Cardano (ADA) has skilled a major surge over the previous 4 days, with its value growing by a powerful 32%. Within the final 24 hours alone, ADA has climbed 16%, boosting its market capitalization to $14.932 billion. This surge has propelled Cardano again to its place because the ninth-largest cryptocurrency by market cap. A number of elements have contributed to this bullish momentum:

#1 Bulls Takes Over The Whole Crypto Market

The optimistic market sentiment extends past Cardano, with the crypto market as an entire experiencing a major rally. This upward motion has been largely pushed by Donald Trump’s victory within the US presidential election. Trump’s administration has dedicated to ending the “struggle on crypto” and positioning america as a central hub for crypto companies.

Associated Studying

Including to the constructive momentum, the Federal Reserve’s determination on November 7 to cut back rates of interest by 0.25% has offered further tailwinds for the crypto market. The Fed cited easing labor market circumstances and elevated confidence that inflation is shifting sustainably towards the two% goal. Analysts from The Kobeissi Letter famous that the vote for the speed minimize was unanimous. Powell stated that “labor market circumstances have usually eased” and that “dangers to targets stay roughly in stability.”

#2 Cardano Whale Exercise

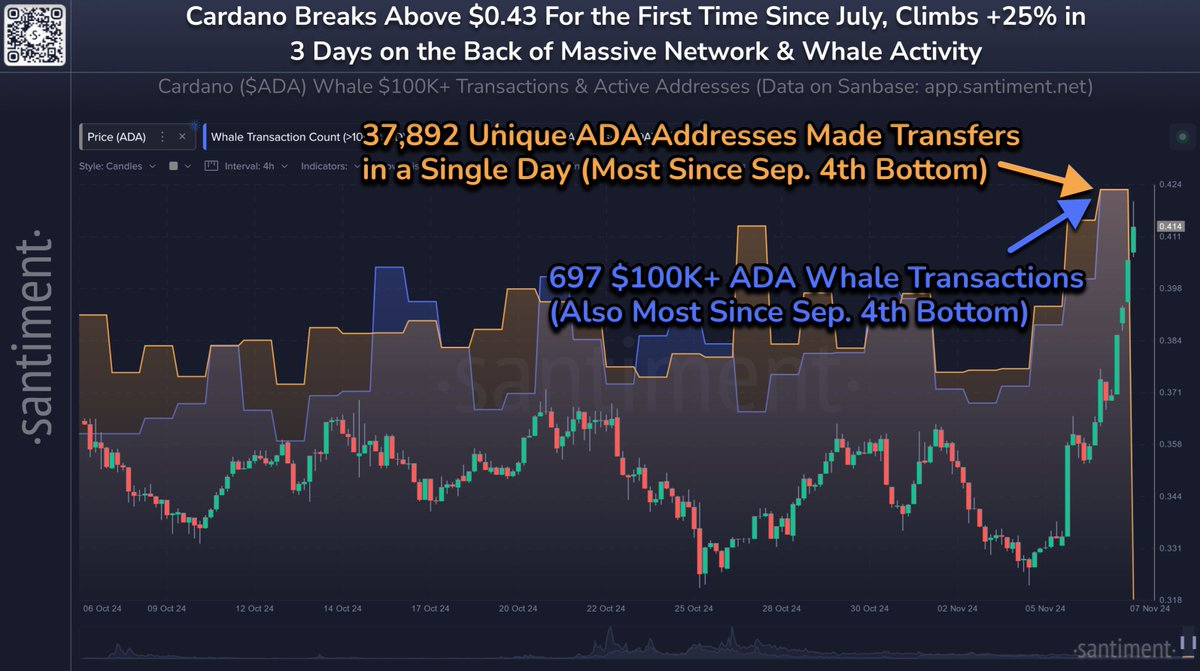

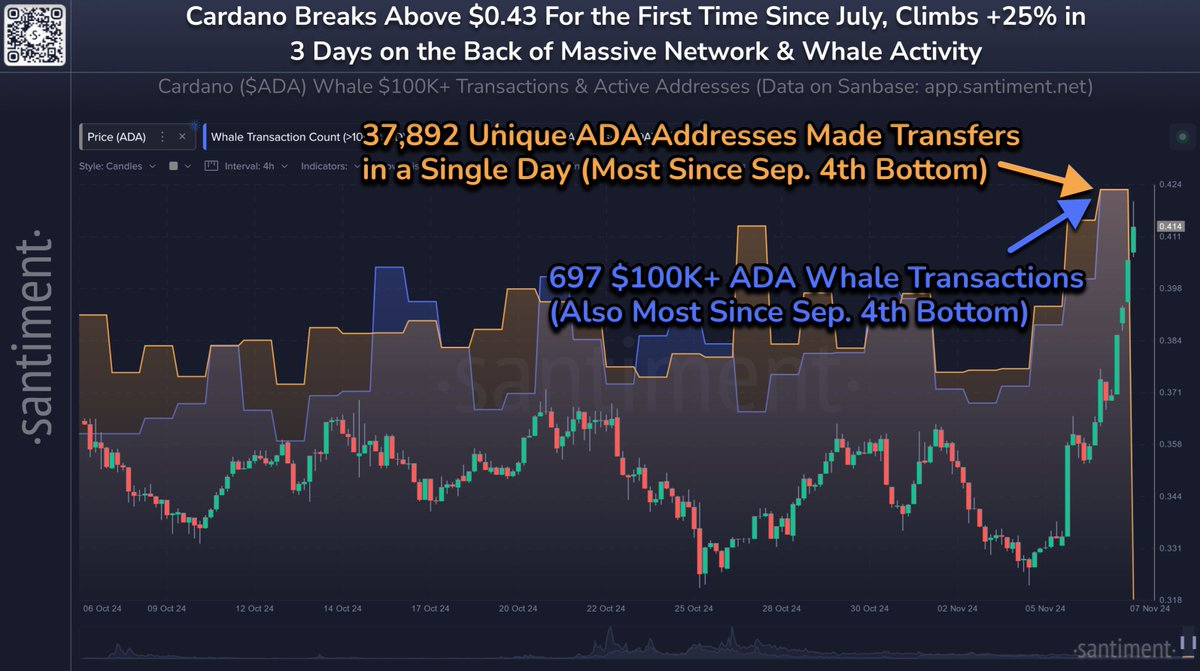

On-chain evaluation agency Santiment has highlighted a surge in whale exercise surrounding Cardano. In a current submit on X, they noticed that ADA has been “one of many notable shock altcoins withdrawing throughout this crypto-wide pump.” They recommended that “we could also be seeing some retail FOMO coming quickly,” acknowledging that this surge “has been a very long time coming for the affected person ADA group.”

Santiment reported that Cardano broke above $0.43 for the primary time since July, climbing 25% in three days as a result of “large community and whale exercise.” Particularly, they identified that 37,892 distinctive ADA addresses made transfers in a single day—probably the most because the September 4th backside—and there have been 697 transactions exceeding $100,000, additionally the best since that date. This uptick in giant transactions and energetic addresses signifies heightened curiosity from main buyers, signaling the potential for continued upward momentum.

#3 Technical Breakout

In contrast to many different altcoins, ADA has been in a chronic bearish section. Nevertheless, the current surge might mark a pivotal turning level, indicating a possible bullish reversal. Since August, Cardano’s value has been making a collection of upper lows.

Associated Studying

The present transfer has additionally allowed the ADA value to interrupt above a downtrend line that has dictated its value motion since April, after being rejected 5 instances beforehand. The breakout may be thought of considerably bullish because it aligned with the sample of upper lows.

Notably, ADA has surpassed the 20-, 50-, 100-, and 200-day shifting averages throughout this surge. Moreover, ADA has moved previous the 0.236 Fibonacci retracement degree, probably the most vital horizontal resistance level. A profitable retest of this value degree at $0.40 in the present day might pave the way in which for additional upside.

At press time, ADA traded at $0.4266.

Featured picture from Shutterstock, chart from TradingView.com

Cardano (ADA) has skilled a major surge over the previous 4 days, with its value growing by a powerful 32%. Within the final 24 hours alone, ADA has climbed 16%, boosting its market capitalization to $14.932 billion. This surge has propelled Cardano again to its place because the ninth-largest cryptocurrency by market cap. A number of elements have contributed to this bullish momentum:

#1 Bulls Takes Over The Whole Crypto Market

The optimistic market sentiment extends past Cardano, with the crypto market as an entire experiencing a major rally. This upward motion has been largely pushed by Donald Trump’s victory within the US presidential election. Trump’s administration has dedicated to ending the “struggle on crypto” and positioning america as a central hub for crypto companies.

Associated Studying

Including to the constructive momentum, the Federal Reserve’s determination on November 7 to cut back rates of interest by 0.25% has offered further tailwinds for the crypto market. The Fed cited easing labor market circumstances and elevated confidence that inflation is shifting sustainably towards the two% goal. Analysts from The Kobeissi Letter famous that the vote for the speed minimize was unanimous. Powell stated that “labor market circumstances have usually eased” and that “dangers to targets stay roughly in stability.”

#2 Cardano Whale Exercise

On-chain evaluation agency Santiment has highlighted a surge in whale exercise surrounding Cardano. In a current submit on X, they noticed that ADA has been “one of many notable shock altcoins withdrawing throughout this crypto-wide pump.” They recommended that “we could also be seeing some retail FOMO coming quickly,” acknowledging that this surge “has been a very long time coming for the affected person ADA group.”

Santiment reported that Cardano broke above $0.43 for the primary time since July, climbing 25% in three days as a result of “large community and whale exercise.” Particularly, they identified that 37,892 distinctive ADA addresses made transfers in a single day—probably the most because the September 4th backside—and there have been 697 transactions exceeding $100,000, additionally the best since that date. This uptick in giant transactions and energetic addresses signifies heightened curiosity from main buyers, signaling the potential for continued upward momentum.

#3 Technical Breakout

In contrast to many different altcoins, ADA has been in a chronic bearish section. Nevertheless, the current surge might mark a pivotal turning level, indicating a possible bullish reversal. Since August, Cardano’s value has been making a collection of upper lows.

Associated Studying

The present transfer has additionally allowed the ADA value to interrupt above a downtrend line that has dictated its value motion since April, after being rejected 5 instances beforehand. The breakout may be thought of considerably bullish because it aligned with the sample of upper lows.

Notably, ADA has surpassed the 20-, 50-, 100-, and 200-day shifting averages throughout this surge. Moreover, ADA has moved previous the 0.236 Fibonacci retracement degree, probably the most vital horizontal resistance level. A profitable retest of this value degree at $0.40 in the present day might pave the way in which for additional upside.

At press time, ADA traded at $0.4266.

Featured picture from Shutterstock, chart from TradingView.com