- Cortex’s quantity surged as its value dropped by over 54% on the charts

- If the pattern reversal solidifies itself, CTXC may see a breakout

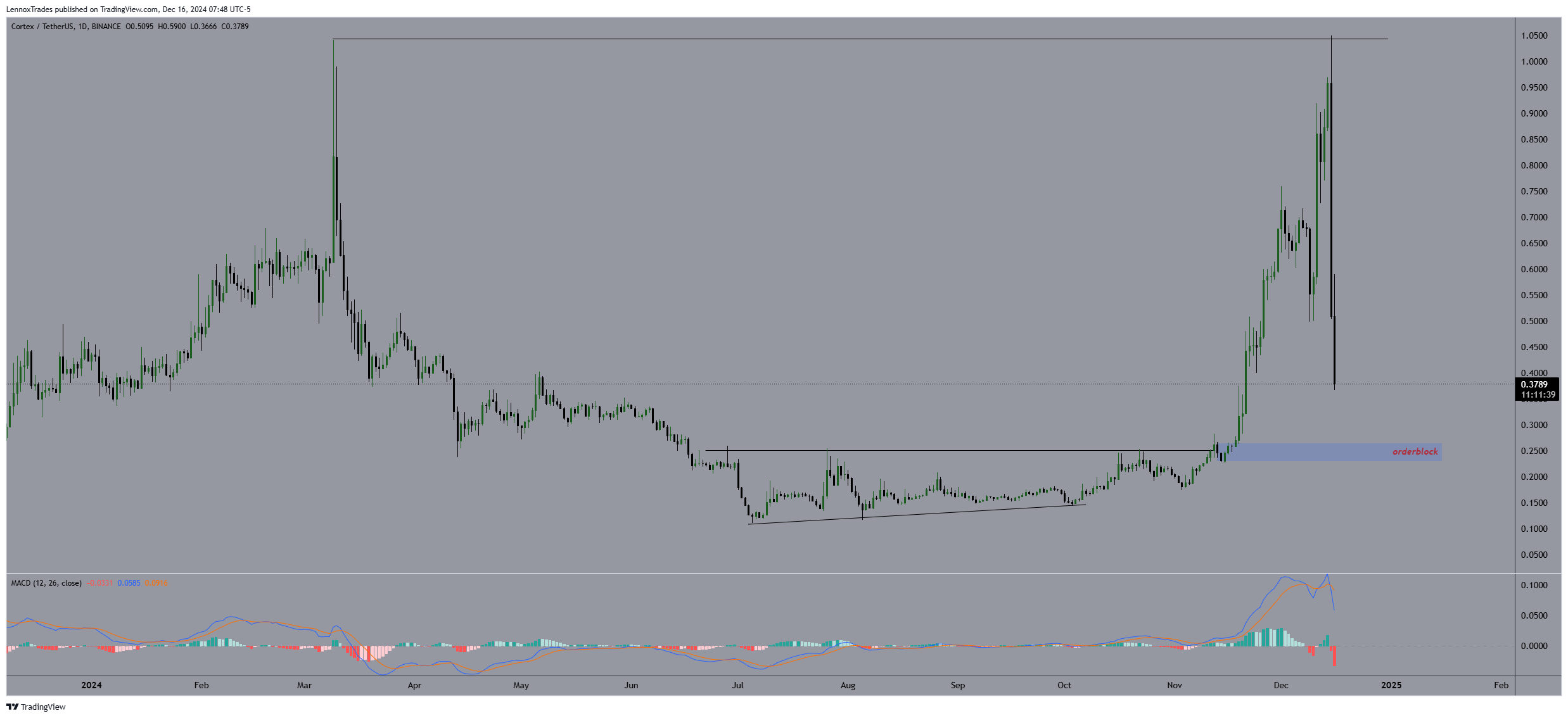

Cortex (CTXC) crypto’s buying and selling quantity rose sharply whereas its value itself declined considerably on the charts. In reality, CTXC’s quantity spike was a 4x, compared to earlier weeks. This was alongside a pointy value drop from a excessive of roughly $1.05 to a low close to $0.37, constituting a fall of round 45%.

CTXC’s ‘orderblock’ at $0.25 traditionally acted as each help and resistance and on the time of writing, the value appeared to be approaching there. This zone triggered a modest rebound, suggesting some resistance to additional declines on the charts.

Regardless of the bearish pattern, nonetheless, the hike in quantity accompanying the value drop indicated accumulative actions by merchants anticipating potential worth.

The MACD indicator pointed to an in depth convergence and a possible bullish crossover, hinting at potential upward momentum. If this pattern reversal solidifies itself, CTXC may register a breakout.

This urged what the important space for this potential rally may very well be if CTXC can maintain itself above the $0.40 resistance degree. That is prone to pave the way in which for a extra important restoration.

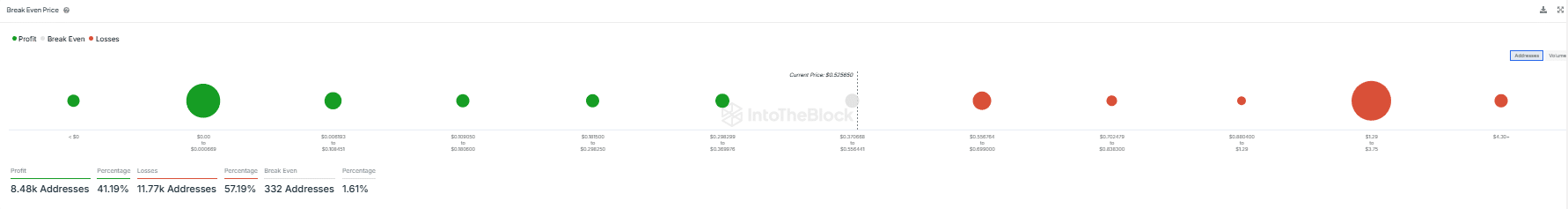

Profitability at break even value

CTXC’s distribution of addresses based mostly on their profitability, relative to the break-even costs, noticed 41.19% in income. These addresses entered the market at $0.385250.

Quite the opposite, 57.19% of addresses confronted losses with the value factors at $0.40 and above as much as $0.50, the place the most important losses have been concentrated. The addresses at break-even have been simply 1.61%, indicated minimal buying and selling exercise.

The longer term market habits of CTXC may pivot round these ranges as addresses in losses may determine to promote if the value approaches their entry factors, probably capping upward value actions.

Conversely, sustained upward traits would possibly convert extra addresses to profitability, encouraging a extra bullish sentiment within the Cortex market.

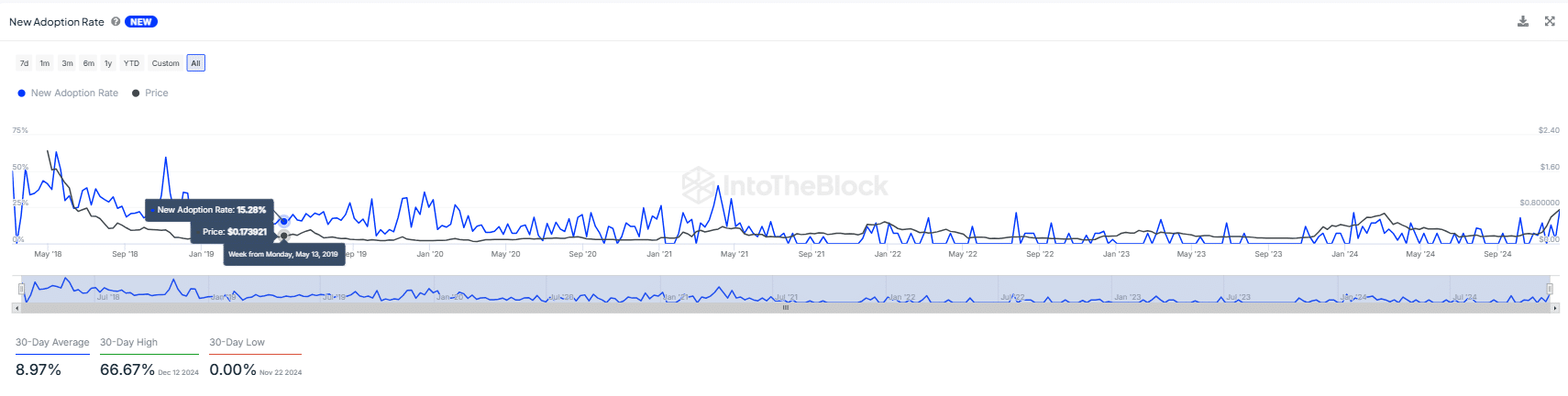

CTCX new adoption fee

New adoption fee of Cortex noticed a notable spike in Might 2018, reaching practically 50%, coinciding with a value peak of roughly $0.30. This pattern demonstrated that prime adoption charges beforehand propelled value surges, though this connection lessened over time.

Subsequent spikes in adoption all through 2019 and 2020 confirmed the same, albeit extra insignificant, influence on the value. This pointed to diminishing returns from new adoption surges on the asset’s value.

By 2024, the adoption fee has steadied round 8.97%, considerably decrease than its earlier highs. Additionally, it didn’t correspond to any notable value adjustments, as the value stabilized at round $0.80.

This sample indicated that whereas early surges in adoption considerably influenced Cortex’s value, the impact has waned. Seemingly attributable to market maturation or lowered responsiveness to adoption adjustments.

If the adoption fee continues to extend, its earlier influence on the value urged that future value actions may now not correlate strongly with new adoption charges. By extension, this hinted at a decoupling of person progress from direct value incentives.

- Cortex’s quantity surged as its value dropped by over 54% on the charts

- If the pattern reversal solidifies itself, CTXC may see a breakout

Cortex (CTXC) crypto’s buying and selling quantity rose sharply whereas its value itself declined considerably on the charts. In reality, CTXC’s quantity spike was a 4x, compared to earlier weeks. This was alongside a pointy value drop from a excessive of roughly $1.05 to a low close to $0.37, constituting a fall of round 45%.

CTXC’s ‘orderblock’ at $0.25 traditionally acted as each help and resistance and on the time of writing, the value appeared to be approaching there. This zone triggered a modest rebound, suggesting some resistance to additional declines on the charts.

Regardless of the bearish pattern, nonetheless, the hike in quantity accompanying the value drop indicated accumulative actions by merchants anticipating potential worth.

The MACD indicator pointed to an in depth convergence and a possible bullish crossover, hinting at potential upward momentum. If this pattern reversal solidifies itself, CTXC may register a breakout.

This urged what the important space for this potential rally may very well be if CTXC can maintain itself above the $0.40 resistance degree. That is prone to pave the way in which for a extra important restoration.

Profitability at break even value

CTXC’s distribution of addresses based mostly on their profitability, relative to the break-even costs, noticed 41.19% in income. These addresses entered the market at $0.385250.

Quite the opposite, 57.19% of addresses confronted losses with the value factors at $0.40 and above as much as $0.50, the place the most important losses have been concentrated. The addresses at break-even have been simply 1.61%, indicated minimal buying and selling exercise.

The longer term market habits of CTXC may pivot round these ranges as addresses in losses may determine to promote if the value approaches their entry factors, probably capping upward value actions.

Conversely, sustained upward traits would possibly convert extra addresses to profitability, encouraging a extra bullish sentiment within the Cortex market.

CTCX new adoption fee

New adoption fee of Cortex noticed a notable spike in Might 2018, reaching practically 50%, coinciding with a value peak of roughly $0.30. This pattern demonstrated that prime adoption charges beforehand propelled value surges, though this connection lessened over time.

Subsequent spikes in adoption all through 2019 and 2020 confirmed the same, albeit extra insignificant, influence on the value. This pointed to diminishing returns from new adoption surges on the asset’s value.

By 2024, the adoption fee has steadied round 8.97%, considerably decrease than its earlier highs. Additionally, it didn’t correspond to any notable value adjustments, as the value stabilized at round $0.80.

This sample indicated that whereas early surges in adoption considerably influenced Cortex’s value, the impact has waned. Seemingly attributable to market maturation or lowered responsiveness to adoption adjustments.

If the adoption fee continues to extend, its earlier influence on the value urged that future value actions may now not correlate strongly with new adoption charges. By extension, this hinted at a decoupling of person progress from direct value incentives.