- Ethereum’s MVRV ratio nears the “pink field” zone, signaling potential promoting strain.

- Historic patterns recommend a correction may observe as ETH’s overvaluation dangers enhance.

Ethereum’s [ETH] MVRV ratio is inching nearer to the dreaded “pink field” zone — a degree traditionally linked to market pullbacks.

Because the metric teeters on the brink, merchants are on excessive alert, weighing the danger of overvaluation in opposition to the potential of sustained momentum.

With previous patterns hinting at looming promoting strain, may Ethereum’s current beneficial properties be working on borrowed time?

Ethereum’s MVRV nears crucial ranges

Ethereum’s MVRV ratio is inching nearer to the crucial “pink field” zone — the metric is hovering at round 0.88 at press time.

This has drawn consideration from merchants cautious of a possible correction. Because the ratio edges nearer to this hazard zone, issues come up over whether or not Ethereum’s present worth degree precisely displays its intrinsic worth.

Supply: IntoTheBlock

The chart reveals a current dip after a interval of gradual restoration, suggesting the market may be approaching a tipping level.

Whereas bullish sentiment persists, this MVRV motion hints that profit-taking may quickly outweigh shopping for strain.

Classes from the final MVRV peaks

Wanting again at earlier cases when Ethereum’s MVRV ratio entered the “pink field” zone, the aftermath has typically been grim.

Essentially the most notable peak occurred in late 2021, adopted by a pointy decline that worn out almost all of the gathered beneficial properties.

Equally, the ratio’s strategy to overvaluation territory in mid-2022 additionally triggered a steep correction, dragging ETH costs down considerably.

Every time the MVRV ratio flirted with these higher limits, the market responded with pronounced promoting strain. The sample may indicate that Ethereum’s present uptrend would possibly quickly face a difficult take a look at.

Is Ethereum due for a pullback?

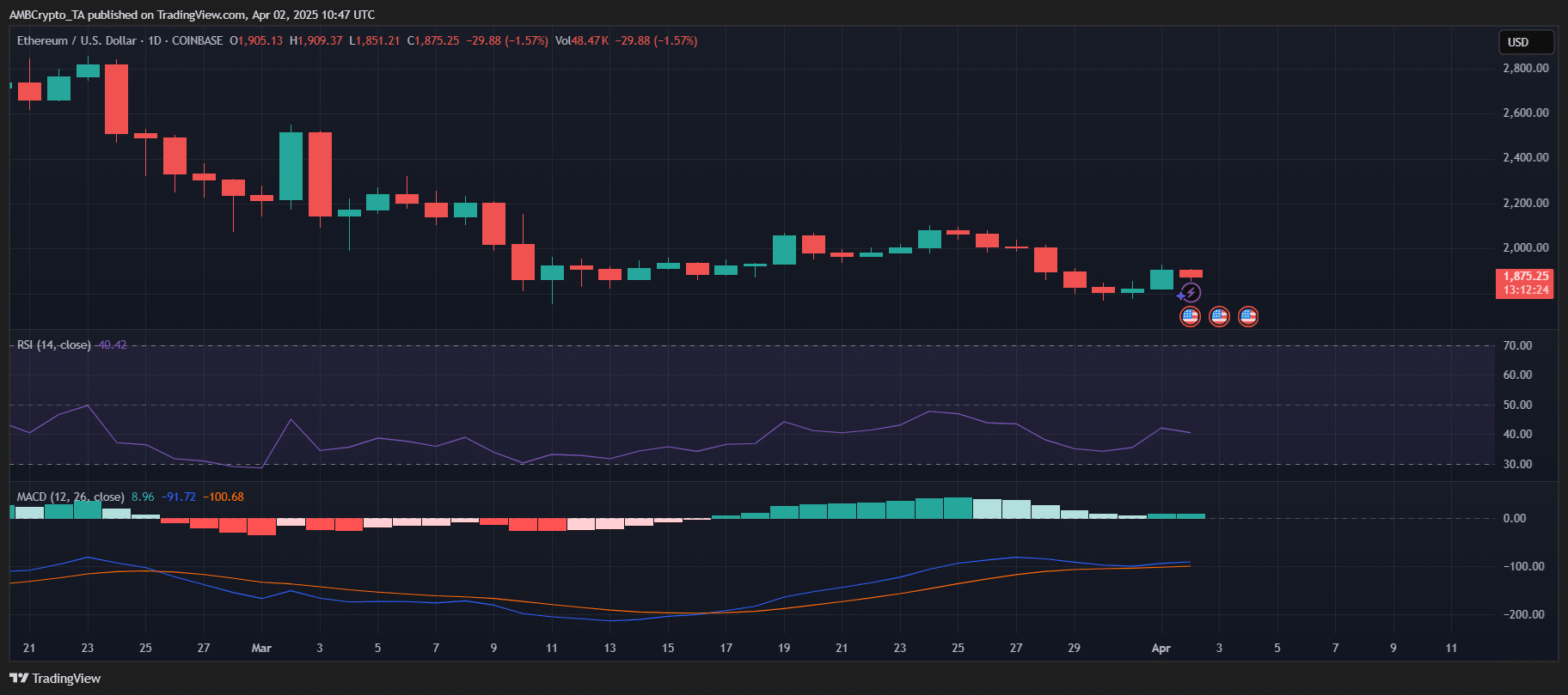

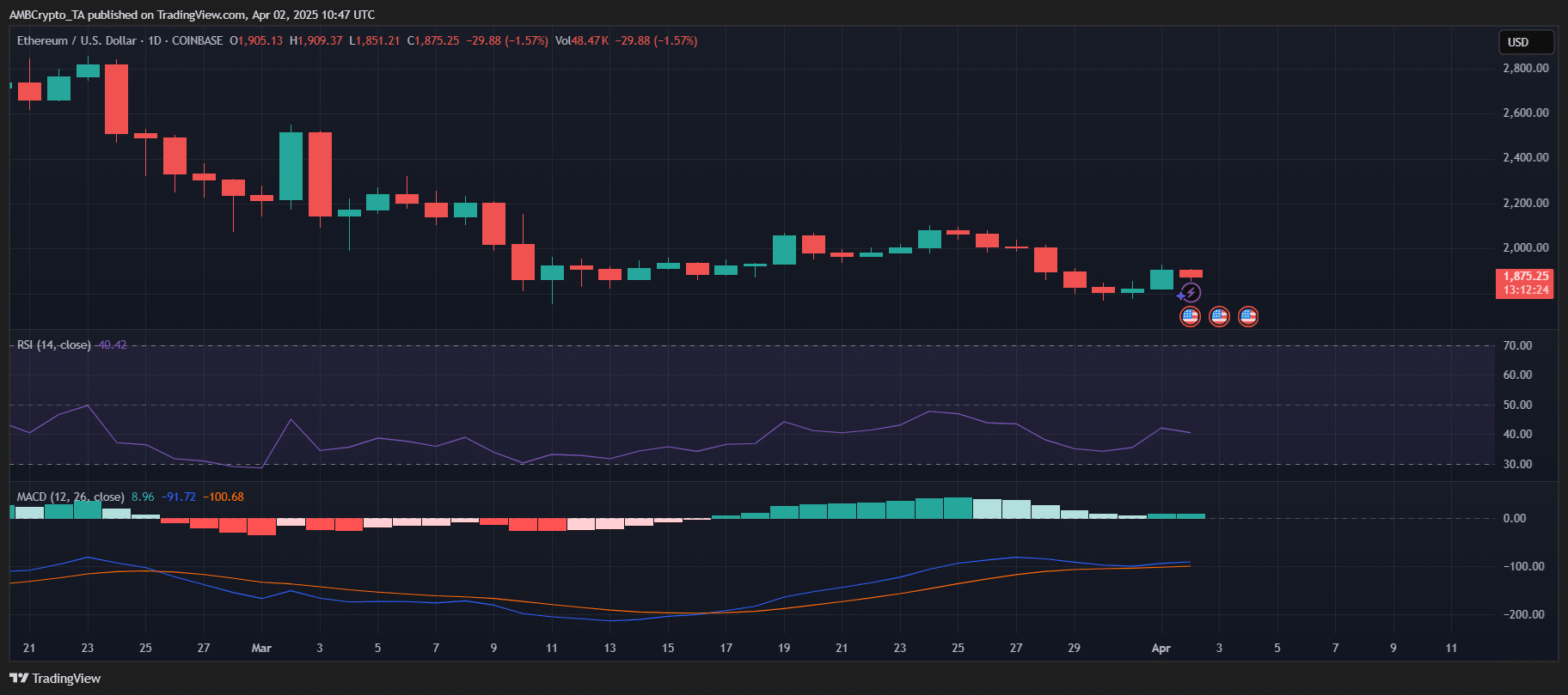

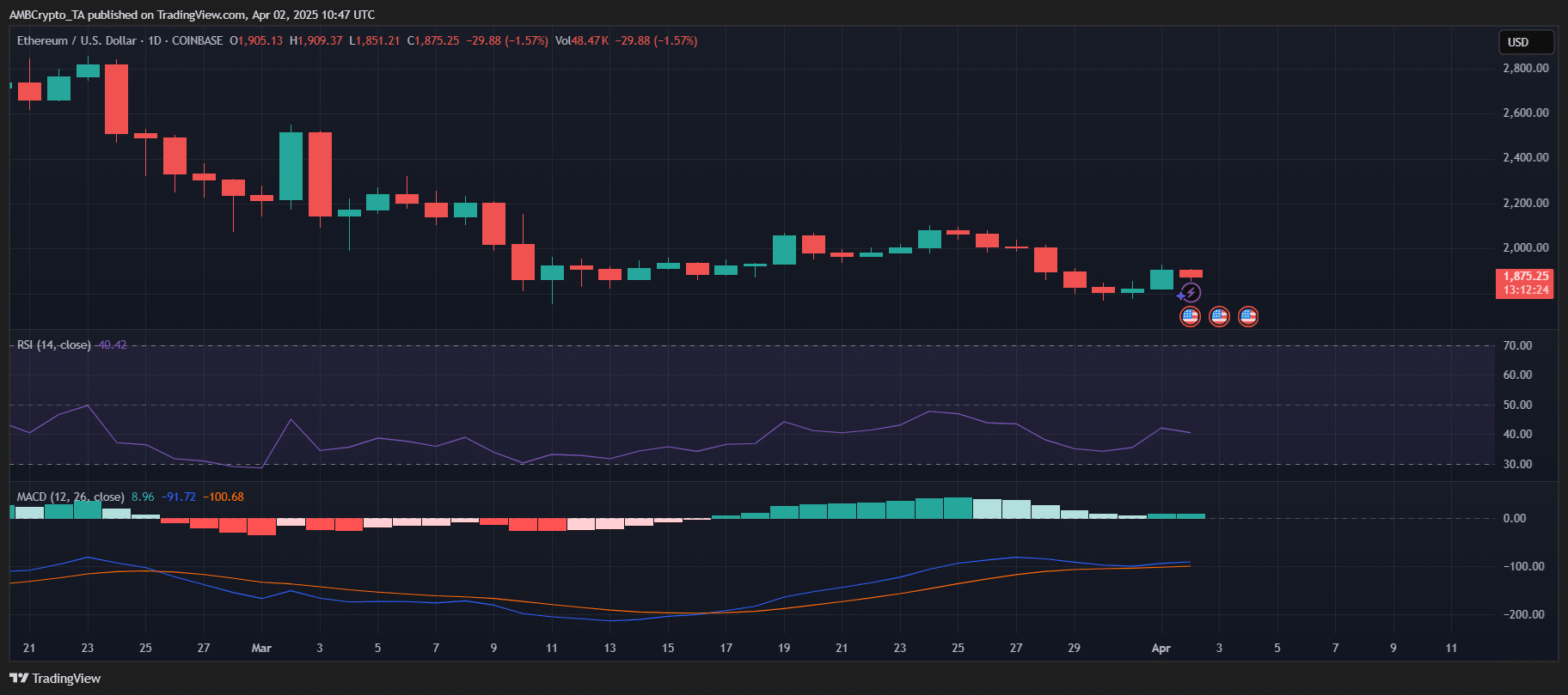

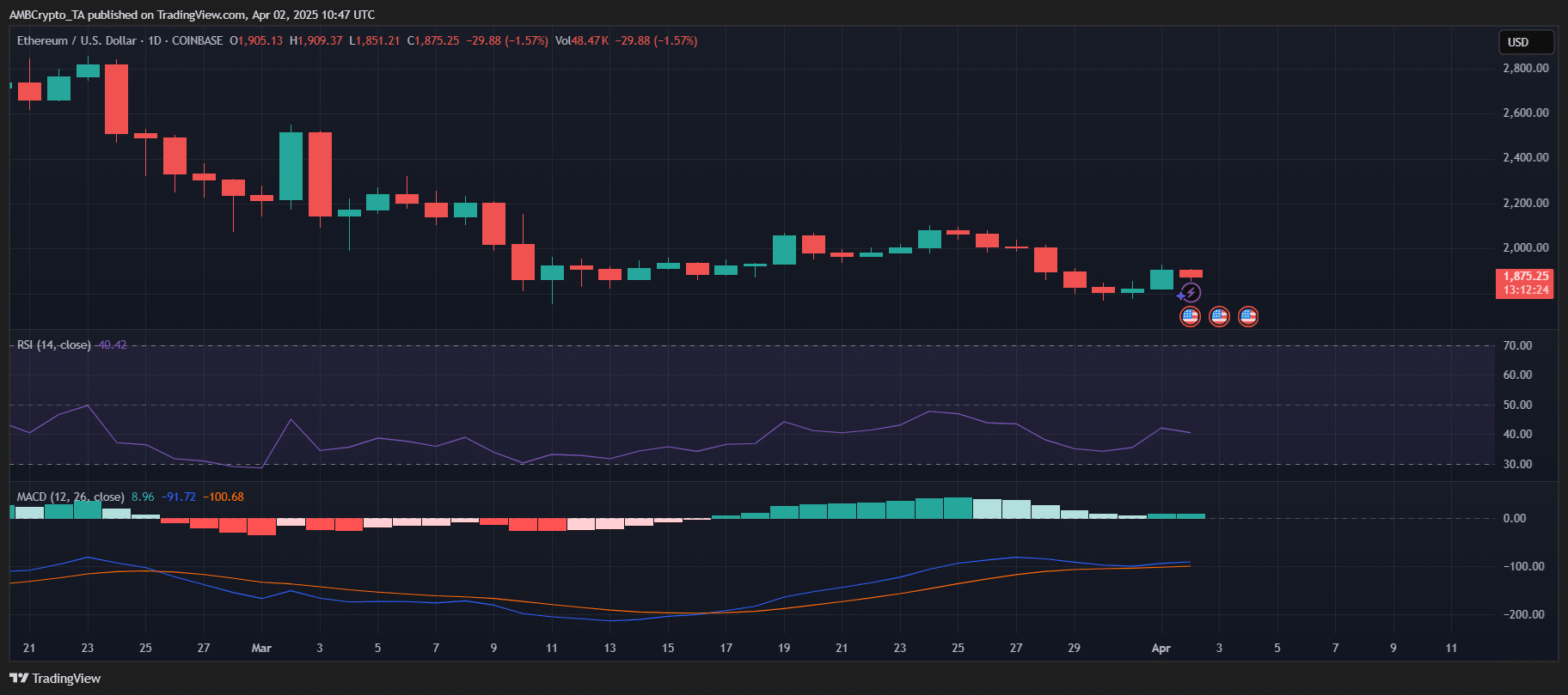

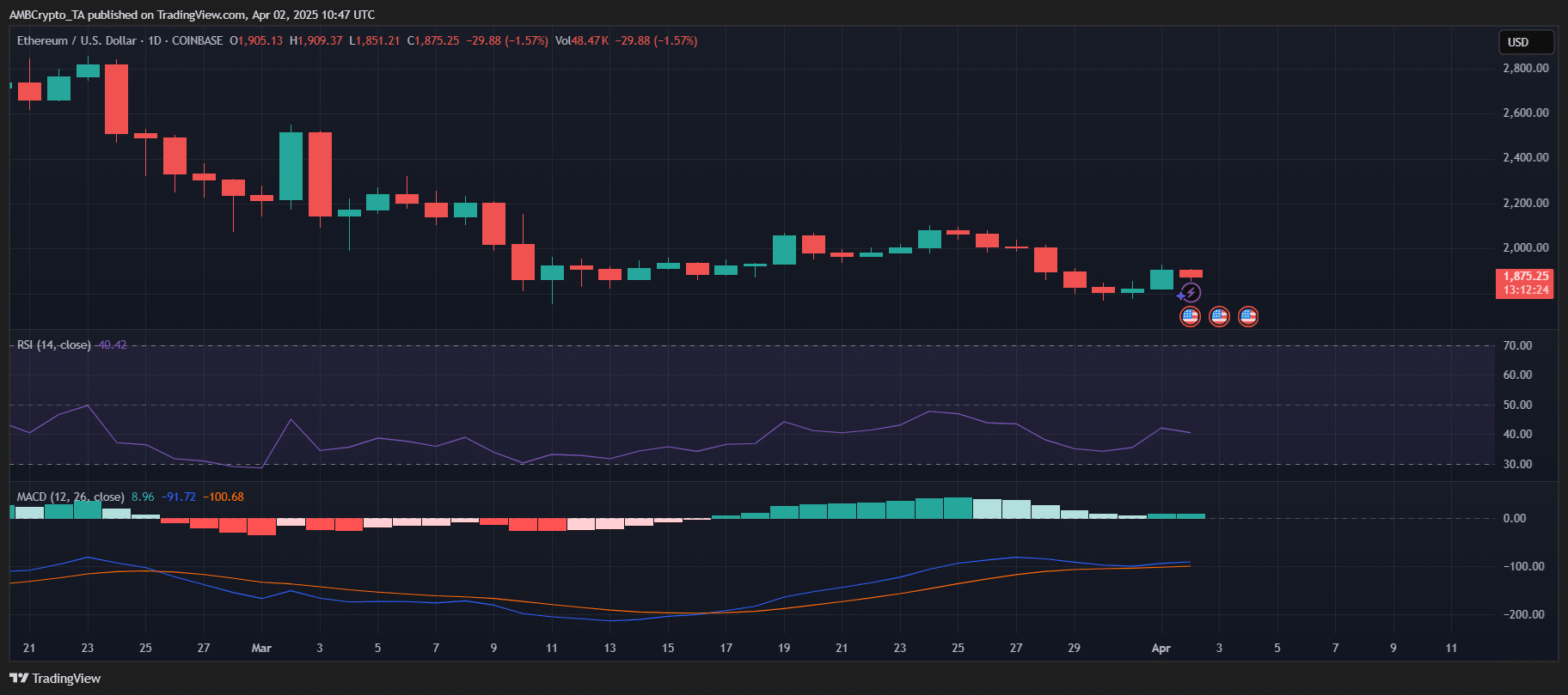

Ethereum hit $1,875 at press time, reflecting a 1.57% decline on the every day chart. The RSI was hovering at 40.42, signaling that ETH was approaching oversold territory, which may restrict additional draw back.

Nonetheless, the MACD histogram remained within the destructive, indicating bearish momentum regardless of a slight discount in promoting strain.

Supply: TradingView

The current collection of pink candles means that bulls are struggling to regain management. Ought to the promoting persist, ETH may take a look at the $1,800 assist degree.

Conversely, a rebound above $1,900 would possibly encourage consumers to push towards the $2,000 resistance.

- Ethereum’s MVRV ratio nears the “pink field” zone, signaling potential promoting strain.

- Historic patterns recommend a correction may observe as ETH’s overvaluation dangers enhance.

Ethereum’s [ETH] MVRV ratio is inching nearer to the dreaded “pink field” zone — a degree traditionally linked to market pullbacks.

Because the metric teeters on the brink, merchants are on excessive alert, weighing the danger of overvaluation in opposition to the potential of sustained momentum.

With previous patterns hinting at looming promoting strain, may Ethereum’s current beneficial properties be working on borrowed time?

Ethereum’s MVRV nears crucial ranges

Ethereum’s MVRV ratio is inching nearer to the crucial “pink field” zone — the metric is hovering at round 0.88 at press time.

This has drawn consideration from merchants cautious of a possible correction. Because the ratio edges nearer to this hazard zone, issues come up over whether or not Ethereum’s present worth degree precisely displays its intrinsic worth.

Supply: IntoTheBlock

The chart reveals a current dip after a interval of gradual restoration, suggesting the market may be approaching a tipping level.

Whereas bullish sentiment persists, this MVRV motion hints that profit-taking may quickly outweigh shopping for strain.

Classes from the final MVRV peaks

Wanting again at earlier cases when Ethereum’s MVRV ratio entered the “pink field” zone, the aftermath has typically been grim.

Essentially the most notable peak occurred in late 2021, adopted by a pointy decline that worn out almost all of the gathered beneficial properties.

Equally, the ratio’s strategy to overvaluation territory in mid-2022 additionally triggered a steep correction, dragging ETH costs down considerably.

Every time the MVRV ratio flirted with these higher limits, the market responded with pronounced promoting strain. The sample may indicate that Ethereum’s present uptrend would possibly quickly face a difficult take a look at.

Is Ethereum due for a pullback?

Ethereum hit $1,875 at press time, reflecting a 1.57% decline on the every day chart. The RSI was hovering at 40.42, signaling that ETH was approaching oversold territory, which may restrict additional draw back.

Nonetheless, the MACD histogram remained within the destructive, indicating bearish momentum regardless of a slight discount in promoting strain.

Supply: TradingView

The current collection of pink candles means that bulls are struggling to regain management. Ought to the promoting persist, ETH may take a look at the $1,800 assist degree.

Conversely, a rebound above $1,900 would possibly encourage consumers to push towards the $2,000 resistance.