Efficient danger administration is the backbone of profitable buying and selling. Furthermore, in risky markets, managing drawdowns is vital to safeguarding capital and guaranteeing long-term profitability. As well as, a Drawdown Limiter serves as a vital danger administration instrument that helps merchants management losses, preserve self-discipline, and protect their buying and selling accounts.

What’s Drawdown?

In buying and selling, drawdown refers back to the decline in account fairness from its peak to its lowest level. It’s sometimes expressed as a share and signifies the capital misplaced throughout a particular interval. Understanding drawdown helps merchants determine technique weaknesses and alter danger accordingly.

Forms of Drawdown:

Most Drawdown:

The most important drop in fairness from peak to trough throughout a buying and selling interval.

Relative Drawdown:

Drawdown is relative to the preliminary account stability.

Absolute Drawdown:

The loss from the preliminary account stability to the bottom fairness level, excluding earlier income.

Key Perception:

Giant drawdowns, subsequently, spotlight weaknesses in buying and selling methods or unfavorable market circumstances. In contrast, retaining drawdowns low ensures capital preservation and constant efficiency.

Why Limiting Drawdown is Essential

Whereas merchants typically give attention to maximizing income, limiting losses is equally very important for sustainable success. Implementing a drawdown limiter can:

Protect Capital: Protects buying and selling accounts from vital losses that may jeopardize future trades.

Cut back Emotional Stress: Minimizes emotional decision-making attributable to giant, surprising losses.

Keep Consistency: Ensures steady fairness progress by capping potential dangers.

Allow Lengthy-Time period Success: Sustains a wholesome risk-reward stability, permitting merchants to stay energetic within the markets.

How a Drawdown Limiter Works

A Drawdown Limiter is an automatic danger administration instrument that stops buying and selling or adjusts place sizes when a predefined drawdown threshold is reached. It ensures merchants keep inside their danger tolerance, stopping extreme losses. For additional inquiries or to discover danger administration instruments custom-made for MetaTrader, go to 4xPip or contact us by way of Telegram.

Key Options of a Drawdown Limiter:

Customizable Drawdown Ranges: Merchants can set customized drawdown limits to align with their danger urge for food. For instance:

Cautious merchants might cap drawdowns at 5%.

Aggressive merchants might enable drawdowns as much as 15%.

Automated Threat Administration:

Eliminates the necessity for fixed monitoring by robotically imposing guidelines when the drawdown threshold is triggered.

Seamless Integration with MetaTrader EAs:

Suitable with MQL5 Knowledgeable Advisors (EAs), thereby permitting automated methods to include danger administration seamlessly. Consequently, this ensures that algorithmic buying and selling methods stay protected.

Actual-Time Alerts and Notifications:

Gives well timed alerts by way of e-mail or push notifications when drawdown ranges strategy vital limits, permitting proactive motion.

Person-Pleasant Configuration:

Designed for merchants of all talent ranges, it options an intuitive interface, permitting for fast setup and operation.

Advantages of Utilizing a Drawdown Limiter

Protects Buying and selling Accounts: Prevents catastrophic losses that might wipe out capital.

Enhances Dealer Self-discipline: Applies danger administration plans, eradicating feelings from decision-making.

Improves Confidence: Furthermore, it supplies peace of thoughts by mitigating giant losses, thereby enabling merchants to give attention to technique execution.

Optimized for Algorithmic Buying and selling: It provides an additional layer of safety, particularly for automated buying and selling methods operating on MetaTrader 4 or 5.

Sensible Purposes Throughout Markets

Foreign exchange Buying and selling:

In extremely risky Foreign exchange markets, a drawdown limiter prevents margin calls and protects accounts throughout unpredictable worth swings.

Inventory Market Buying and selling:

Inventory merchants generally use drawdown limiters, not solely to safeguard portfolios in opposition to sudden market declines but in addition to guard them throughout corrections or bear markets.

Futures and Commodities:

Leverage in futures and commodities amplifies each income and losses. A drawdown limiter ensures leveraged trades stay beneath management, stopping vital account harm.

Drawdown Limiter After Utilized on MetaTrader

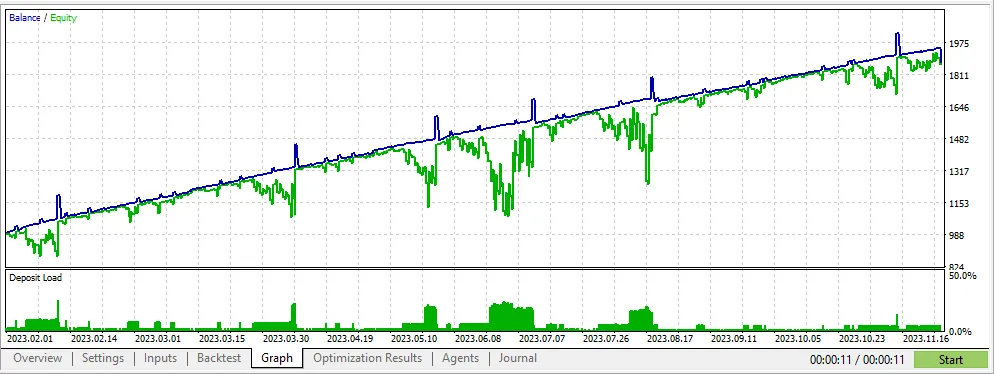

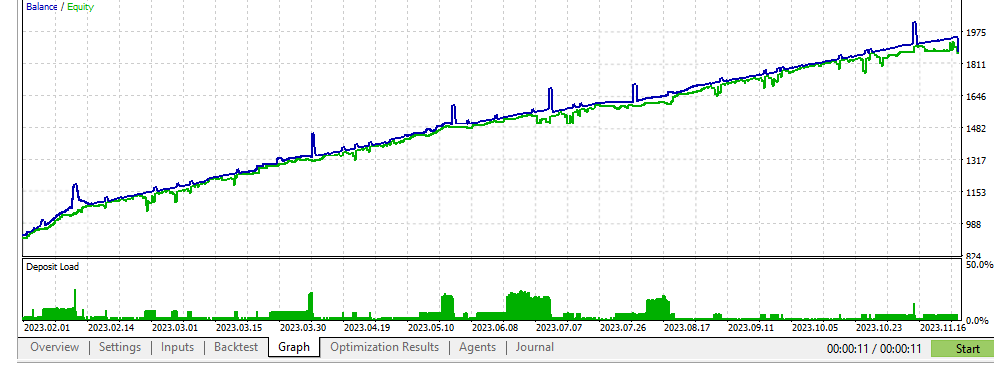

Drawdown is principally operating lack of merchants, if trades are closed, it converts into precise loss inflicting you lack of cash $$. The Drawdown might be seen as a inexperienced line in each backtest graph. The decrease the inexperienced line is, the upper the drawdown is.

Huge drawdown principally happens in high-risk buying and selling akin to martingale, grid buying and selling, averaging or hedging. When the worth strikes away from Revenue Goal and professional advisor retains opening new trades.

Under is an image of Grid EA buying and selling the place extreme Drawdown is proven as inexperienced line

This is similar graph from Grid EA after making use of the Drawdown Limiter

Contact Data:

Obtain MT4 Drawdown Limiter from the next button:

Obtain MT5 Drawdown Limiter from the next button:

4xpip Telegram: https://t.me/pip_4x

4xpip Whatsapp: https://api.whatsapp.com/ship/?telephone=18382131588