A trailing cease loss is easy.

Trip the development and seize monster earnings…

Appears to be like simple however, what else is occurring right here?

Nicely – the reality is, it’s a buying and selling approach that may have enormous results in your buying and selling psychology.

Think about you’re in revenue…

However the market pushes its method again to your trailing cease loss…

It’s nonetheless a revenue…

…however what in regards to the thought creeping into your thoughts?

“Rattling, if I hadn’t had a trailing cease loss and brought my earnings at resistance, my earnings would’ve been a lot larger!”

Sounds acquainted, proper?

It’s why in immediately’s buying and selling information, I’ll not solely share with you the disadvantages of trailing cease loss but in addition provide the full context behind it and strategies on what you are able to do as a substitute.

Particularly, you’ll be taught…

- The totally different sorts of trailing cease loss and the perfect indicators to make use of for them

- Why trailing cease loss isn’t as fairly as you assume if you commerce it in real-time

- Highly effective trailing cease loss strategies and techniques to raised optimize and decide the perfect trailing cease loss for you

- An entire trailing cease loss technique for short-term and long-term tendencies

Secure to say that after this coaching information, you’ll by no means see trailing cease loss the identical method!

Are you prepared?

Then let’s get began.

Disadvantages of Trailing Cease Loss: What’s it and The way it Works

Let me ask you:

In the event you google “trailing cease loss” what do you discover?

That’s proper!

Nevertheless, do you know that there are alternative ways in which you’ll path your cease loss?

Particularly, they’re:

- Development-based indicator trailing cease loss

- Oscillator-based trailing cease loss

- Candlestick trailing cease loss

to be taught extra?

Let me share them with you intimately…

Development-based indicator trailing cease loss

You possibly can most likely guess the that means, proper?

These indicators work finest in trending markets.

Indicators corresponding to a shifting common…

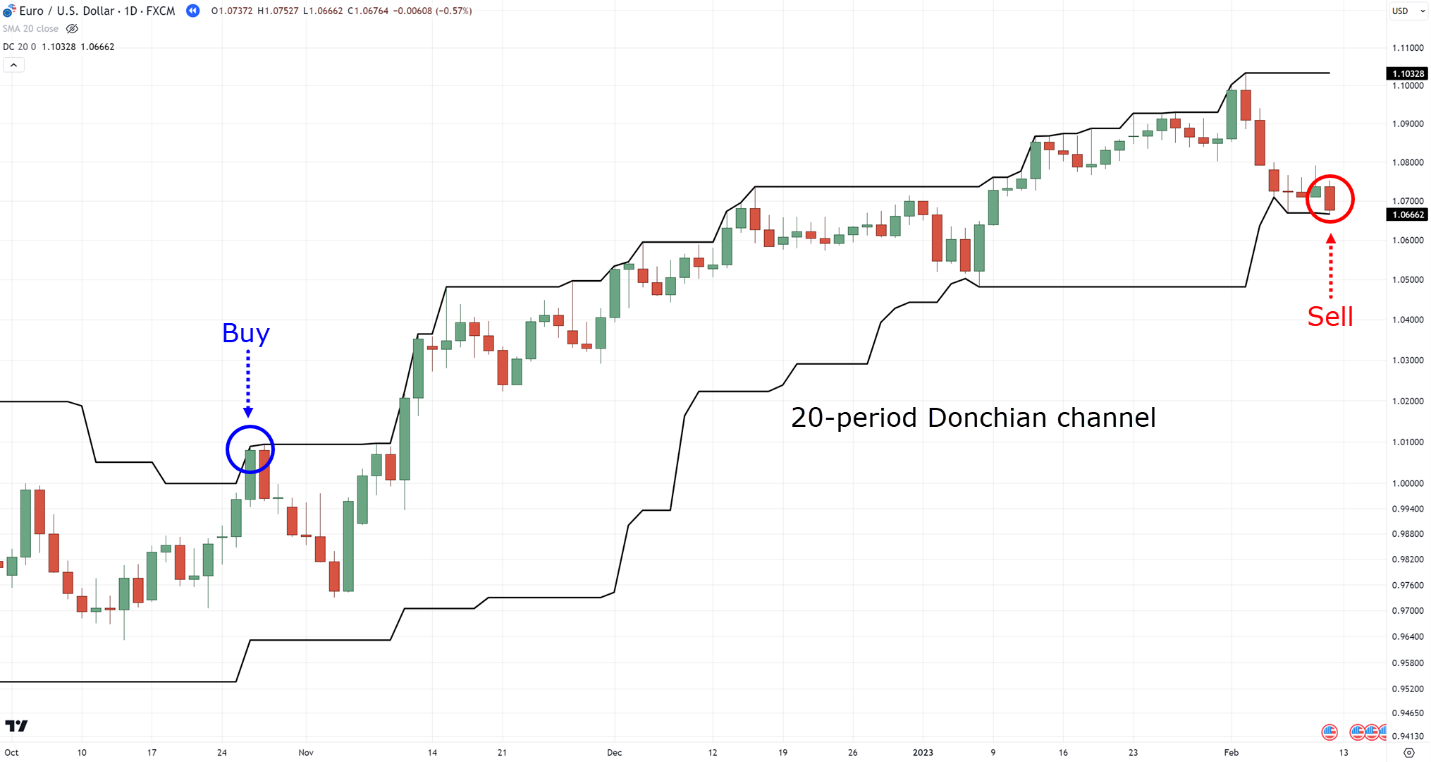

And the Donchian channel…

…each work fairly successfully!

Nevertheless, they’re not the holy grail… as these indicators will falter on vary markets, so be careful!

Oscillator-based trailing cease loss

The sort of trailing cease loss technique can work finest when making an attempt to catch the short-term momentum of the markets.

One instance is the RSI indicator, whereby you solely exit if the value closes above the overbought stage…

After which await the value to shut beneath the overbought stage once more as an exit set off…

It may be counter-intuitive, as we are sometimes taught to purchase at oversold and promote at over-bought ranges, proper?

However in actuality, the market can maintain its momentum by staying at these ranges for fairly a while…

…opening alternatives for trailing your cease loss.

Candlestick trailing cease loss

Throughout all trailing cease losses on the market, this one is probably the most aggressive.

It should even be well-practiced with a view to apply correctly.

However, the way to go about it?

As soon as you might be within the commerce…

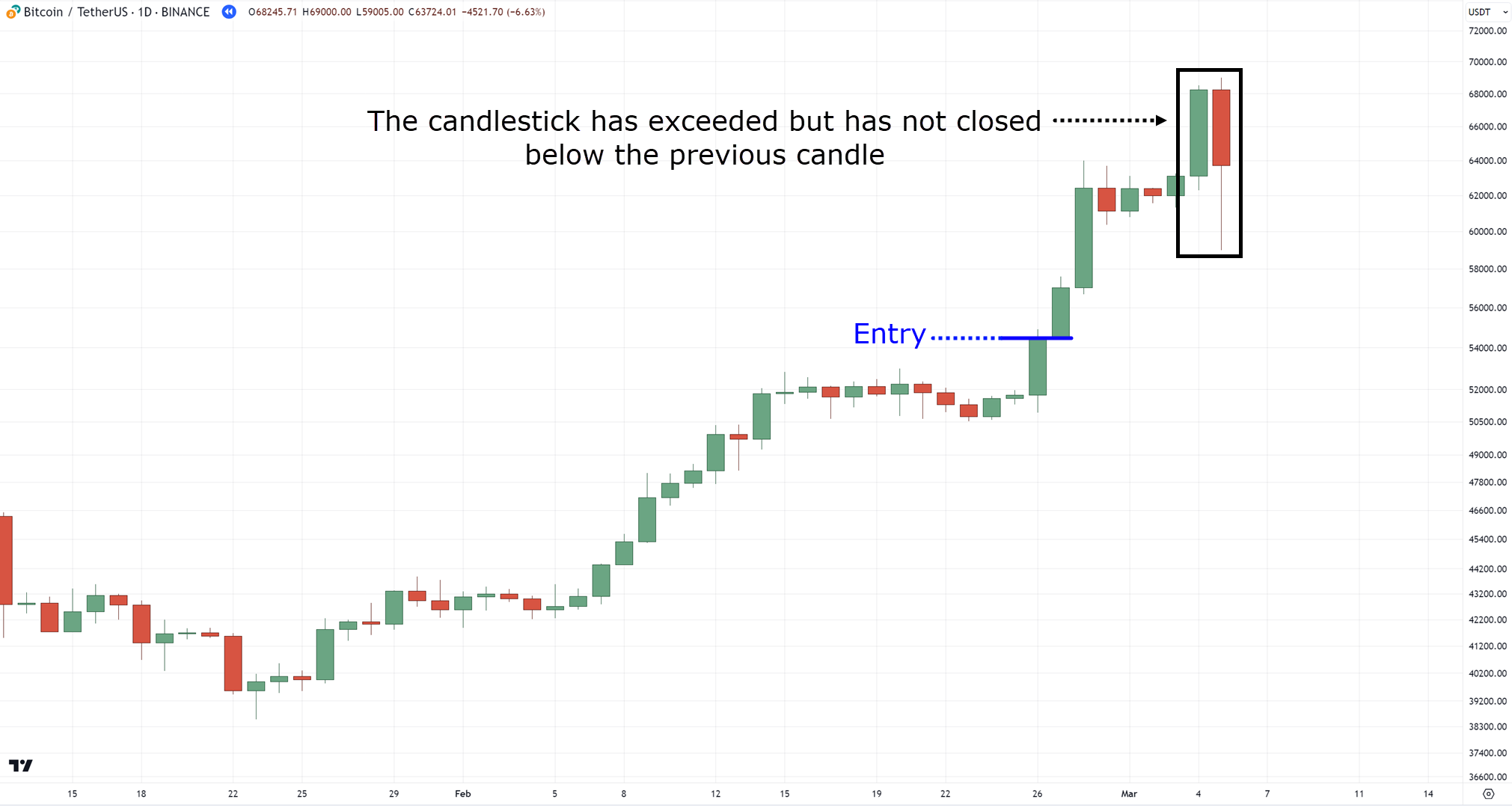

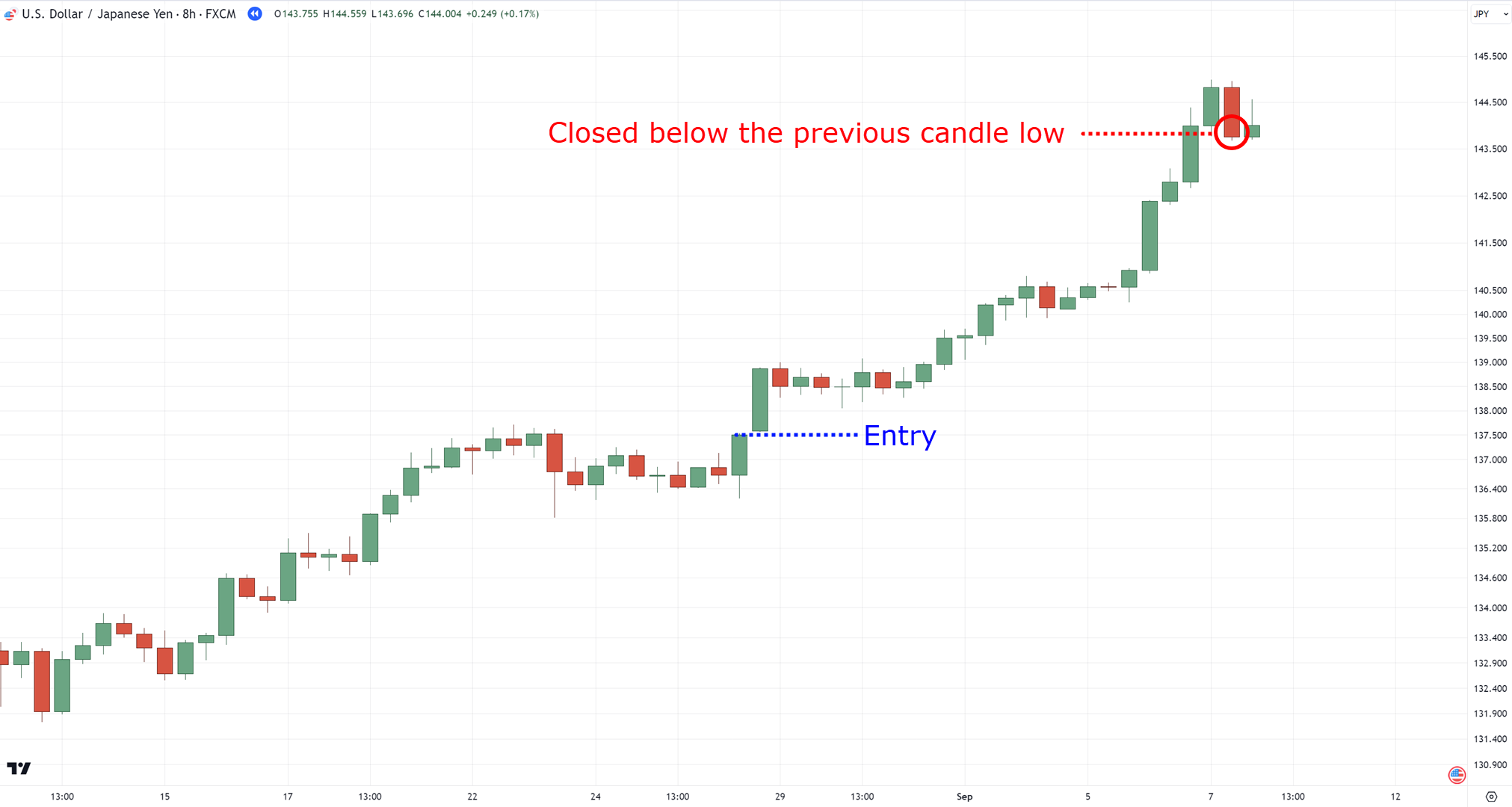

…you await the candlestick to shut past the earlier candlestick…

That’s proper, if the candlestick’s wicks have exceeded the earlier candle, you continue to keep within the commerce…

…but when it closes past the earlier candle’s highs and lows, you then exit the commerce…

Once more, this technique might be the best to know because it doesn’t require any magic indicators or intervals.

It’s pure candlestick!

Nevertheless, it does want a while to get used to.

So now that you simply’re outfitted with some data…

How are you going to use it in dwell buying and selling?

In spite of everything, seeing ideas in textbooks is at all times totally different from actuality, proper?

So, let me share the disadvantages with you within the subsequent part…

What Are The Disadvantages Of Trailing Cease Loss?

The reality is that each one the disadvantages you’ll hear from this part are just about the price of doing enterprise.

Nevertheless, have you ever ever heard the saying:

“There is no such thing as a holy grail within the markets”…?

It’s why I’m going to share with you the professionals and cons of every idea proven to date, that can assist you resolve which one to decide on.

As a result of that’s what it takes to be a constant dealer.

Let’s get began…

Disadvantages of a trend-based indicator trailing cease loss

There are two important disadvantages right here.

First, you’ll typically have poor danger to reward trades because the development doesn’t push far…

Second, there’s the psychological affect of such a trailing cease loss.

Think about being in critical revenue, just for the market to wipe most of it away…

Ouch!

It’s par for the course when selecting this technique, but it surely will not be for everybody.

Disadvantages of an oscillator-based indicator trailing cease loss

Relating to indicators, a significant drawback is fake alerts.

There can be occasions if you see the value break and reverses from overbought ranges…

….just for the value to reverse once more – again to the development!…

Fairly darn irritating!

However one approach to cut back that is to extend your RSI-period worth to 14-period or above.

Once more, this reduces it, however doesn’t eradicate the issue completely.

Disadvantages of a candlestick-based trailing cease loss

Regardless of it being probably the most aggressive trailing cease loss there’s, false alerts current a significant drawback.

They imply there can be occasions if you’ll exit the commerce as a consequence of only a small blip…

After all, you’ll’ve made extra revenue for those who stayed within the commerce, however that’s the way it goes!

Now you may be considering:

“Which one is the perfect one for me?”

“I nonetheless can’t decide what sort of trailing cease loss I ought to use.”

Don’t fear, as I’ve all of the solutions for you within the subsequent part!

How To Overcome The Disadvantages Of Trailing Cease Loss

Consider the ideas I shared with you as job candidates it’s a must to select from….

So, now you need to ask your self…

“What are the standards I ought to contemplate on the subject of selecting the perfect one?”

“Which one’s the perfect match for me and my buying and selling plan?”

In brief…

Step 1: Know your buying and selling methodology

What are the totally different buying and selling strategies?

Nicely, there’s the basic development following…

Momentum buying and selling, the place you solely plan to trip and seize the quick momentum energy within the markets…

And Imply Reversion buying and selling, which is kind of the alternative of momentum buying and selling the place you revenue out there’s weak point…

After all, there are different buying and selling strategies on the market!

However on the subject of trailing cease loss, these are sometimes those that you simply want.

So, which trailing cease loss is most related for every?

Step 2: Use a related trailing cease loss technique on your buying and selling methodology

For development following, you’ll need to resolve what sorts of development you need to seize.

Do you need to seize short-term, medium-term, or long-term tendencies?

If you wish to seize short-term tendencies, you then’ll need to use a “tight” trailing cease loss – such because the 20 to 30-period Donchian channel trailing cease loss…

For medium-term tendencies, you’d need to use a 50 to 100-period Donchian channel trailing cease loss…

Lastly, for long-term tendencies, a 100 to 200-period Donchian channel is related…

Now that’s a really lengthy commerce!

Keep in mind that these are cherry-picked charts extracted from the cruel actuality of actual world of buying and selling…

There can be loads of occasions when you will note your earnings evaporate (a significant drawback of trailing cease loss)!

However you possibly can’t deny how easy the idea is, proper?

Nevertheless, it’s by no means about selecting the perfect interval on the market – it’s all about choosing probably the most related indicator and interval that fits your buying and selling type.

Transferring on, we now have momentum buying and selling.

For this, you will have two methods to path your cease loss.

The primary is by utilizing a candlestick cease.

Which means when you enter the commerce…

…you’ll not exit the commerce till it closes past its earlier candlestick…

Now, ensure to learn that once more.

Even when the candlestick’s wick exceeds the earlier candle, you’re nonetheless within the commerce.

You’ll need to await an in depth after which exit on the subsequent bar…

Systematic and easy, proper?

As beforehand said, although, its main drawback is that it may be a false sign.

However for those who’re a momentum dealer who needs to seize short-term strikes within the markets, then the drawback turns into a standard price of doing enterprise!

The second approach to go about that is by utilizing an indicator trailing cease.

You are able to do so by selecting an oscillator and momentum-based indicator such because the MACD, RSI, or stochastic.

Let’s take the RSI indicator for example…

In the event you enter a breakout commerce, you then’ll need to await the RSI to shut above RSI 70…

(As a result of once more, we’re adopting a momentum buying and selling strategy.)

…however solely exit when it closes again beneath RSI 70…

Are you able to see how utilizing an indicator-based trailing cease loss makes it extra goal and systematic?

Nicely, how about imply reversion buying and selling?

It’s really much more easy – as you should use the identical instruments I shared with you beforehand.

The one distinction is that you simply’re getting into on a pullback as a substitute of a breakout.

Particularly, for those who’ve entered a pullback commerce…

…you’ll need to await the value to shut above 50, solely exiting when the value closes beneath 50 once more…

Similar idea as some time in the past, proper?

Besides this time, once more, you’re getting into on a pullback.

Now, I’ve shared a variety of strategies and ideas in a brief period of time.

I feel if you wish to be taught in depth in regards to the buying and selling methodologies I’ve shared with you, you must try these hyperlinks:

Development Following Buying and selling Technique Information

The Important Information to Momentum Buying and selling

With that mentioned, let me shell out some truths about trailing cease loss within the subsequent part…

Disadvantages Of Trailing Cease Loss: Do you have to use a trailing cease loss?

Truthfully, Trailing cease loss will not be for everybody.

However how will you inform?

You have to contemplate the next…

You’re used to and are prepared to delay your gratification

It’s true.

Having a trailing cease loss can can help you seize monster tendencies.

However as a rule, you’ll encounter failed trades virtually half of the time.

So, let me ask you…

Are you prepared to endure loads of dropping and breakeven trades earlier than discovering a monster development?

Or are you extra comfy taking a hard and fast goal revenue to cut back the uncertainty in your thoughts?

I’m positive my query highlights how every part has its execs and cons.

However with this information, I hope you possibly can see there are alternatives on the market!

With that mentioned, let’s do a fast recap of what you’ve discovered immediately.

Conclusion

All the pieces that I’ve shared immediately will not be so that you can utterly keep away from cease losses however so that you can acquire a greater understanding of their idea.

The number of trailing cease losses means they don’t seem to be all created the identical – every has its personal quirks.

So, right here’s what you’ve discovered immediately:

- Numerous sorts of trailing cease loss exist, together with trend-based, oscillator-based, and candlestick indicators.

- Every sort has drawbacks corresponding to forfeiting earnings, false alerts, and inappropriate utilization throughout sure market situations.

- Matching the trailing cease loss technique to your buying and selling technique helps mitigate its disadvantages.

- Trailing cease loss could not go well with everybody, so at all times weigh its execs and cons towards your buying and selling type.

Now it’s over to you!

Do you comply with the disadvantages of a trailing cease loss I shared with you?

Additionally, d you typically change your trailing cease loss relying in the marketplace situation?

Or maybe you solely use one, to be as constant as potential?

I sit up for your response within the feedback beneath!