- The asset is at the moment buying and selling inside a bullish framework that might propel it past its earlier ATH if the pattern materializes.

- On-chain metrics reveal robust shopping for curiosity amongst market contributors, additional reinforcing the asset’s bullish outlook.

Over the previous 24 hours, bullish momentum has lifted Binance Coin’s [BNB] value by 5.21% from the day prior to this’s shut. This restoration follows a 3.46% decline earlier within the week that had weighed on its efficiency.

An evaluation by AMBCrypto means that the asset retains vital potential for additional positive aspects, supported by strong market sentiment.

Bullish construction targets a brand new excessive

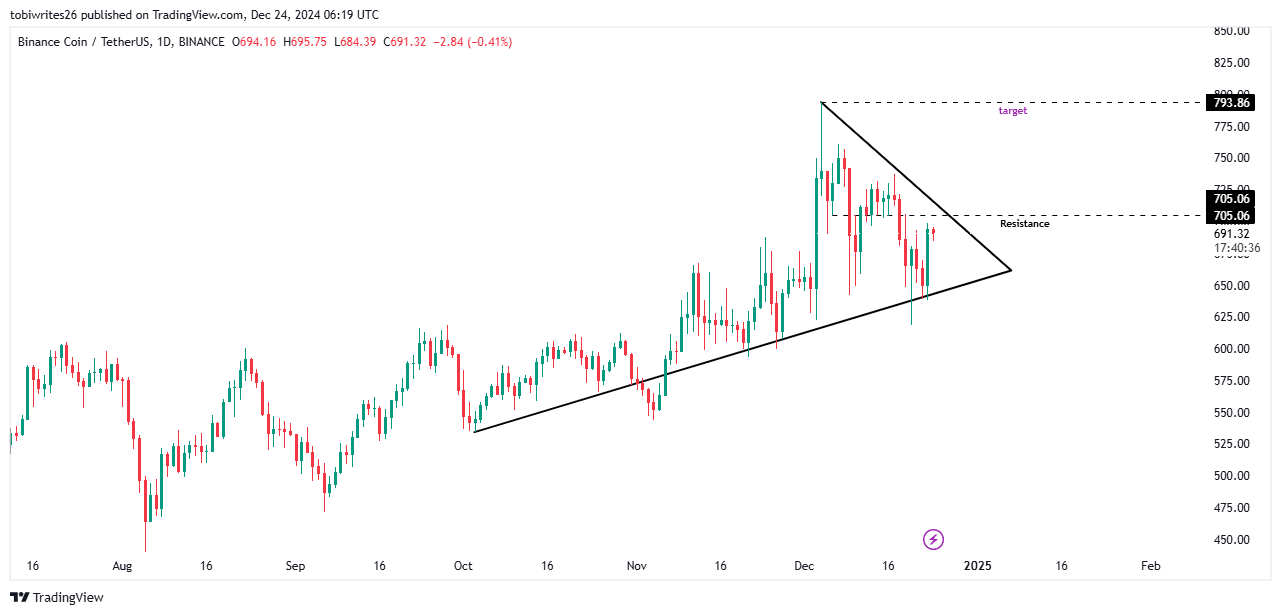

BNB is at the moment buying and selling inside a bullish symmetrical triangle sample which is an accumulation part dominated by shopping for. This sample is characterised by value fluctuations between converging help and resistance ranges.

If this pattern holds, BNB is to revisit its earlier all-time excessive of $793.86, with the potential of approaching the $800 area. Nevertheless, the asset will encounter a big resistance zone at $705.06, which might briefly stall its upward momentum.

Up to now 24 hours, a notable value spike has led BNB nearer to breaking out of the sample, contributing to a 5.25% improve in market capitalization to $99.59 billion. Buying and selling quantity has additionally surged by 29.39%, reaching $1.6 billion.

Shorts report losses as lengthy contracts surge

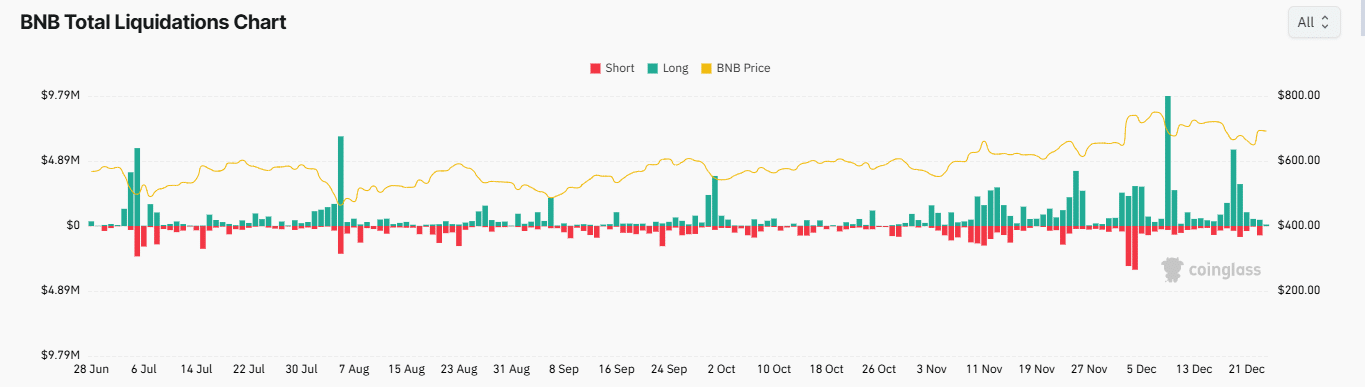

Coinglass liquidation information reveals a market bias towards rising costs, with extra quick contracts being liquidated than lengthy positions.

Out of the $1.03 million in whole liquidations, $578,680 price of quick contracts have been forcibly closed, in comparison with $447,480 in lengthy contracts over the previous 24 hours.

Moreover, lengthy contracts out there have seen a big improve. The long-to-short ratio, which compares the quantity of lengthy contracts to quick contracts, is at the moment above 1.

As of the most recent information, the ratio stands at 1.0202, indicating that extra merchants are betting on BNB’s value rising. This shift is mirrored within the asset’s upward value motion and the rising losses for brief positions, as proven within the liquidation information.

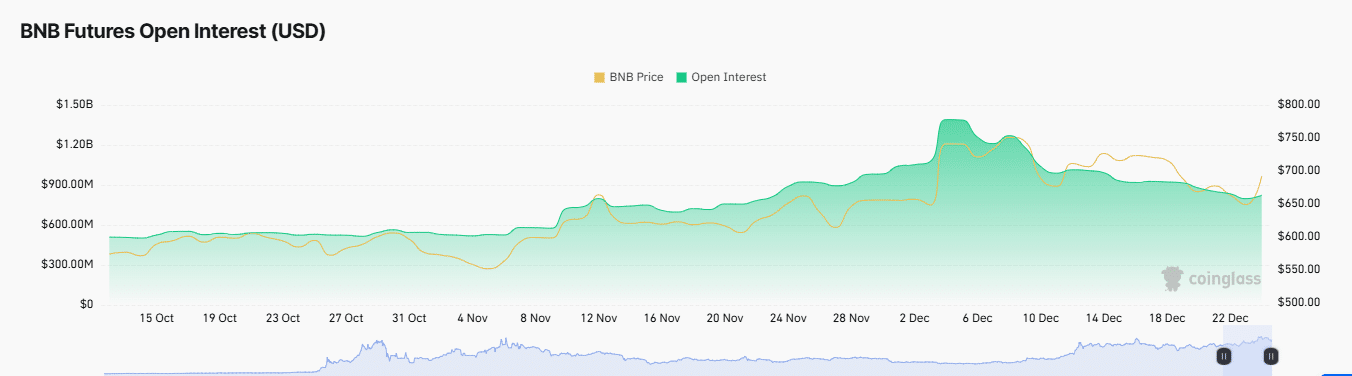

BNB open curiosity surges increased

After a interval of constant decline, Open Curiosity—the measure of unsettled by-product contracts out there—has began to rise, rising by 0.57% to roughly $817.75 million.

This shift means that extra contracts are being opened out there. Mixed with the latest surge in buying and selling quantity and value, it hints at a better chance of bullish sentiment driving these new positions.

Learn Binance Coin’s [BNB] Worth Prediction 2024–2025

Lastly, there was a noticeable change in BNB holders’ habits. Extra merchants are actually opting to carry their positions quite than promote, with a good portion of property being moved to non-public wallets for safekeeping. In whole, 2.15 million price of BNB has been transferred.

Given the general market sentiment, BNB stays bullish, and it’s poised to doubtlessly attain new value ranges within the upcoming buying and selling periods.