- Solana behaved like a extra of a unstable model of Ethereum till press time.

- Pump.Enjoyable and establishments impacted worth of SOL.

Solana [SOL] is poised to shine within the upcoming bull market, probably outpacing different altcoins if Bitcoin [BTC] rises.

Solana has gained a fame as one of the user-friendly cryptocurrencies, making it a robust contender for progress. Nonetheless, regardless of its potential, SOL has confronted resistance from its bull market assist band.

Technical analyst, Benjamin Cowen, famous on X (previously Twitter) that Solana’s habits mirrored that of Ethereum [ETH], suggesting that SOL may drop again into its earlier ascending wedge sample if the present pattern continues.

This alerts {that a} essential second for Solana is approaching. October is anticipated to be a good month for each SOL and the broader crypto market, because it has traditionally been a robust interval because the inception of crypto.

Regardless of some sideways motion, there may be nonetheless a bias in the direction of taking lengthy positions in SOL, with the opportunity of positive factors, though this stays a dangerous commerce.

If SOL stays under the retest zone of its ascending triangle for an prolonged interval, the worth may decline earlier than any important surge.

Volatility index of Solana

Along with these technical insights, the launch of the Solana Volmex Implied Volatility Index (SVIV) provides one other layer of study. The SVIV, which measures the 14-day anticipated volatility of SOL, was 87 at press time.

This excessive volatility index recommended that the market anticipated important worth swings, both upwards or downwards.

Whereas such volatility can entice merchants trying to capitalize on these actions, it additionally will increase the chance of surprising and sharp losses.

As Bitcoin’s worth strikes increased, Solana may gain advantage from these market situations, however warning is suggested.

On-chain information evaluation

On-chain information, per Artemis, additional sophisticated the outlook for Solana. Though SOL continues to dominate in each day lively addresses, indicating excessive exercise on the community, institutional exercise doesn’t seem bullish.

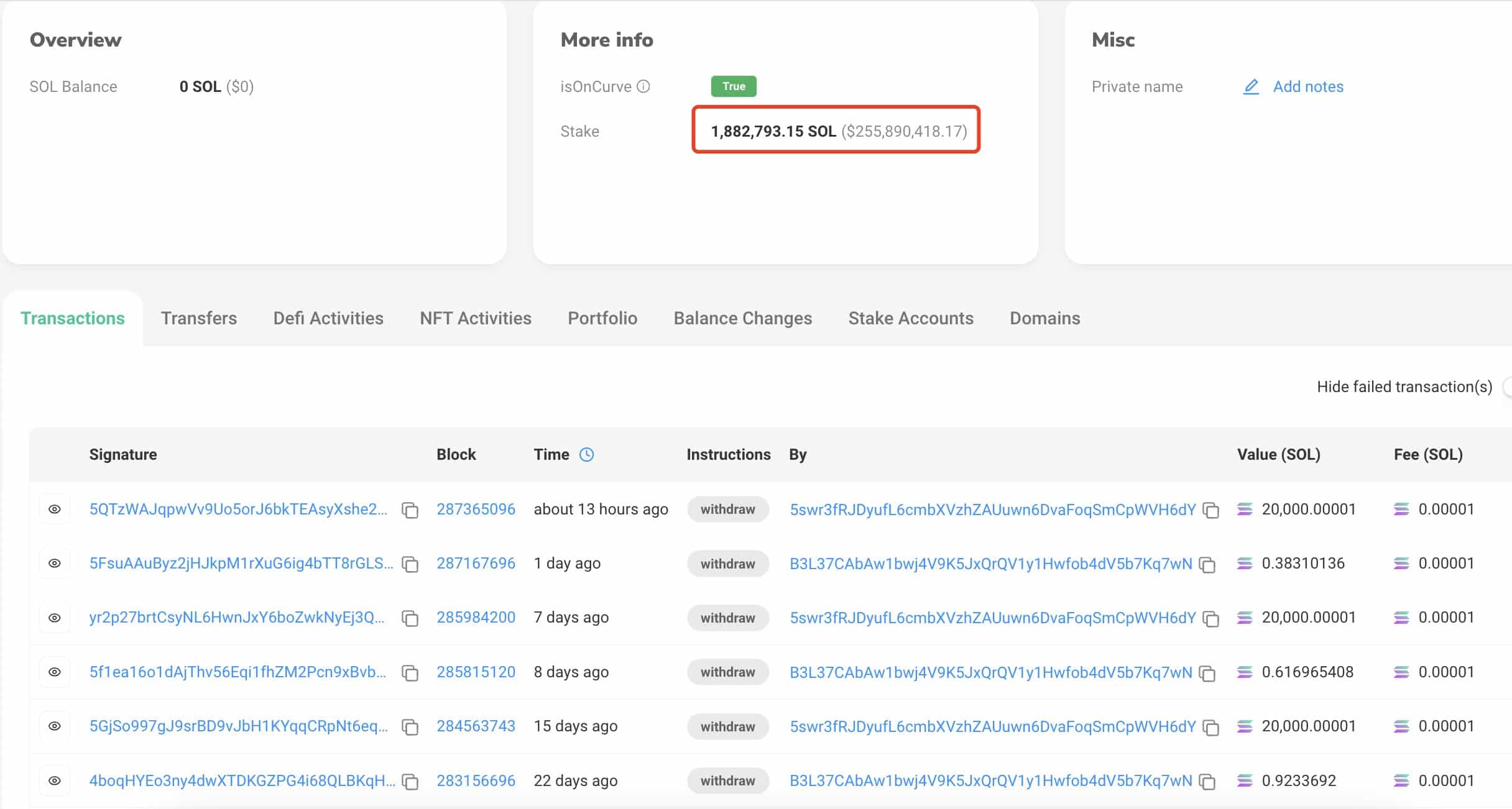

In line with Lookonchain, one establishment bought 695,000 SOL, price roughly $99.5 million, this 12 months. This establishment has been offloading a mean of 19,306 SOL weekly, totaling practically $100 million in gross sales.

Regardless of these gross sales, the establishment nonetheless holds 1.88 million SOL, price round $255.89 million, which is staked. This promoting strain has seemingly contributed to the current struggles of Solana’s worth.

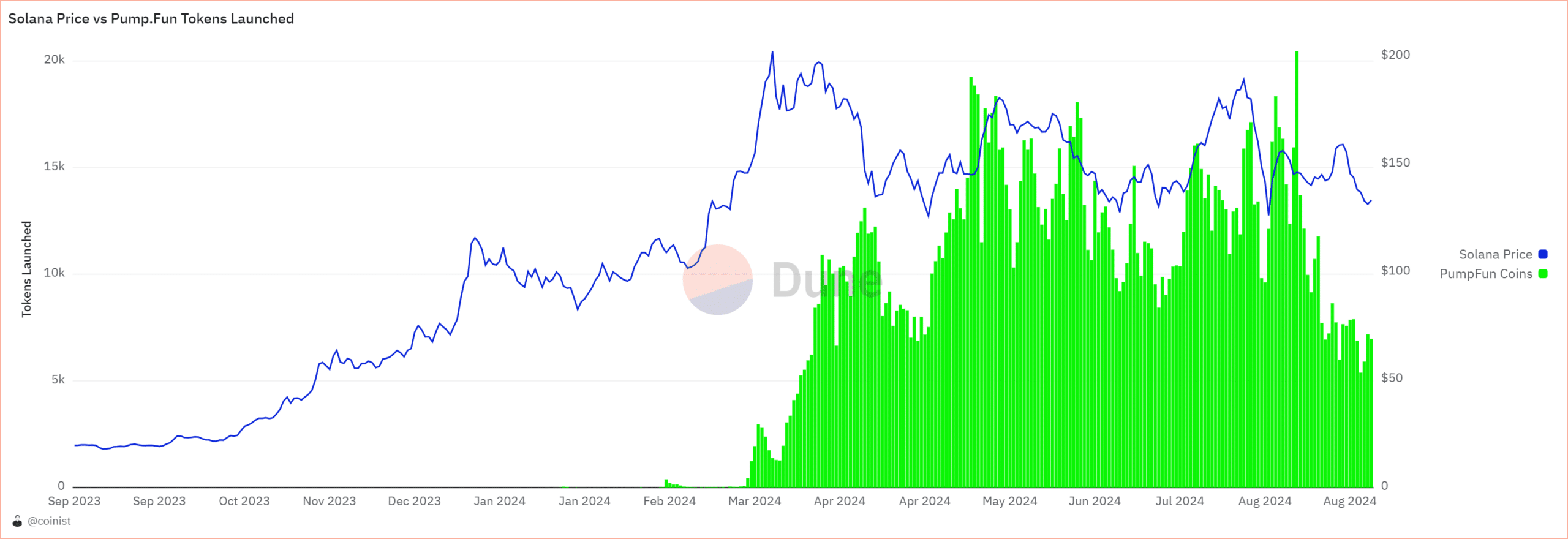

Solana worth vs. Pump.Enjoyable tokens launch

Furthermore, the launch of Pump.Enjoyable tokens have had a notable affect on SOL’s worth. When analyzing the worth chart, it turns into evident that SOL’s upward momentum halted across the time these memecoins have been launched.

Pump.Enjoyable has bought a good portion of its income, together with 264,373 SOL at a mean worth of $157.5, resulting in a considerable decline in Solana’s worth.

This has induced concern amongst traders, because the promoting strain from these tokens has weighed closely on Solana.

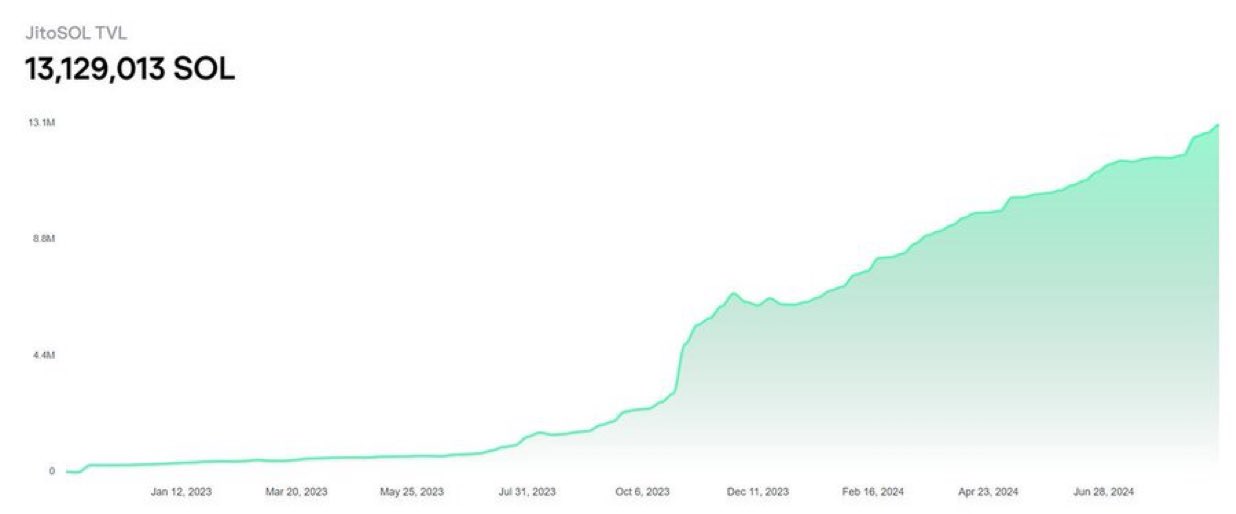

Solana-staking merchandise

Nonetheless, there may be hope for Solana as Binance [BNB] lately introduced the launch of its Solana Staking product, BNSOL, set for late September 2024. Additionally, JitoSOL TVL surpassed 13M SOL for the primary time.

Learn Solana’s [SOL] Worth Prediction 2024–2025

This product will enable customers to stake SOL tokens, earn dynamic rewards, and preserve management over their property, which may positively affect Solana’s future costs.

Solana may see a resurgence, pushed by these new staking alternatives and the potential for a broader market restoration.