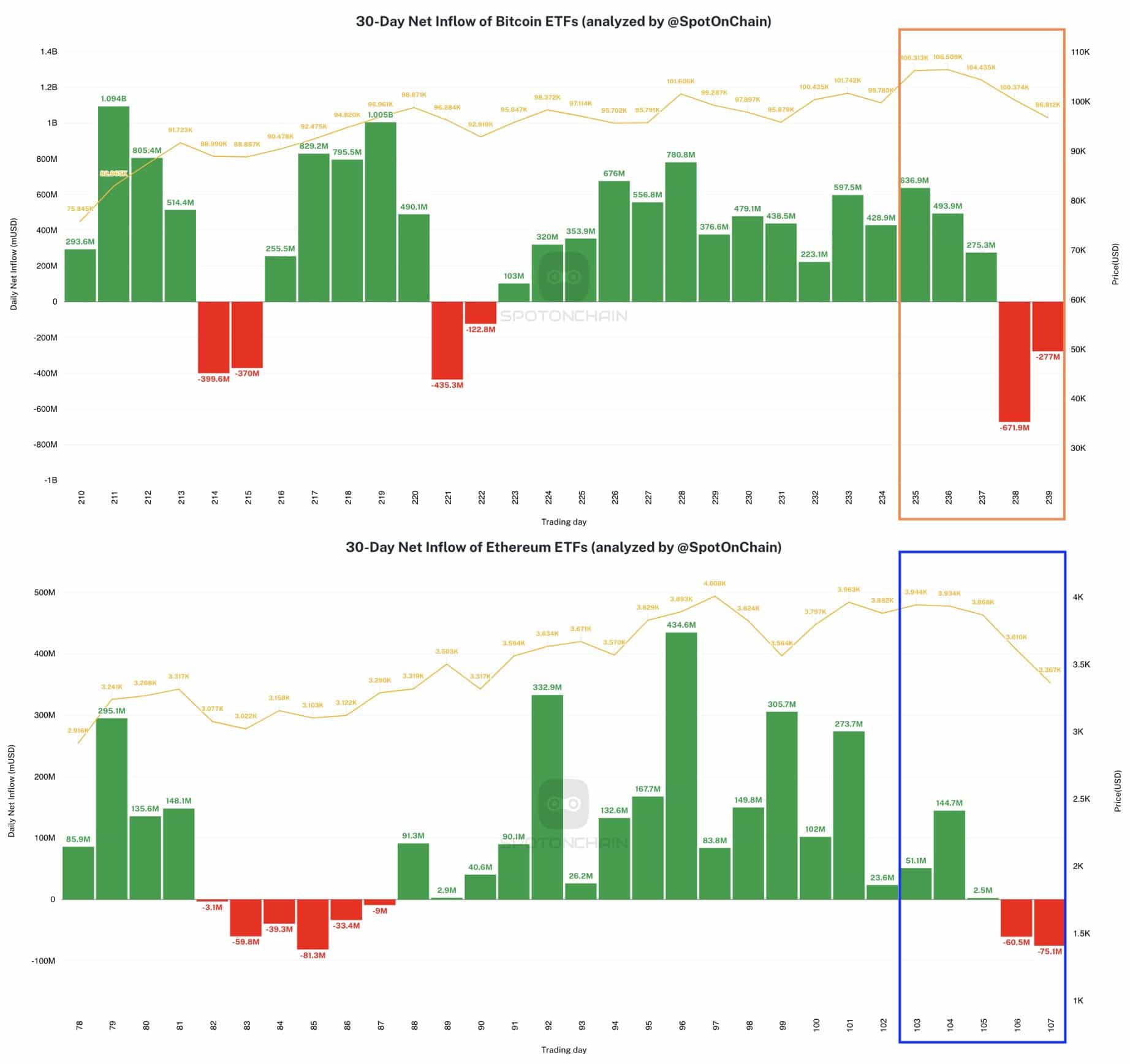

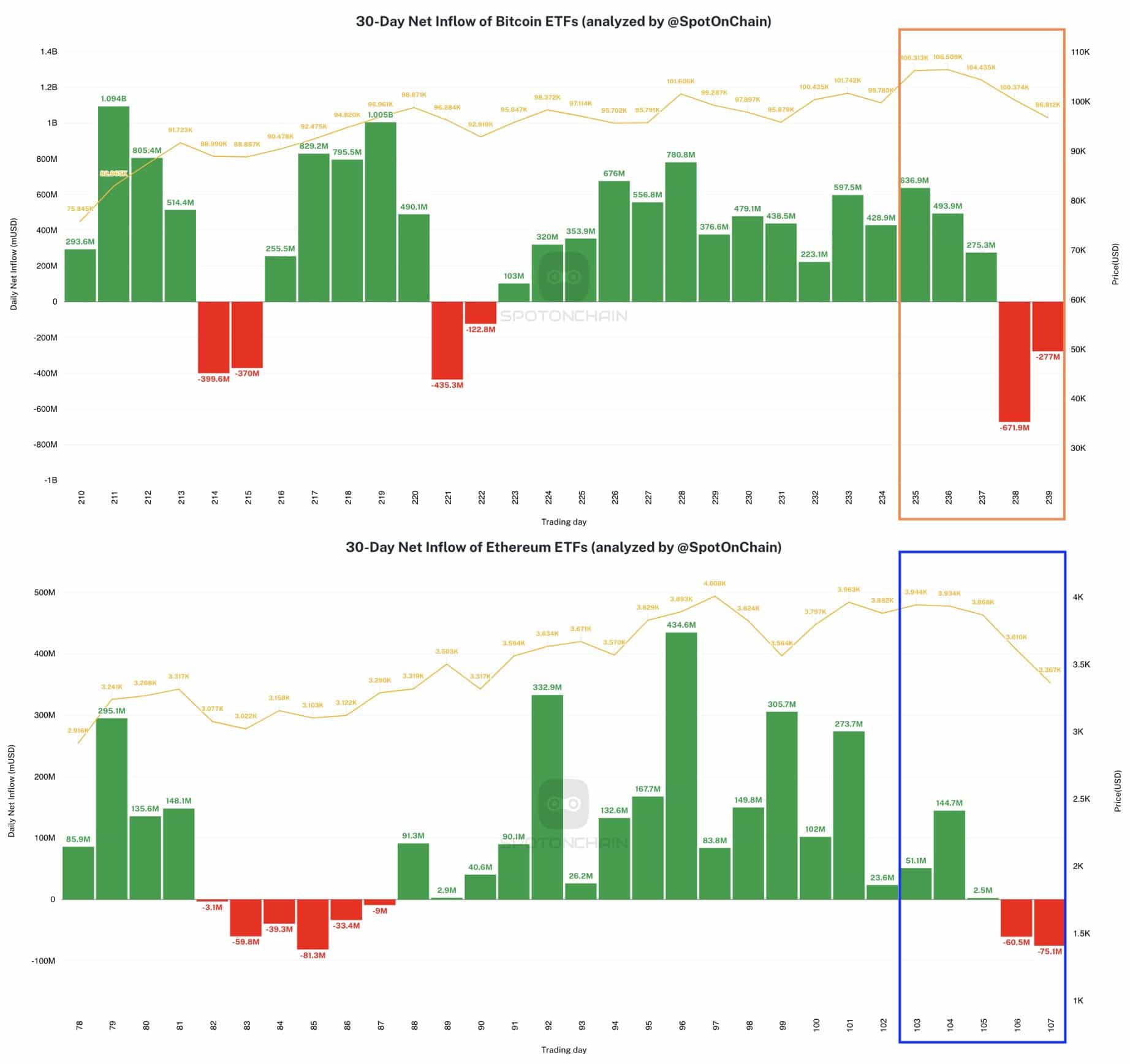

Spot ETH ETFs movement

Nonetheless, Ethereum ETFs skilled notable outflows, with BlackRock’s ETHA seeing the most important ever, round $103.7 million, throughout per week marked by market declines.

In distinction, Bitcoin ETFs additionally witnessed their most vital outflow since inception, totaling round $671.9 million.

This reversal ended two consecutive weeks of inflows for each Bitcoin and Ethereum ETFs.

Supply: SpotOnChain

Notably, regardless of the outflows, BlackRock amassed substantial positions, including 13.7K BTC valued at $1.45 billion and 33.9K ETH price $143.7 million.

These actions indicated important shifts in ETF dynamics, reflecting broader market sentiments and doubtlessly setting the stage for future traits in cryptocurrency investments.

- Whales purchased 340,000 ETH within the final 3 days price greater than $1 billion.

- ETH might need accomplished its correction because the Lengthy Time period Pattern Instructions is strongly bullish.

Ethereum’s ([ETH] whale exercise contrasted with its worth, displaying important shopping for in the course of the downturn.

Over three days, whales acquired 340,000 ETH, valued over $1 billion, suggesting strategic bulk purchases throughout worth dips.

This sample in opposition to a backdrop of normal crypto declines, sparked hypothesis about potential market rebound.

The exercise aligned with historic patterns the place substantial buys usually precede market recoveries. This hinted that ETH may quickly expertise a worth improve if this development holds true.

Is correction over amid long run development instructions?

Ethereum weekly chart indicated a possible completion of its correction.

The worth successively retested the Tenkan and Kijun traces of the Ichimoku Kinko Hyo indicator, suggesting a stabilization.

Additional indicators of assist have been evident as ETH interacted with the Kumo Cloud’s Senkou Span A, seen as a preliminary resistance turned assist.

Moreover, the lagging span retraced to its Tenkan line, reinforcing the resilience of present worth ranges. Regardless of these bullish indicators, there remained warning with a attainable retest of the Kumo Cloud’s Senkou Span B.

If Ethereum’s worth approaches this line, it will doubtless signify a crucial take a look at of market sentiment and energy.

Once more, the Lengthy Time period Pattern Instructions (LTTD) rating the 12 months might finish at a robust bullish degree of 0.82, suggesting a constructive long-term outlook.

Regardless of a short dip in mid-year, the LTTD returned to bullish territory.

Ethereum began a constant climb, coinciding with the LTTD rating sustaining above 0.5, indicating sustained purchaser curiosity.

The sharp decline within the LTTD rating in July corresponded with a worth drop, displaying a short-term bearish part.

Nonetheless, the fast restoration in LTTD by October and a corresponding worth rise instructed the correction part ended, and ETH was resuming its long-term upward development.

Spot ETH ETFs movement

Nonetheless, Ethereum ETFs skilled notable outflows, with BlackRock’s ETHA seeing the most important ever, round $103.7 million, throughout per week marked by market declines.

In distinction, Bitcoin ETFs additionally witnessed their most vital outflow since inception, totaling round $671.9 million.

This reversal ended two consecutive weeks of inflows for each Bitcoin and Ethereum ETFs.

Supply: SpotOnChain

Notably, regardless of the outflows, BlackRock amassed substantial positions, including 13.7K BTC valued at $1.45 billion and 33.9K ETH price $143.7 million.

These actions indicated important shifts in ETF dynamics, reflecting broader market sentiments and doubtlessly setting the stage for future traits in cryptocurrency investments.