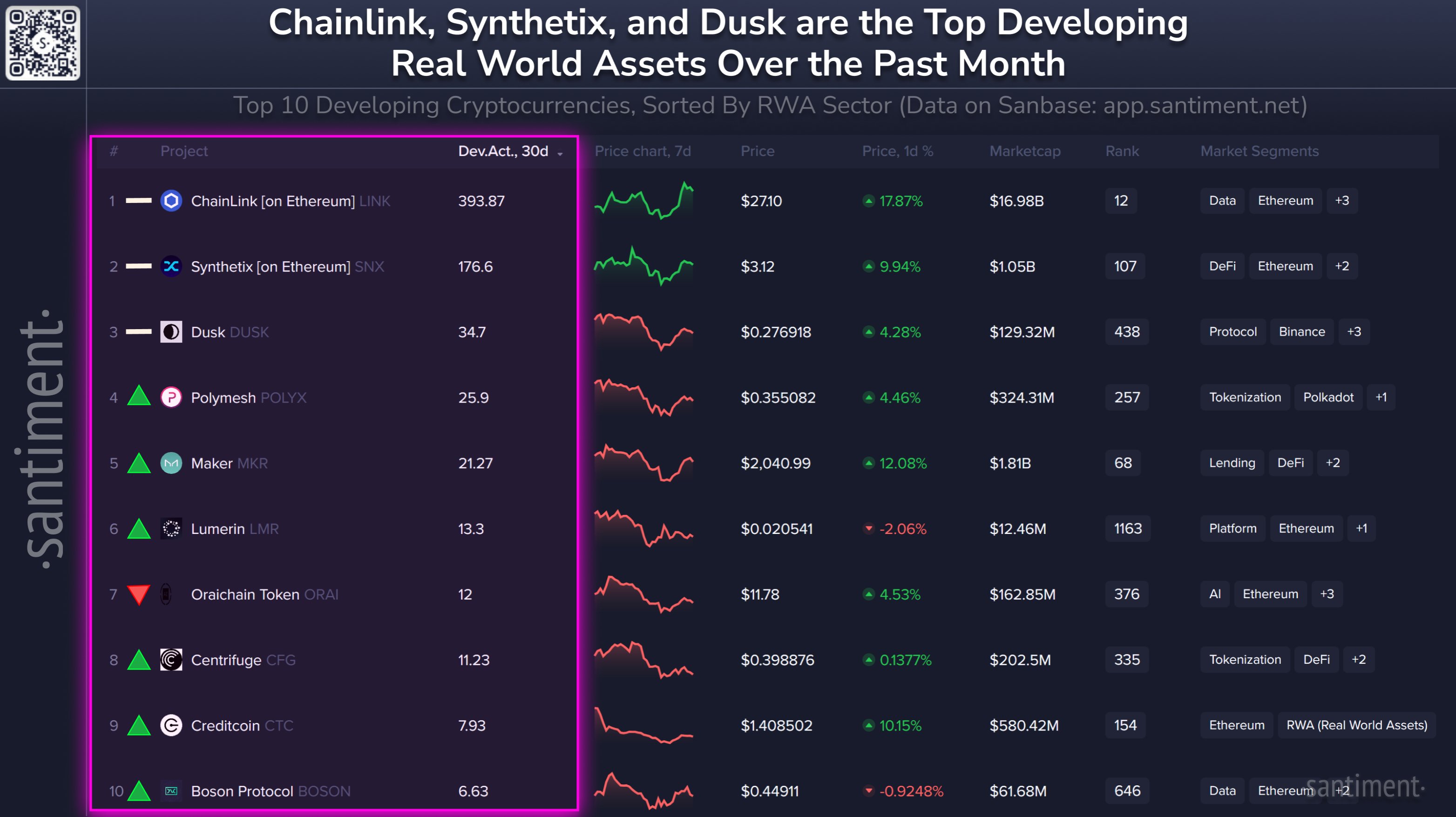

New knowledge from market intelligence platform Santiment reveals that Chainlink (LINK) is main the real-world property (RWA) sector when it comes to current growth exercise.

In a brand new submit on the social media platform X, Santiment says the nascent sector is being led by the decentralized oracle community adopted by Ethereum (ETH)-based artificial asset creator Synthetix (SNX) and privacy-focused tokenization undertaking Nightfall Basis (DUSK).

Based on the information, Chainlink had practically 394 notable GitHub occasions throughout the previous 30 days whereas Synthetix and Nightfall Basis clocked in with 176.6 and 34.7, respectively.

Different notable digital property on the listing embrace Polymesh (POLYX), a layer-1 designed for tokenized securities, and decentralized finance (DeFi) protocol Maker (MKR).

Polymesh and Maker moved as much as fourth and fifth place respectively whereas seeing 25.9 and 21.7 notable GitHub occasions over the past month.

Beforehand, knowledge analytics platform Glassnode famous that Chainlink’s on-chain momentum was on the rise, whereas additionally pointing towards its surging value and bettering fundamentals.

“Whereas LINK’s value surge was clearly pushed by speculative and short-term market exercise, its fundamentals are bettering too.

Lively addresses momentum is trending greater, with the short-term SMA (easy transferring common) of 6,682 nonetheless above the long-term SMA of 5,878…

Chainlink’s token LINK has hit its highest value in practically two years, and futures open curiosity (OI) simply surged to an all-time excessive of $770.27 million!”

LINK is buying and selling for $28.10 at time of writing, a 2% lower on the day whereas SNX, DUSK, POLYX, and MKR are buying and selling for $3.11, $0.283, $0.364, and $2,069, respectively.

Do not Miss a Beat – Subscribe to get e mail alerts delivered on to your inbox

Examine Worth Motion

Comply with us on X, Fb and Telegram

Surf The Every day Hodl Combine

Disclaimer: Opinions expressed at The Every day Hodl should not funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your personal danger, and any losses you could incur are your duty. The Every day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital property, neither is The Every day Hodl an funding advisor. Please be aware that The Every day Hodl participates in affiliate marketing online.

Generated Picture: Midjourney