Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

In a interval marked by extraordinary polarization, market members discover themselves torn between two opposing camps: one steadfastly predicting that the present dip is merely a setup for an impending altcoin rally, and the opposite resolute that the broader crypto bull run has already reached its conclusion. In a publish on X, Koroush Khaneghah, Founding father of Zero Complexity Buying and selling, said, “Proper now could be probably the most divided timeline I’ve ever seen. Bulls imagine that is the final dip earlier than an Altseason. Bears assume bull run is over.”

In response to Khaneghah, “It’s changing into tougher to ‘predict’ cycle phases as crypto matures.” He highlights developments that didn’t seem in earlier cycles, together with a shift from a conventional altseason to a memecoin season, Ethereum (ETH) nonetheless not breaking its all-time highs, and Bitcoin (BTC) surpassing its ATH and transferring past $100K+ (an consequence absent in earlier cycles)

Two Situations For Crypto

1. This Cycle Is Completely different From Others

Khaneghah factors to rising institutional involvement—a component noticeably absent in earlier bull markets. He cites information suggesting that BlackRock is at the moment holding practically $52 billion price of BTC (by way of Arkham). In his view, this considerably boosts the long-term purchase strain for Bitcoin, resulting in probably shallower pullbacks since “establishments will maintain shopping for.”

Associated Studying

Due to heightened institutional curiosity, Khaneghah expects BTC dominance to proceed rising. This dynamic might change how capital rotates into altcoins: “On this cycle, altcoins have seen Capital Dispersion. Which means, extra belongings are available in the market and liquidity is unfold throughout a number of sectors, stopping any ONE sector from pumping laborious.”

He contrasts the memecoin market with DeFi. Within the earlier cycle, the memecoin market was roughly half the scale of DeFi. On this cycle, memecoin market capitalization has equaled that of DeFi.

If this state of affairs holds, Khaneghah believes BTC will stay the point of interest for main strikes whereas altcoins expertise extra fragmented, micro bull runs. “This implies earlier bull run playbooks gained’t apply and also you merely should commerce rotations,” he notes.

2. The Bull Run Is Not Over

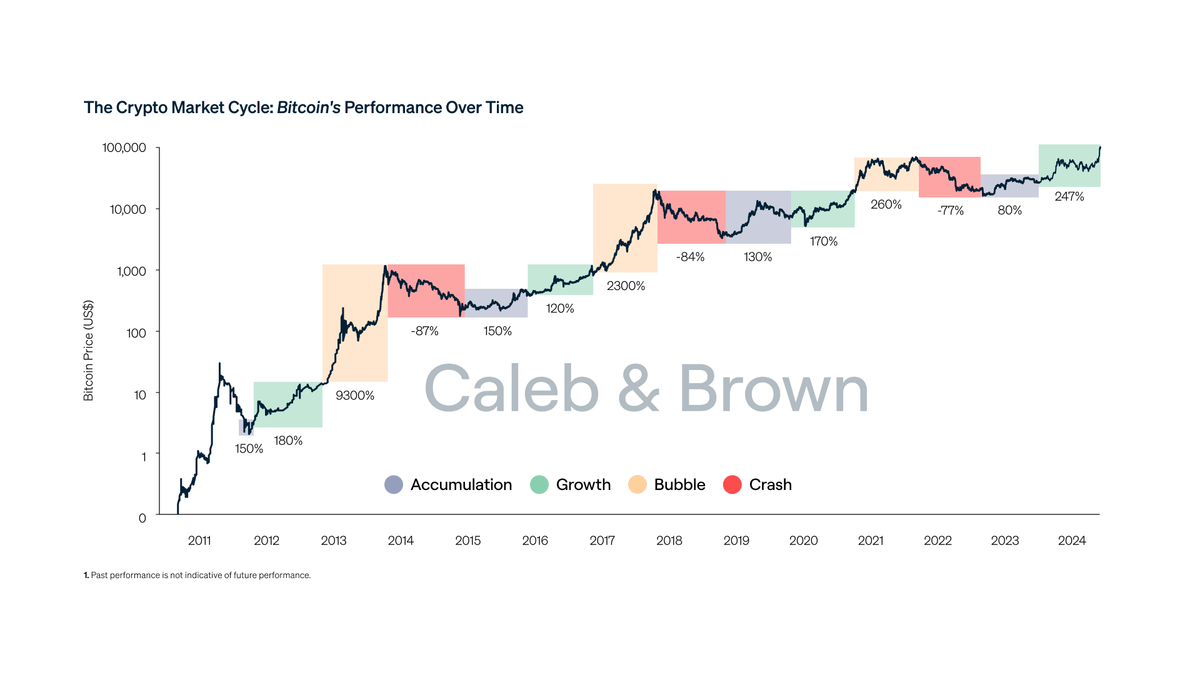

Khaneghah observes that BTC has solely run 1.6x above the earlier cycle highs earlier than pulling again, calling it “not what a traditional blow-off prime/bubble appears like.” From a historic standpoint, BTC has regularly retraced by 40-50% from its ATH previous to surging larger. Within the present cycle, BTC has solely retraced about 26% from its peak, suggesting the opportunity of extra upside if previous patterns repeat.

A standard bull-run set off, in keeping with many analysts, is ETH surpassing its prior cycle excessive—one thing but to happen, provided that ETH has not but breached $4,000. Khaneghah posits that this lag would possibly point out a delayed altseason and a for much longer total cycle than anticipated.

Associated Studying

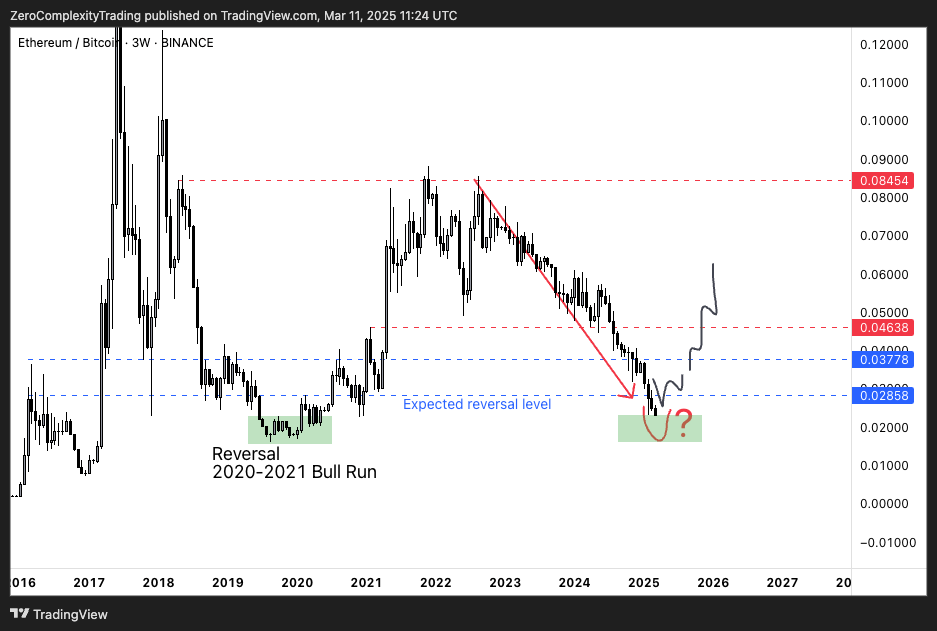

For altcoins to regain momentum, Khaneghah sees the ETH/BTC pair as a important indicator. A backside in ETH/BTC, mixed with a rotation of capital from memecoins into different utility sectors resembling DeFi and RWA (Actual World Property), might reignite altcoin rallies.

Khaneghah concludes that merchants needn’t be fixated on both the bull or bear facet: “For those who’re a dealer, you don’t should marry a bias or decide to state of affairs 1 or 2. If BTC dominance continues, commerce BTC by longing power and shorting weak spot. -If alts begin to backside, shift capital there and purchase the strongest cash.”

At press time, BTC traded at $81,786.

Featured picture created with DALL.E, chart from TradingView.com

Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

In a interval marked by extraordinary polarization, market members discover themselves torn between two opposing camps: one steadfastly predicting that the present dip is merely a setup for an impending altcoin rally, and the opposite resolute that the broader crypto bull run has already reached its conclusion. In a publish on X, Koroush Khaneghah, Founding father of Zero Complexity Buying and selling, said, “Proper now could be probably the most divided timeline I’ve ever seen. Bulls imagine that is the final dip earlier than an Altseason. Bears assume bull run is over.”

In response to Khaneghah, “It’s changing into tougher to ‘predict’ cycle phases as crypto matures.” He highlights developments that didn’t seem in earlier cycles, together with a shift from a conventional altseason to a memecoin season, Ethereum (ETH) nonetheless not breaking its all-time highs, and Bitcoin (BTC) surpassing its ATH and transferring past $100K+ (an consequence absent in earlier cycles)

Two Situations For Crypto

1. This Cycle Is Completely different From Others

Khaneghah factors to rising institutional involvement—a component noticeably absent in earlier bull markets. He cites information suggesting that BlackRock is at the moment holding practically $52 billion price of BTC (by way of Arkham). In his view, this considerably boosts the long-term purchase strain for Bitcoin, resulting in probably shallower pullbacks since “establishments will maintain shopping for.”

Associated Studying

Due to heightened institutional curiosity, Khaneghah expects BTC dominance to proceed rising. This dynamic might change how capital rotates into altcoins: “On this cycle, altcoins have seen Capital Dispersion. Which means, extra belongings are available in the market and liquidity is unfold throughout a number of sectors, stopping any ONE sector from pumping laborious.”

He contrasts the memecoin market with DeFi. Within the earlier cycle, the memecoin market was roughly half the scale of DeFi. On this cycle, memecoin market capitalization has equaled that of DeFi.

If this state of affairs holds, Khaneghah believes BTC will stay the point of interest for main strikes whereas altcoins expertise extra fragmented, micro bull runs. “This implies earlier bull run playbooks gained’t apply and also you merely should commerce rotations,” he notes.

2. The Bull Run Is Not Over

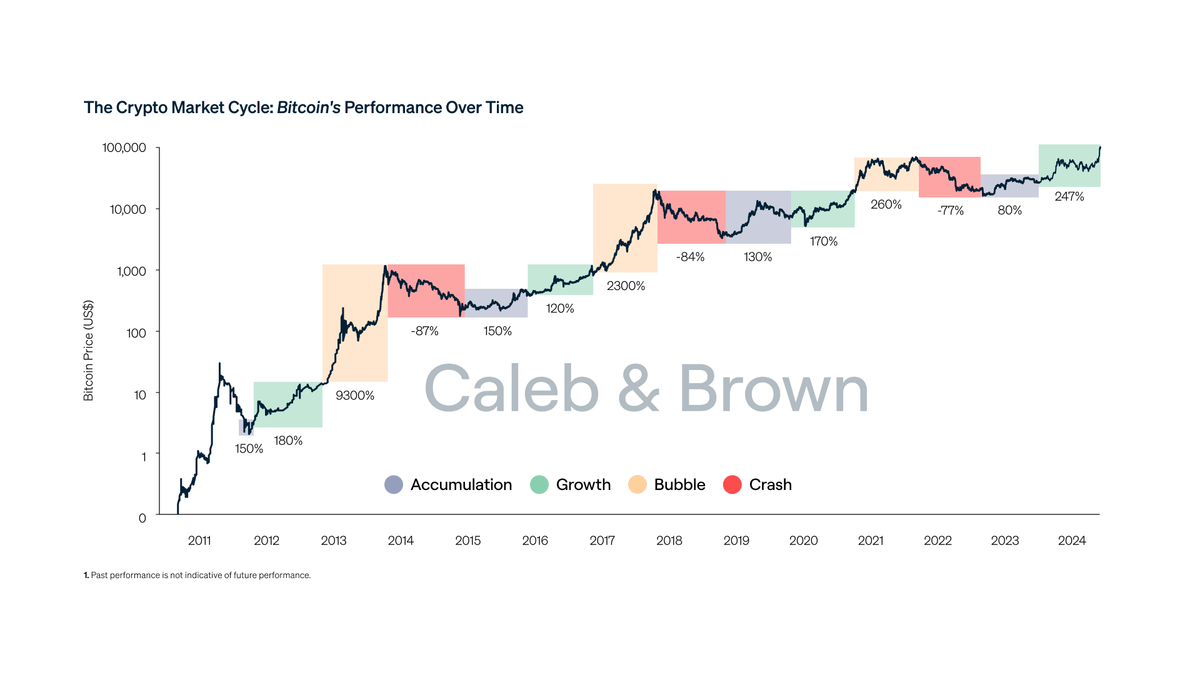

Khaneghah observes that BTC has solely run 1.6x above the earlier cycle highs earlier than pulling again, calling it “not what a traditional blow-off prime/bubble appears like.” From a historic standpoint, BTC has regularly retraced by 40-50% from its ATH previous to surging larger. Within the present cycle, BTC has solely retraced about 26% from its peak, suggesting the opportunity of extra upside if previous patterns repeat.

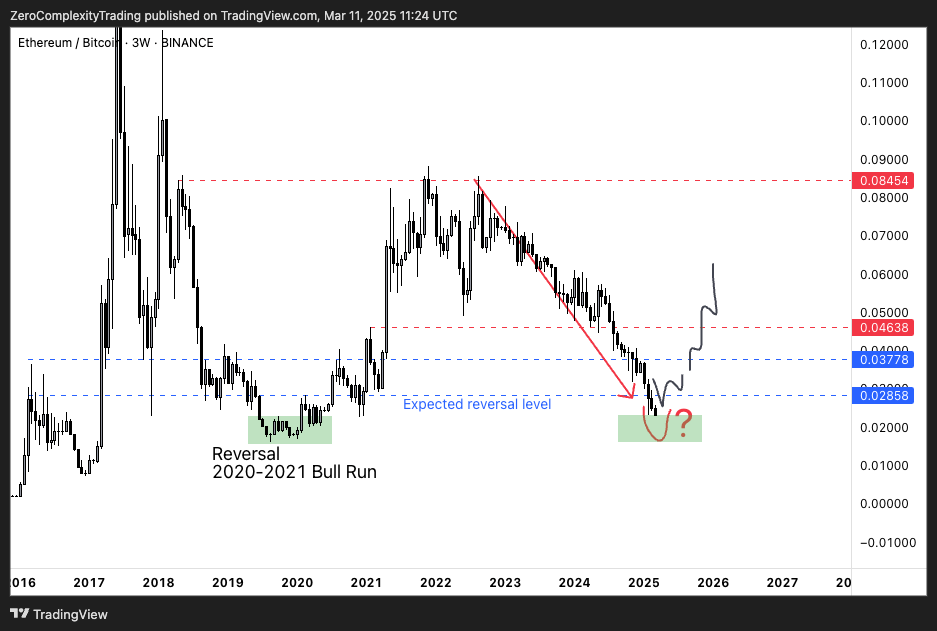

A standard bull-run set off, in keeping with many analysts, is ETH surpassing its prior cycle excessive—one thing but to happen, provided that ETH has not but breached $4,000. Khaneghah posits that this lag would possibly point out a delayed altseason and a for much longer total cycle than anticipated.

Associated Studying

For altcoins to regain momentum, Khaneghah sees the ETH/BTC pair as a important indicator. A backside in ETH/BTC, mixed with a rotation of capital from memecoins into different utility sectors resembling DeFi and RWA (Actual World Property), might reignite altcoin rallies.

Khaneghah concludes that merchants needn’t be fixated on both the bull or bear facet: “For those who’re a dealer, you don’t should marry a bias or decide to state of affairs 1 or 2. If BTC dominance continues, commerce BTC by longing power and shorting weak spot. -If alts begin to backside, shift capital there and purchase the strongest cash.”

At press time, BTC traded at $81,786.

Featured picture created with DALL.E, chart from TradingView.com