- LINK has surged by 12.9% in 24 hours.

- Chainlink outflows have surpassed $120 million, signaling ongoing accumulation.

Since hitting $27 three months in the past, Chainlink [LINK] has struggled with low demand, with costs declining considerably. Nonetheless, over the previous 30 days, fortunes have turned as patrons return to the market.

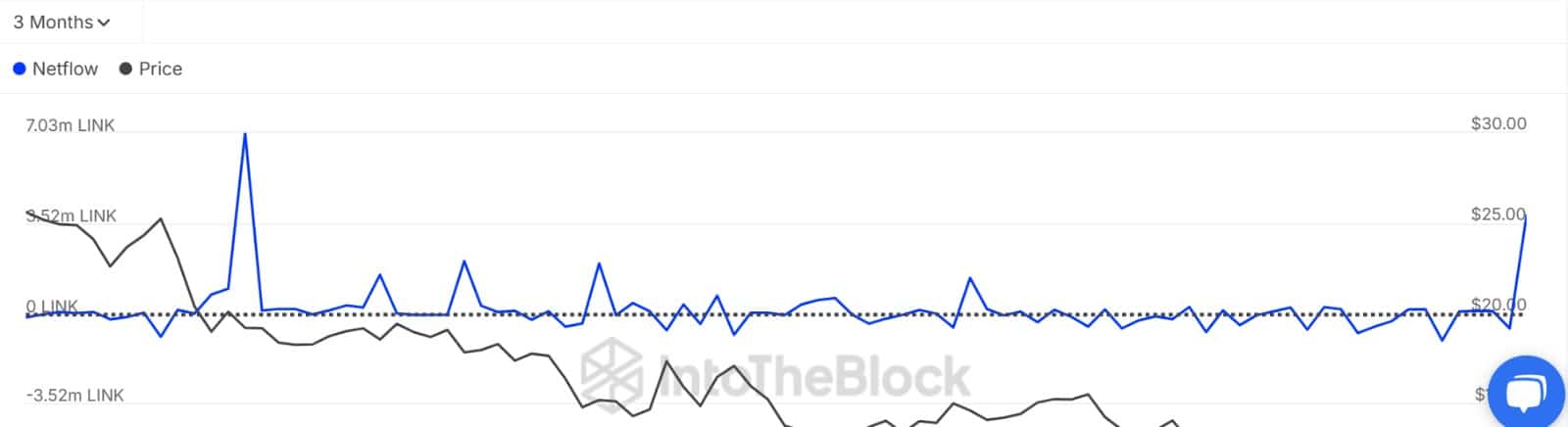

In keeping with IntoTheBlock, LINK has seen constant outflows from exchanges over the previous month, hinting at ongoing accumulation. Web outflows have surpassed $120 million price of LINK within the final 30 days.

Such a spike in outflows signifies rising demand for the altcoin, with traders aggressively shopping for.

The rising accumulation is additional evidenced by Chainlink’s Trade Netflow, which has remained damaging over the previous 12 days.

With netflow holding inside damaging for a sustained interval, it means that traders are strongly bullish and people accumulating have a complete grip in the marketplace.

The buildup pattern is much more prevalent amongst whales. The truth is, massive holders’ netflow has spiked to hit a 2-month excessive of three.81 million hyperlink tokens. Such a surge means that whales are strongly again out there.

With whales’ netflow and change netflow signaling accumulation, it suggests that every one market contributors are bullish and anticipate costs to rise even.

Moreover capital flows, Chainlink can be seeing its fundamentals strengthen. As such, the altcoin’s energetic addresses are rising, surging from 2.3k to three.6k, marking a 1.3k improve over the previous 4 days.

When energetic addresses begin to rise, it means that the community is seeing important curiosity, which frequently results in bullish bias.

What subsequent for LINK?

Chainlink was experiencing sturdy upward momentum amidst rising bullish sentiments. As of this writing, the altcoin was buying and selling at $14.95 after a 12.05% improve on day by day charts. On weekly charts, the altcoin rose by 22.38.

After this worth pump, Chainlink has made a breakout from a descending triangle after buying and selling below this sample over the previous two months. After the breakout, LINK confronted the following important resistance degree round $16.12.

Nonetheless, the value pump additionally signifies that most traders who’ve been sitting on realized losses are again to profitability.

If these holders determine to take revenue as they capitalize on the latest uptick, the altcoin will pull again to $13.7.

- LINK has surged by 12.9% in 24 hours.

- Chainlink outflows have surpassed $120 million, signaling ongoing accumulation.

Since hitting $27 three months in the past, Chainlink [LINK] has struggled with low demand, with costs declining considerably. Nonetheless, over the previous 30 days, fortunes have turned as patrons return to the market.

In keeping with IntoTheBlock, LINK has seen constant outflows from exchanges over the previous month, hinting at ongoing accumulation. Web outflows have surpassed $120 million price of LINK within the final 30 days.

Such a spike in outflows signifies rising demand for the altcoin, with traders aggressively shopping for.

The rising accumulation is additional evidenced by Chainlink’s Trade Netflow, which has remained damaging over the previous 12 days.

With netflow holding inside damaging for a sustained interval, it means that traders are strongly bullish and people accumulating have a complete grip in the marketplace.

The buildup pattern is much more prevalent amongst whales. The truth is, massive holders’ netflow has spiked to hit a 2-month excessive of three.81 million hyperlink tokens. Such a surge means that whales are strongly again out there.

With whales’ netflow and change netflow signaling accumulation, it suggests that every one market contributors are bullish and anticipate costs to rise even.

Moreover capital flows, Chainlink can be seeing its fundamentals strengthen. As such, the altcoin’s energetic addresses are rising, surging from 2.3k to three.6k, marking a 1.3k improve over the previous 4 days.

When energetic addresses begin to rise, it means that the community is seeing important curiosity, which frequently results in bullish bias.

What subsequent for LINK?

Chainlink was experiencing sturdy upward momentum amidst rising bullish sentiments. As of this writing, the altcoin was buying and selling at $14.95 after a 12.05% improve on day by day charts. On weekly charts, the altcoin rose by 22.38.

After this worth pump, Chainlink has made a breakout from a descending triangle after buying and selling below this sample over the previous two months. After the breakout, LINK confronted the following important resistance degree round $16.12.

Nonetheless, the value pump additionally signifies that most traders who’ve been sitting on realized losses are again to profitability.

If these holders determine to take revenue as they capitalize on the latest uptick, the altcoin will pull again to $13.7.