- ENA’s value exhibited notable fluctuations, rising 1.89% from $0.4020 to $0.4096 earlier than dropping to $0.3790 underselling strain.

- ENA’s CME Futures Open Curiosity surged to $120,000 on the sixth of March 2025, coinciding with Bitcoin’s rise to $65,000.

Ethena [ENA] not too long ago unlocked 2.07 billion ENA, price $740.71 million, marking a serious improve in circulating provide.

This transfer, together with massive investor deposits into main exchanges, has raised questions on potential value actions and market stability.

The Ethena unlock

On the fifth of March 2025, Ethena launched 2.07 billion ENA into circulation, constituting 39.17% of its complete provide. Following this occasion, massive buyers moved 125 million ENA, price $45 million, to Binance, Bybit, and FalconX.

Traditionally, related unlocks have triggered value declines attributable to elevated provide and profit-taking by buyers. The numerous deposit volumes point out that buyers could also be hedging or securing earnings in anticipation of a market downturn.

Regardless of the dilution danger, long-term stability may come up if demand successfully absorbs the brand new provide. Nevertheless, if promoting strain continues, ENA would possibly check decrease ranges, doubtlessly dropping to $0.30.

This sample aligns with earlier altcoin unlocks, the place deposit surges typically preceded value corrections.

Navigating ENA’s market swings

Just lately, ENA’s value exhibited notable fluctuations, rising 1.89% from $0.4020 to $0.4096 earlier than dropping to $0.3790 below promoting strain. The Volatility Index stood at 0.3769, indicating reasonable market swings.

In the meantime, aggregated spot CVD declined from -108.707M to -107.359M and later to -107.07M, signaling a bearish quantity imbalance the place sellers dominated patrons.

The downward CVD development discouraged merchants from aggressive shopping for, as sustained promoting momentum recommended additional draw back danger.

If CVD reverses into constructive territory, a restoration to $0.4200 could possibly be attainable. Conversely, ought to volatility exceed 0.4000 and CVD stay weak, ENA could dip towards $0.3500.

This sample resembled ADA’s current dump, the place related CVD traits preceded additional declines.

ENA Market sentiment and value implications

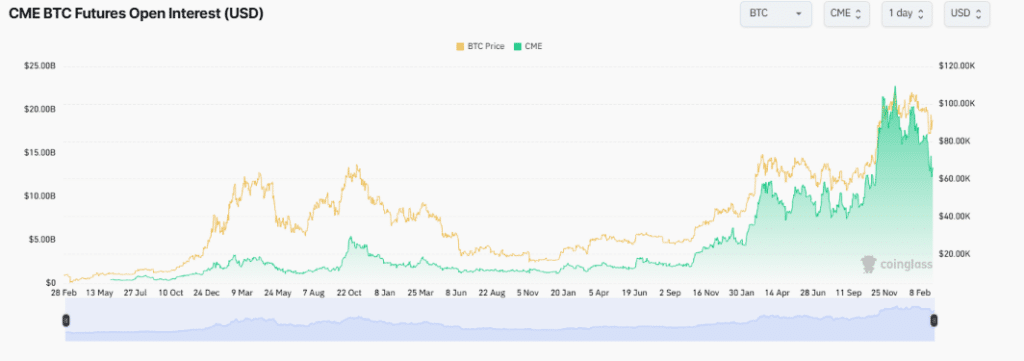

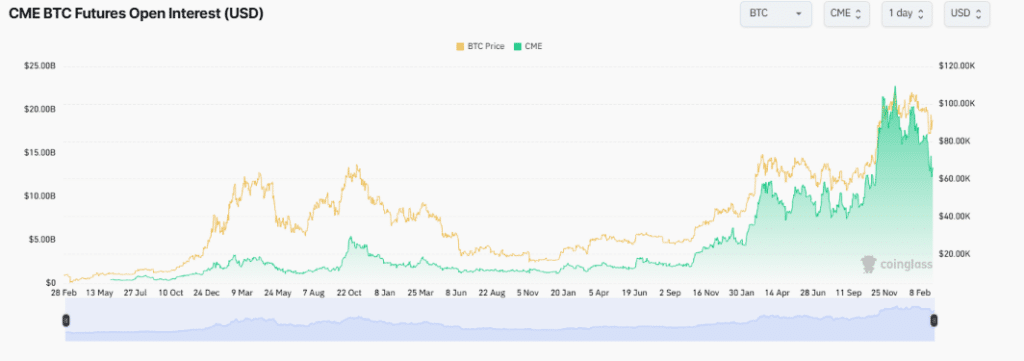

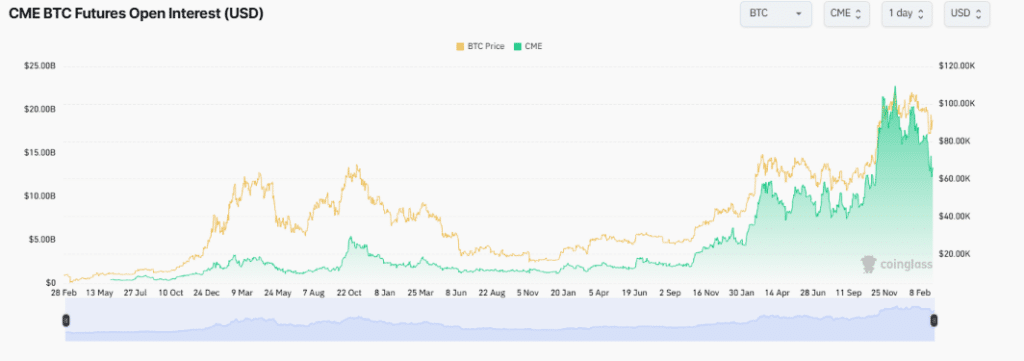

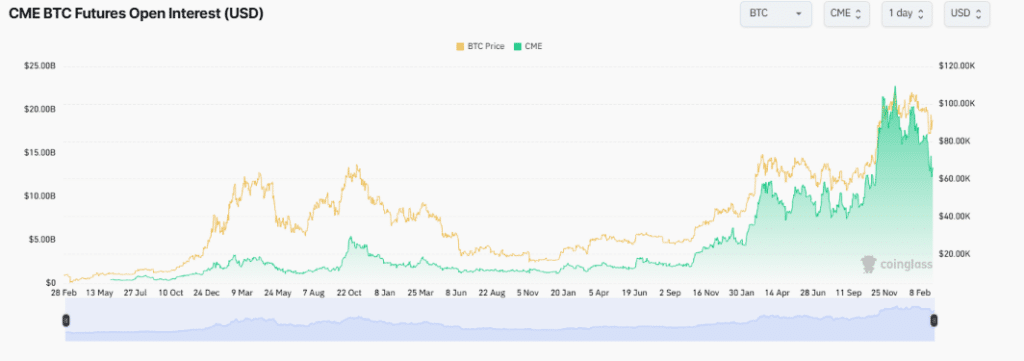

ENA’s CME Futures Open Curiosity (OI) surged to $120,000 on the sixth of March 2025, coinciding with Bitcoin’s rise to $65,000. Over prior weeks, OI grew from $20,000 to $100,000, peaking at $110,000 in late February.

This uptrend indicated elevated leveraged publicity, with open curiosity intently monitoring Bitcoin’s value actions round $60,000.

Supply: CoinGlass

If OI stays excessive, bullish sentiment may drive $ENA towards $0.4500. Nevertheless, a drop in OI beneath $50,000 would possibly set off liquidations, doubtlessly dragging costs right down to $0.3800.

Ethena’s $ENA unlock occasion launched important supply-side strain, with 125 million tokens transferred to exchanges, doubtless for profit-taking.

Though $ENA initially noticed a 1.89% value improve, a declining CVD factors to ongoing promoting strain.

- ENA’s value exhibited notable fluctuations, rising 1.89% from $0.4020 to $0.4096 earlier than dropping to $0.3790 underselling strain.

- ENA’s CME Futures Open Curiosity surged to $120,000 on the sixth of March 2025, coinciding with Bitcoin’s rise to $65,000.

Ethena [ENA] not too long ago unlocked 2.07 billion ENA, price $740.71 million, marking a serious improve in circulating provide.

This transfer, together with massive investor deposits into main exchanges, has raised questions on potential value actions and market stability.

The Ethena unlock

On the fifth of March 2025, Ethena launched 2.07 billion ENA into circulation, constituting 39.17% of its complete provide. Following this occasion, massive buyers moved 125 million ENA, price $45 million, to Binance, Bybit, and FalconX.

Traditionally, related unlocks have triggered value declines attributable to elevated provide and profit-taking by buyers. The numerous deposit volumes point out that buyers could also be hedging or securing earnings in anticipation of a market downturn.

Regardless of the dilution danger, long-term stability may come up if demand successfully absorbs the brand new provide. Nevertheless, if promoting strain continues, ENA would possibly check decrease ranges, doubtlessly dropping to $0.30.

This sample aligns with earlier altcoin unlocks, the place deposit surges typically preceded value corrections.

Navigating ENA’s market swings

Just lately, ENA’s value exhibited notable fluctuations, rising 1.89% from $0.4020 to $0.4096 earlier than dropping to $0.3790 below promoting strain. The Volatility Index stood at 0.3769, indicating reasonable market swings.

In the meantime, aggregated spot CVD declined from -108.707M to -107.359M and later to -107.07M, signaling a bearish quantity imbalance the place sellers dominated patrons.

The downward CVD development discouraged merchants from aggressive shopping for, as sustained promoting momentum recommended additional draw back danger.

If CVD reverses into constructive territory, a restoration to $0.4200 could possibly be attainable. Conversely, ought to volatility exceed 0.4000 and CVD stay weak, ENA could dip towards $0.3500.

This sample resembled ADA’s current dump, the place related CVD traits preceded additional declines.

ENA Market sentiment and value implications

ENA’s CME Futures Open Curiosity (OI) surged to $120,000 on the sixth of March 2025, coinciding with Bitcoin’s rise to $65,000. Over prior weeks, OI grew from $20,000 to $100,000, peaking at $110,000 in late February.

This uptrend indicated elevated leveraged publicity, with open curiosity intently monitoring Bitcoin’s value actions round $60,000.

Supply: CoinGlass

If OI stays excessive, bullish sentiment may drive $ENA towards $0.4500. Nevertheless, a drop in OI beneath $50,000 would possibly set off liquidations, doubtlessly dragging costs right down to $0.3800.

Ethena’s $ENA unlock occasion launched important supply-side strain, with 125 million tokens transferred to exchanges, doubtless for profit-taking.

Though $ENA initially noticed a 1.89% value improve, a declining CVD factors to ongoing promoting strain.