- With a robust bearish sentiment, ADA may drop by 15% to succeed in the $0.71 degree.

- On-chain metrics revealed that the exchanges have witnessed an outflow of $30 million in ADA tokens.

Amid the bearish market sentiment, Cardano [ADA] is poised for a notable worth decline attributable to bearish affirmation on its every day timeframe.

Moreover, the prevailing market sentiment and merchants’ bearish exercise have additional strengthened this adverse outlook.

Merchants closely shorting ADA

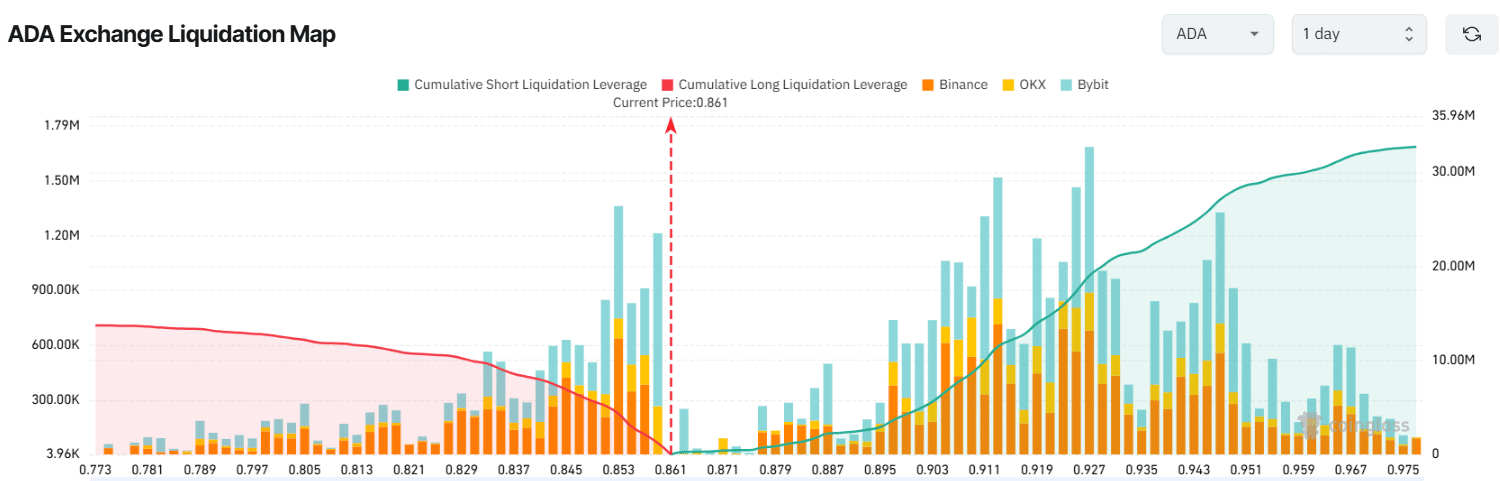

In accordance with on-chain analytics agency Coinglass, merchants are probably taking benefit of the present market sentiment by strongly betting on the brief aspect.

Information reveals that merchants holding lengthy positions are over-leveraged at $0.85, with $4.10 million value of lengthy positions.

In the meantime, brief sellers appear to be dominating, being over-leveraged on the $0.912 and $0.926 ranges, presently holding $16.77 million value of brief positions.

This on-chain information exhibits that brief sellers are thrice stronger than merchants holding lengthy positions. This means a bearish sign.

Traders’ bullish view

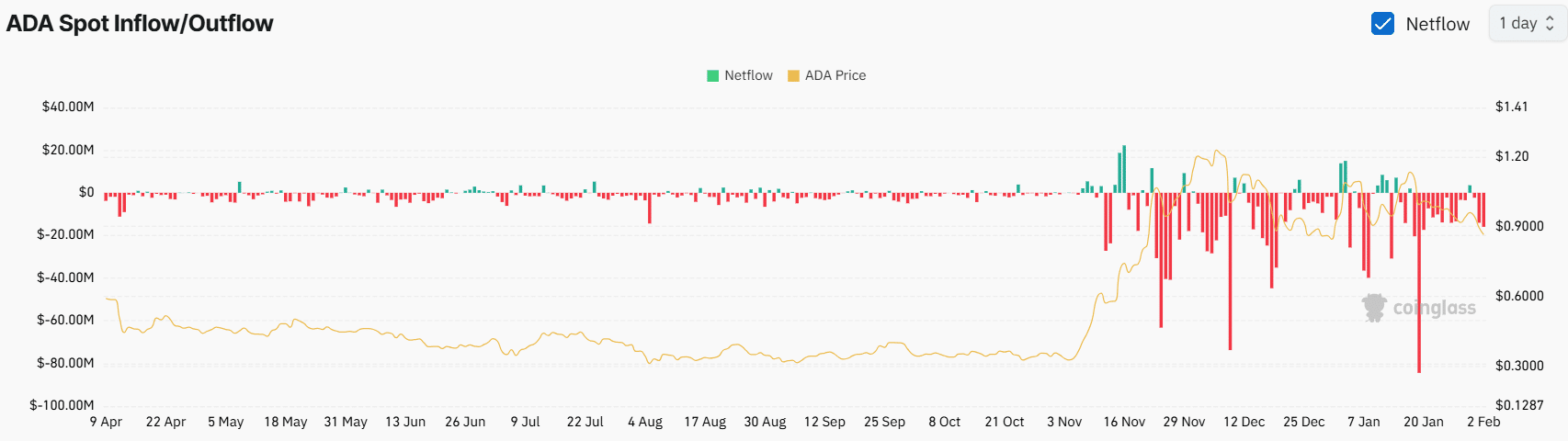

Moreover merchants, long-term holders and traders see the present market sentiment as a chance, to build up ADA tokens.

Information from Spot Influx/Outflow revealed that exchanges have witnessed an outflow of $30 million ADA tokens up to now 48 hours, indicating potential accumulation.

Some consultants see this outflow as an excellent long-term shopping for alternative.

When combining these on-chain metrics, it seems that ADA is bearish within the brief time period however stays bullish over the long run, which explains traders’ potential accumulation.

Cardano’s technical evaluation and upcoming ranges

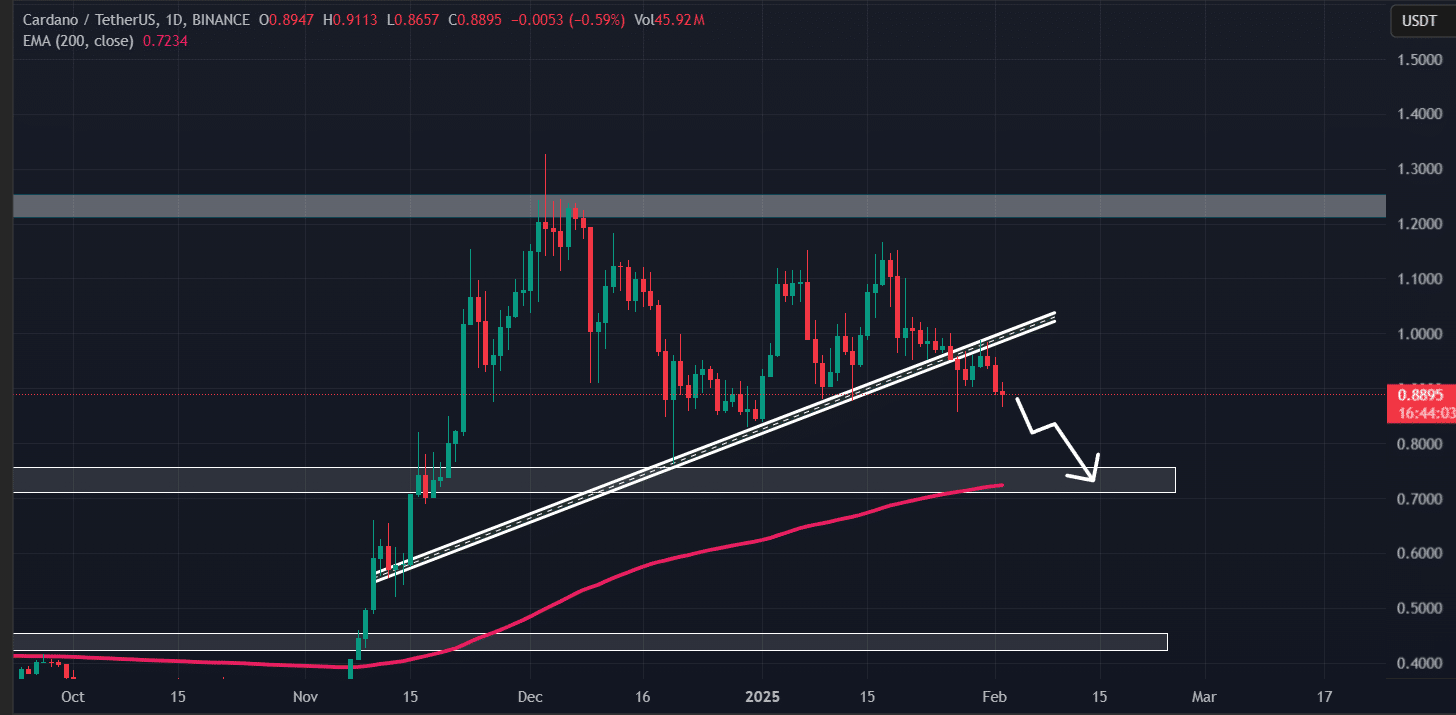

In accordance with AMBCrypto’s technical evaluation, ADA seems bearish because it has efficiently retested the ascending trendline breakdown degree and has begun shifting in a downtrend.

Based mostly on latest worth motion and historic momentum, ADA may drop by 15% to succeed in $0.71 within the coming days.

Nevertheless, the general market seems to be beneath important strain attributable to merchants’ robust bearish outlook. This might additional strengthen ADA’s bearish development.

- With a robust bearish sentiment, ADA may drop by 15% to succeed in the $0.71 degree.

- On-chain metrics revealed that the exchanges have witnessed an outflow of $30 million in ADA tokens.

Amid the bearish market sentiment, Cardano [ADA] is poised for a notable worth decline attributable to bearish affirmation on its every day timeframe.

Moreover, the prevailing market sentiment and merchants’ bearish exercise have additional strengthened this adverse outlook.

Merchants closely shorting ADA

In accordance with on-chain analytics agency Coinglass, merchants are probably taking benefit of the present market sentiment by strongly betting on the brief aspect.

Information reveals that merchants holding lengthy positions are over-leveraged at $0.85, with $4.10 million value of lengthy positions.

In the meantime, brief sellers appear to be dominating, being over-leveraged on the $0.912 and $0.926 ranges, presently holding $16.77 million value of brief positions.

This on-chain information exhibits that brief sellers are thrice stronger than merchants holding lengthy positions. This means a bearish sign.

Traders’ bullish view

Moreover merchants, long-term holders and traders see the present market sentiment as a chance, to build up ADA tokens.

Information from Spot Influx/Outflow revealed that exchanges have witnessed an outflow of $30 million ADA tokens up to now 48 hours, indicating potential accumulation.

Some consultants see this outflow as an excellent long-term shopping for alternative.

When combining these on-chain metrics, it seems that ADA is bearish within the brief time period however stays bullish over the long run, which explains traders’ potential accumulation.

Cardano’s technical evaluation and upcoming ranges

In accordance with AMBCrypto’s technical evaluation, ADA seems bearish because it has efficiently retested the ascending trendline breakdown degree and has begun shifting in a downtrend.

Based mostly on latest worth motion and historic momentum, ADA may drop by 15% to succeed in $0.71 within the coming days.

Nevertheless, the general market seems to be beneath important strain attributable to merchants’ robust bearish outlook. This might additional strengthen ADA’s bearish development.