- The Concern and Greed Index was at 73, indicating heightened market optimism.

- Regardless of the rising greed, the full cryptocurrency market cap held sturdy at $2.23 trillion.

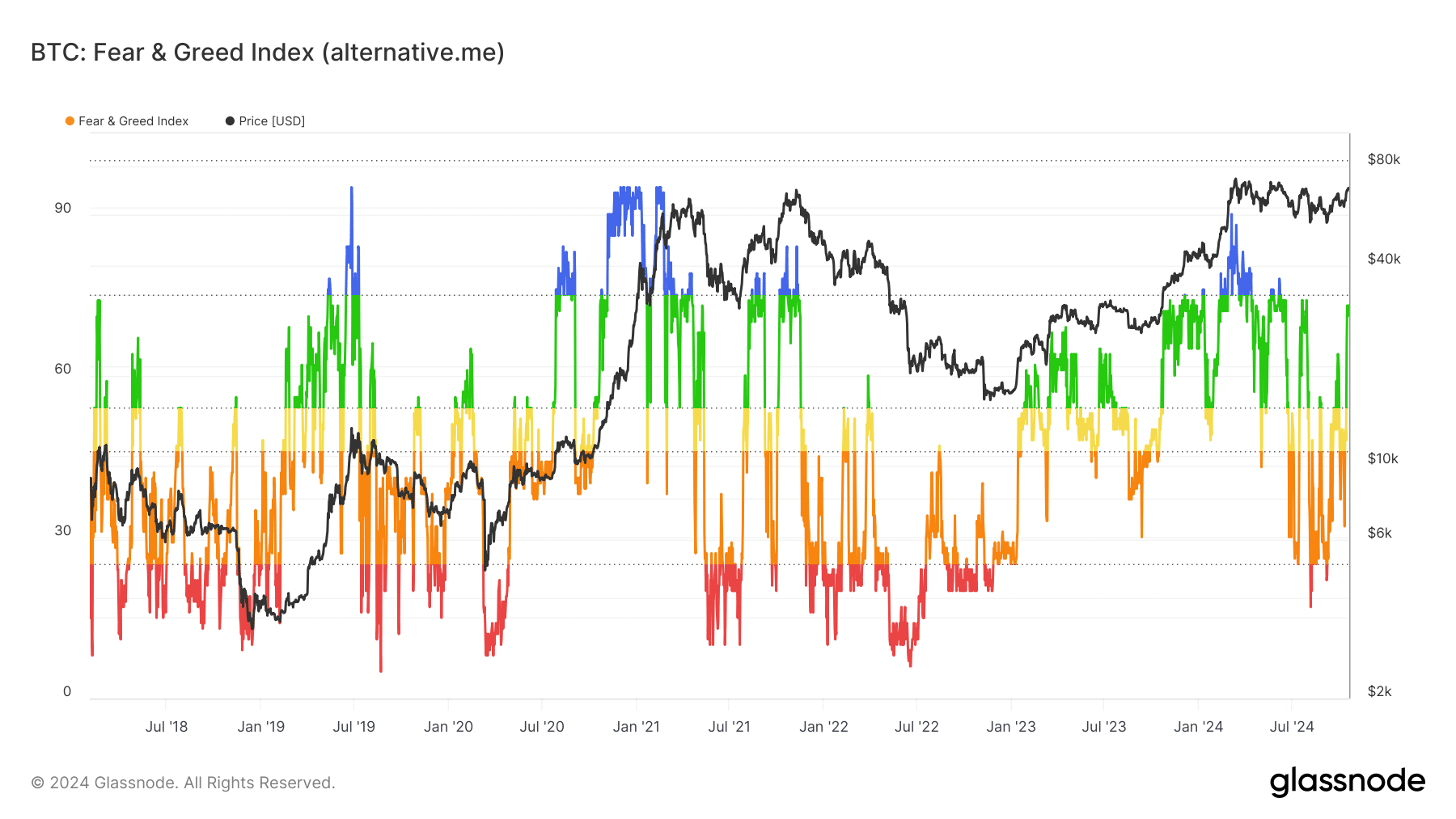

The Concern and Greed Index was at 73 at press time, indicating that the market is in a state of greed. This stage of optimism steered that many traders are assured about additional worth will increase.

It additionally raises issues about potential market overheating.

Potential for market overheating

AMBCrypto’s evaluation of the Crypto Concern and Greed Index from Glassnode highlighted a studying of 73, signaling that the market was transferring deeper into greed territory.

This heightened greed can usually be a double-edged sword. Whereas rising optimism can drive costs increased, it additionally will increase the chance of a pointy market correction.

When the Concern and Greed Index reaches excessive ranges, merchants might tackle extreme threat, pursuing increased returns with out totally contemplating the potential downsides.

This conduct could cause costs to surge within the quick time period, however historical past exhibits that intervals of maximum greed usually precede corrections.

As an illustration, in early 2021, the index confirmed comparable ranges of greed, adopted by a considerable market pullback.

Market holds sturdy regardless of Concern and Greed Index

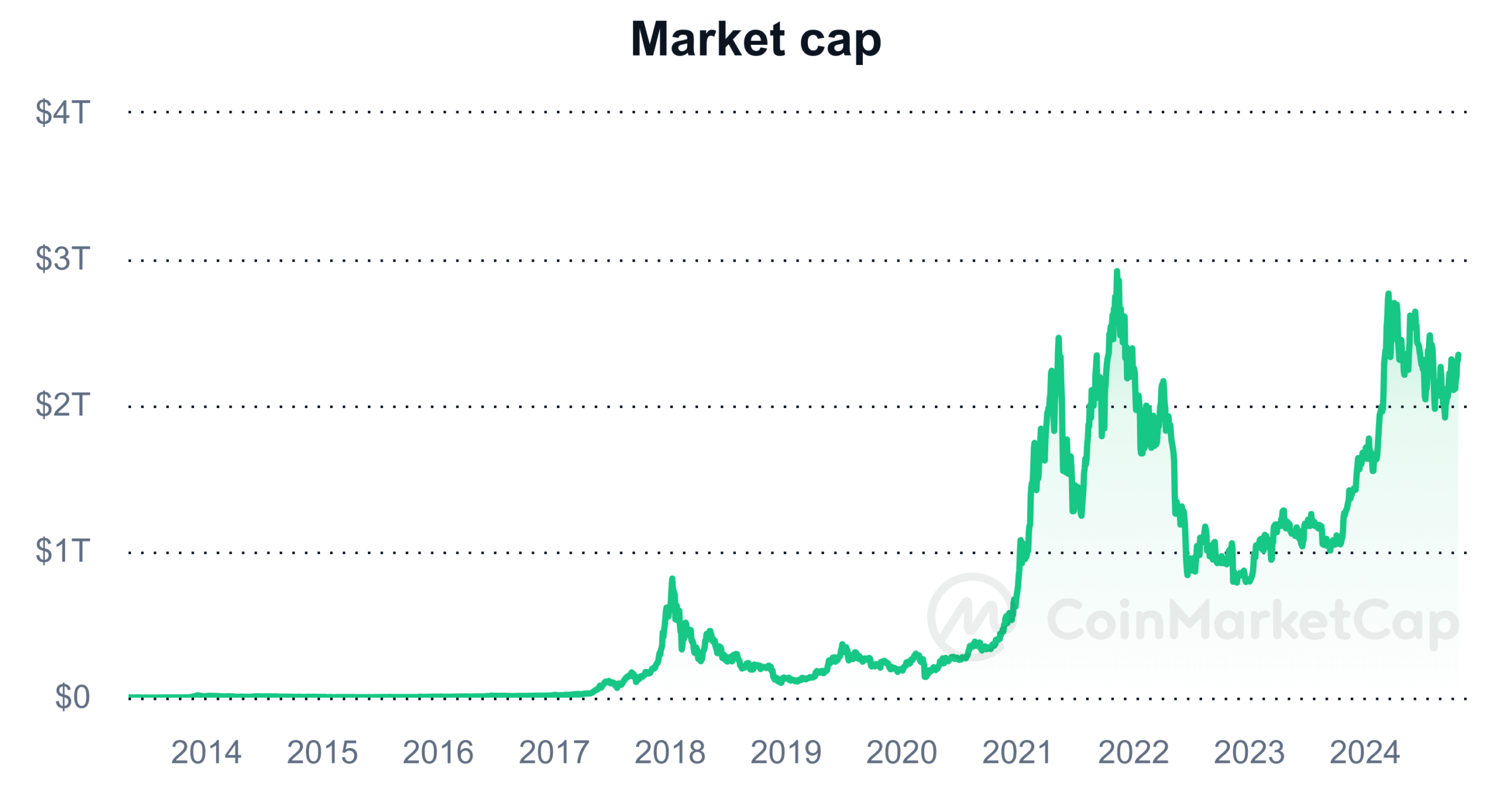

Even with the Concern and Greed Index signaling warning, the full cryptocurrency market cap remained sturdy at $2.23 trillion. This sturdy market cap mirrored ongoing curiosity from each institutional and retail traders.

Main cryptocurrencies like Bitcoin [BTC] and Ethereum [ETH] continued to anchor the market’s total worth, contributing to its constructive development.

Along with these prime property, altcoins comparable to Solana [SOL] and Worldcoin [WLD] have additionally performed a key position in sustaining the market’s development.

Regardless of rising greed, the soundness of the market cap exhibits that confidence within the long-term potential of the crypto market stays sturdy.

Outlook: Alternative or threat?

With the Concern and Greed Index firmly within the greed zone, merchants ought to weigh each alternatives and dangers. On one hand, the sturdy market sentiment and strong market cap may result in additional good points within the quick time period.

Alternatively, intervals of excessive greed have traditionally been adopted by market corrections as traders lock in earnings and threat urge for food declines.

Like the present studying, elevated ranges within the Concern and Greed Index usually function a warning signal {that a} correction could also be on the horizon.

Whereas the present optimism presents alternatives for good points, merchants ought to stay cautious and ready for potential volatility.

- The Concern and Greed Index was at 73, indicating heightened market optimism.

- Regardless of the rising greed, the full cryptocurrency market cap held sturdy at $2.23 trillion.

The Concern and Greed Index was at 73 at press time, indicating that the market is in a state of greed. This stage of optimism steered that many traders are assured about additional worth will increase.

It additionally raises issues about potential market overheating.

Potential for market overheating

AMBCrypto’s evaluation of the Crypto Concern and Greed Index from Glassnode highlighted a studying of 73, signaling that the market was transferring deeper into greed territory.

This heightened greed can usually be a double-edged sword. Whereas rising optimism can drive costs increased, it additionally will increase the chance of a pointy market correction.

When the Concern and Greed Index reaches excessive ranges, merchants might tackle extreme threat, pursuing increased returns with out totally contemplating the potential downsides.

This conduct could cause costs to surge within the quick time period, however historical past exhibits that intervals of maximum greed usually precede corrections.

As an illustration, in early 2021, the index confirmed comparable ranges of greed, adopted by a considerable market pullback.

Market holds sturdy regardless of Concern and Greed Index

Even with the Concern and Greed Index signaling warning, the full cryptocurrency market cap remained sturdy at $2.23 trillion. This sturdy market cap mirrored ongoing curiosity from each institutional and retail traders.

Main cryptocurrencies like Bitcoin [BTC] and Ethereum [ETH] continued to anchor the market’s total worth, contributing to its constructive development.

Along with these prime property, altcoins comparable to Solana [SOL] and Worldcoin [WLD] have additionally performed a key position in sustaining the market’s development.

Regardless of rising greed, the soundness of the market cap exhibits that confidence within the long-term potential of the crypto market stays sturdy.

Outlook: Alternative or threat?

With the Concern and Greed Index firmly within the greed zone, merchants ought to weigh each alternatives and dangers. On one hand, the sturdy market sentiment and strong market cap may result in additional good points within the quick time period.

Alternatively, intervals of excessive greed have traditionally been adopted by market corrections as traders lock in earnings and threat urge for food declines.

Like the present studying, elevated ranges within the Concern and Greed Index usually function a warning signal {that a} correction could also be on the horizon.

Whereas the present optimism presents alternatives for good points, merchants ought to stay cautious and ready for potential volatility.